-

An exchange flow metric showed that the local bottom might be in for BTC, ETH.

The market sentiment was not bullish and holder behavior at crucial support levels would be key for the next price move.

As an experienced analyst, I believe that the exchange flow metric indicates a potential local bottom for Bitcoin (BTC) and Ethereum (ETH). The heavy outflows over the past month suggest accumulation by market participants, which is a positive sign for buyers. However, it’s important to note that the 30-day moving averages remain negative, indicating ongoing selling pressure.

Bitcoin (BTC) and Ethereum (ETH) advocates faced challenges in reversing market trends following substantial losses over the previous ten days. These setbacks brought the prices back to critical support areas, where investors are anticipated to thwart further selling activity.

Based on Ethereum’s MVRM (Market Value to Realized Value) and NVT (Network Value to Transactions) ratios, it appears that the asset may be underpriced. The accumulation of liquidity around the $3500 mark could potentially lead to a short squeeze. However, overall trend indicated bearish momentum.

Simultaneously, a different probe into Bitcoin revealed that mining operations had decreased, resulting in miners offloading their Bitcoins. Nevertheless, the rate of sell-offs had lessened noticeably during the last two days.

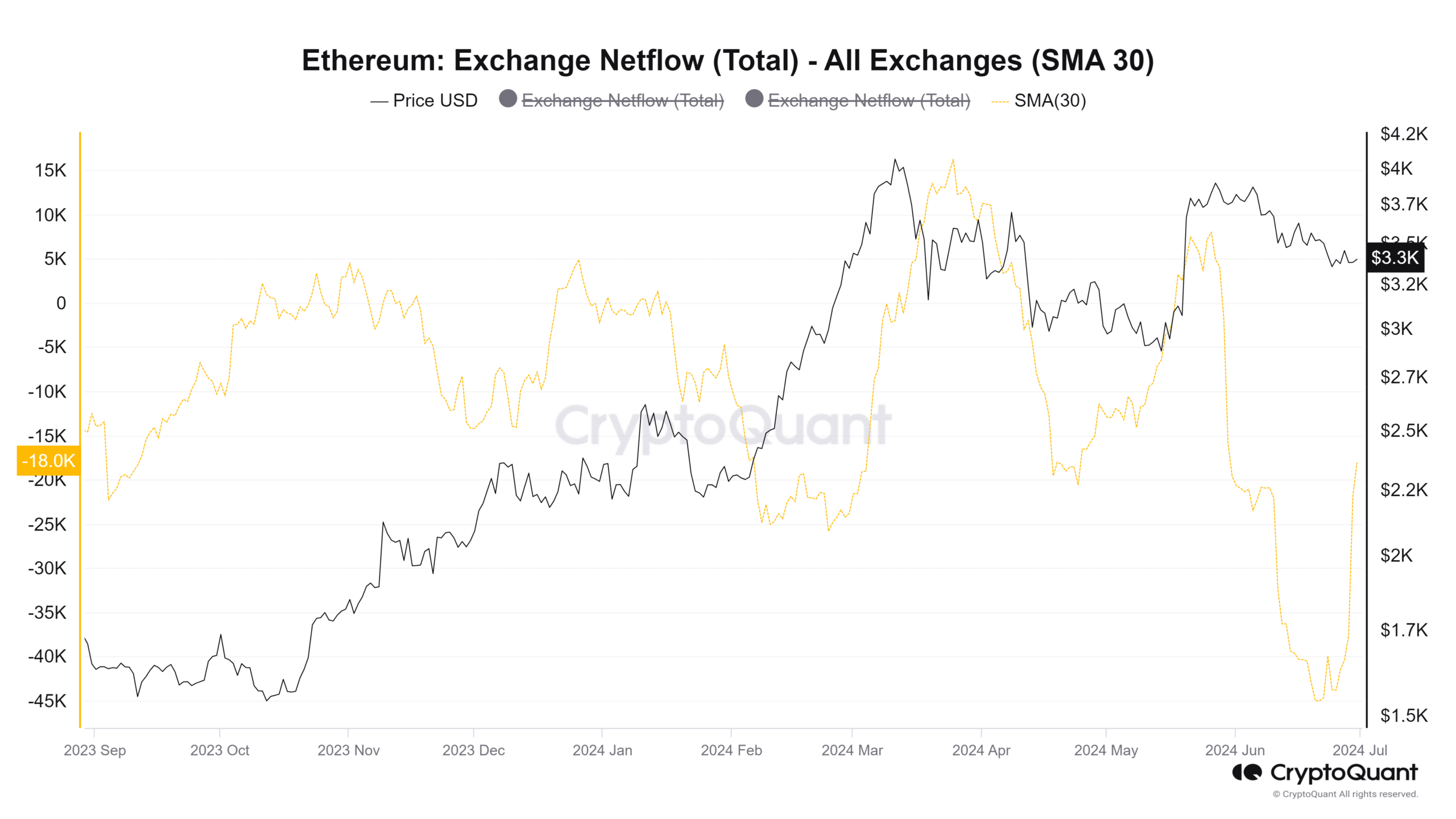

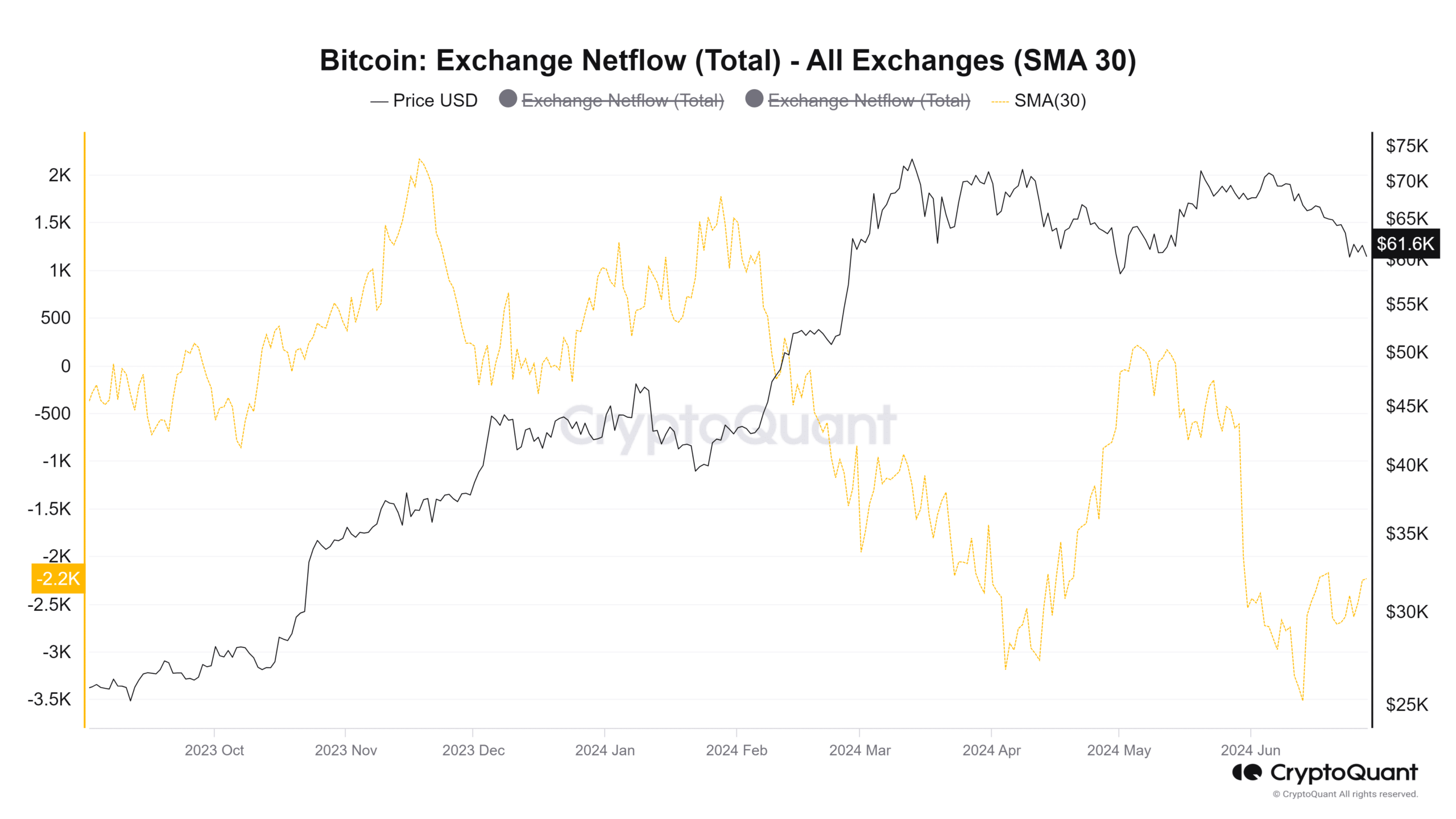

To gauge the market sentiment, AMBCrypto examined the transfer of both assets from exchanges. The findings suggested that bulls may need to be cautious and not celebrate just yet.

What does the exchange netflow metric indicate?

The exchange net flows metric provides useful information about the market dynamics. A positive exchange net flow signifies that more funds are flowing into the market than out.

This action indicates that selling pressure for the crypto may be building up, as market participants appear to be transferring the cryptocurrency to exchanges in order to sell it.

Values below zero mean that outflows are greater, which is a good sign for buyers.

Market participants appear to be transferring their assets from exchanges, possibly for secure storage, which is a sign of accumulation.

To gain a clearer perspective on the trends of exchange flows, we analyzed the 30-day moving averages. Notably, Ethereum saw significant inflows around mid-March and toward the end of May.

Both occurrences marked a local top for the price.

Over the past month, there’s been a significant outpouring of funds, indicating accumulation. However, over the last eight days, this outflow has begun to decelerate. Nevertheless, the 30-day moving average net flow remains in the red.

During February and March, Bitcoin experienced steady accumulation. The 30-day moving average indicated that a greater amount of Bitcoins were leaving exchanges than entering them.

During late April and specifically on May 21st, there were notable increases in Bitcoin’s inflow. However, these incidents bucked the overall trend.

Are Bitcoin, Ethereum headed for a consolidation?

