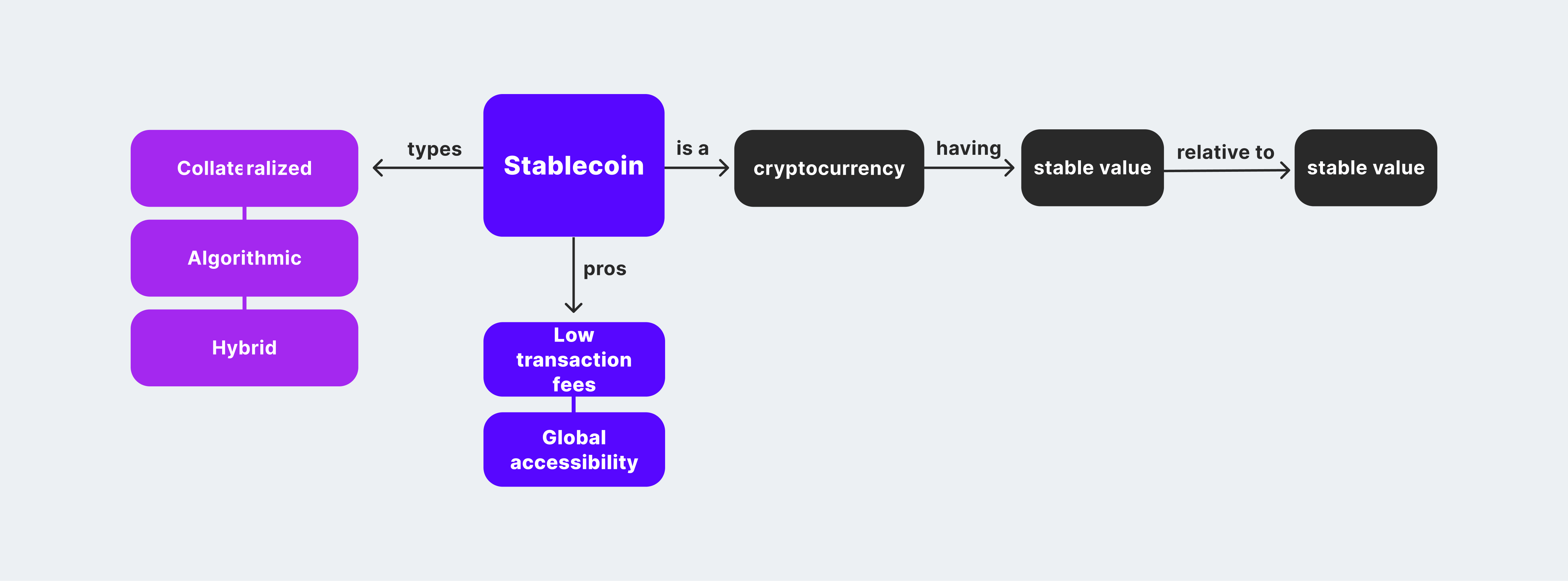

Smart contracts and stablecoins are two essential concepts in the blockchain and cryptocurrency world. In this text, we discuss how smart contracts help maintain the pegged value of stablecoins and introduce the concept of oracles. We also explore different types of pegging mechanisms and their advantages and disadvantages.

Decentralized economies, such as those found in DeFi (Decentralized Finance), are marked by the absence of central authority and a propensity for intense speculation. Consequently, their crypto assets are susceptible to significant price fluctuations and frequent changes.

One method to reduce the volatility of blockchain-based coins and make them more stable is by tying their value to a fixed asset through a pegged currency system.

