-

The crypto market rallied after an aggressive Fed rate cut.

Trump became the first former president to transact using BTC.

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous market shifts and transformations. The recent developments in the crypto sphere are no exception to my observations.

The crypto market reacted positively to the first Fed rate cut in four years.

On September 18th, the U.S. Federal Reserve reduced its interest rates by half a percent (or 50 basis points), an unexpectedly bold decision that left many economists, who had anticipated only a quarter of a percent reduction, taken aback.

After the Federal Reserve’s shift in policy, also known as a “pivot”, Bitcoin saw a 2.3% increase during Wednesday’s trading session. In the wee hours of the 19th of September in Asia, Bitcoin rose to reach approximately $62,500.

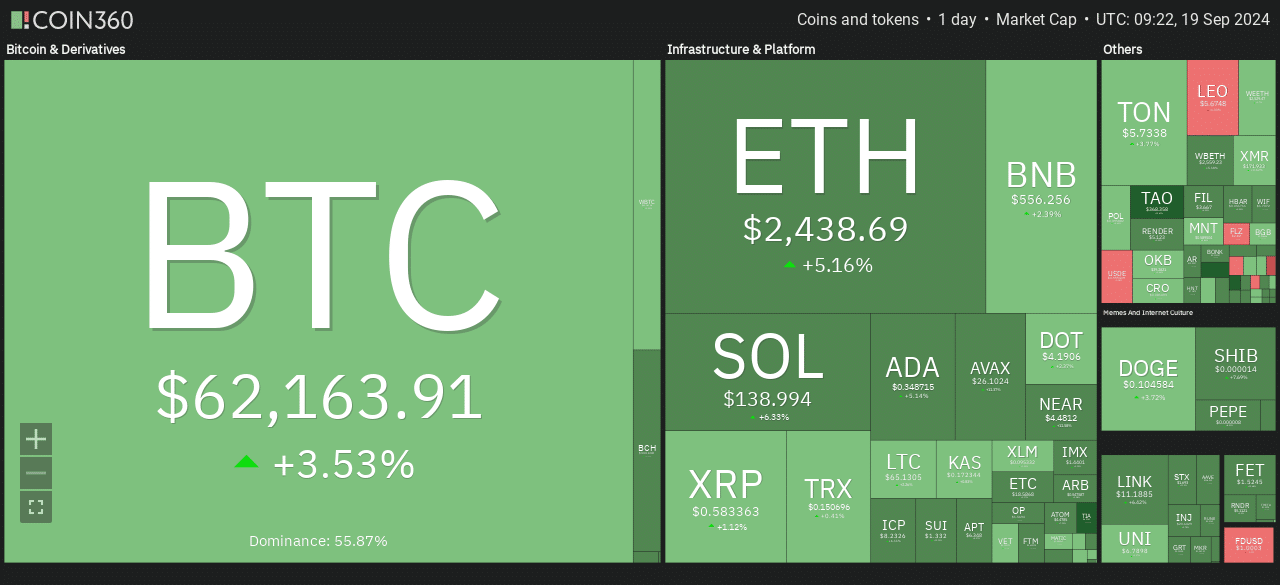

Currently, the value of the asset is recorded at approximately $62,100, and there have been significant increases observed within the industry. Specifically, Ethereum [ETH] has experienced a 5% increase over the previous 24-hour period.

However, during that timeframe, Solana (SOL) posted the largest daily increases among significant assets, amounting to approximately 6.4%.

Nevertheless, financial experts expressed caution, suggesting that the significant rate reduction by the Fed might indicate a slowing economy, which could potentially unsettle risky investments in the near future.

In simpler terms, Arthur Hayes, the founder of BitMEX, referred to a severe reduction as a ‘devastating event’ for financial markets. This drastic move might result in subdued price movements following a couple of days.

He further warned that Friday’s BoJ (Bank of Japan) decision could be another factor determining BTC’s next price direction. Hayes noted,

“A weak JPY will mean stronger BTC and vice versa.”

