- Litecoin surged by 10.32% on the weekly charts, as analysts eyed a 40% rally.

- Whales transactions over the past seven days hit $17.3 billion.

As a seasoned analyst with over two decades of market experience under my belt, I can confidently say that Litecoin’s recent surge and the whale activities are certainly worth keeping an eye on. The 10.32% weekly gain is a clear indication of a coin defying trends and carving its unique path.

Over the past fortnight, the cryptocurrency market has shown significant ups and downs. However, against this turbulent backdrop, Litecoin [LTC] has forged its own distinct course.

Inasmuch, LTC’s price action has left analysts speculating a sustained bull run.

A significant influence shaping the market’s perception towards LTC is the ongoing active participation of ‘whales.’ In the last three months, there’s been a consistent increase in large investors holding LTC, peaking at approximately $3.6 billion in daily whale transactions.

Prevailing market sentiment

As a crypto investor, I’ve been closely watching Litecoin’s recent price fluctuations, and it seems like we might be on the verge of a significant surge. Just like Analyst Crypto Whales, I’ve got my fingers crossed for a major breakout of this altcoin, as they too have expressed their confidence in it, highlighting its potential to soar high.

“On the daily chart, Litecoin appears to have burst free from a ‘falling wedge’ formation, suggesting that the prior decline may be over. With this escape, there could be a possible 40% upward surge in value.”

Based on his assessment, the value of the altcoin is expected to reach a resistance point of around $94.7, a level not seen since April 12th. Yet, some analysts like Crypto Surf argue that a historical pattern could potentially predict a favorable outlook for LTC in the future.

Crypto Surf stated,

“Historically speaking, the price of LTC tends to increase significantly following a period of 15 to 19 months after its halving event, and approximately 6 to 8 months after the BTC halving. Therefore, we can expect a potential bull run for LTC somewhere between October 2024 and March 2025.”

Litecoin: What price charts suggest

At the moment of reporting, Litecoin was being traded at around $67.62, marking a 10.32% increase over its weekly performance. Yet, it’s worth noting that the trading volume for this altcoin has dropped by approximately 24.8% on daily charts to reach roughly $205.5 million.

However, despite the decline in trading, LTC was experiencing a strong upward movement.

The altcoin’s Advance Decline Ratio (ADR) was above 1 at 1.93, suggesting increased buying activity. This suggested that LTC was reporting more highs than lows, indicating a positive outlook among investors.

Additionally, the Altcoin’s Relative Volume Growth Index (RVGI) stood at 0.31, indicating robust increases in its price. Consequently, this implied that the current closing prices were higher than the initial ones, a sign that is generally considered bullish as it suggests an upward trend.

Furthermore, the Aroon line exhibited a robust increase in value. This indicates that the Aroon Up line reached 100%, whereas the Aroon Down line was only at 7.14%. This implies that the upward trend was both powerful and persistent.

By examining more closely, it appears that Large-Scale Investors (whales) have been contributing significantly to LTC, implying a generally optimistic viewpoint among them.

