Bitcoin climbed past $104,000 on Monday, climbing with the determined enthusiasm of a cat that’s discovered a box labeled “Absolutely No Cats Allowed.” Naturally, this entices a peculiar breed—the professional gambler, wearing trousers made entirely out of risk, to bet against gravity (and Bitcoin’s momentum). Now, some short-sellers—bigger than the appetite of an Ankh-Morpork librarian on banana day—are discovering that if you bet on gravity in Discworld, sometimes the floor moves instead.

Massive Short Position At Risk, a.k.a. “The Tale of the Overconfident Whale”

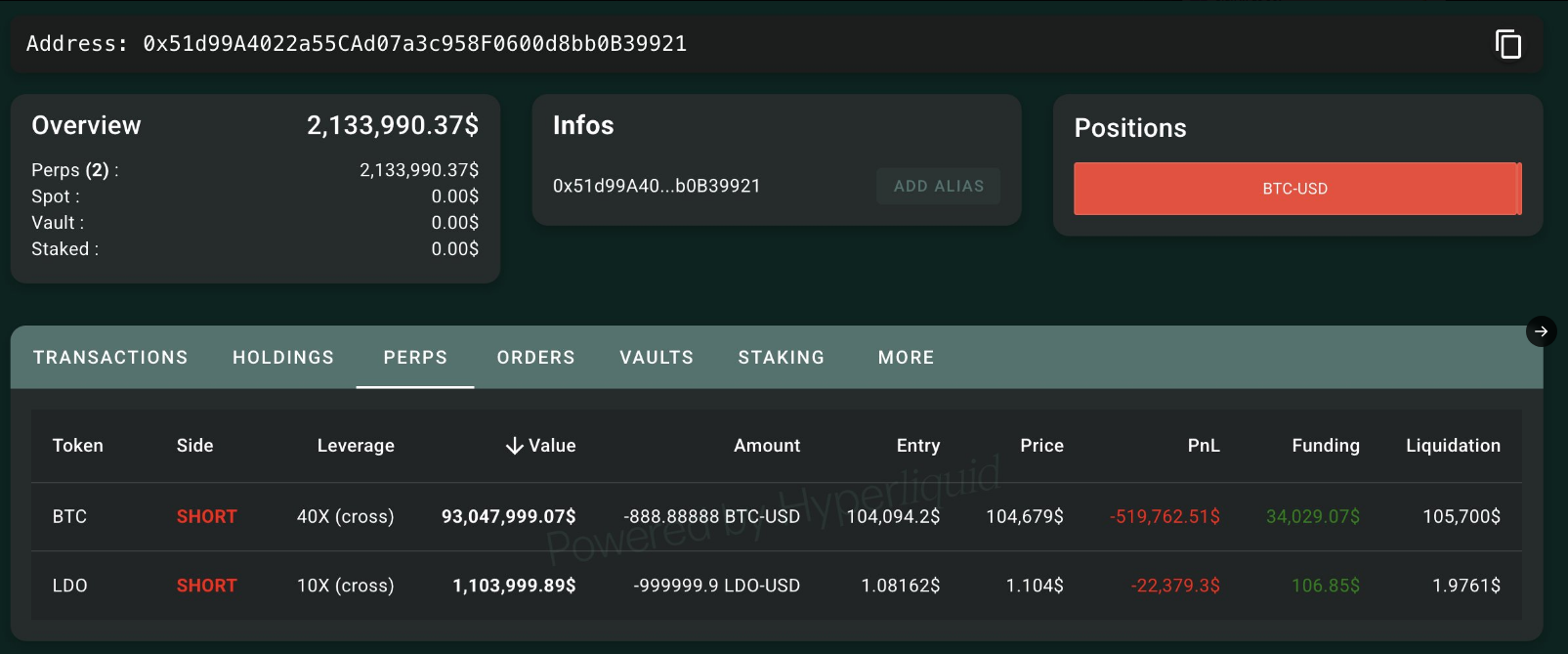

Our first contestant is tracked by Lookonchain, the blockchain’s equivalent of Nobby Nobbs with binoculars. One stately financial whale slid $93 million into a short, with a daintily balanced 40× margin. At Bitcoin’s current altitude, precariously teetering at $104,000, just a 1.5% twitch upwards would toss this whale out like last week’s fish. In common-sense terms, that’s a $500,000 paper loss—enough to make a troll accountant cry. Sure, funding fees pay out $34,000, but that’s like receiving a bandaid when you’ve been run over by the Patrician’s coach.

Many gamblers are shorting $BTC with high leverage!

0x51d9 opened a $93M short position on $BTC with 40x leverage, with a liquidation price of $105,690.

