-

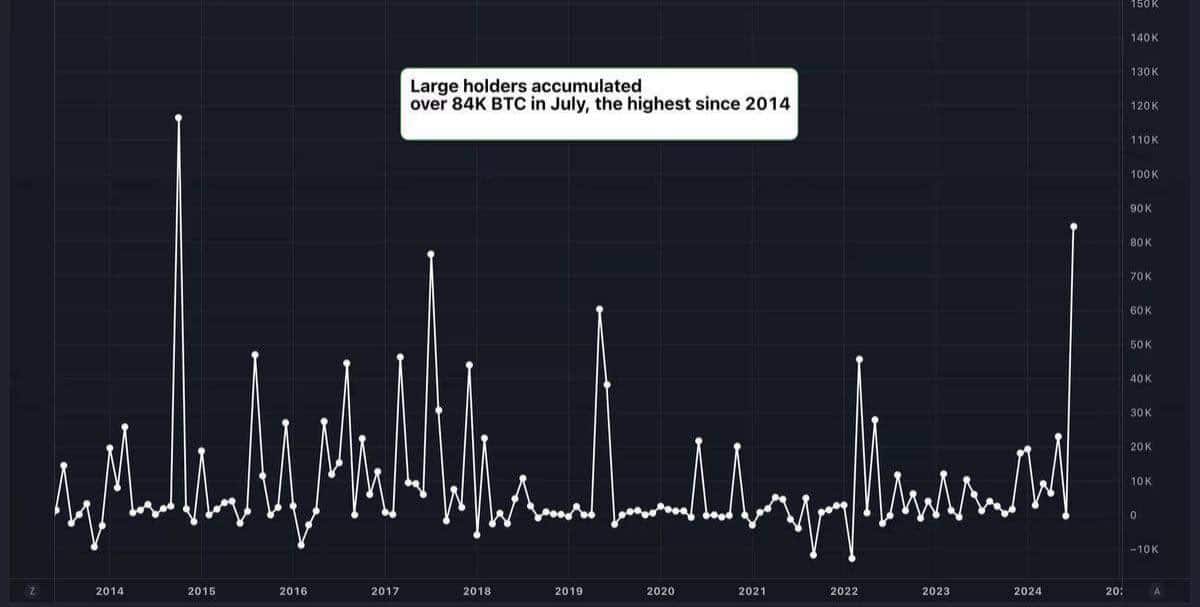

Large holders accumulated 84,000 Bitcoins worth over $5 Billion in July.

BTC’s 2nd highest trading volume as Bitcoin ETFs inflows surge.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen more than my fair share of market trends and shifts. The recent accumulation of 84,000 Bitcoins worth over $5 billion by large holders in July is an event that has caught my attention. Historically, such significant buying patterns have often indicated a major market shift, and I believe this might be the case with Bitcoin as well.

In July, large Bitcoin holders (referred to as “whales”) amassed approximately 84,000 Bitcoins, amounting to around $5 billion in value. This represents the highest monthly increase in Bitcoin accumulation since 2014. This substantial purchase trend often signals a significant change in market dynamics.

Large-scale Bitcoin activity indicates it could experience a significant shift soon. In the past, such extensive hoarding by ‘whales’ (large investors) has typically forecast major price fluctuations. Now is an important moment for investors to keep a close watch.