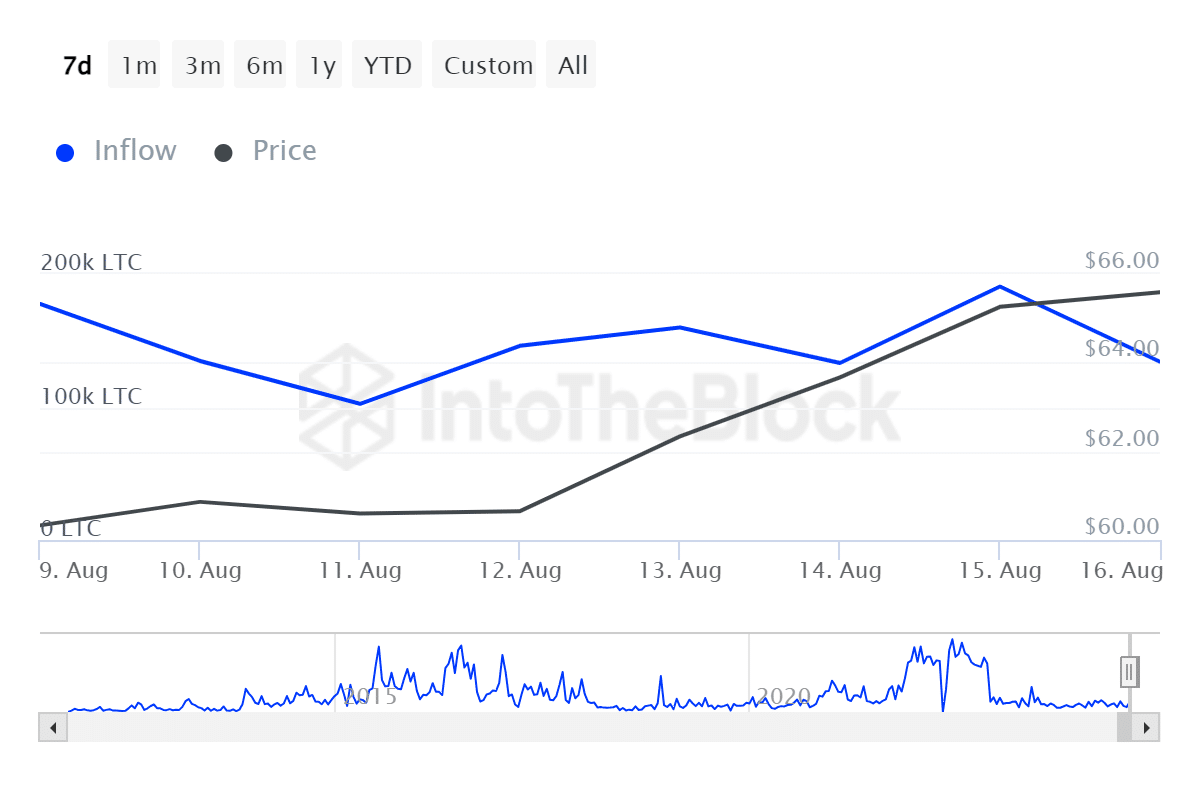

According to data from IntoTheBlock, the inflow of Litecoin held by significant investors on weekly charts remains elevated, reaching a peak of approximately 190,500 tokens. The associated transactions amounted to around $17.3 billion in the previous week.

So, there was increased confidence among whales in the future potential and trust in the direction.

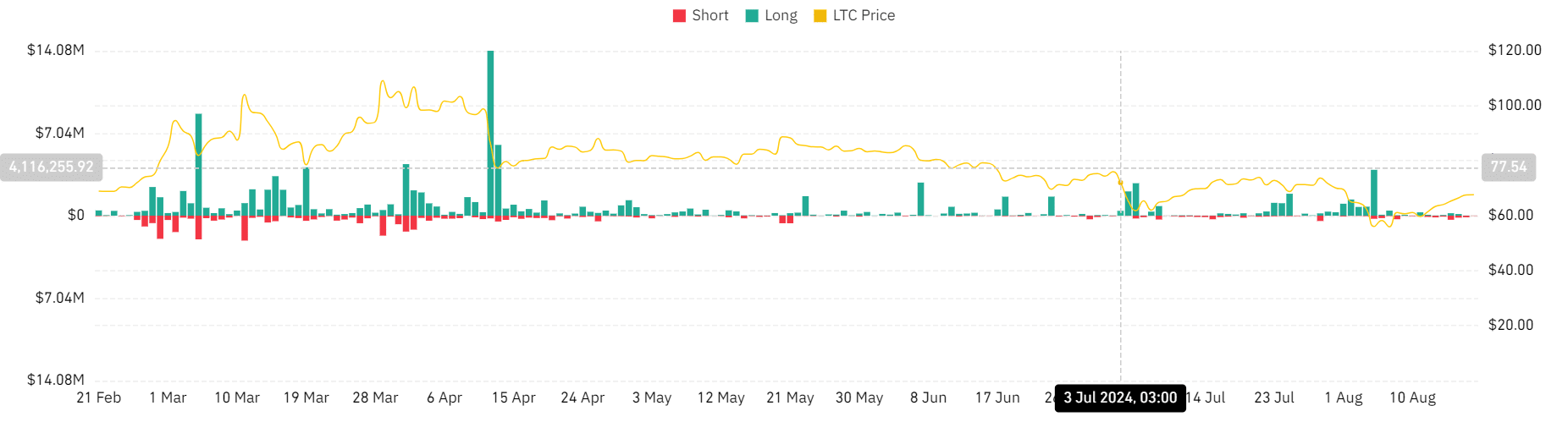

After scrutinizing the Coinglass data as an analyst, I’ve noticed a significant decrease in long position liquidation for the altcoin over the last fortnight. At the moment of writing, the liquidation stands at approximately $8,200, having dropped from a figure of $3.9 million previously.

Investors felt assured about the altcoin’s trajectory, and they couldn’t sell their holdings even during the low points.

Consequently, there was a favorable outlook for LTC, with its price steadily increasing.

If the day’s closing price for the altcoin is above the $69.02 resistance point, it could potentially push through the subsequent resistance at $76.67.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-19 07:04