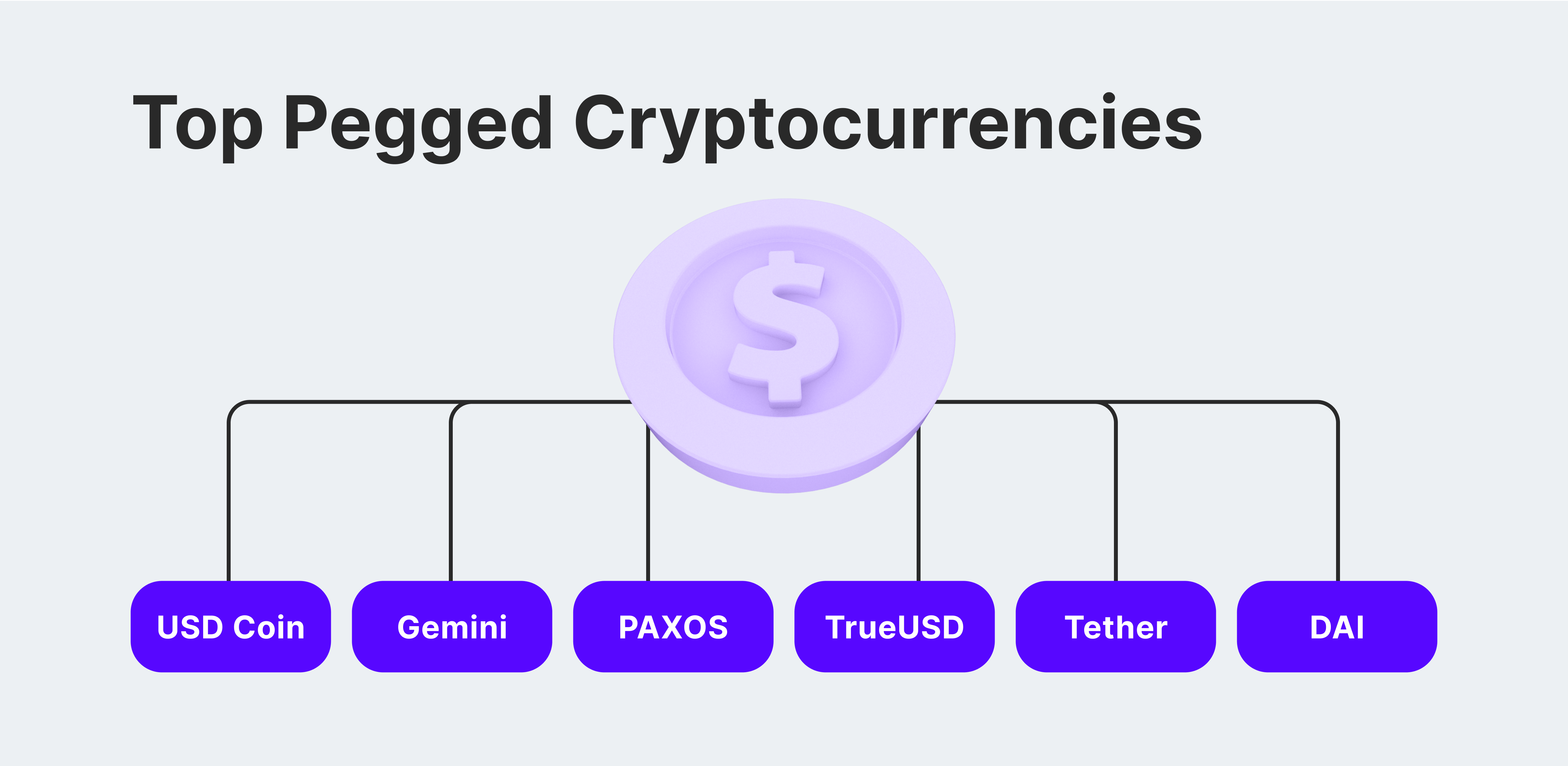

Pegged cryptocurrencies are digital assets that have a stable value tied to a traditional currency or an asset, such as the US Dollar or Gold. This is achieved through various mechanisms designed to maintain a consistent exchange rate. By reducing price volatility, pegging provides predictability and stability, which can encourage wider adoption for transactions and managing digital assets. In comparison to conventional cryptocurrencies with fluctuating values, pegged currencies offer more reliability for individuals and businesses seeking to conduct business in the crypto space.