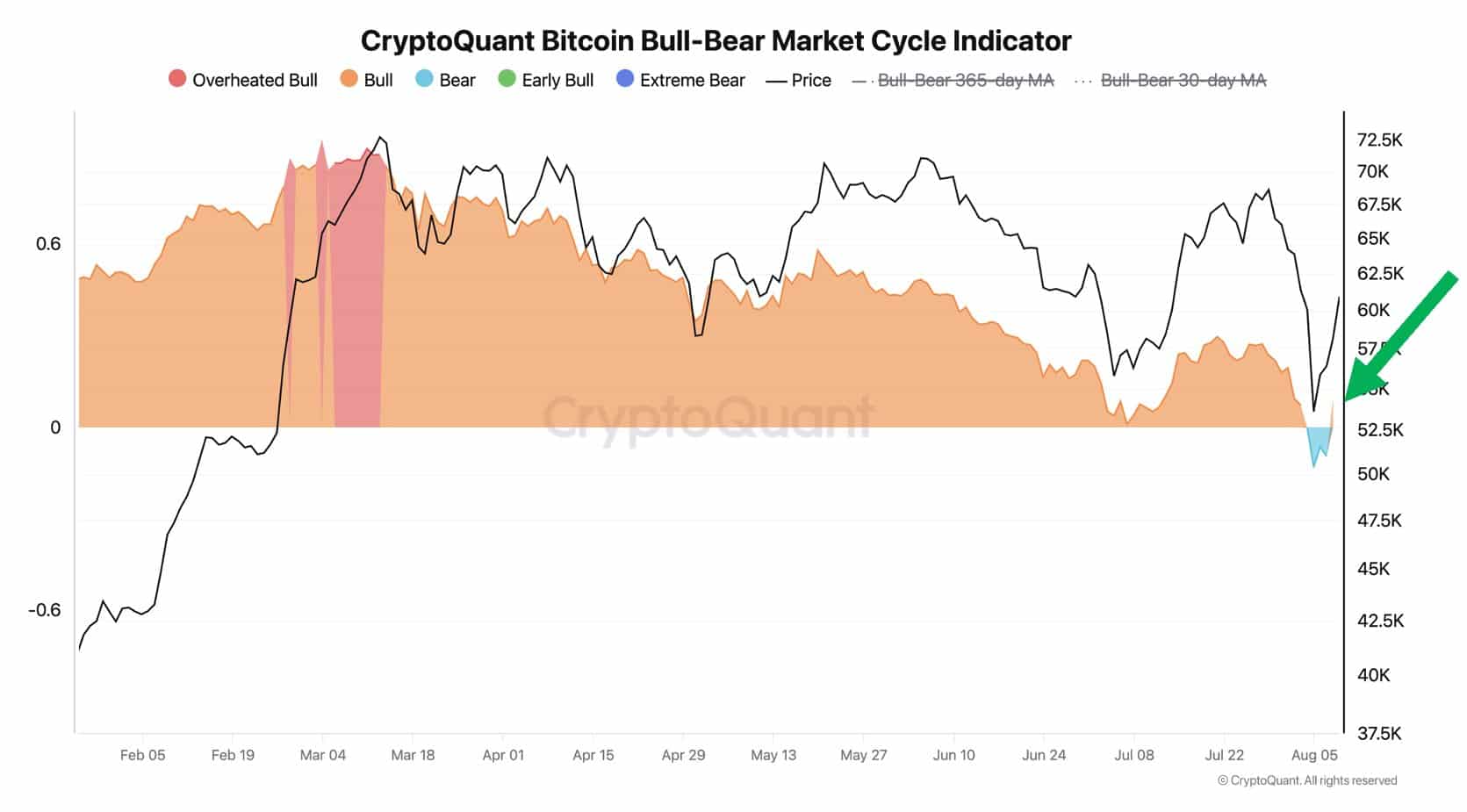

Bitcoin on-chain cyclical indicators signal a bull market

Furthermore, many Bitcoin market indicators, such as the bull-bear cycle indicator, which were almost suggesting a decline, are now signaling an uptrend or a bull market again.

In simple terms, Bitcoin’s price dropped for only a short span of three days. This suggests a strong bull market. Within approximately two weeks, we can expect the market to recover.

