-

XRP saw a rapid increase in dormant activity that was followed by a 12% price drop.

The falling MDIA gave long-term holders some bullish hope.

As a seasoned crypto investor with a few battle scars to show for it, I’ve learned to read between the lines when it comes to market trends and on-chain metrics. The recent surge in dormant activity on XRP is a red flag that I’ve seen before – it often precedes a price correction, as we saw with the 12% drop last week. However, I’m not one to panic sell just yet.

Last week, there was a surge in significant investor activity involving Ripple [XRP]. In fact, investors holding over $5 million account for approximately 55% of the total token supply. This high concentration among large investors could potentially cause significant price fluctuations, like the one observed on July 10th, 2023.

Over the past few months, the price had been going through a period of stabilization and found it challenging to surpass the upper limit of $0.7, which has stood firm since August 2023. The analysis of transaction data indicated an uptick in short-term selling activity related to XRP.

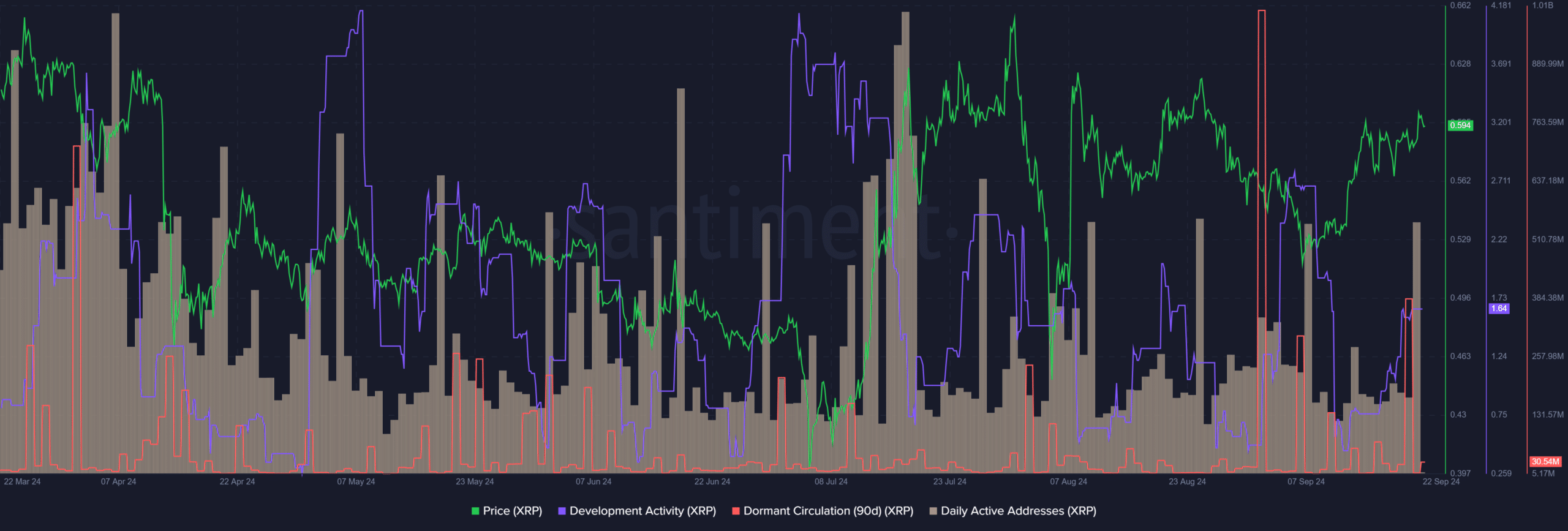

Biggest dormant circulation spike in over a year

On September 2nd, there was a massive increase in the dormant circulation, indicating a significant surge in activity across XRP addresses. This spike was even surpassed by the activity level seen in June of 2023.

Typically, when this measurement rises, it tends to be followed by a significant decrease in price. In the case of XRP, such a decline occurred over the subsequent four days, leading to a drop of 12.18%, from $0.572 down to $0.502.

