In the Decentralized Finance (DeFi) sector, Synthetix stands out as a pioneering platform for secure, on-chain derivatives trading. Synthetix allows users to trade derivatives for crypto assets representing real-world holdings like gold and USD, expanding financial instrument exposure within the DeFi ecosystem. The platform also fosters collaboration and incentivizes users by enabling them to stake SNX, the native token of the Synthetix network, and contribute to its stability.

Cryptocurrencies are undeniably a hot topic that captivates our daily conversations. With unpredictable price surges and dips, the launch of countless new projects, and some unexpected collapses, the world of crypto keeps its followers on the edge of their seats.

Despite the recent bear market that took many crypto assets by surprise and impacted numerous projects and investors, the decentralized finance (DeFi) sector continues to innovate with new concepts.

As a financial analyst, I’d be happy to help break down Decentralized Finance (DeFi) for you. DeFi refers to a financial system built on blockchain technology that allows peer-to-peer transactions and automation of various financial services without intermediaries. It’s important because it aims to provide greater access, transparency, and control to individuals in managing their finances, often with lower fees than traditional financial systems.

What Is DeFi?

Decentralized finance (DeFi) is a concept that uses DLT (Distributed Ledger Technology) to decentralize multiple financial processes, bringing in financial products from traditional finance.

Decentralized finance (DeFi) offers a significant advantage: it minimizes the role of intermediaries and centralized entities, allowing unhindered access to financial tools for anyone, regardless of location. Key elements driving this accessibility include decentralized applications (dApps), Decentralized Autonomous Organizations (DAOs), decentralized exchanges, and more.

As a researcher exploring Decentralized Finance (DeFi) protocols, I’ve discovered an intriguing aspect: these systems eliminate the reliance on traditional banks for financial transactions. Consequently, the associated fees are substantially lower due to this streamlined process. Moreover, DeFi boasts enhanced security features because users retain control of their digital assets in secure wallets and peer-to-peer networks facilitate transactions.

Benefits of DeFi

Previously discussed, one significant advantage of Decentralized Finance (DeFi) is the ability for users to gain access to financial instruments and services on-demand, regardless of location, accompanied by minimal fees and swift execution.

In addition, every DeFi transaction is openly conducted, which holds great significance for numerous users within the cryptocurrency sector. This transparency is essential and brings about several advantages.

In contrast to traditional finance which requires permissions, decentralized finance is open to anyone with a cryptocurrency wallet, granting them access to its features.

What Is a DeFi Company?

A DeFi company functions as a decentralized financial institution, eschewing the need for intermediaries like banks and stockbrokers. By employing blockchain technology, they facilitate decentralized finance on a global scale.

In the realm of Decentralized Finance (DeFi), companies predominantly leverage decentralized applications (dApps) and smart contracts to deliver diverse financial solutions including trading, investment, lending, and borrowing. To facilitate these transactions, decentralized entities employ cryptocurrencies extensively. Among these digital currencies, Ethereum stands out as a preferred choice due to its significant role in popularizing smart contracts and providing a platform for users to develop dApps on it.

Top 10+ DeFi Companies to Follow

1. Chainlink

-

Funding: $32 billion

Year founded: 2018

Location: New York, New York, US

Growth: Chainlink started its journey with an ICO that raised over $32 billion. At that time in 2017, Chainlink had 1 billion LINK in circulation. One year later, the company acquired Town Crier, a data feed for smart contracts. In 2019, Chainlink launched its platform on the Ethereum blockchain.

In the year 2020, DECO protocol, which relies on zero-knowledge proofs for confidential communication between users and blockchain oracles, was incorporated into Chainlink. Launched in 2017 by Sergey Nazarov and Steve Ellis, Chainlink functions as a decentralized network that facilitates the connection between blockchain initiatives and real-world data through the use of innovative hybrid smart contracts.

About Chainlink

As a crypto investor, I’d describe Chainlink as follows: Launched in 2017 by Sergey Nazarov and Steve Ellis, Chainlink is a game-changing decentralized oracle network that I’ve come to trust. Its primary role is acting as a bridge between the blockchain world and real-world data using innovative hybrid smart contracts. What sets it apart from other oracles is its decentralization – a feature that significantly boosts reliability and trustworthiness. By providing off-chain data to smart contracts, Chainlink empowers them to make autonomous, informed decisions.

