- Bitcoin LTHs sold 366k BTC, the highest level since April.

- BTC declined by 4.47% over the past 24 hours.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles. The recent decline in Bitcoin [BTC] following the historic rally has raised some eyebrows, and after careful analysis, it appears that the Long-Term Holders (LTHs) are indeed behind this selling pressure.

After reaching its all-time high (ATH) of $99,800, Bitcoin [BTC] has subsequently dropped to a recent low of $92,584. At the current moment, Bitcoin is being traded at $94,972, representing a 3.47% decrease over the past 24 hours.

Previously, the value of Bitcoin was trending upwards, registering a 3.44% increase over the past week and a significant surge of 41.61% in the last month.

Consequently, the significant drop following a remarkable surge has sparked curiosity about its cause. It appears that Long-Term Holders (LTHs) might hold the key, based on insights from Glassnode.

Who is selling Bitcoin?

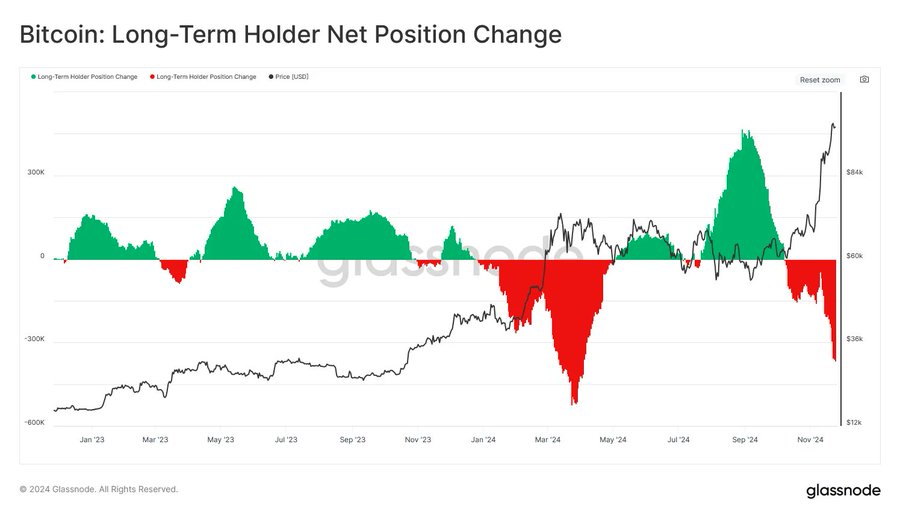

According to Glassnode’s assessment, it appears that Long-Term Holders (LTHs) of Bitcoin have decided to sell their tokens. They have offloaded a substantial amount, approximately 366,000 BTC units, which is the highest since April. This massive sale could potentially put pressure on the market, leading to a temporary pullback.

Consequently, due to the increased profits observed over the past few days, Large Traders have started cashing out their gains (or taking profits).