The development activity was going apace for XRP, but its value was surprisingly low compared to large-cap industry leaders such as Cardano [ADA]. Meanwhile, the daily active addresses remained relatively stable in the past six weeks.

Assessing the chances of capital flow into the network

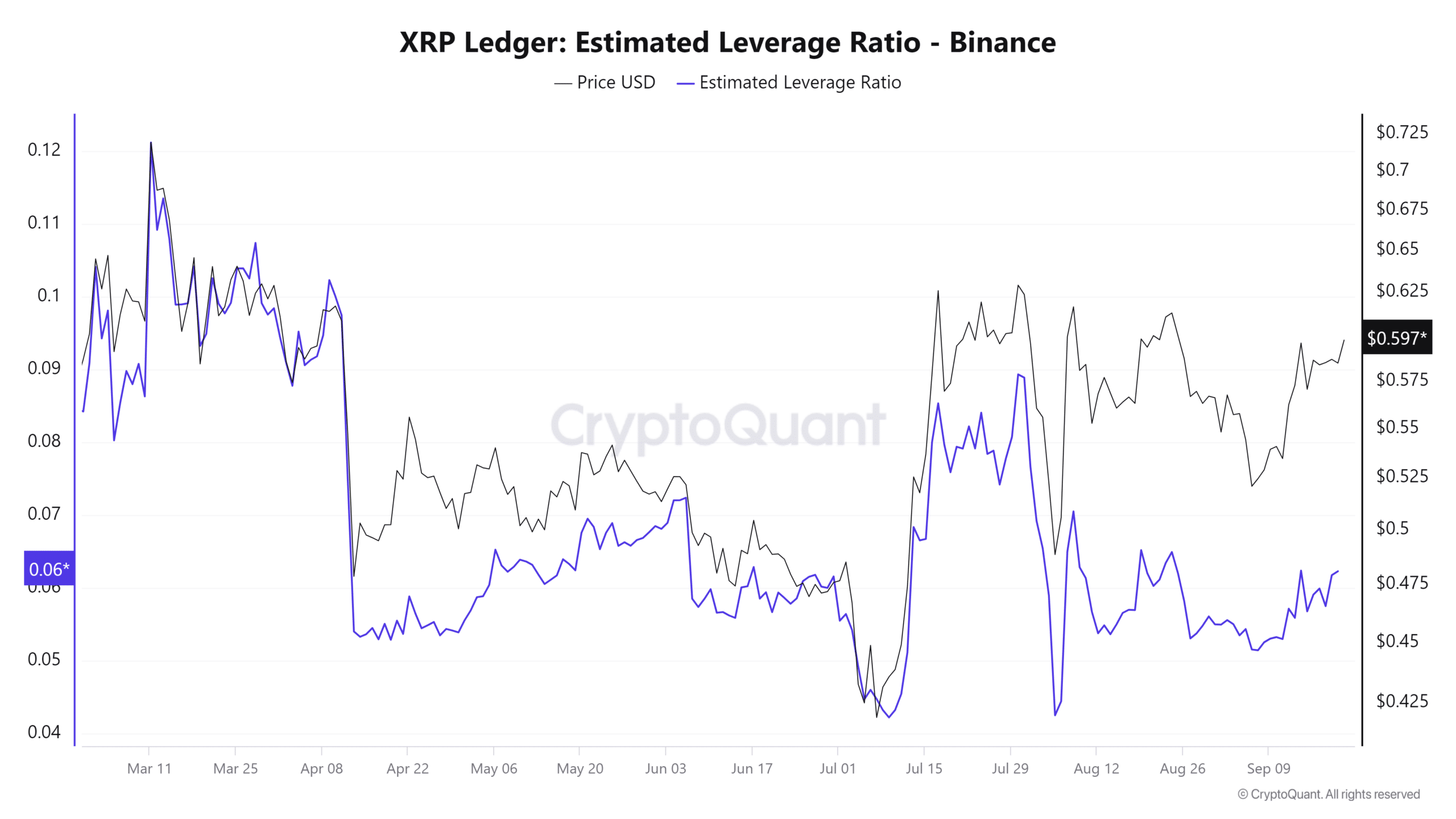

In mid-July, the projected leverage ratio noticeably increased along with prices, but it’s been relatively stable since then, indicating that speculators have been hesitant to take on new margin positions in the last month.