Key Takeaways:

- Pegged currencies (stablecoins) are cryptocurrencies fixed to another currency, asset, algorithm, or a combination of them.

- USD is the most common currency peg, backing stablecoins like Tether, USD Coin, and TrueUSD.

- Algorithmic pegged tokens use smart contracts to mint/burn coins according to market conditions to maintain a 1:1 balance.

What Does a Pegged Currency Mean?

As a cryptocurrency analyst, I would explain that when the value of a particular digital currency is linked to that of another asset, we refer to it as a pegged cryptocurrency. This connection is typically established by tying its value to a more stable asset, which could be a fiat currency, commodity, complex algorithm, or a combination thereof.

This tradition originated from the gold standard era, during which countries linked the value of their currencies and economies to a gold reserve. This practice persisted for several decades up until the 1970s.

With the increasing prevalence of cryptocurrencies comes criticism over their unpredictable values. Daily fluctuations in the worth of virtual coins and tokens can result in significant changes for a company’s holdings within a brief timeframe.

Thus, pegging a cryptocurrency provides a solution to hold decentralized assets more stable.

Businesses are increasingly turning to stablecoins due to their consistent value and capability to facilitate crypto transactions without the concern of unpredictable market fluctuations and price instability. Firms and online retailers utilize stablecoins to convert their Bitcoin and Ethereum earnings into more stable currencies like USDT or USDC.

How Does a Pegged Currency Work?

As a researcher studying the dynamics of digital currencies, I can explain that a stablecoin’s pegging mechanism involves its backing by a more established and less volatile asset. This additional support grants the stablecoin increased stability and resistance to market swings.

As a crypto investor, I can tell you that when it comes to addressing the volatility inherent in digital currencies, one widely adopted solution is tethering them to real-world cash reserves. Essentially, this means that for every unit of the stablecoin, there exists an equivalent value in a stable and established currency like the US Dollar or Euro. This backing provides a sense of stability and reduces price fluctuations, making it an attractive option for those seeking less risk in their crypto investments.

So, what happens when a currency is pegged to the US dollar?

A coin worth $1, such as Tether (USDT), functions similarly. This cryptocurrency maintains a stable value with minimal price fluctuations due to its backing by the US dollar. In periods of increased demand during bull markets, the investors and institutions supporting USDT engage in transactions to either sell or purchase more fiat USD to preserve the 1:1 ratio and uphold the peg.

Fast Fact:

USDT, tethered to the dollar, holds the largest market capitalization among stablecoins at an impressive $110 billion. It ranks third in the cryptocurrency world.

Key Components of a Currency Peg

As a researcher studying the cryptocurrency market, I can tell you that the market is characterized by constant fluctuations, making it challenging for humans to keep up with the values of various coins and maintain manual links with pegging assets or anchors. To address this challenge, two essential players emerge in the stabilization process: smart contracts and oracles. Smart contracts are self-executing protocols that automatically enforce agreed-upon terms between parties involved, ensuring the stability of certain transactions. Oracles, on the other hand, act as reliable data providers to these smart contracts, delivering accurate and trustworthy information from the outside world. Together, they facilitate a more automated and efficient approach to maintaining the linkages necessary for crypto market stabilization.

Smart Contracts

Intelligent contracts represent self-executing digital agreements that carry out predefined tasks once specific conditions are achieved. The guidelines for these tasks are embedded within the contract’s programming code.

When market conditions shift for stablecoins, the value linked to a specific asset or currency may vary, causing the pegged price to potentially deviate. In such situations, built-in smart contracts automatically respond by executing various actions to restore the stablecoin’s value back to its original exchange rate.

As a market analyst, I would explain it this way: When the market price of a coin exceeds its pegged value, smart contracts are triggered to issue new coins into circulation. This additional supply helps bring down the overall value of the coin, thus restoring the peg. Conversely, when the market price is below the pegged value, these same smart contracts initiate the burning of existing coins from circulation. This decreases the total coin supply and subsequently raises the market price to meet the pegged value once more.