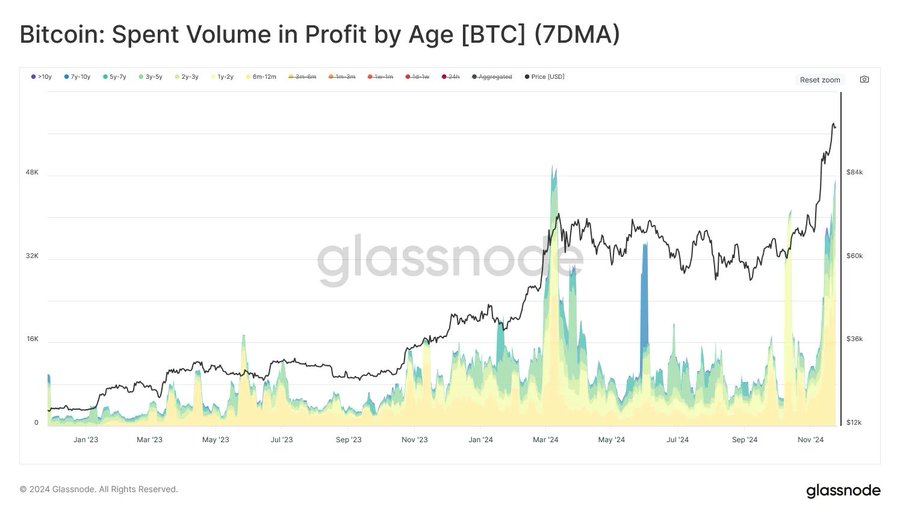

Among these Long-Term Holders (LTHs), we find groups of approximately 6 million to 12 million individuals. These enthusiastic investors are consistently leading the market trend, investing a minimum of 25,600 Bitcoin tokens per day with profits.

In simpler terms, they used Bitcoin that they had purchased for an average of 29% below its current record-high price of $99k. Furthermore, given that BTC reached this historic peak, long-term holders in this group have significantly profited from the market surge.

From this observation, it appears that the current market adjustment stems primarily from heightened selling actions by Long-Term Holders (LTHs).

Impacts on BTC Charts?

As a crypto investor, I’ve been closely watching the market, and according to my analysis based on AMBCrypto’s insights, while Bitcoin (BTC) has experienced a daily decline, it continues to be in a bullish phase. This recent pullback seems to have provided an opportunity for both whales and retail traders like myself to accumulate more BTC, potentially setting us up for further gains.

