-

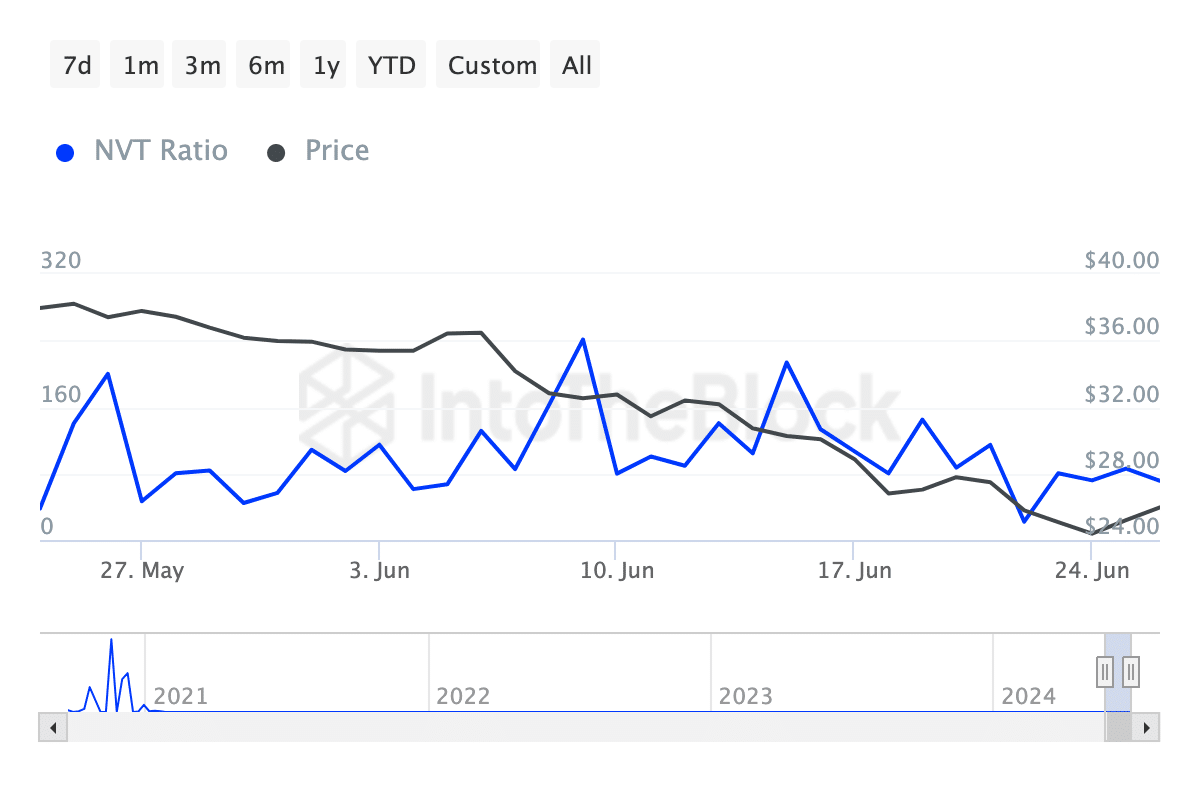

AVAX’s NVT ratio downtrend signals potential undervaluation, indicating bullish prospects.

