- A surge in demand has been observed among U.S. investors, who appear eager to accumulate ETH

- Analysts predict the next potential price target could exceed $10,000, fueled by an anticipated rally

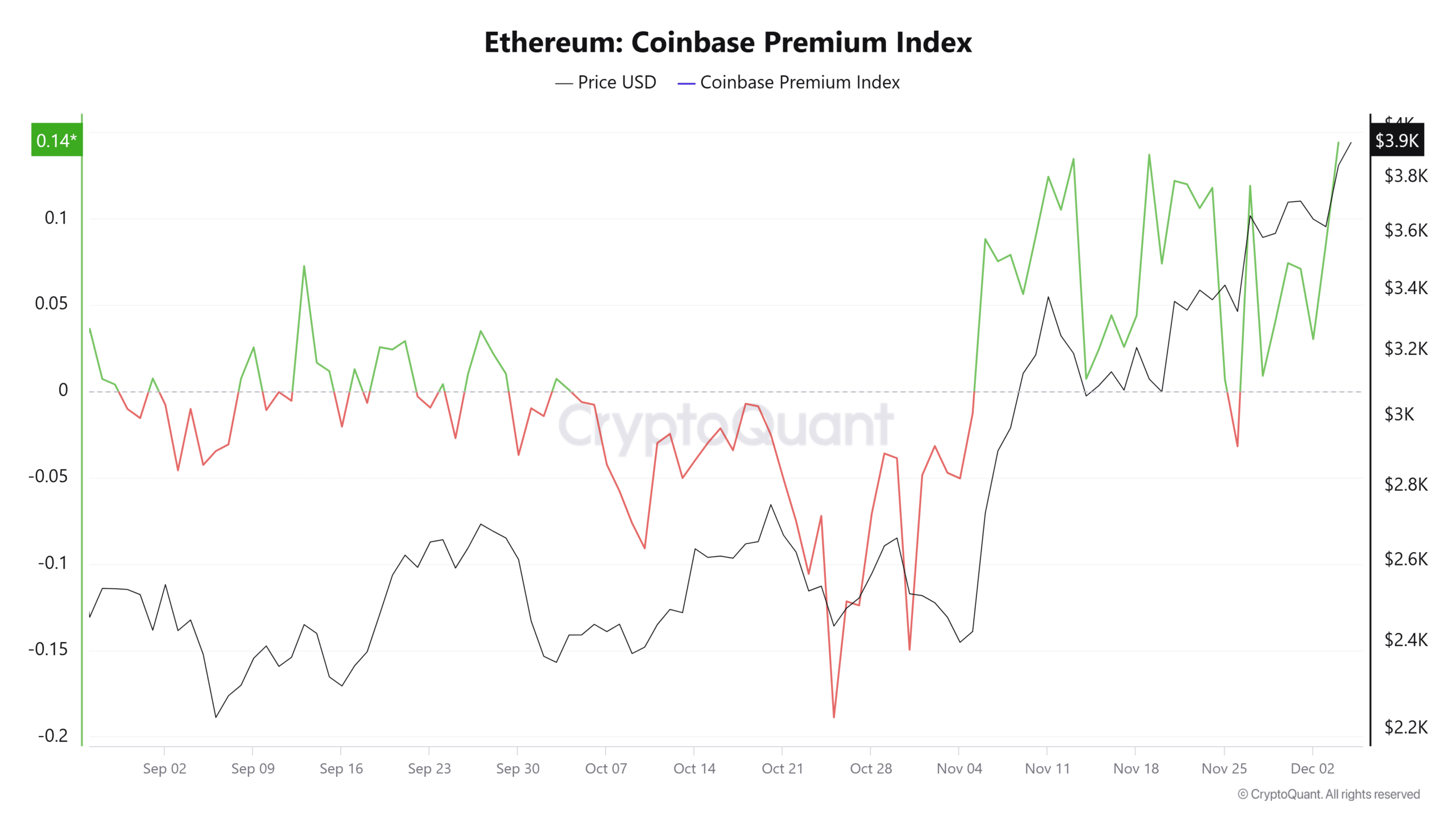

As a seasoned researcher with a decade of experience in the ever-evolving world of cryptocurrencies, I can confidently say that the recent surge in interest from U.S. investors towards Ethereum (ETH) is more than just a passing trend. The Coinbase Premium Index, a reliable indicator of demand, reaching its highest level since April 2024, is a clear sign that this isn’t your average market flutter.