The finding reinforced the idea that XRP is undergoing consolidation.

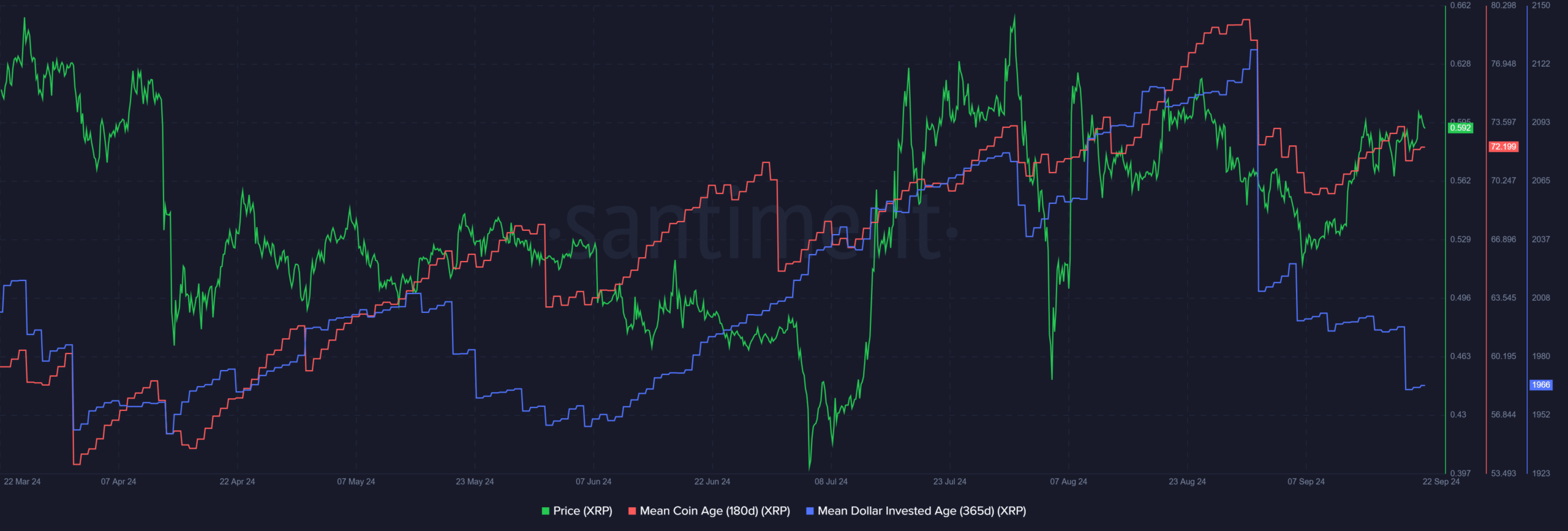

In September, the average age of coins decreased significantly, supporting the observation from inactive circulation. Over the last fortnight, this widespread distribution has been slowing down, and the average age of coins seems to be trying to rise again.

Realistic or not, here’s XRP’s market cap in BTC’s terms

A notable observation is the swift drop in the average age of dollars invested (MDIA). When this trend ascends, it indicates that investments are becoming increasingly stationary, with older coins tending to stay in the same digital wallets for longer periods.

A decline in a token’s trend often suggests that it may soon experience an increase in value. This can be interpreted as investors withdrawing their assets and returning them to circulation, which could lead to heightened network engagement.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-23 10:15