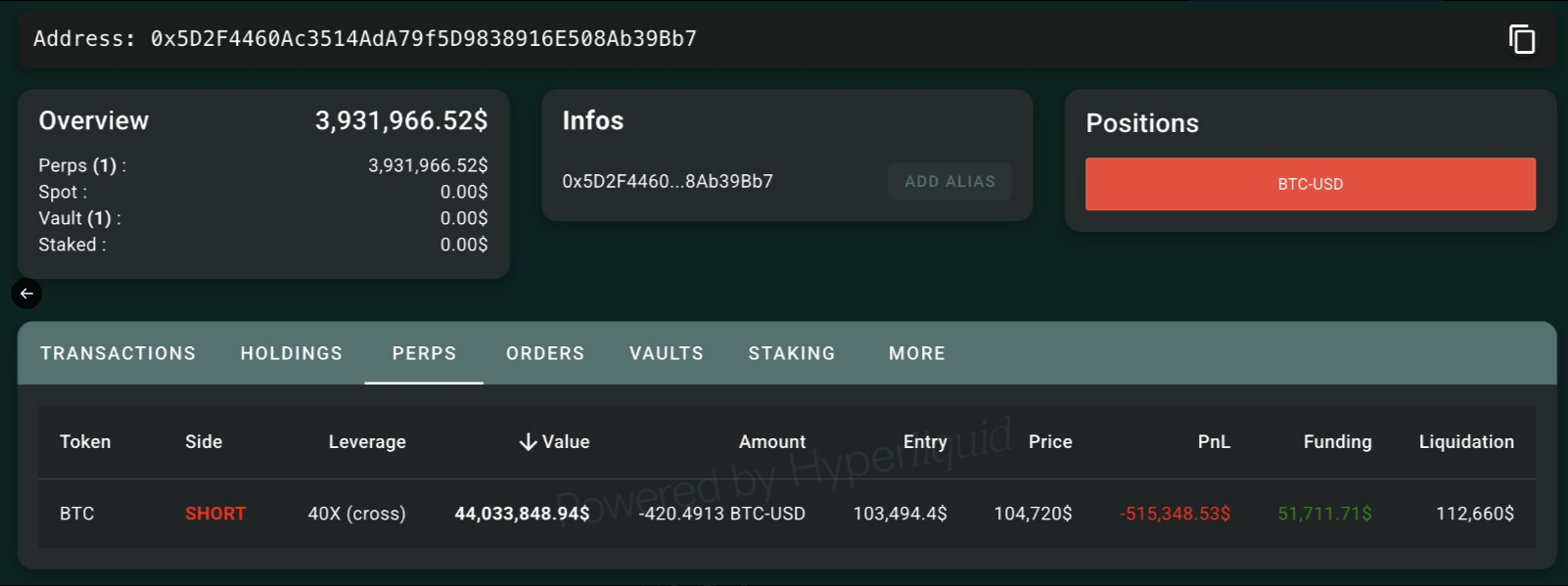

0x5D2F opened a $44M short position on $BTC with 40x leverage, with a liquidation price of $112,660.…— Lookonchain (@lookonchain) May 12, 2025

Second Whale: Watching the Tides Come In

What’s better than one enormous, groaning short position? Two, obviously! Another ambitious wallet plonked down $44 million short at $103,494.40, also with a dashing 40× cross margin. Present losses are running at about $515,348.53—give or take a sausage-inna-bun—though they’ve set their personal doom lever all the way out at $112,660 for that slight sense of dramatic flair.

So far, this doughty gambler has snagged $51,711.71 in funding, which—as the wise say on the streets—is slightly better than a poke in the eye with a sharp stick. But once the tide comes in, even the bravest sea cows end up beached.

The Early Bird Gets Liquidated

A third daring soul, emboldened by dreams (and perhaps a few pints), went all in: shorted $69.7 million at $95,969, dancing the 40× jig. Price snuck up past $103,470 like an Assassin on bonus night, leaving the trade about as viable as a long-term career in sausage reconstitution. That short’s destiny was sealed days ago when Bitcoin waltzed past the line—leaving only the cautionary tale behind, and, no doubt, shards of a broken keyboard.

The Market’s Clean-Up Crew: Liquidators with Brooms

In the last twelve hours, the mighty digital broom swept away $66.66 million in liquidations— $51.25 million straight from shorters. Spread out over a day, $82.58 million got the farewell song, while the longs merely looked mildly embarrassed ($21 million gone—barely worth the bottle deposit on Unseen University’s wine collection).

So what have we learnt? Well, when you try to stand in the way of an avalanche, you don’t stop the avalanche. You just give it something extra crunchy to roll over. These shorters found out: Bitcoin does what it likes, and right now, what it likes is running over anyone who says “It can’t possibly go higher!”

the margin players might as well be betting on the direction of Ankh-Morpork’s River (hint: always down, never clean). Bitcoin remains perched at $104,000, the shorts are looking nervous, and anyone betting big against the rally is about to appear in next week’s edition of “Oops, All Liquidations!” 🐋🤑🤦♂️

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-05-13 05:35