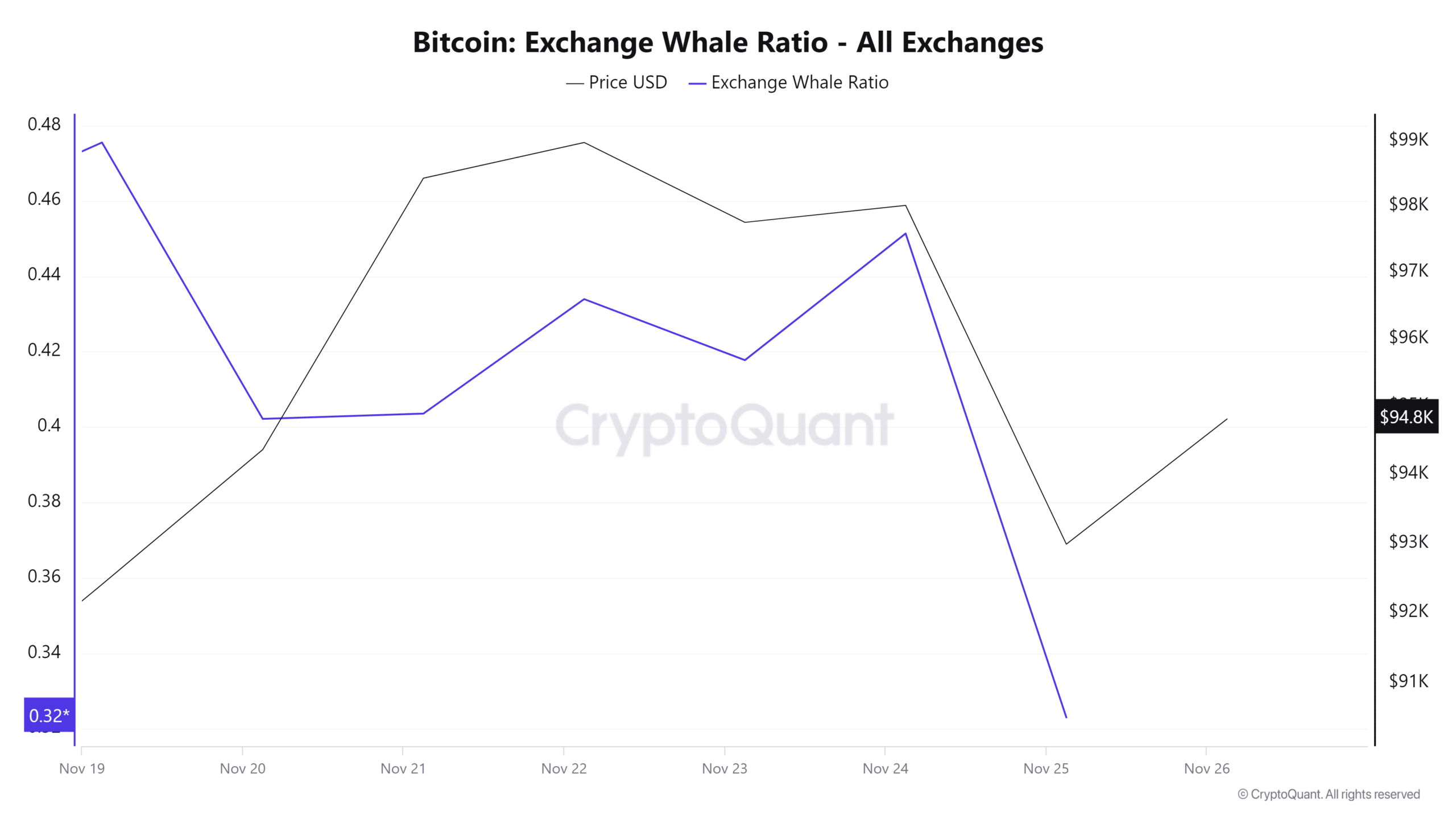

To begin with, the Bitcoin Whale Exchange Ratio dropped from 0.4 to 0.32 during the last week. This suggests that while Large Token Holders (LTHs) have offloaded some BTC, Whales are still actively purchasing more Bitcoin.

Consequently, it seems that large Bitcoin holders (whales) aren’t moving their BTC to exchanges, which usually indicates a desire to sell. Instead, this action suggests that these whales are optimistic about the future of Bitcoin and plan to keep holding onto it for potential long-term profits.

