-

Whale transactions on the Polygon network spiked amid price fluctuations

Despite institutional interest, MATIC’s price might slide below $0.47

As a researcher with experience in cryptocurrency analysis, I’ve been closely monitoring the recent surge in whale transactions on the Polygon network involving Matic tokens. While such large-scale trades are often indicative of institutional interest and can positively impact a token’s price, I believe that MATIC might not be immune to further price fluctuations.

A few days ago, there was buzz around significant transactions on the Polygon [MATIC] network involving large-scale investors, or “whales,” due to an uptick in such high-value trades. Transactions worth $100,000 and above are commonly referred to as whale transactions.

Based on IntoTheBlock’s analysis, there was a significant surge of over 1000% in whale-sized transactions involving MATIC, with a total value exceeding $100 million. This trend is often indicative of increased institutional investment in the token. Typically, such activity can influence the token’s price.

Over $100 million exchanged, but MATIC stays sober

At the current moment, MATIC was priced at $0.49. This represented a 4.19% decrease from its price over the past 24 hours. Intriguingly, earlier in the week, the cost of this token had peaked at $0.52 on the charts. Consequently, those holding MATIC likely sold some of their holdings during this recent decline, realizing profits from the initial increase.

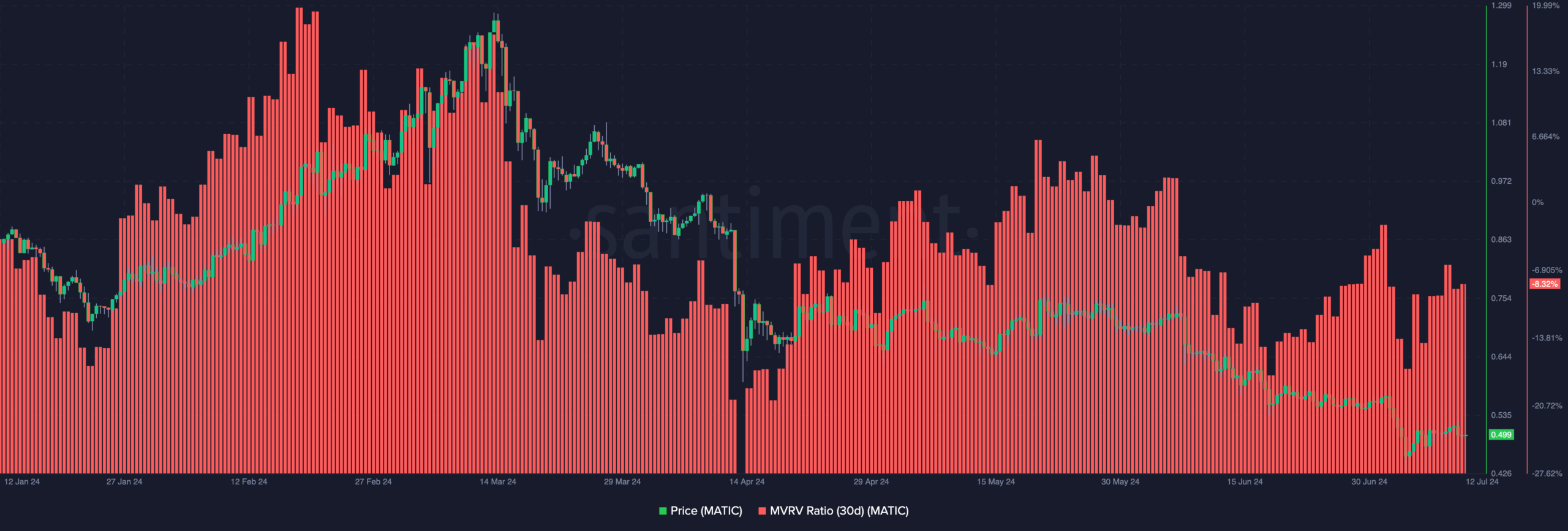

Given the query: Does the price of MATIC increase when there is renewed interest from large investors or whales? Let’s first examine the Market Value to Realized Value (MVRV) ratio for some insight.