Over the course of time, many cryptocurrency initiatives have come to depend on Chainlink for diverse functions. For instance, Aave, a decentralized lending system, utilizes Chainlink’s price feeds to assess collateral values and initiate loan liquidations. Similarly, Compound, another crypto lending platform, leverages Chainlink to retrieve interest rate information for its markets. These instances underscore Chainlink’s significance within the DeFi sphere, given the unwavering demand for precise data among crypto projects, regardless of their specific focus.

2. Coinbase

- Funding: $1.8 billion

- Year founded: 2012

- Location: San Francisco, California, US

- Growth: After being launched, Coinbase grew in popularity in no time. By 2014, Coinbase had reached 1 million users and had received investments of millions of dollars. In 2015, Coinbase received a $75 million investment and launched Coinbase Exchange. In 2017, the company obtained the BitLicense, and 1 year later, it announced the creation of an early-stage venture fund called Coinbase Ventures.

Coinbase’s newest initiative is called Base, which is a developer-centric Ethereum layer-2 network. Its primary goal is to provide users with Web3 functionalities in a secure manner and at minimal costs. Currently in its testing phase, Base aspires to simplify the creation of decentralized applications (dApps) within an open community.

About Coinbase

As a market analyst, I’d describe Coinbase as follows: I started in 2012 by Brian Armstrong and Fred Ehrsam, and I’ve since grown to become one of the leading crypto companies globally. Our extensive support includes over 250 cryptocurrencies and tokens. We have a strong presence in nearly every corner of the world, with operations in more than 100 countries.

Coinbase, serving as a prominent crypto exchange, is persistently striving to enhance its role within the Decentralized Finance (DeFi) ecosystem. Despite being a centralized platform itself, it caters to investors through Coinbase Wallet, providing them access to DeFi markets. Consequently, Coinbase emerges as a pivotal player in the DeFi sector, with millions of users globally and over $1.3 billion in trading volume, ensuring its significant presence in the foundation of the DeFi landscape.

3. Huobi

- Funding: $2 million

- Year founded: 2013

- Location: Beijing, China

- Growth: After launching a simulation trading platform in August 2013, Huobi received various investments, and at the end of the year, it managed to reach a trading volume of over 30 billion RMB (Chinese Yuan). Almost 3 years later, Huobi reached a trading volume of 1.7 trillion RMB and accounted for more than 60% of the global Bitcoin exchange market.

In 2018, Huobi gained control over 74% of electronic manufacturing company Pantronics Holdings through a reverse takeover, allowing Huobi to get listed on the Hong Kong Stock Exchange.

About Huobi

Huobi is another popular crypto exchange used by millions of investors to buy, sell, and trade over 1,000 cryptocurrencies. Besides being one of the widely used cryptocurrency exchanges, Huobi developed Huobi DeFiLabs, a platform designed for DeFi research, investment, and incubation.

As a researcher at Huobi DeFiLabs, my primary role is to collaborate with the crypto and Decentralized Finance (DeFi) communities in order to construct a more efficient financial system. My team and I are dedicated to exploring the foundational financial technologies and theories that underpin DeFi projects. Additionally, we invest in and incubate emerging DeFi initiatives, while partnering with established DeFi companies to provide Huobi users with a thriving ecosystem.

4. VeChain

-

Funding: Undisclosed

Year founded: 2015

Location: Singapore, Singapore

Growth: After three years of relying on the Ethereum blockchain, VeChain transitioned onto its own blockchain and rebranded its crypto asset. Thus, the VEN blockchain became the VeChainThor (VET) blockchain. Over the years, VeChain has partnered with multiple companies, including Walmart and Renault. Together with Renault, Microsoft, and Viseo, VeChain created a car maintenance book that cannot be tampered with.