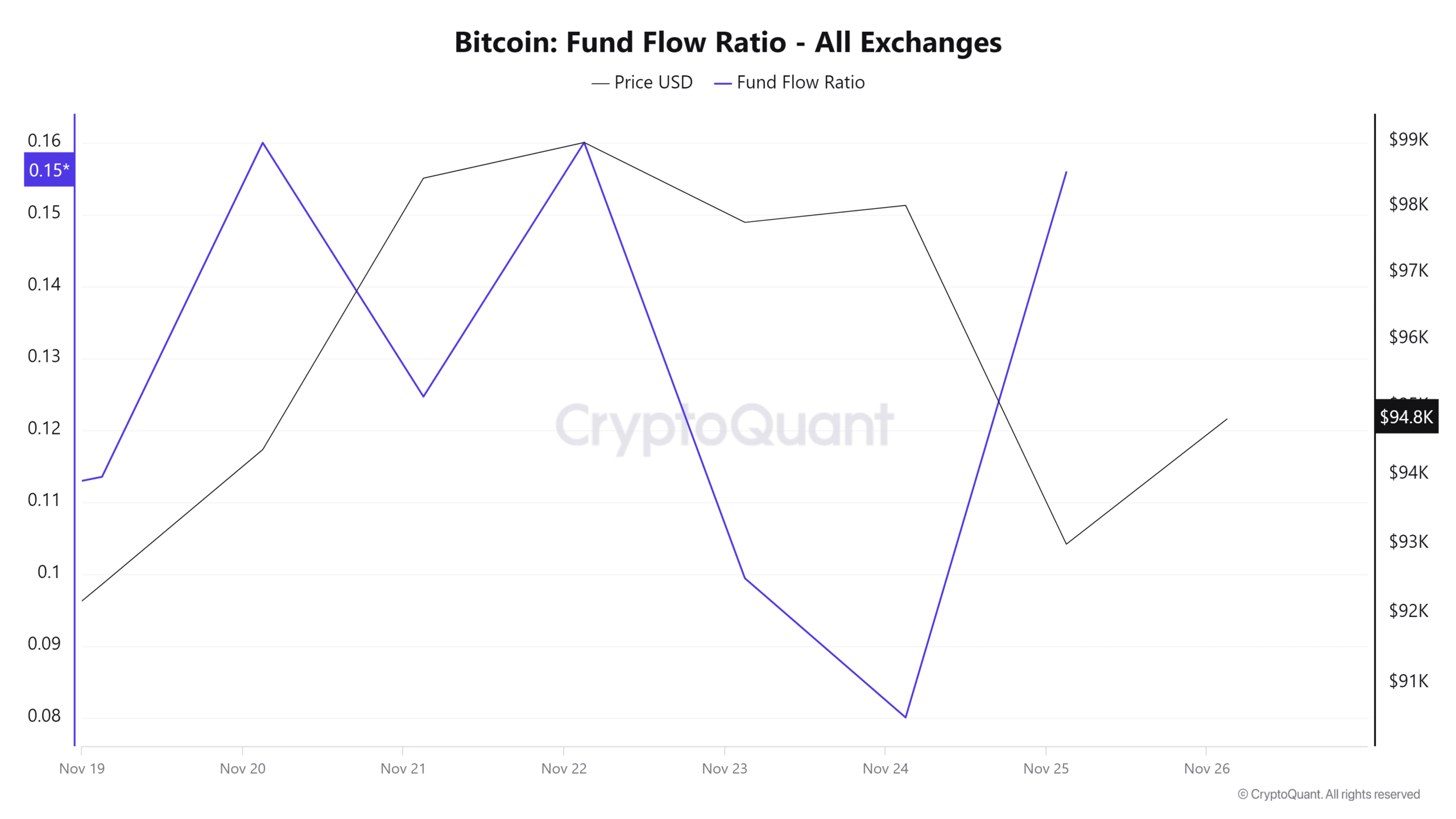

Furthermore, the Bitcoin Fund Flow Ratio has significantly risen from 0.08 to 0.15, indicating a higher demand for purchasing compared to selling since more money is flowing in than out.

