Ah, Ripple! The illustrious giant of cross-border payments, now embroiled in a delightful dance with the SEC, has recently achieved milestones that would make even the most stoic of traders raise an eyebrow. With stablecoin partnerships blossoming like spring flowers and ecosystem growth that rivals the most ambitious of gardeners, the native token, XRP, has decided to join the party, much to the astonishment of traders who thought they had seen it all. 🐋💰

As of late, XRP has been frolicking above the $2 mark, a staggering 33% leap from its April 7 low of $1.64. Traders, with bated breath, await the inevitable drop in Bitcoin dominance, hoping for an altcoin season that might just make their dreams come true. 🌊

Table of Contents

XRP bulls are sitting on over 300% gains

According to the daily price chart, XRP has added a remarkable 335% to its value since November 2024. Those fortunate enough to have acquired the token before this meteoric rise are now basking in unrealized gains that would make even the most seasoned investor weep with joy. 😭💸

From April 2025 to now, XRP has rallied nearly 65%, climbing from a low of $1.6134 to a peak of $2.6549 in May 2025. It now hovers tantalizingly close to that peak, trading above the key support level of $2. The resistance levels, however, are like the gates of a fortress: $2.2524, $2.6549, and the ever-elusive $3. The 2025 peak of $3.4000 beckons like a siren’s song, promising riches in Q3 2025. 🎶

Technical indicators, however, are playing coy, with the RSI reading a modest 45 and the MACD flashing red histogram bars beneath the neutral line. A game of cat and mouse, indeed!

Should XRP break free from its consolidation and close a daily candlestick above $2.2524, it may very well test the resistance at $2.6549. A thrilling prospect for those who enjoy a bit of risk! 🎢

In early June, retail traders, sitting on their unrealized gains, began to realize profits at a staggering pace of $68.8 million per day. A wave of distribution by early holders coincided with whale accumulation, creating a spectacle worthy of a grand opera. 🎭