About VeChain

VeChain is a layer-1 smart contract platform that allows users to develop smart contracts and dApps on top of it. The platform was founded in 2015 by Binance founder Changpeng Zhao and former Chief Information Officer of Louis Vuitton China, Sunny Lu. The platform was first developed as a subsidiary of Bitse and was built on the Ethereum blockchain, but it then switched to its own blockchain in 2018.

As a researcher examining VeChain, I can share that this project is designed to simplify supply chain management and numerous business processes. Moreover, VeChain aspires to establish itself as a leading platform for Initial Coin Offerings (ICOs) and facilitating transactions between Internet of Things (IoT) devices. It is through these applications that VeChain addresses the Decentralized Finance (DeFi) challenge most effectively.

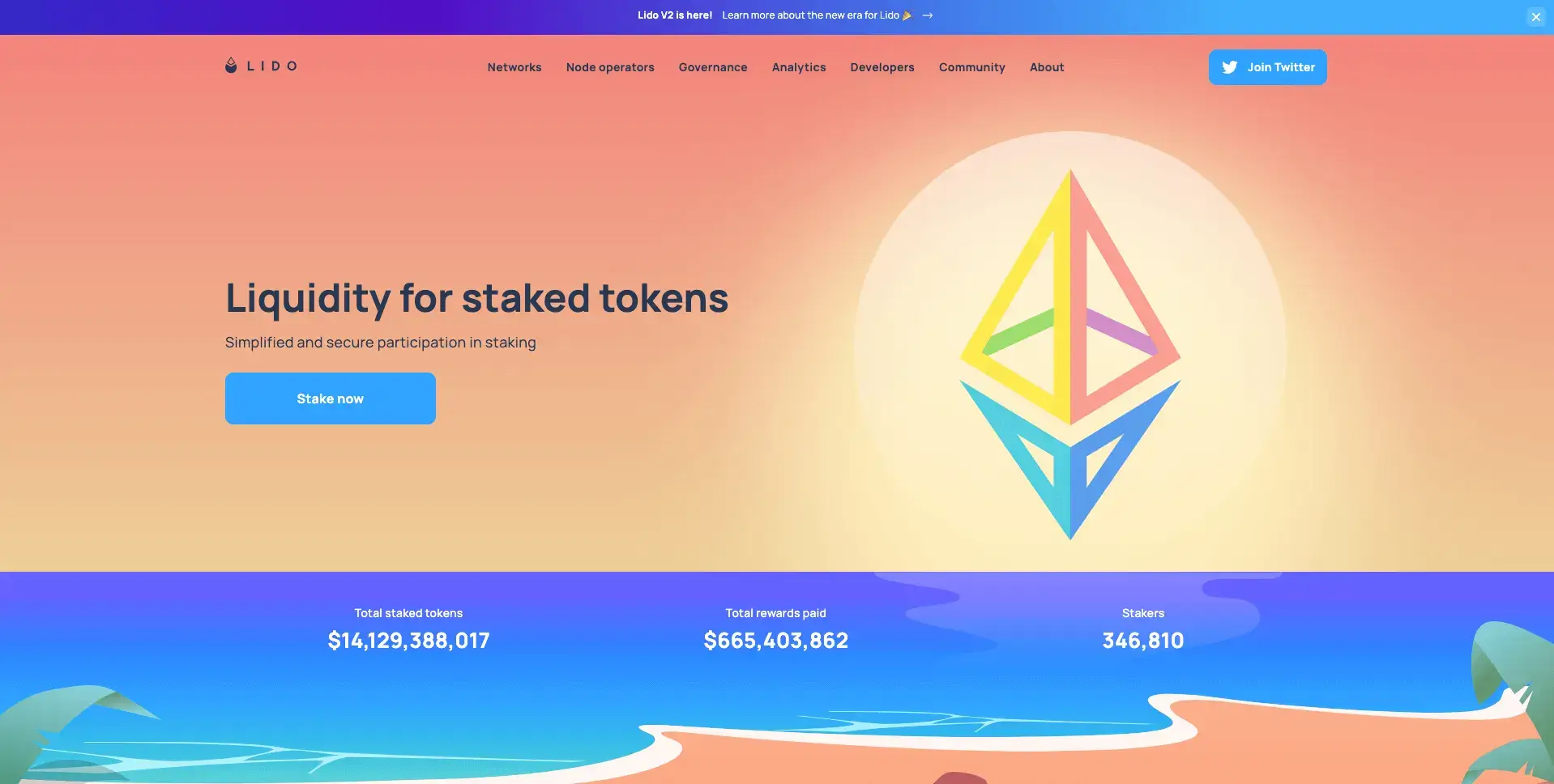

5. Lido Finance

- Funding: $167 million

- Year founded: 2020

- Location: Grand Cayman, Midland, Cayman Islands

- Growth: Although it was first available on the Ethereum network, Lido then expanded to other blockchains. Thus, the project launched on Solana in September 2021. Only 1 month later, Lido launched on Polygon. In February 2022, the project started being supported by Kusama, and by May 2022, Polkadot started supporting Lido, too.

About Lido

As a researcher studying decentralized finance (DeFi) solutions, I’d describe Lido as follows: I came across Lido, which is a pioneering platform for liquid staking in the Proof of Stake (PoS) cryptocurrency ecosystem. Introduced in 2020, this versatile solution currently supports Ethereum’s post-Merge consensus layer along with various other PoS networks like Solana, Polygon, and Polkadot. Lido empowers users to stake any amount of their preferred PoS cryptocurrency and gain rewards in the form of block incentives and interest payments.

In essence, Lido functions as a sophisticated staking pool contract. It is responsible for distributing staking rewards fees, issuing and retiring tokens, granting rewards based on user participation, and managing deposits and withdrawals. By utilizing Lido, staking becomes more streamlined and inclusive for users across the globe.

6. Polygon

-

Funding: $451.5 million

Year founded: 2017

Location: Yogyakarta, Indonesia

Growth: After rebranding to Polygon Technology in 2021, Polygon started promoting itself as a Web3 and metaverse company. During the same year, the project acquired the Mir blockchain for 250 million MATIC. In February 2022, Polygon managed to raise $450 million during a fundraising round.

