- Why did the PEPE cross the road? To recover 63% from its 60% loss, of course! 🐸💸

- Alas, with weak market interest, our heroic bulls seem to be stuck in a endless time loop of indecisiveness.

Ah, the noble Pepe [PEPE], a creature of both charm and befuddlement, finds itself basking in the glow of renewed whale interest. Just last week, a brand-spanking-new wallet heroically (or foolishly?) withdrew 500B PEPE, netting a staggering $4.3M from Binance – the plot thickens! 😮

Not long before, another early enthusiast of our froggy friend, who once minted a whopping 110% profit, returned to the fray, poetically withdrawing 506.2B tokens (we’re talking about $4.4M here). They’ve now expanded their long bet to 699.8B ($5.11M), a veritable feast of digital froggery! 🐸💰

Can whales restore some semblance of dignity to our quarterly losses?

As if by divine intervention, AMBCrypto proclaimed that PEPE whale activity surged a jaw-dropping 170% this week, with these majestic beings snatching up 14.5 trillion tokens like children at a candy store! 🍭

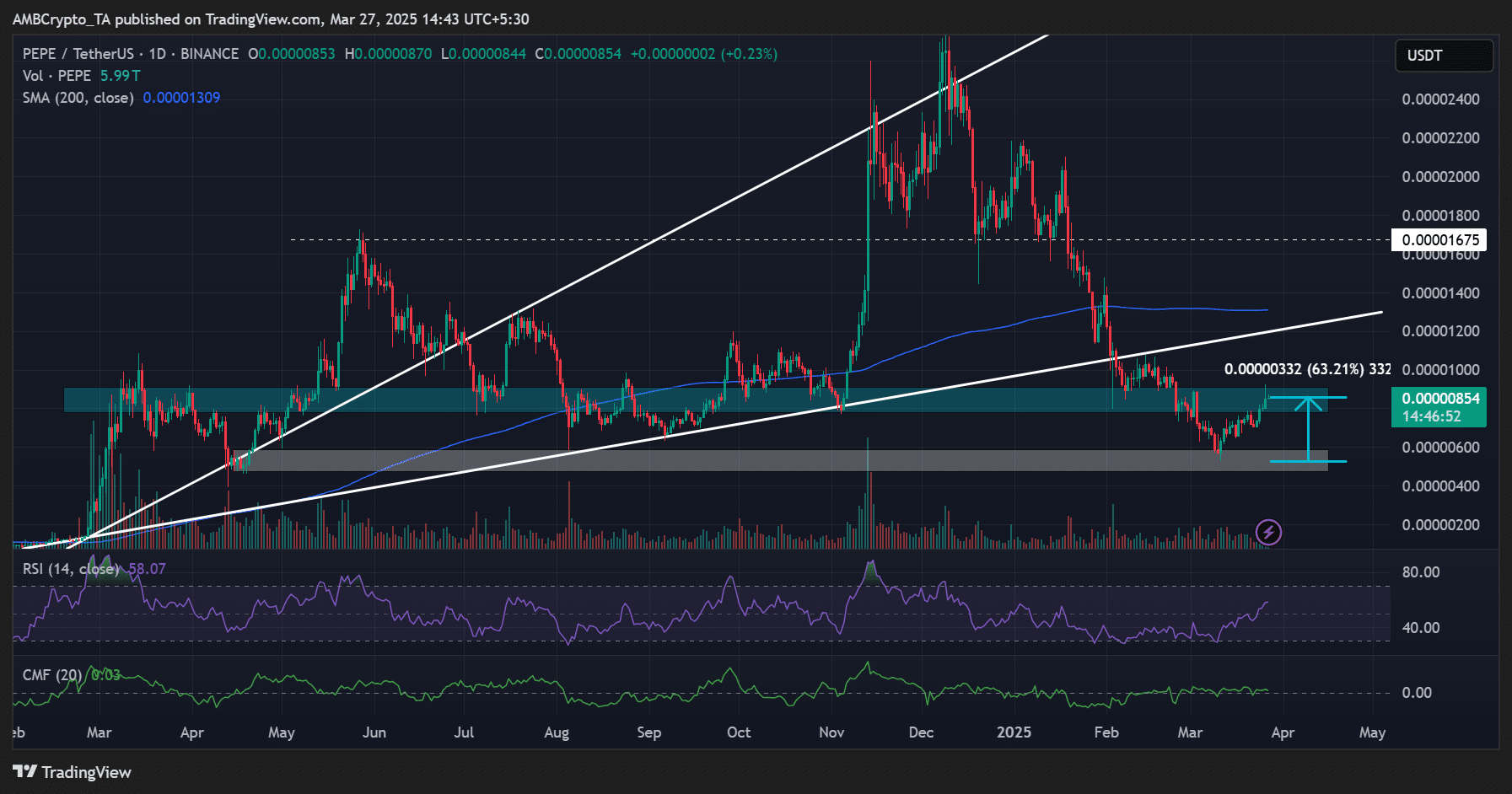

Yet, despite the excitement, kindly redirect your gaze to the price chart, where PEPE has ascended a modest 63% from the dismal March lows of $0.0000056. However, do not be deceived; it remains far beneath its former glory of $0.000028, a high it achieved last December with an air of misplaced confidence.

In all reality, dear reader, one must ponder the fate of those who bought at the zenith, as they currently writhe in maximum discomfort following an over 80% plunge during the first quarter. 🍵

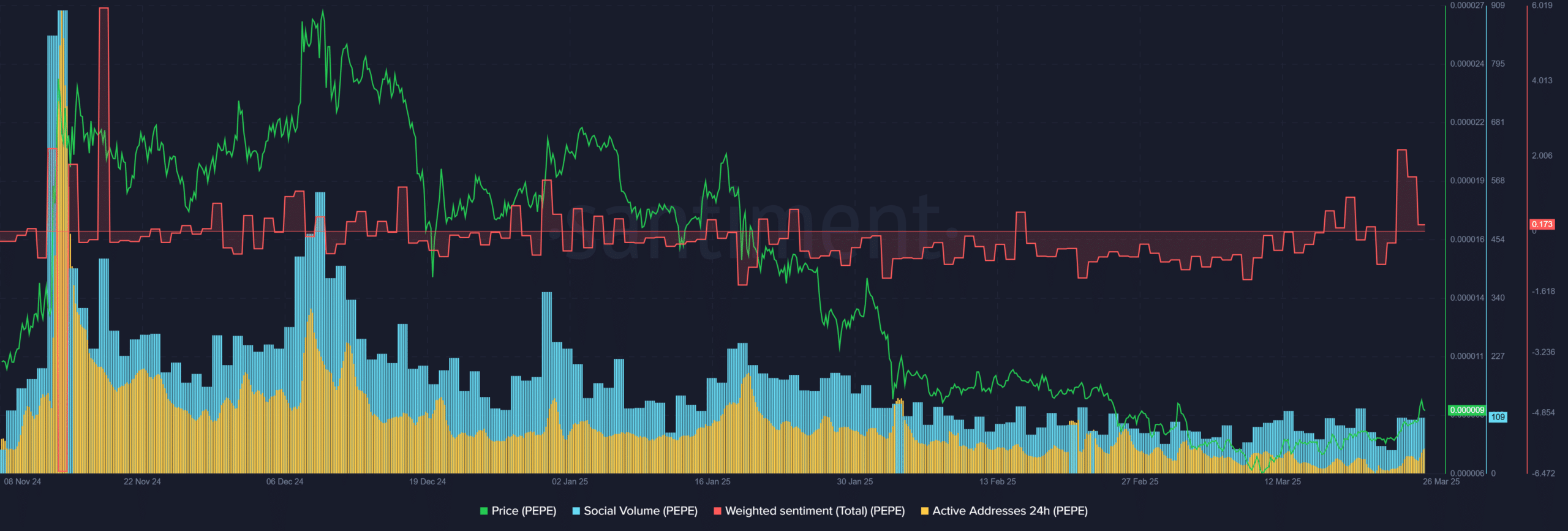

But could this fresh whale interest push the recovery into elation? Well, according to the wise sages at Santiment, the key signals of demand—social volume and address activity—remain in the gloomy depths of the ocean. 🌊

Moreover, the formerly optimistic sentiment has retreated to a rather lukewarm neutrality, suggesting we may be riding a seesaw of uncertainty. Who knows where we are headed, dear friends? 🤷♂️