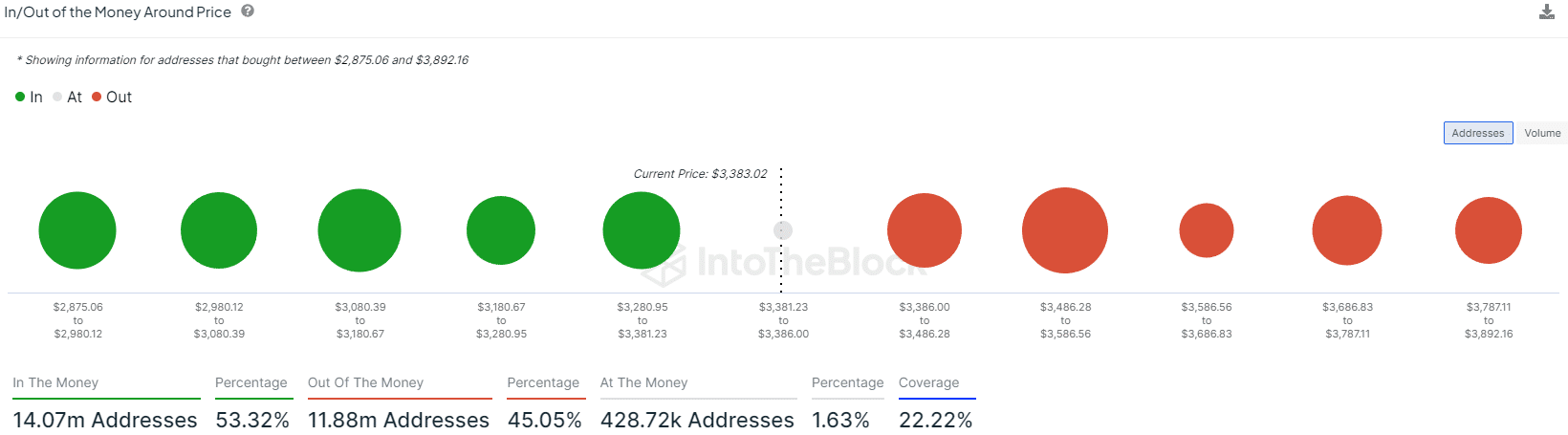

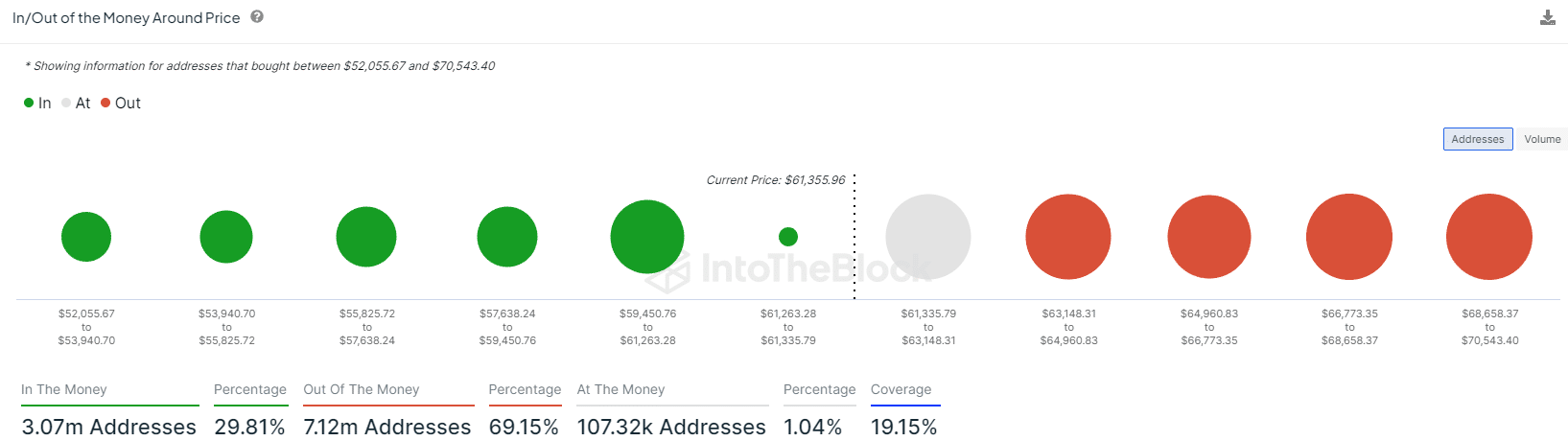

In analyzing the in-and-out-of-money data provided by AMBCrypto, key support areas were identified by IntoTheBlock based on their findings.

Ethereum’s price exhibits robust support levels between $3080 and $3180, as well as $3280 and $3381. Conversely, the price encounters significant resistance around $3486 and $3586.

Read Bitcoin’s [BTC] Price Prediction 2024-25

For Bitcoin, the $59,450-$61,263 is support and $63,148-$64,960 resistance.

The consolidation of prices for these two cryptocurrency market leaders may be limited to these specific levels, resulting in a price range between them.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-01 06:15