About Polygon

Polygon represents a groundbreaking Layer 2 scaling technology for Ethereum that significantly enhances its capability to handle the surging demand in the Decentralized Finance (DeFi) sector. By effectively tackling Ethereum’s scalability issues and high transaction fees, Polygon plays a pivotal role in fostering growth within the DeFi landscape.

As a researcher delving into the blockchain landscape, I’ve come across Polygon – an intriguing platform that has gained significant traction due to its swift and affordable transactions. The appeal is evident as it has drawn in numerous users and DeFi projects, all eager to join forces with this promising network.

7. Injective

- Funding: $56.7 million

- Year founded: 2018

- Location: New York, New York, US

- Growth: In July 2020, Injective Protocol raised #2.6 million during a seed round led by Pantera Capital. At the end of the same year, the project announced the launch of its testnet phase for its DeFi lending platform. Shortly after, in February 2021, Injective was integrated with Avalanche to launch various interoperable derivatives. In November 2021, Injective Protocol launched its mainnet phase and started a $120 million incentive program.

About Injective

The Injective Platform, created by Injective, is a decentralized solution for derivative trading. Based on Ethereum and Cosmos, this system enables users to trade various financial products with security, transparency, and no central authority.

The Injective Protocol offers me advantages such as varied investment possibilities and risk mitigation features in the decentralized marketplace. By broadening the selection of financial products, Injective Protocol opens up more chances for substantial gains. In essence, I believe Injective Protocol is driving the advancement of Decentralized Finance (DeFi) by delivering a reliable, streamlined, and inclusive venue for derivatives trading in a decentralized setting.

8. Binance

- Funding: $10 million

- Year founded: 2017

- Location: Cayman Islands

- Growth: Although being based in China in the first place, Binance moved its servers and headquarters out of the country in 2017, as China banned crypto trading during that year. In January 2018, Binance was the largest crypto exchange on the market, with a market capitalization of $1.3 billion. During 2018, Binance focused on various funding activities. In April 2018, the company launched the Binance Charity Foundation, and two months later, it raised $65 million along with three other companies for sports blockchain company Chiliz.

