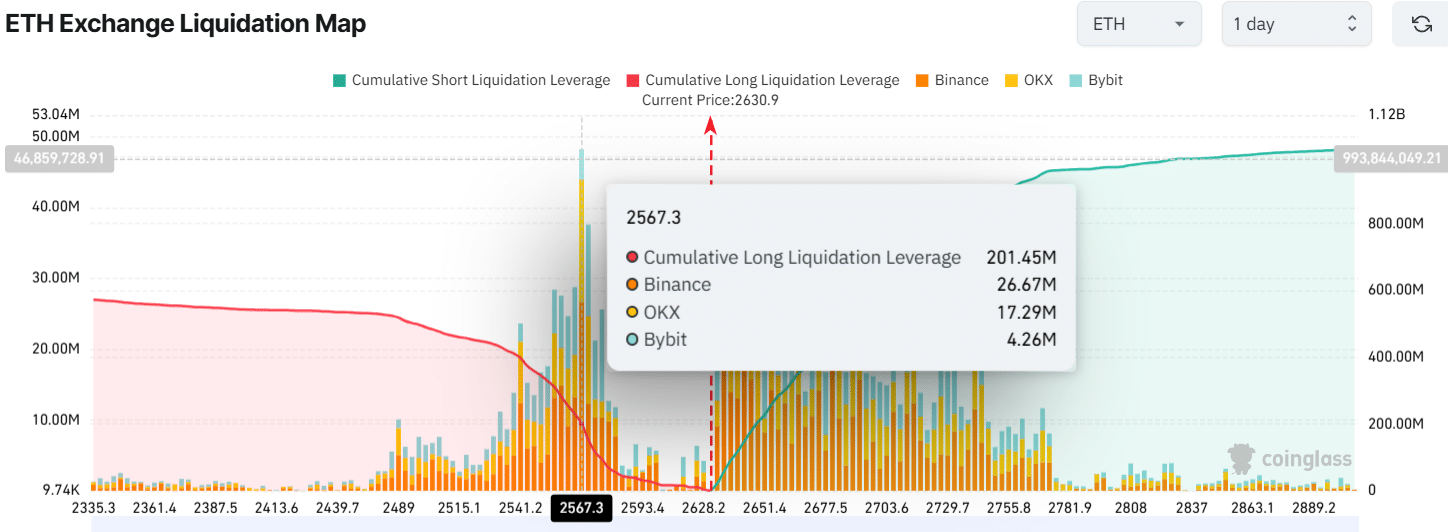

- In the past 24 hours, intraday traders have amassed a staggering $201 million in long positions at the price of $2,567. Quite the gamble, wouldn’t you say?

- Should Ethereum manage to close a four-hour candle above the $2,700 mark, it might just take off by 10%. Who knew candles could be so influential?

Ah, Ethereum [ETH], the second-largest cryptocurrency, is like that friend who keeps falling down but somehow manages to get back up, albeit with a few bruises. Its price continues to tumble, yet the industry’s elite seem to be taking notice. Curious, isn’t it?

Ethereum whales buy the dip

On this fateful day, the 12th of February 2025, a crypto sage proclaimed on X (formerly known as Twitter) that a horde of whales had gobbled up a whopping 600,000 Ethereum (ETH) in the past week. Talk about a shopping spree!

This grand purchase serves as a textbook example of the “Buy the Dip” philosophy. However, after their shopping frenzy, these whales were spotted unceremoniously dumping ETH tokens onto exchanges, as reported by Coinglass. Oh, the irony!

Data from Spot Inflow/Outflow revealed a modest inflow of $10 million worth of ETH into exchanges over the last 24 hours. A mere drop in the ocean, really. Inflows, you see, are the assets that long-term holders reluctantly send to exchanges, creating a bit of selling pressure. But fret not, this inflow is too trivial to cause any real ruckus.

Traders’ $201 million worth of bets on the long side

Meanwhile, our dear intraday traders seem to be channeling the spirit of long-term holders. At this very moment, they are over-leveraged at $2,567, with a staggering $201.5 million in long positions. Risky business, indeed!

In contrast, those holding short positions are also feeling the heat, over-leveraged at $2,635, with $60 million worth of shorts. It’s a veritable tug-of-war!

These over-leveraged positions reflect the traders’ fervent beliefs and bullish sentiments. Yet, despite their optimism, ETH is currently languishing near $2,630, having taken a 3.25% nosedive in the last 24 hours. Ouch!

During this tumultuous period, the sentiment among investors and traders has sparked a notable 15% increase in trading volume. A silver lining, perhaps?

Ethereum’s price action and key levels

According to the wise sages at AMBCrypto, ETH appears to be forming a descending triangle pattern in the four-hour timeframe. A classic case of “will it or won’t it?”

Currently, it is meandering within a narrow range, which could lead to a breakout. Fingers crossed!

If ETH manages to break free and close a four-hour candle above $2,700, it could very well soar by 10% to reach the lofty heights of $3,000. A dream worth dreaming!

However, let us not forget that ETH is currently trading below the 200-day Exponential Moving Average (EMA) on the daily timeframe, signaling a downtrend. Ah, the bittersweet nature of cryptocurrency!

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Michelle Trachtenberg’s Desperate Secret

2025-02-12 17:47