In a brief span of about a week, Ethereum (ETH), the leading alternative coin, experienced a nearly 10% surge and was trading around $3,900 as of the current press update – Indicating a revived enthusiasm towards this digital currency. However, that’s not the only development…

Due to increasing attention from U.S. investors and a decrease in its foreign currency reserves, Ethereum (ETH) might show a substantial price increase in its charts shortly.

ETH attracts more interest from U.S. investors

The interest in Ethereum (ETH) among American investors is significantly increasing, a trend that’s clear from the Coinbase Premium Index on CryptoQuant.

Currently as I type this, the index stands at 0.1440, marking its peak since the month of April 2024. It’s important to mention that during this time, the value of ETH was significantly elevated.

The Coinbase Premium Index tracks the price difference between ETH on Coinbase, a major U.S-based cryptocurrency exchange, and other global platforms like Binance.

A larger reading suggests a stronger interest or higher preference for Ethereum (ETH) among American investors compared to those from other global markets.

The increase we previously mentioned in the index suggests an increasing curiosity about the asset, potentially leading to more positive movement for Ether (ETH).

What’s next for ETH?

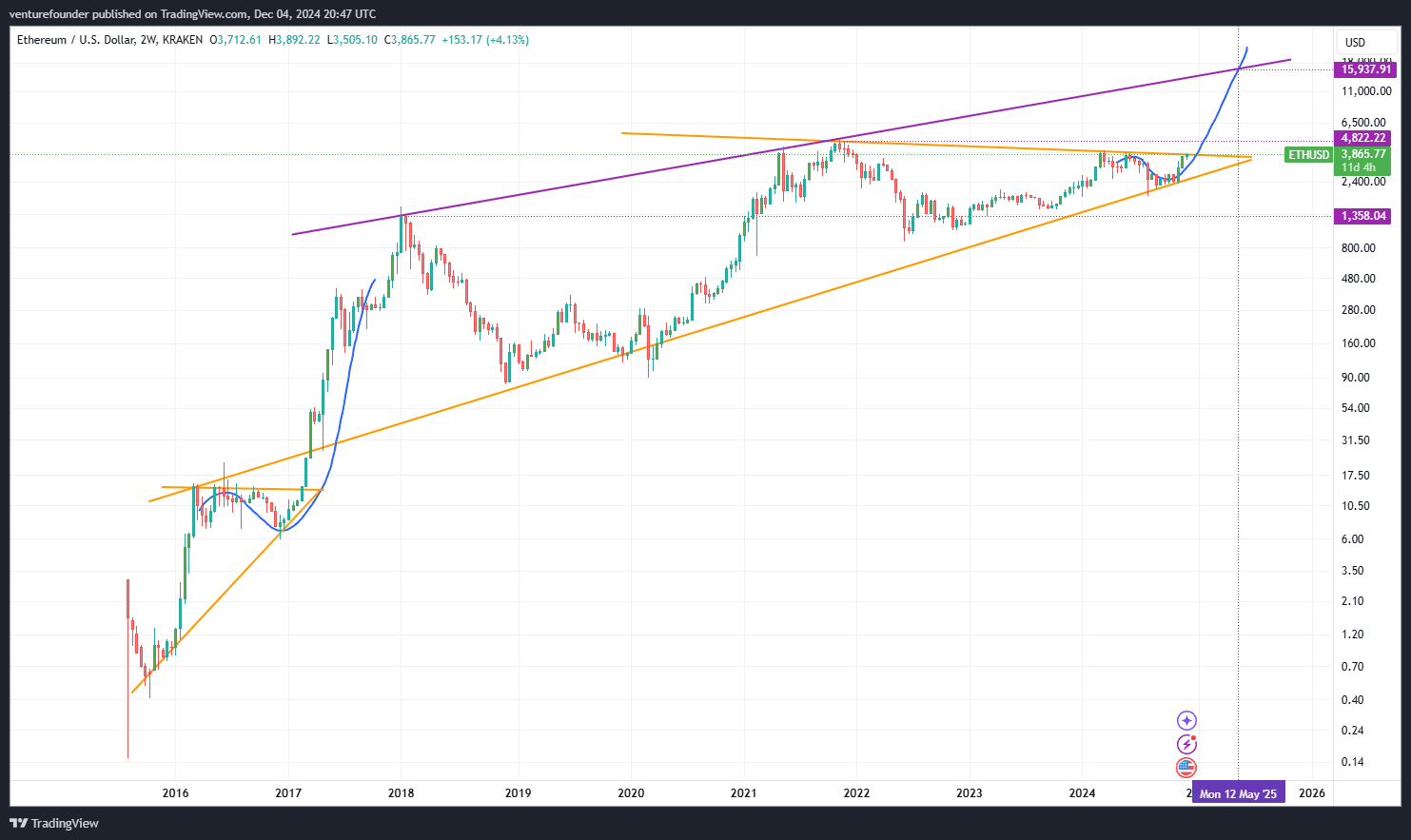

As an analyst, I’ve been closely observing the Ethereum (ETH) market, and based on my analysis, it appears that ETH could be poised to burst out from a three-year consolidation triangle formation. Historically, such a breakout often indicates the commencement of a bullish trend or rally.