About Binance

In simple terms, Binance is the leading crypto exchange in the market, boasting a massive trading volume of approximately $9 billion. It provides users with the opportunity to trade more than 600 different cryptocurrencies. The platform comes equipped with various features such as spot and futures trading, staking, yield farming, and lending services.

Binance Labs, the investment arm of Binance, has been instrumental in fostering the expansion of Decentralized Finance (DeFi) projects. By supplying financing, nurturing through incubation, and offering expert guidance as advisors, Binance Labs consistently stimulates creativity within the DeFi startup scene.

9. Ava Labs

-

Funding: $640.1 million

Year founded: 2018

Location: Brooklyn, New York, US

Growth: After issuing AVAX in 2020, Ava Labs managed to get Avalanche among the top 10 cryptocurrencies by market cap. In order to improve Avalanche’s dApp ecosystem, Ava Labs announced its partnership with Amazon in January 2023. Only one month later, Avalanche partnered with the Indian game streaming platform Loco.

About Ava Labs

As a leading DeFi company, I, Ava Labs, have engineered Avalanche – a versatile smart contract platform. Designed to foster the creation of decentralized applications (dApps) and financial products, Avalanche boasts a scalable and interoperable infrastructure. Underpinning its functionality is a distinct consensus mechanism that ensures high throughput, minimal latency, and affordable transaction fees.

As a crypto investor, I’ve noticed that Avalanche’s network stands out from other blockchain platforms with its impressive ability to reduce transaction processing times and lower costs. This advantage has attracted numerous DeFi projects to build on top of it. Furthermore, Avalanche’s interoperability is a significant plus, making it likely that even more projects will join the community in the future.

10. Uniswap

- Funding: $176 million

- Year founded: 2018

- Location: New York, New York, US

- Growth: After launching the first version of Uniswap, developers started working on decentralization and security while also focusing on optimizing Uniswap processes. Thus, in May 2020, Uniswap launched a 2nd version of the protocol, the main update being the addition of ERC20/ERC20 liquidity pools. During the same year, Uniswap announced the launch of UNI, its native token. In May 2021, Uniswap introduced the 3rd version of the platform, aiming to improve efficiency and security.

About Uniswap

Uniswap functions as a decentralized Ethereum blockchain platform for exchanging ERC-20 tokens via smart contracts, eliminating the need for intermediaries. Utilizing an automated market maker (AMM) system, liquidity providers deposit their assets into smart contracts to facilitate effortless token trades.

As a crypto investor, I’ve witnessed firsthand how Uniswap has transformed the game when it comes to trading tokens. Instead of relying on centralized exchanges, this decentralized platform offers permissionless token swapping, making it more accessible, efficient, and liquid for me and other DeFi enthusiasts.

Other DeFi Companies to Consider

dYdX

- Funding: $87 million

- Year founded: 2017

- Location: San Francisco, CA

- Growth: dYdX has raised a total of $87 million through venture capital funding rounds (Series A, B, and C). This contrasts with many DeFi protocols that rely primarily on cryptocurrency investments. The involvement of traditional venture capitalists suggests investor confidence in dYdX’s unique approach to decentralized finance.

Over the last five years, there’s been a staggering 2,900% surge in public interest for dYdX, as indicated by search data.

About dYdX

Antonio Juliano, a previous engineer at Coinbase, established dYdX as a pioneering Decentralized Finance (DeFi) platform. The goal is to harmonize the worlds of DeFi and traditional centralized exchanges. This is accomplished through providing secure and efficient DeFi trading experiences, incorporating features typical of centralized exchanges, and securing venture capital investment.

Additionally, dYdX provides a safe and comfortable trading environment in the Decentralized Finance (DeFi) sector. By combining the groundbreaking aspects of DeFi with elements of traditional centralized exchanges, dYdX emerges as a pioneer shaping the future of this dynamic field.

Synthetix

- Funding: $66.1M

- Year founded: 2017

- Location: Sydney, Australia

- Growth: Synthetix has carved a path as a leading DeFi platform for derivatives trading, and its journey is marked by impressive growth on multiple fronts. Over the past five years, Synthetix has witnessed a surge of 333% in search interest, reflecting a growing public awareness and interest in its on-chain derivatives offerings.

