- Ah! The whales, they frolic less, and the Coin Days Destroyed (CDD) whisper sweet nothings!

- Perchance a deeper plunge awaits, but lo! The worst of the selling may have bid adieu.

On the 11th of March, Bitcoin [BTC] took a tumble to $76.6k, only to bounce back like a jester at court! At this very moment, it prances at $82.8k, a merry 8.2% leap in just over a day. The downtrend, however, remains as strong as a stubborn mule, leaving us to ponder if this is the final dip or merely a jest.

To catch falling knives, dear investors, is a fool’s errand! Better to wait until they clatter to the ground. Yet, understanding how far the price is from the floor may illuminate our path, for metrics can be our guiding stars! 🌟

Short-term BTC holder losses akin to a farcical consolidation

The whales, those grand lords of the crypto seas, offer us a glimpse into the future of BTC! Analyst Darkfost, in a post on CryptoQuant Insights, has noted that Binance, the mightiest exchange of them all, has seen a decline in its whale ratio. A sign of hope, or merely a jest? 🤔

The Exchange Whale Ratio, a curious measure indeed, tracks the top 10 inflows against the total. A higher value, they say, indicates a flurry of whale activity, often signaling a tempest of selling pressure!

Since November 2024, this metric has danced upwards, but alas! It has recently taken a bow, offering a glimmer of hope. Yet, BTC remains a mere 11% below the $92K range lows of yore, as if it were a tragic hero in a play! 🎭

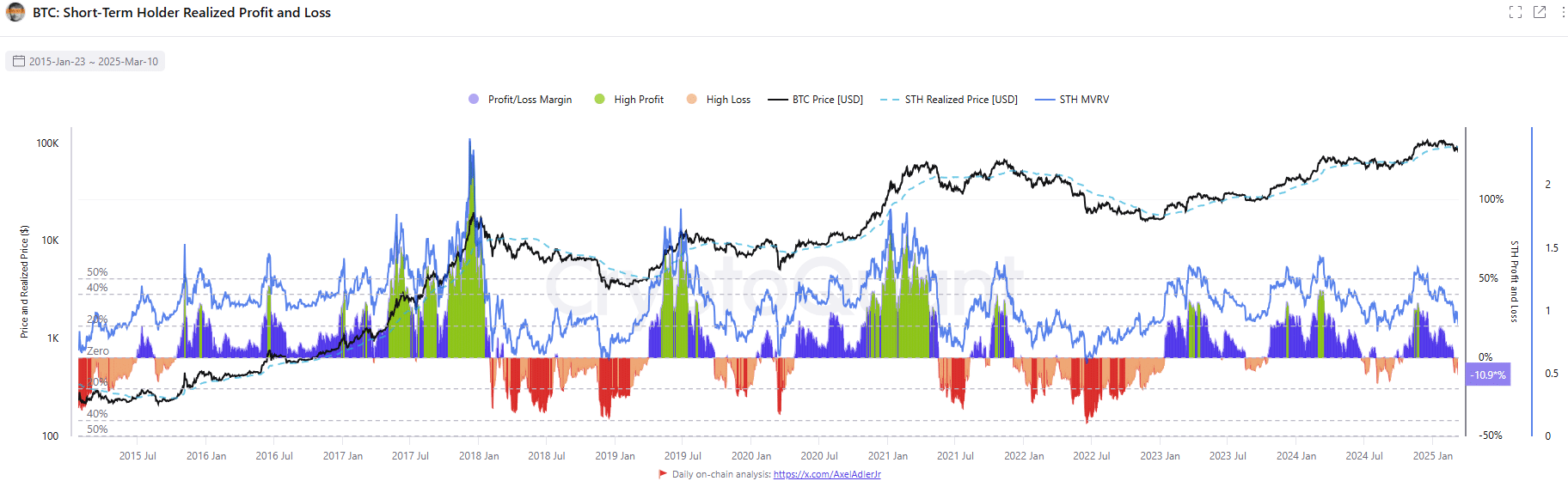

The STH Realized Profit/Loss Ratio stands at a dismal -10.9%, echoing the trends of June-August 2024 and August-October 2023, when Bitcoin found itself in a two-month low before entering a consolidation phase that felt like an eternity!