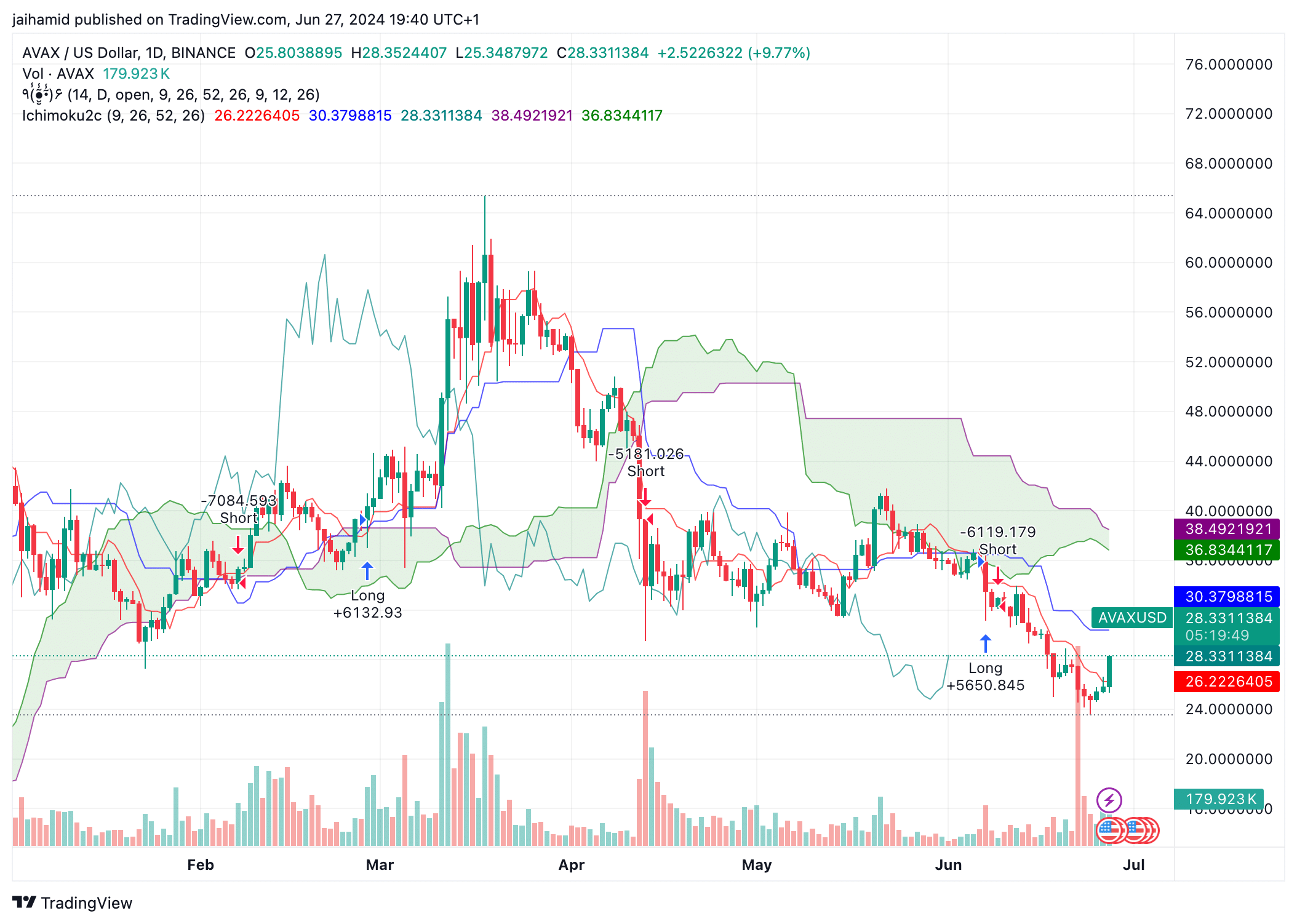

For a bullish reversal, AVAX needs to break above the Ichimoku cloud and see the MACD line cross above the signal line.

As a researcher with experience in analyzing cryptocurrency markets, I find AVAX‘s recent trend intriguing. The downtrend in its NVT ratio is an encouraging sign of potential undervaluation and could indicate bullish prospects. However, the decline in active addresses and increased exchange netflow are concerning factors that may dampen the bullish momentum.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

