-

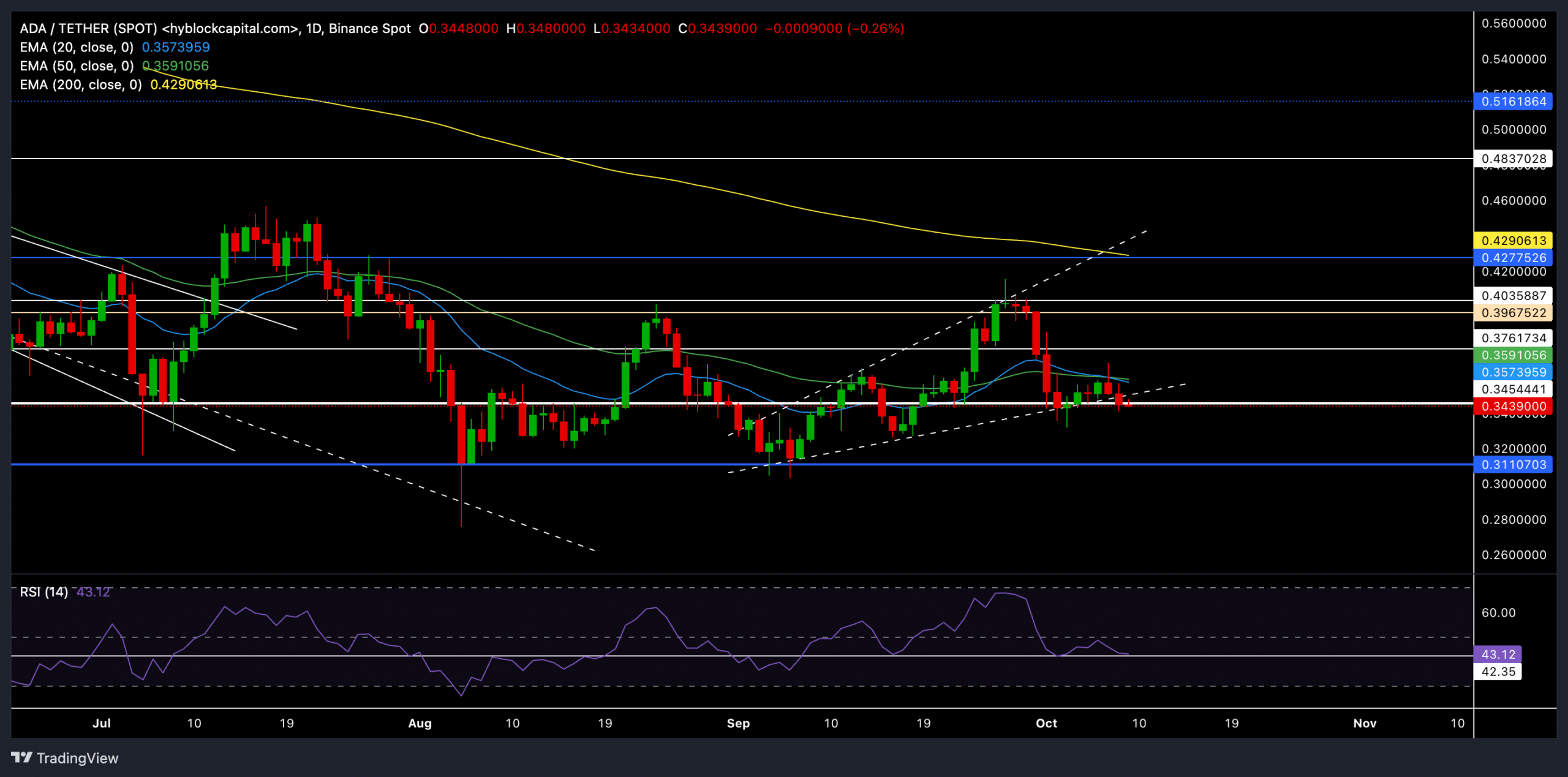

A decline below the $0.34 support can confirm a patterned breakout.

Derivates data for ADA showed mixed sentiment.

As a seasoned analyst with years of experience navigating the volatile crypto markets, I find myself cautiously optimistic about Cardano [ADA]. While the recent bearish trend is evident, the current price action presents an intriguing opportunity for traders who understand market dynamics and are willing to take calculated risks.

The cryptocurrency, Cardano‘s ADA, has persistently shown a downward trajectory, dipping beneath both its 20-day and 50-day moving averages, indicating a stronger tendency for prices to decrease.

Following a dip in value, ADA has been finding it tough to hold ground above vital resistance points. As of now, it’s being transacted at approximately $0.3439, experiencing a decrease of 2.5% over the past day.

Is a rebound for Cardano in sight?

The latest surge in ADA‘s price, which originated at the $0.30 support level, has formed a characteristic widening trend channel or wedge shape on its daily graph.

The altcoin attempted to position itself above the 20-day and 50-day EMAs, only to be rejected at the $0.40 resistance level.

Over the past fortnight, this rejection caused a drop in value by approximately 14%, and the market’s movement fell beneath the Exponential Moving Averages (EMAs).

The descending trend in ADA now positions the $0.34 mark as a vital threshold.

If ADA falls below its current level, it may signal a breakout from the expanding triangle formation, which might increase the chances of more price drops ahead.

Potential short-term goal for Cardano sellers is approximately $0.31, a level that could attract buyers again as they look to safeguard the psychological support area.

Strengthening the negative trend, the 20-day Exponential Moving Average (EMA) dropped below the 50-day EMA, hinting at a rise in bearish power within the market.

This blend might push downward momentum even more, potentially causing Cardano (ADA) to test the $0.31 as a potential support point. Following this, there could be a possible upturn.

In simpler terms, when looking at the Relative Strength Index (RSI), it showed less pronounced troughs, but the actual price drops were more severe.

This gap suggests that the demand may be increasing, possibly signaling a future shift or reversal in the upcoming trading periods.

If the price bounces back at around $0.3 and the Relative Strength Index (RSI) rises over 50, it might suggest an advantageous moment for traders seeking to benefit from brief price increases in the short term.

Derivatives data reveals…

Based on the provided derivatives data, the future perspective for ADA appears somewhat ambiguous. The 24-hour trading trend leaned slightly towards neutral, as indicated by a long/short ratio of 0.941, suggesting a relatively even distribution of bullish and bearish sentiments among traders.

On Binance and OKX, there was a significant bias towards long positions, with the Long/Short Ratios standing at approximately 3.59 and 3.05 respectively.

Read Cardano’s [ADA] Price Prediction 2024–2025

Although there’s an upbeat atmosphere, it appears that the trading volume has dropped by 34.43%. This suggests less market activity and potentially weak confidence among Cardano traders, who may not be fully committed to their positions.

The liquidation data revealed that long positions were more prominent, with minimal short liquidations, hinting that profit-taking might drive the current downward movement more than aggressive shorting.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-10-09 18:16