Could history repeat itself? While further losses may lurk in the shadows, the worst may have already taken its leave. A consolidation around the $72K support level over the next three months seems as plausible as a well-timed punchline! 🎉

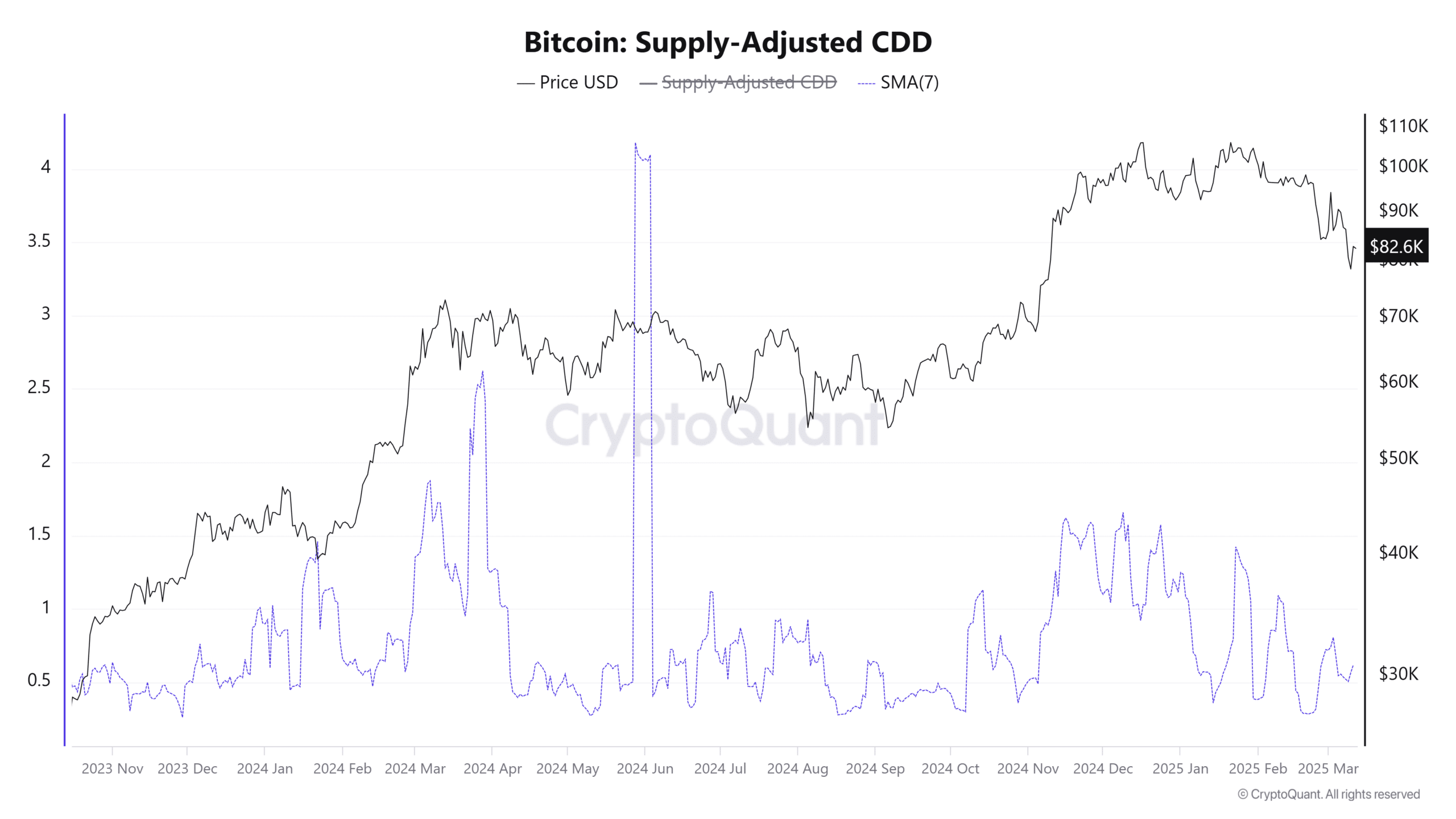

The supply-adjusted Coin Days Destroyed (CDD) metric, a mouthful indeed, is calculated by multiplying the number of coins by the days since they last danced! Spikes in this metric suggest that older coins are being sold, as if they were old shoes tossed aside.

Since December, the 7-day Moving Average (7DMA) of this metric has been making lower highs, indicating a decline in selling activity and a reduction in the movement of older tokens. A sign of accumulation, perhaps? Though sellers still reign supreme, the most intense phases of selling seem to have taken their final bow!

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2025-03-12 16:11