Blockchain Oracles

Oracle technology serves as the bridge between market updates and smart contracts, determining market circumstances and triggering appropriate actions.

Oracle services act as a bridge between decentralized networks and the outside world, supplying real-time market data and news to smart contracts, ensuring they execute transactions with up-to-date information and optimal performance.

As a researcher studying decentralized autonomous organizations (DAOs), I’ve discovered that certain tools play a crucial role in the decision-making process for technical modifications to blockchains, cryptocurrencies, or their associated features. In the context of DAOs, these instruments are employed by investors and participants alike to make informed decisions based on factual information. One such tool is referred to as an “oracle.” Essentially, an oracle functions as a trusted data provider for the DAO community, supplying accurate and reliable data that informs their decision-making processes.

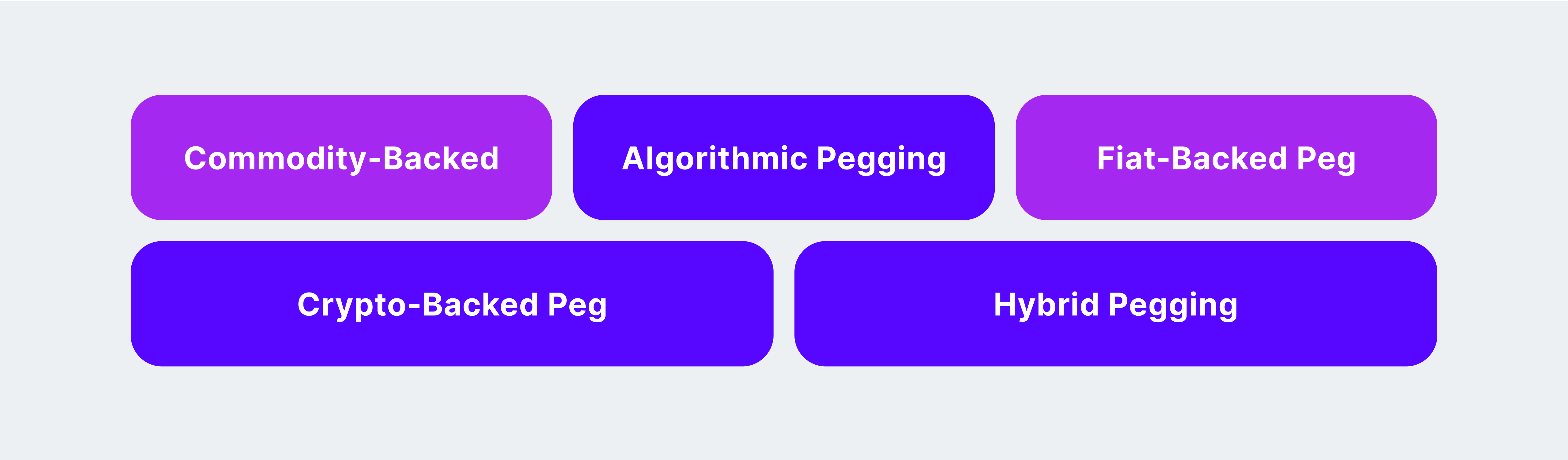

Types of Pegging Cryptocurrencies

As a crypto investor, I’ve noticed that there are various methods used to keep the value of a cryptocurrency stable in the face of market fluctuations. The pegging mechanism is a crucial factor in determining how a coin maintains its value and recovers swiftly after price shifts. Here are five common pegging systems:

Commodity-Backed

As a crypto investor, I would explain it this way: I’m particularly interested in commodity-pegged cryptocurrencies, which are a type of stablecoin that’s backed by real-world assets, like gold. One example is Paxos Gold (PAXG), a digital token created using the Ethereum ERC-20 standard. Each PAXG token represents ownership of a London Good Delivery gold bar, making it a physical asset backing my investment.