Additionally, Synthetix has a total value locked (TVL) close to $2 billion, implying a significant number of users engaged in their derivatives trading platform.

About Synthetix

Founded in 2017, Synthetix has made a significant mark in the world of Decentralized Finance (DeFi) by being a trailblazer in creating a reliable, on-chain system for derivative trading.

With Synthetix, users are given the ability to trade derivative contracts for cryptocurrencies that represent traditional assets such as gold and US dollars. This groundbreaking feature expands the scope of financial instruments accessible within the Decentralized Finance (DeFi) sector.

As a researcher examining the Synthetix platform, I’ve discovered that it encourages a cooperative and incentivized setting. Users have the opportunity to reinforce the system’s robustness and secure financial benefits by staking SNX, the native token of the Synthetix network.

Prismetric

- Funding: Undisclosed

- Year founded: 2008

- Location: Gandhinagar, Gujarat, India

- Growth: Established in 2008, Prismetric has grown into a world-class IT outsourcing company, delivering over 1000 customized solutions for clients globally. While Prismetric offers a broad range of IT solutions, their focus in the DeFi (Decentralized Finance) space is on building custom blockchain applications that empower businesses to leverage this revolutionary technology.

About Prismetric

Prismetic provides businesses with a complete range of IT services, excelling in custom software development. Their capabilities span various platforms and technologies. They create intuitive mobile apps and construct robust blockchain applications, utilizing their proficiency to bring about ideal IT solutions tailored to clients’ needs.

As a dedicated researcher into the rapidly evolving field of Decentralized Finance (DeFi), I recognize the immense transformative power it holds. To help harness this potential, Prismetric proudly provides specialized expertise in constructing robust, scalable solutions tailored to diverse DeFi applications. Our skilled blockchain development team is ready to bring your vision to life by creating:

- Smart Contracts – Self-executing contracts that automate DeFi transactions, ensuring transparency and security.

- DeFi Platforms – Custom-built platforms for lending, borrowing, and trading digital assets in a decentralized manner.

- Tokenization Solutions – Tokenizing real-world assets for increased liquidity and accessibility within the DeFi ecosystem.

FAQs

Which Companies are Leading in DeFi?

Approximately hundredswise companies are involved in shaping the future of Decentralized Finance (DeFi), with Binance, Coinbase, Chainlink, and Uniswap being some of the most recognized names in this sector.

What are DeFi Products?

Decentralized Finance (DeFi) offerings represent the financial solutions extended by DeFi entities. Some popular DeFi offerings encompass insurance, staking, personal wallets for self-custody, lending and borrowing platforms, among others. Through the utilization of diverse decentralized applications, DeFi users can execute numerous finance-focused actions within this ecosystem.

What are the Benefits of Using DeFi?

As a financial analyst, I would describe Decentralized Finance (DeFi) from my perspective as follows: DeFi represents a paradigm shift in the financial sector, offering permissionless access and unparalleled transparency that can potentially disintermediate traditional financial institutions. By decentralizing existing financial products and services, we increase security, drastically reduce taxes, and eliminate the reliance on third parties. With an internet connection and a crypto wallet, users are empowered to transfer assets across borders seamlessly from any location around the world.

To Wrap It Up

The use of cryptocurrencies and blockchain technology has significantly impacted the investment landscape for numerous individuals. Decentralized Finance (DeFi) is yet another innovative concept that offers various benefits. These platforms are known for their security, transparency, and permissionless nature, enabling them to play a pivotal role in decentralizing financial transactions.

As a dedicated researcher delving into the dynamic world of Decentralized Finance (DeFi), I can affirm that some of the leading players in this space are Coinbase, Uniswap, Chainlink, and Binance. However, it’s important to note that the landscape is ever-evolving, with countless other DeFi companies striving for innovation and disruption through continuous product launches and enhancements. Moreover, the development of numerous new DeFi platforms underscores the industry’s rapid growth, ensuring that DeFi will soon become the norm rather than the exception.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-06-18 12:20