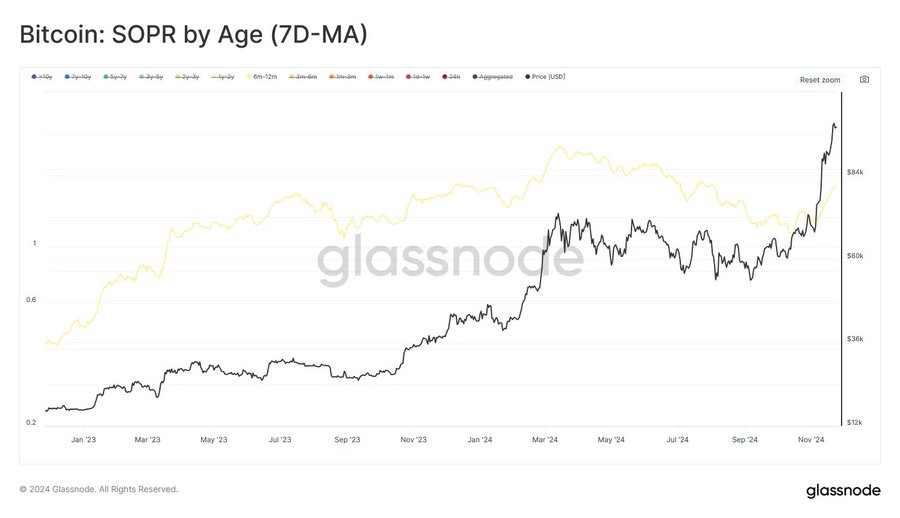

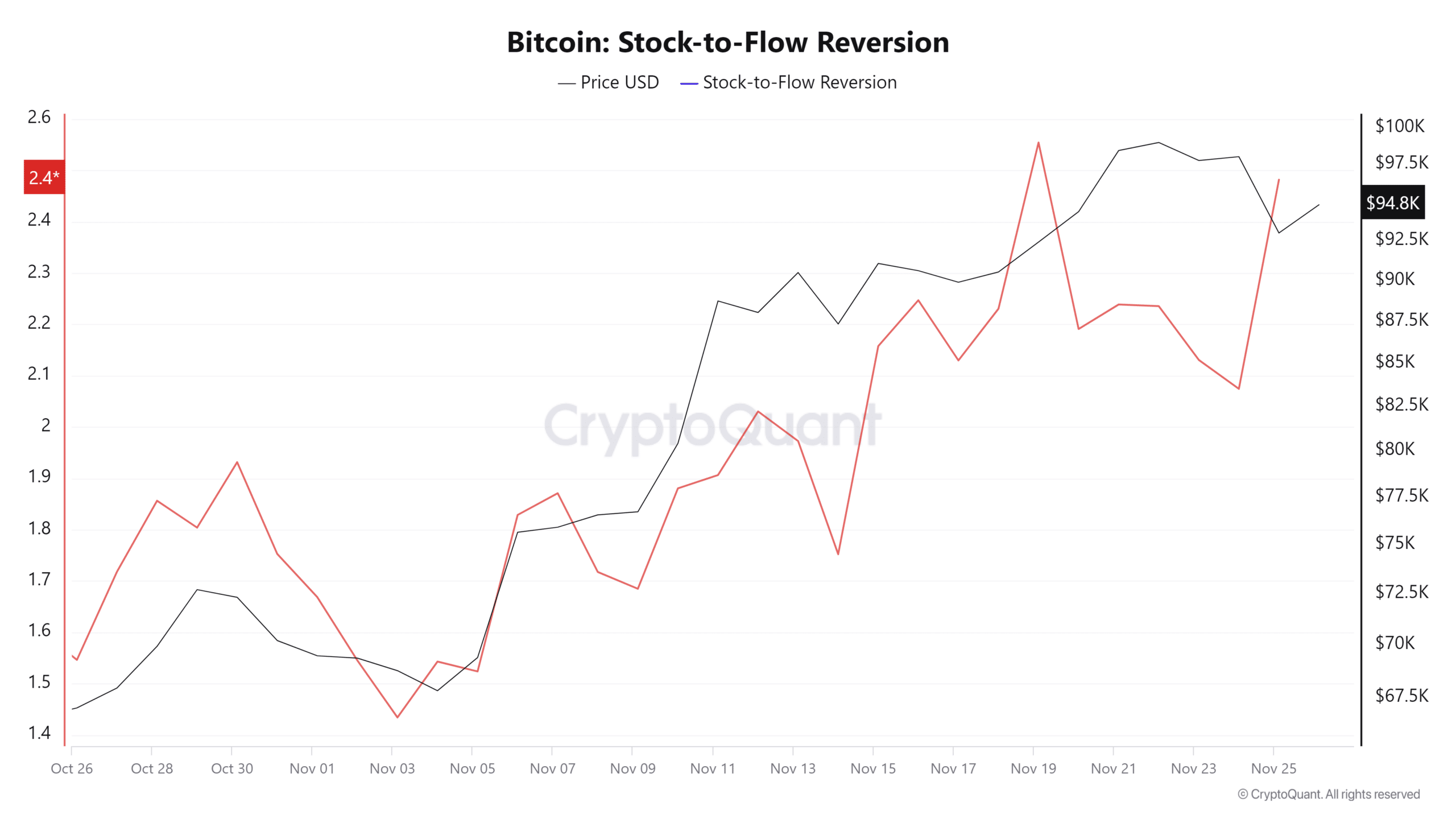

In summary, the increasing Stock-to-Flow (SFR) reversal indicates a surge in optimism towards Bitcoin. A higher SFR reversal usually signals an increase in investor confidence about Bitcoin’s worth, which is often driven by greater demand and acceptance within the market.

In simpler terms, even though Long-Term Holders (LTHs) of Bitcoin have recently shifted to making profits, the overall trend for Bitcoin continues to be bullish. This is evident as whales are buying more Bitcoin and there’s still a significant amount of money flowing into it.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Under these circumstances, I anticipate Bitcoin (BTC) may continue to grow. Specifically, I believe that BTC will overcome the $99,000 resistance point, a level where it has previously been rejected three times. Beyond this threshold, there appears to be minimal significant resistance, which could potentially lead Bitcoin to set another All-Time High (ATH).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-26 19:04