Antony Pompiliano, a Bitcoin investor, asserted that concerns about an economic downturn primarily affect short-term traders looking to profit quickly. On the other hand, for those with a long-term investment perspective, the Federal Reserve’s interest rate reductions are seen as positive for Bitcoin’s growth trajectory.

Trump becomes the first president to transact using BTC

18th September found former U.S. President Donald Trump dropping by a well-known New York pub, settling his bill with Bitcoin.

Thomas Pacchia, the owner of the pub key, declared it a historic moment when he paid for his event’s attendees’ meals and beverages using Bitcoin.

“The first transaction by a president on the Bitcoin protocol. History!”

Instead of being against Bitcoin during his previous term in the White House, Trump now supports it and has proposed creating a strategic reserve of Bitcoin if he gets re-elected.

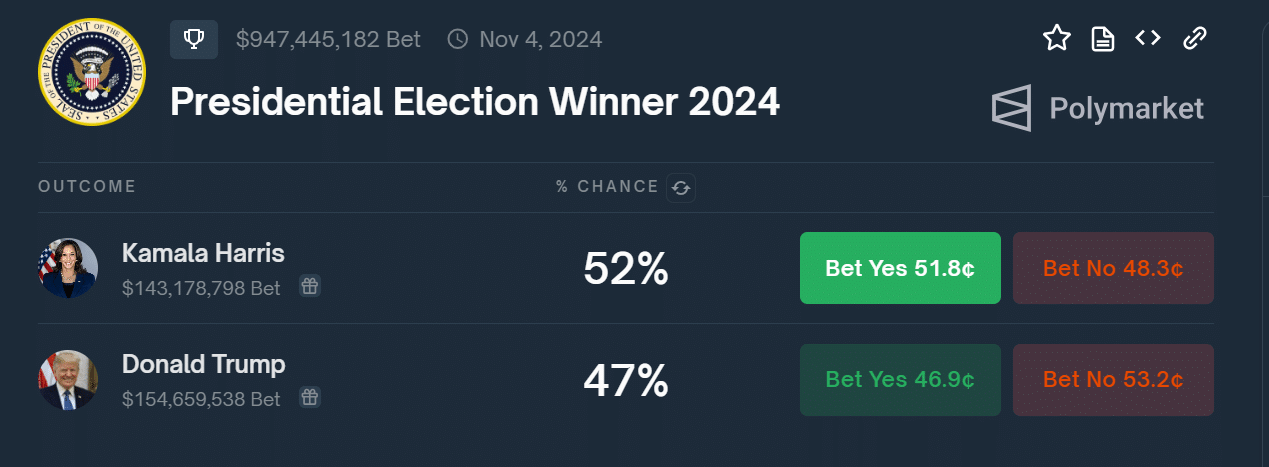

Consequently, the movement of Bitcoin’s price seems to be growing more closely tied to the likelihood of Donald Trump winning the 2024 U.S. presidential election.

Currently, if the election were held now, there’s approximately a 47% probability of Donald Trump winning, while Joe Biden has a 5-point advantage on the forecasting platform Polymarket.

Wisdom Tree unveils RWA platform on Ethereum

Ultimately, the asset management firm known as Wisdom Tree, overseeing a whopping $110 billion in assets, has debuted a tokenization platform for real-world assets. This innovative system is designed to operate smoothly on the Ethereum network.

The innovative product named Wisdom Tree Connect is designed to facilitate seamless communication between traditional finance (TradFi) and decentralized finance (DeFi), as stated by the company. In charge of the Digital Assets sector at WisdomTree, Will Peck made this statement:

As the curiosity towards tokenized real-world assets grows, WisdomTree Connect aims to offer these digital funds to businesses operating within blockchain environments, ensuring they can continue to function seamlessly within their ecosystem.

Wisdom Tree is set to align with industry giants such as BlackRock and Franklin Templeton by introducing comparable offerings. These offerings aim to provide cryptocurrency companies with investment opportunities in U.S. Treasury bonds, serving as a potential reserve.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-19 23:04