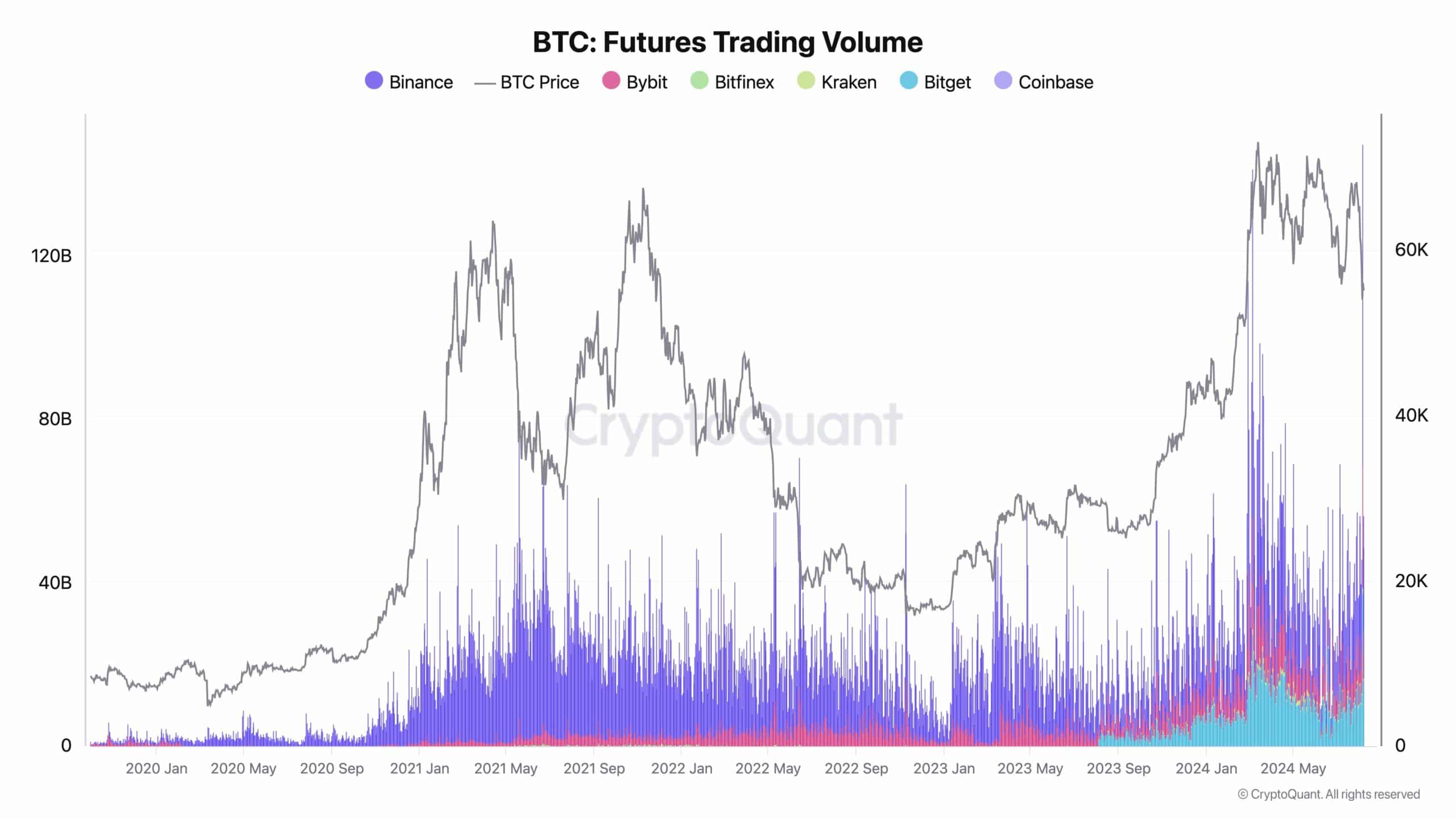

BTC futures and spot trading volume hits ATH

When the price of Bitcoin dropped to $50,000, the volume of futures trading hit an all-time high of $154 billion, while the spot trading volume also peaked at $83 billion (the second highest on record), further reinforcing market activity.

After experiencing a significant decline, Bitcoin bounced back vigorously, witnessing an approximately 23% surge in value since its lowest point of the week.