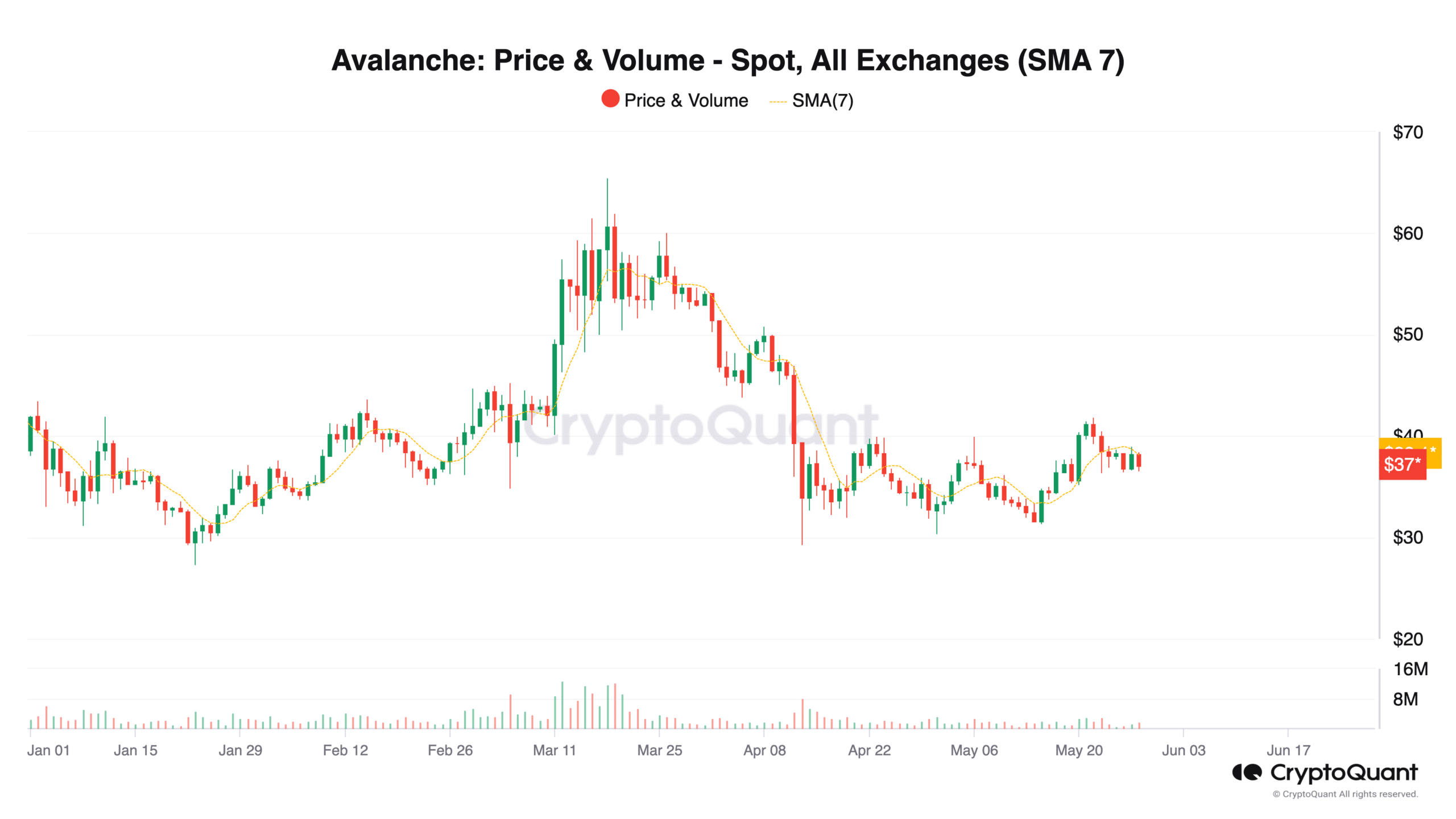

View Urgent ForecastAvalanche [AVAX] is currently showing promising signs of a bullish reversal, driven by recent market dynamics and buying pressure. But what does it need in order for the bulls to make a complete overturn?

As an analyst, I recently examined AVAX‘s network value to transactions ratio based on data from AMBCrypto. The trend is showing a decrease, which is often a positive sign for a token. This downturn could suggest that the token may be underpriced in comparison to the volume of transactions taking place on its network.

The decrease in active addresses on the network up until June may indicate lessened network activity, which could potentially weaken bullish sentiment if this trend continues.

AVAX bulls overpowered by the bears

The amount of AVAX being traded on cryptocurrency exchanges relative to the total daily trading volume has risen significantly, indicating a recent upward trend in the volume of AVAX being transferred to these platforms.

If the NVT ratio (Network Value to Transactions ratio) keeps dropping while transaction volumes increase, this could indicate a stronger, more fundamental market growth. This positive trend might lead to a bullish market turnaround.

The Ichimoku Cloud, represented by the red overlay, indicates a bearish trend approaching. Meanwhile, the Tenkan-Sen line, depicted in blue, sits below the Kijun-Sen line, which is an additional signal hinting at a potential downturn.

Crossover under the cloud completely undermines the current bullish momentum.

As a researcher studying AVAX‘s price action, I believe a bullish reversal can be confirmed if AVAX manages to surpass the Ichimoku cloud significantly, accompanied by the Tenkan-Sen line crossing above the Kijun-Sen line, either within or outside the cloud. Furthermore, an uptick in trading volume on bullish days would add credence to this reversal trend.