The profitability ratio serves as an indicator of whether a cryptocurrency has peaked or is experiencing a trough. Typically, a higher average profit suggests that the token is approaching its peak.

When there are substantial unrealized losses, this is typically a sign that the asset’s price is near its bottom. Currently, the MVRV ratio for MATIC over the past 30 days stands at -8.32%. This figure indicates that if holders choose to sell now, they would incur a loss of 8.32% based on their initial investment cost.

As a crypto investor, I’ve noticed that MATIC‘s price performance has been similar to other altcoins lately. Given this trend, it’s possible that MATIC is nearing its bottom. If the price takes a dip once more, the ratio of MATIC to my portfolio value could become even more attractive, potentially offering superior buying opportunities.

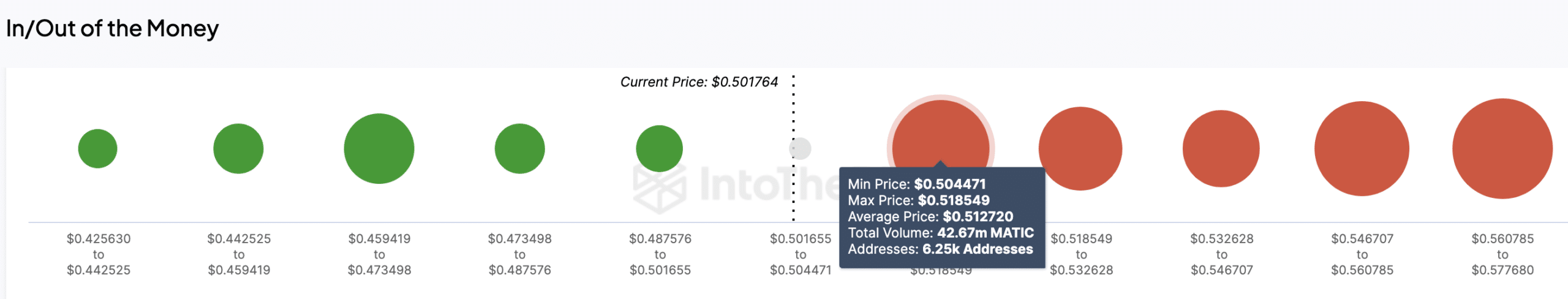

As a researcher studying the behavior of MATIC prices, I’ve discovered that besides the given ratio, another significant indicator is the In/Out of Money Around Price (IOMAP). This tool categorizes wallet addresses based on their purchase price and current profit status. By examining the IOMAP, we can determine if there is a strong demand or supply pressure around a specific price level, potentially influencing the price trend of MATIC.

No more respite?

This metric can function as a point of support or resistance based on the number of purchases in a specific price range. Therefore, areas with a significant number of transactions will act as potential support or resistance levels.

As a crypto investor, I would interpret this scenario as follows: When larger addresses are showing a loss on their holdings, those levels can act as resistance. Conversely, when they’re profitable, those levels become support for the price.

Based on IntoTheBlock’s data, approximately 6,250 wallets bought a total of 42.67 million MATIC tokens at an average price of $0.51 each. These buyers are currently underwater as the current price is lower than their purchase price. Conversely, around 1,060 wallets acquired 58.97 million MATIC tokens at approximately $0.49 per token.

Realistic or not, here’s MATIC’s market cap in ETH terms

With a greater concentration of addresses showing up at prices above the current market value, it’s evident that MATIC is encountering resistance on the price charts. Consequently, investors holding at the $0.51 mark could consider selling to secure their initial investment once the price reaches that level again.

If that happens, MATIC might retrace and the next decline could be below $0.48.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Quick Guide: Finding Garlic in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- LUNC PREDICTION. LUNC cryptocurrency

2024-07-13 05:12