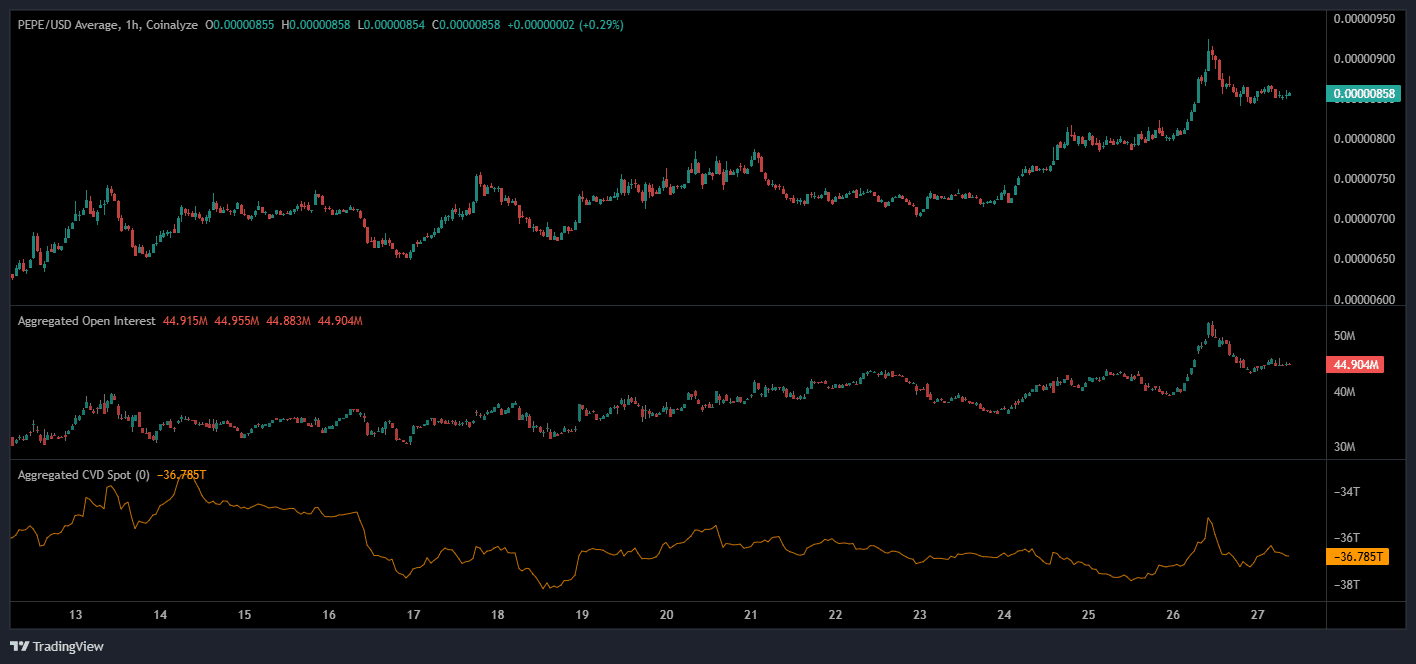

In the realm of derivatives, PEPE’s Open Interest rates gallivanted from $26M to a glitzy $50M before settling below $45M like a cat after a long chase. Meanwhile, the spot CVD (Cumulative Volume Delta) has barely moved, as if it were taking a leisurely stroll through the park, indicating that this thrilling pump may be driven by leverage rather than organic demand. 🎢

On the price charts (three-day timeframe), our dear PEPE’s recent 63% recovery has undone its March losses, but the bulls are still wandering a fog-laden forest of uncertainty. 🌲

As we pen these words, the price action lingers below the bull market trendline and the 200DMA (daily moving average, blue). A leap beyond these hurdles would surely boost our chances of reclaiming the larger Q1 losses. But until then, we watch and wait with bated breath! ⏳

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Kanye West’s Wife Stuns Completely Naked at 2025 Grammys

- Solo Leveling Season 3: What Fans Are Really Speculating!

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

- White Lotus: Cast’s Shocking Equal Pay Plan Revealed

2025-03-27 18:18