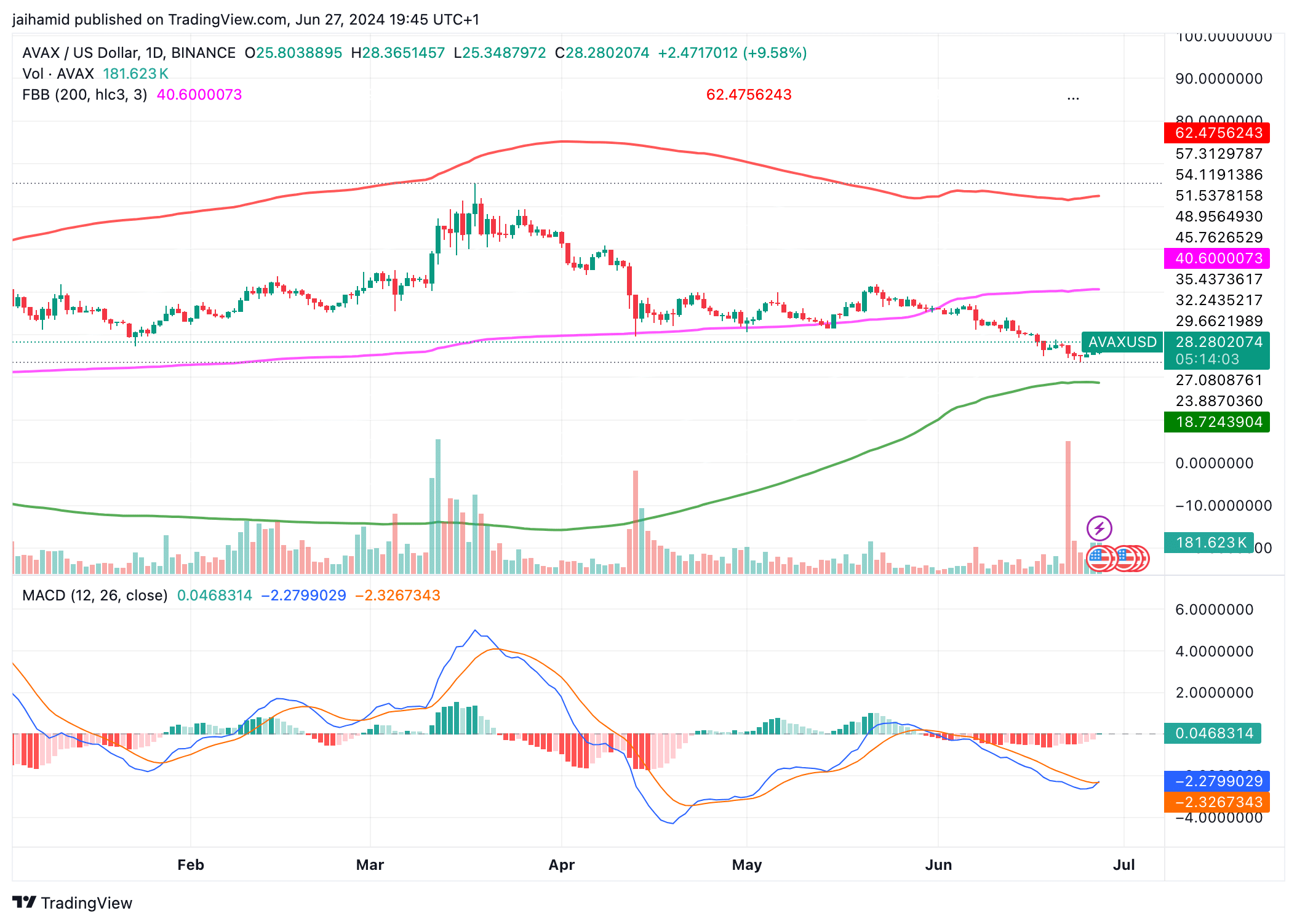

It’s intriguing to note that the 200-day moving average exhibits a robust uptrend in the long run, yet it currently resides well beneath the existing price point. Meanwhile, the MACD line is under the signal line and both are trending downward, driven by bearish forces.

If the price tries to bounce back, the 200-day moving average (green MA) could serve as a significant floor. A turnaround from this point would indicate a bullish shift in the market trend.

Realistic or not, here’s AVAX market cap in BTC’s terms

An effective turnaround would be indicated if the MACD line surpassed the signal line and the price rose above the mid-level red Bollinger Band.

Regrettably, the present configuration strongly favors a bearish outlook, allowing for possible additional decreases.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-06-28 12:07