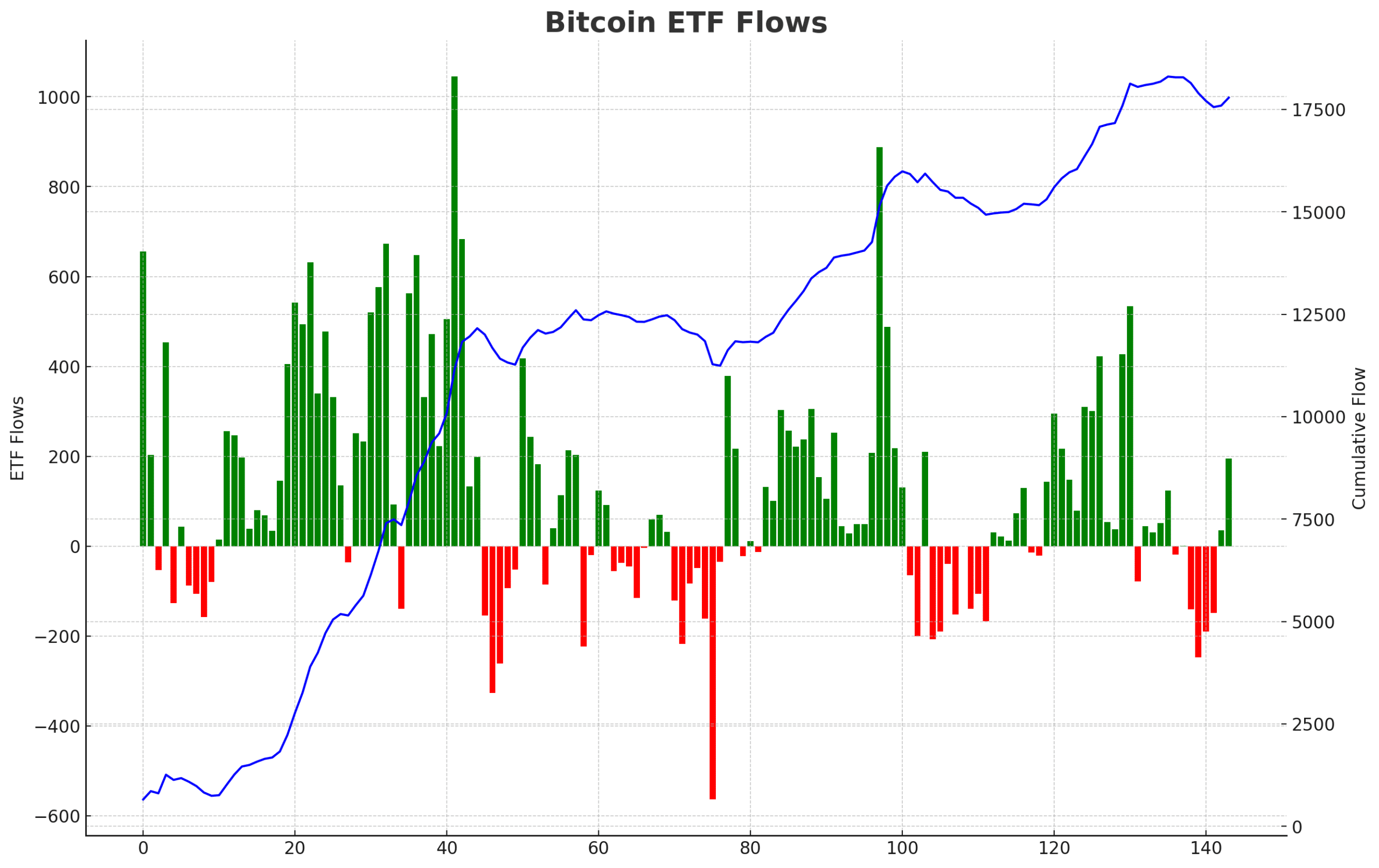

ETF inflows surge

In contrast to Bitcoin’s volatility, the Bitcoin ETF launched by BlackRock in January has seen just a single day of withdrawals, holding more than $20 billion in assets.

Over the past five days, there have been $194 million flowing into Bitcoin ETFs. Interestingly, whenever Bitcoin dips close to $50,000, the influx of money into these ETFs increases substantially.

Each instance when Bitcoin (BTC) drops into the lower $50,000 range, we’ve noticed a recurring pattern – significant influxes of money take place. This consistent occurrence implies that prominent investors might be seizing these dips as an opportunity to invest.

Bitcoin sell-side liquidity grabbed

On the fifth day of the month, Bitcoin has exhibited a notable trend in July and August, dipping steeply over a five-day period at the beginning, followed by substantial upward surges.

It’s interesting to consider if the recent trend in BTC might not just be a fluke, but instead represents its ability to soak up selling pressure, potentially indicating an upcoming surge. Most analysts regard the $70K mark as a temporary top for now.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-11 12:07