Whale demand and institutional interest

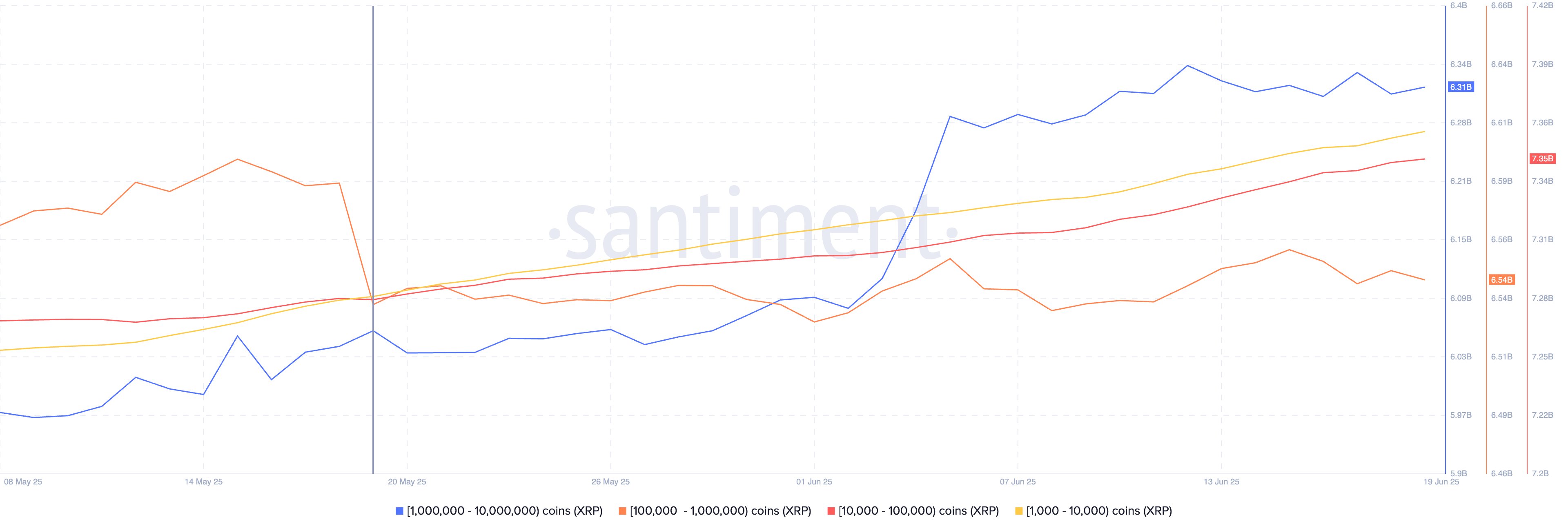

In the past 30 days, XRP whales have been on a shopping spree, accumulating vast quantities of the altcoin, as reported by the ever-watchful crypto intelligence tracker, Santiment. Large wallet investors, those holding between 1 million and 10 million XRP tokens, have added a whopping 260 million XRP tokens to their coffers. 🐋💼

Meanwhile, the smaller whales, those with 100,000 to 1 million XRP, have also joined the fray, scooping up 10 million XRP. The lower tiers, with 1,000 to 100,000 XRP, have collectively added over 100 million XRP tokens to their holdings. It seems the whales are not just swimming; they are feasting! 🍽️

This massive accumulation by nearly all whale cohorts has created a demand for XRP that is hard to ignore, supporting a bullish thesis for the altcoin. Even recent geopolitical tensions and US macroeconomic developments have failed to dim XRP’s gains, further fueling the bullish narrative. 🔥

Institutional interest is also on the rise, as evidenced by the Digital Asset Fund Flows data compiled by CoinShares. XRP funds attracted over $11 million in weekly inflows from institutions last week, second only to Ethereum. A sign of the times, indeed! 📈

Year-to-date, XRP funds have seen $206 million in flows, the highest among altcoins like Solana, Sui, Cardano, and others. The news of XRP’s treasury allocation by Chinese mobility startup WeBus International and VivoPower further underscores the growing institutional interest in this altcoin. 🚀

Ripple fuels demand, catalysts for XRP

Institutional demand is bolstered by Ripple’s recent endeavors. The payment remittance firm has urged UK regulators to accelerate crypto regulation through a proposal submitted at the London Policy Summit. A bold move, indeed! 🏛️

Ripple has previously collaborated with regulators in Dubai, the EU, and Singapore, making strides in crypto regulation. Its prominent role in the SEC lawsuit, now nearing the end of the appeal process, has only added to its mystique. The firm’s push for clearer crypto regulation has fostered a positive sentiment among market participants throughout the market cycle. 🌍

At Ripple’s UK Policy Summit earlier this year, one message was clear: the time to act is now:

Recommendations for UK policymakers:

➡️ Build a growth-driven framework

➡️ Lead on global standards

➡️ Advance stablecoin adoption

➡️ Tackle tokenization…— Ripple (@Ripple) June 18, 2025

Japanese firm SBI Holding’s support for XRPLedger and XRP has been cited as a significant catalyst driving gains in the altcoin. The firm owns 9% of Ripple Labs equity, acquired in 2016, and its influence is palpable. 🏦

Ripple’s partnerships continue to enhance the firm’s stablecoin and XRPLedger adoption, building a robust use case for the native token, XRP. 🌱

What to expect from XRP after the SEC lawsuit ends?

One of the most formidable obstacles in XRP’s journey is the SEC v. Ripple lawsuit, currently in the appeals process. Attorney Bill Morgan has commented that the SEC’s new approach to crypto regulation has “encouraged Ripple to seek more than it would have been satisfied with before the SEC filed its appeal.” A curious twist, indeed! 🤔

regulatory clarity drives innovation. Canada had the world’s first Bitcoin ETF in 2021. Now it beat the US with an XRP ETF. It’s way past time for the US to catch up and get crypto market structure legislation done.

— paulgrewal.eth (@iampaulgrewal) June 18, 2025

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-06-20 17:29