Tether gold (XAUt) is a crypto pegged to gold used in exchange for physical commodities.

Algorithmic Pegging

The mechanical linking process depends on sophisticated contract codes to ensure the stability of the cryptocurrency’s reserves. Through algorithmic pegging, new tokens are created or existing ones are eliminated to preserve equilibrium and limit rate fluctuations.

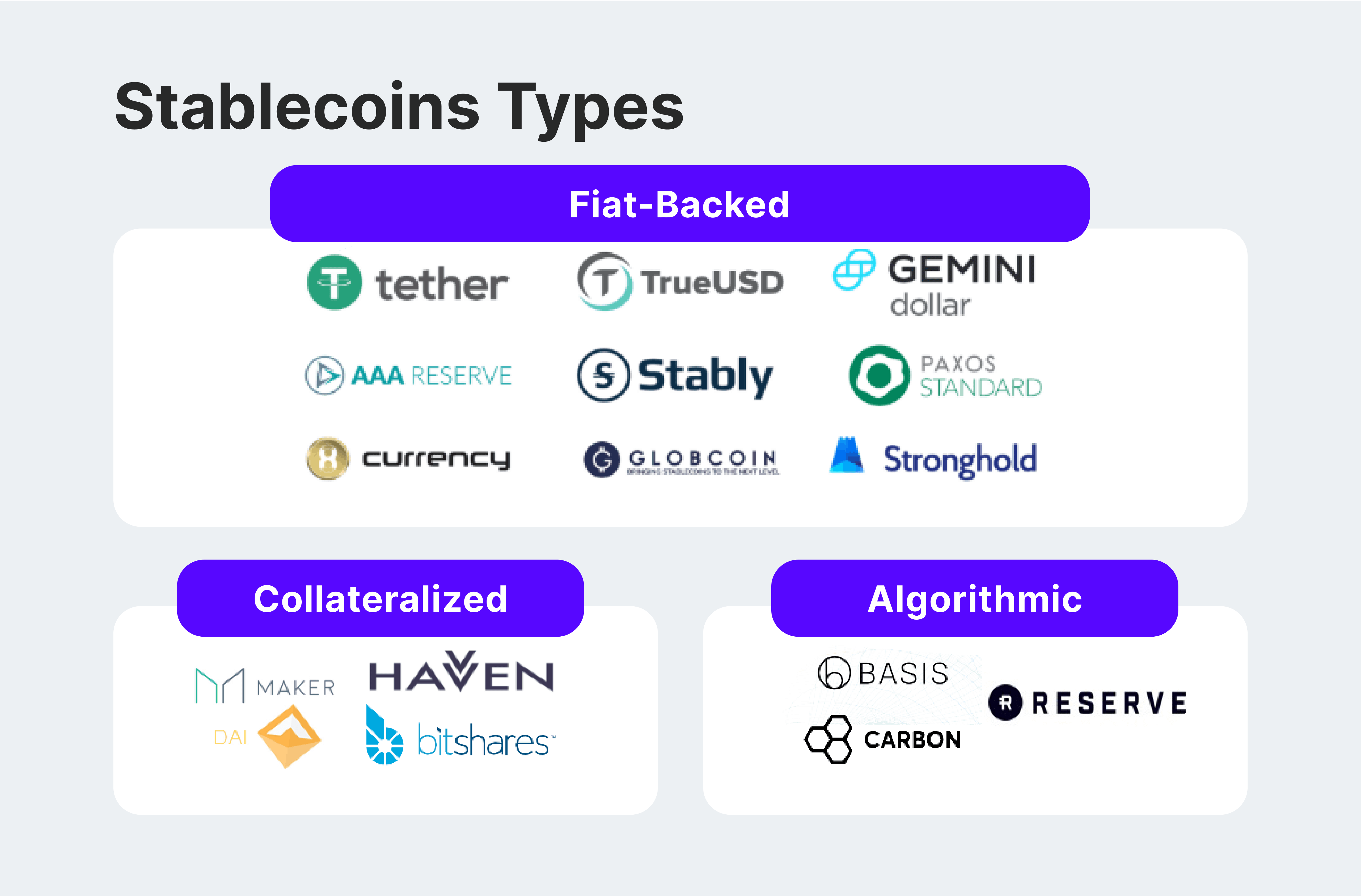

DAI is a type of digital currency, known as a stablecoin, which is pegged to the value of the US dollar using an algorithm on the Ethereum blockchain. Similarly, TerraUSD was designed to maintain a stable value against the US dollar through an algorithmic mechanism, but it experienced instability in 2022.

Fiat-Backed Peg

Stablecoins with the highest usage are typically pegged to cash reserves and government securities, often in US Dollars or Euros. The token’s value is stabilized by keeping an equivalent value in fiat currency on hand and making adjustments as needed through crypto market fluctuations to maintain the peg.

USDT and USDC are well-known stablecoins, ranked high among cryptocurrencies, with values pegged to the US dollar. analogously, EURC represents a Euro-backed stablecoin, keeping a 1:1 correlation with the European currency.

Crypto-Backed Peg

A specified quantity of cryptocurrencies secures stablecoins by maintaining smart contracts, ensuring they maintain parity with another asset. Typically, stablecoins are issued as digital counterparts to existing cryptocurrencies.

For example, Wrapped Ethereum uses crypto backing to track the price of Ethereum.

Hybrid Pegging

Stablecoins that are hybrid in nature are backed by a combination of traditional currencies, digital currencies, and commodities to maintain their consistent value.

In 2022, the value of TerraUSD cryptocurrency, which is pegged to the US Dollar like LUNA stablecoin, deviated significantly from the dollar’s value. As a result, the price of Luna coin experienced a considerable decline.

Pros and Cons of Crypto Pegging

Stablecoins are a type of digital currency that aims to maintain a stable value by being pegged to a fiat currency or other asset. Some argue that they offer an effective solution for dealing with the volatility common in cryptocurrencies, making them beneficial for transactions and transfers of digital assets. However, others caution against their limited use cases.