Upon the onset of this surge, fueled by strong buying pressure that appears to originate primarily from U.S.-based investors and other market participants, I foresee Ethereum (ETH) experiencing a price spike. Potential price targets could range between $11,000 and $15,000, as suggested by the chart provided.

The popular analyst added,

“[ETH] price target: $15,937.”

It’s important to note that the asset might be able to reach those levels if Ethereum (ETH) repeats the significant price surge it experienced from 2016 to 2017, as indicated by the blue line on the graph.

If this pattern holds, ETH could continue its upward trajectory towards the predicted price levels.

Market gears up for upswing

Furthermore, it’s worth noting that the latest figures show a persistent drop in Ethereum Exchange Reserves, currently sitting at approximately 19.3 million ETH as we speak.

A decrease in Ethereum’s exchange reserves usually indicates less ETH available for trading on exchanges. If this decrease coincides with increasing demand, it often triggers an increase in the price of Ethereum.

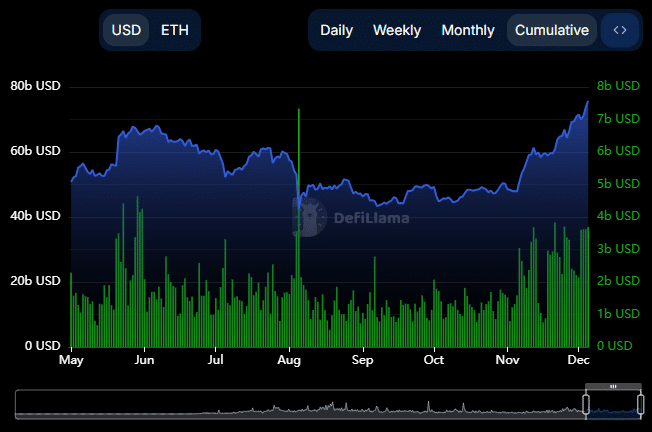

Furthermore, the Total Value Locked (TVL) on Ethereum, representing the value of Ether invested across different platforms, has soared to an impressive $71.08 billion. Notably, this figure hasn’t been attained since the year 2022.

Collectively, these tendencies point towards an optimistic future for Ethereum, indicating robust market trust and the possibility of continuous expansion as demand increases.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-06 09:13