Crypto Triumphs! 🚀🏛️ Rate Cuts & Pro-Bitcoin SEC?!

- The crypto market, like a stubborn weed pushing through concrete, showed resilience, expecting long-term gains from Trump’s trade war.

- Bitcoin holds strong, a digital samovar steaming merrily as pro-crypto sentiment builds in Washington, oh, the irony!

Following the theatrically named “Liberation Day” tariffs, the cryptocurrency market, that unpredictable beast, has experienced notable volatility, a dance between geopolitical gusts and regulatory arm-waving. 🎭

As the dominant asset by market capitalization, Bitcoin [BTC] continues to set the tone, a blaring trumpet in the otherwise chaotic crypto orchestra. 🎺

Trading at $84,121 at press time, BTC registered a modest 0.65% increase from the previous close. A tiny step for Bitcoin, a slightly larger step for crypto-kind? 🤔

Despite concerns over a potential “market-wide” correction—a phantom menace, perhaps?—the anticipated sell-off, that great decluttering sale, failed to materialize. As a result, the market remains in the green, maintaining its upward trajectory. A stubborn, verdant vine clinging to the facade of the financial world.

What happened in crypto today?

Let’s take a step back, as one does when contemplating the absurd, to analyze the aftermath of the trade war. The Volatility Index (VIX) spiked to an eight-month high, reflecting a surge in market uncertainty and risk appetite. Like a startled cat, the market jumped. 🐈⬛

All three major U.S. stock indices saw massive sell-offs, erasing trillions in market capitalization, with the Magnificent Seven stocks trading 34% below their respective all-time highs. Oh, the hubris! Even the mighty stumble. 🤡

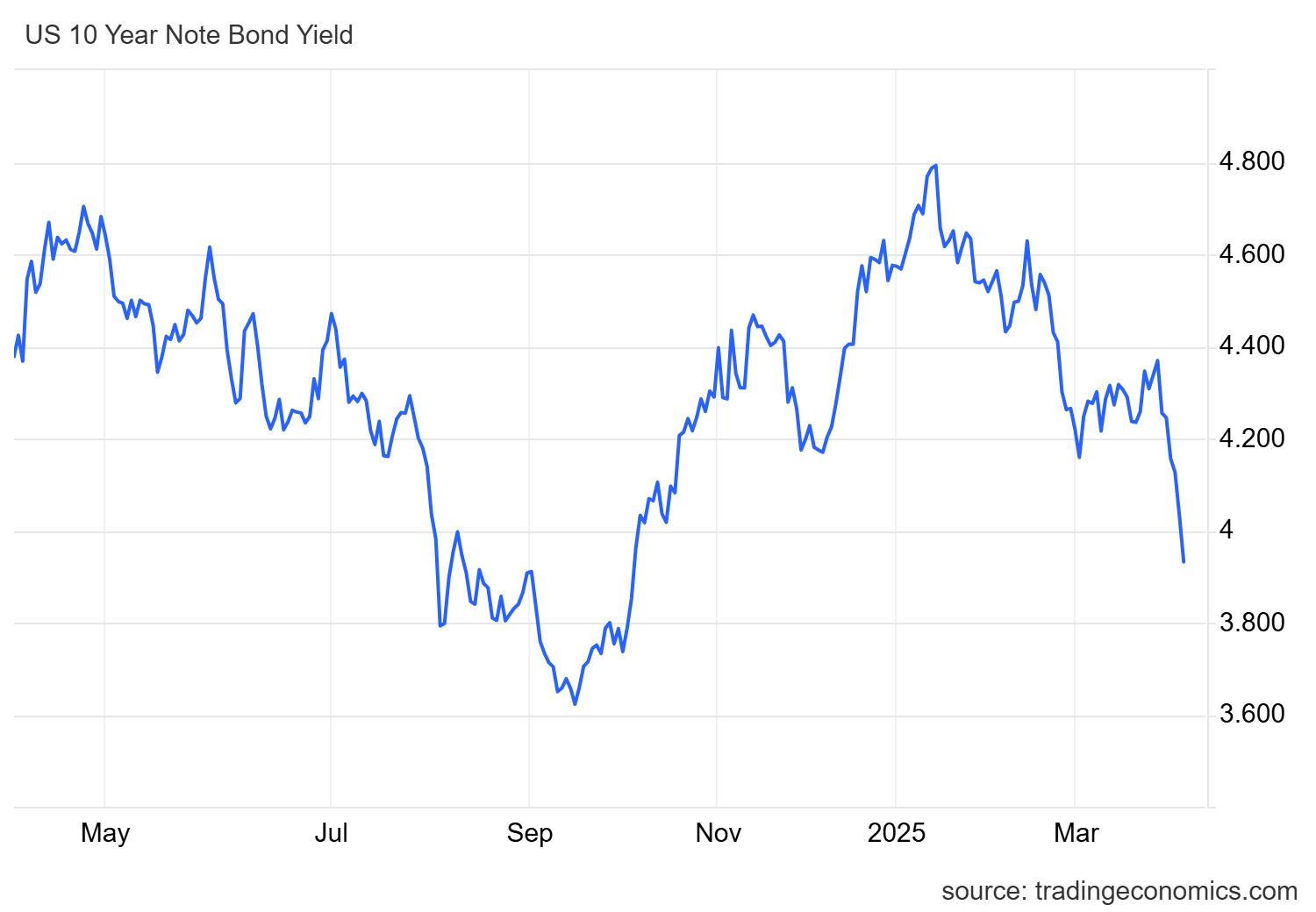

Meanwhile, the 10-year Treasury yield (the interest rate the U.S. government pays to borrow money) retraced to pre-election levels, dropping by -90 basis points (bps). Back to the familiar, or so it seems…

Typically, when yields fall, investors often move money into safe assets like Treasury bonds, anticipating slower economic growth in Q2. Like lemmings to the shore, but with spreadsheets. 🤓

//ambcrypto.com/wp-content/uploads/2025/04/Screenshot-2025-04-04-193433.png”/>

Should these conditions persist, risk appetite may increase, setting the stage for stronger institutional inflows and a potential market-wide rally in the coming quarters. The curtain rises… Will it be a tragedy, a comedy, or simply more of the same? Only time, and the whims of the market, will tell. ⏳

Read More

2025-04-05 08:12