- Analyst Michaël van de Poppe sees Optimism surging by 60% after clearing its $1.83 resistance.

- On-chain data shows 84% of OP supply held by whales, signaling strong accumulation ahead of a potential rally.

As an analyst with a keen eye for spotting trends and a background in the crypto realm that spans over a decade, I can confidently say that Optimism [OP] appears to be gearing up for a potential breakout. Based on my observations of Layer 2 networks and their recent performance, it seems that OP is poised for a substantial rally once it surpasses its current resistance at $1.83.

Michael van de Poppe, an ardent supporter of cryptocurrencies, anticipates a possible breakout for Optimism [OP]. He believes that Layer 2 networks such as OP are poised for a significant upward trend. If the asset manages to break through a crucial resistance point, it could potentially increase by approximately 60%.

Van de Poppe emphasized the increasing energy within Layer 2 networks, mirroring the success trajectory of early-stage Layer 1 initiatives that have already achieved substantial growth.

Right now, optimism’s resistance point is at approximately $1.83. The price seems to be holding steady slightly beneath this level, indicating a period of consolidation. Analyst Van de Poppe proposes that once this resistance is overcome, the price of OP could surge quickly towards higher predicted values.

Price action and key levels to watch

At the moment, market analysis indicates that OP is currently valued at $1.77, marking a 1.35% rise in the last day. However, this temporary growth contrasts with a 1.30% fall over the past week. The asset is still struggling to surpass the resistance level of $1.83.

The price has been persistently maintained by sellers within a narrow band, fluctuating between approximately $1.70 and $1.83.

Analysis based on technical indicators indicates a potential support level at around $1.70. If the price decreases, this level might prevent further drops. On the other hand, surpassing $1.83 could potentially trigger an upward trend leading to the significant resistance at $2.00.

As a crypto investor, I’m keeping an optimistic outlook and closely monitoring the price action. Some experts predict a promising range of $3.25 to $3.50 could be on the horizon, provided the overall market conditions stay positive.

Technical indicators signal mixed momentum

right now, the Relative Strength Index (RSI) of OP is at 55.07, indicating a moderately strong uptrend, as it’s not yet signaling an overbought condition, implying there could be more potential for the asset to rise further.

On the other hand, a decrease in RSI might indicate diminishing bullish power, potentially resulting in another test of the lower support levels near $1.70.

The MACD (Moving Average Convergence Divergence) indicator presents an optimistic perspective as the MACD line consistently stays over the signal line.

As an analyst, I observe that the heightened bars on the histogram indicate persistent buying activity. However, the shrinking width of the histogram hints at a potential decrease in momentum, suggesting a possible gradual shift in market dynamics.

Holder data and market activity

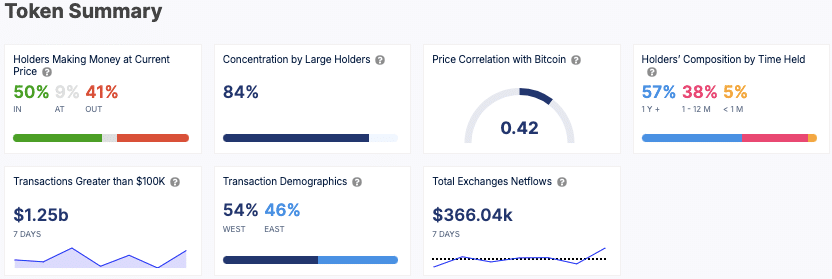

Approximately half of the owners of OP (Ocean Protocol) are currently experiencing a profit, whereas around 41% are facing losses. This suggests that the distribution of market positions for OP is fairly even.

The data indicates that a substantial 84% is controlled by big investors, implying that these ‘whales’ are still exerting considerable influence over the price fluctuations in OP.

Over the last week, there’s been a lot of bustling activity in the market, with approximately $1.25 billion worth of large transactions taking place. Furthermore, there were sizable inflows of $366,040 into exchanges, suggesting increased trading and possibly accumulation by market participants.

The relationship between the OP and Bitcoin is found to be moderately correlated at 0.42, suggesting that it tends to follow broader market movements.

Read More

2024-11-20 05:11