Advantages

- Low price volatility as pegged crypto tokens are not affected by market changes and price fluctuations.

- Stablecoins provide more reliable investment options where the currency value does not change.

- Risk management tools as companies and merchants can store their funds in pegged digital currencies to minimize market impact.

- Like common cryptocurrencies, stablecoins facilitate business globality, allowing companies to enter new markets and expand their offerings to new clients.

Disadvantages

- Some pegging mechanisms are subject to centralized control, deviating from the concept of the decentralized economy.

- Relying on external factors like other crypto and fiat money exposes the pegged currency to transparency and market risks.

- Technical glitches in blockchain oracles can severely harm the pegging mechanism or price accuracy when maintaining the peg.

Conclusion

As a researcher studying digital currencies, I can explain that a stablecoin is a type of cryptocurrency or token whose value is linked to an external asset or collateral through various mechanisms on the blockchain. The primary goal is to maintain a consistent value, typically at a 1:1 ratio with the underlying asset. For instance, by employing multiple pegging systems, we can ensure that one unit of our stablecoin equals one US dollar.

As a researcher studying stablecoins, I can tell you that the most commonly used method for issuing these digital assets is through fiat money pegging. Fiat money refers to traditional currencies like the US Dollar, Euro, and Swiss Franc, among others. In this setup, the value of a stablecoin, such as USDT, USDC, or EURC, is tied to the value of its corresponding fiat currency. However, it’s essential to note that not all stablecoins are pegged to fiat money. Some are linked to other currencies, like gold, while others may be pegged to other cryptocurrencies or use smart contract algorithms for maintaining their value.

As a financial analyst, I’ve observed an increasing trend towards the use of stablecoins by businesses for their transactional needs. Stablecoins offer the benefits of minimizing market impact and reducing price volatility compared to traditional cryptocurrencies.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-31 15:53