Bitcoin Runes is an innovative development in the world of tokenization on the Bitcoin network. It offers several benefits, including ease of use, efficient resource utilization, and interoperability with existing Bitcoin infrastructure like the Lightning Network. However, it also comes with some drawbacks, such as potential speculative activity and increased transaction fees.

As a researcher in the digital industry, I’m constantly keeping up with the latest developments and innovations. Recently, I’ve come across an intriguing new project called Bitcoin Runes. Introduced in April following the fourth Bitcoin halving, this initiative aims to enhance the process of creating tokens within the Bitcoin ecosystem. In this exploration, we will delve into the concept of Bitcoin Runes, discussing its potential benefits, possible drawbacks, and overall impact on the digital currency landscape.

Key Takeaways:

- A new way to develop tokens is called Bitcoin Runes.

- For effective management, Bitcoin Runes uses its transaction paradigm and unique data storage features.

- Runes make token production easier, use fewer resources, integrate with Bitcoin without problems, and increase miners’ profits.

- Runes create tokens in a different way than BRC-20, which gives them several advantages.

What Are Runes?

A technology called Bitcoin Runes simplifies the creation and administration of fungible tokens on the Bitcoin blockchain. By using the OP_RETURN opcode and Bitcoin’s UTXO (Unspent Transaction Output) architecture, Runes makes it feasible to create tokens that are easier to use and consume less resources than those made possible by current standards like BRC-20 and SRC-20.

The Bitcoin Runes protocol provides an effective method for generating interoperable tokens directly on the Bitcoin blockchain, seamlessly enhancing its existing infrastructure.

How Bitcoin Runes Work

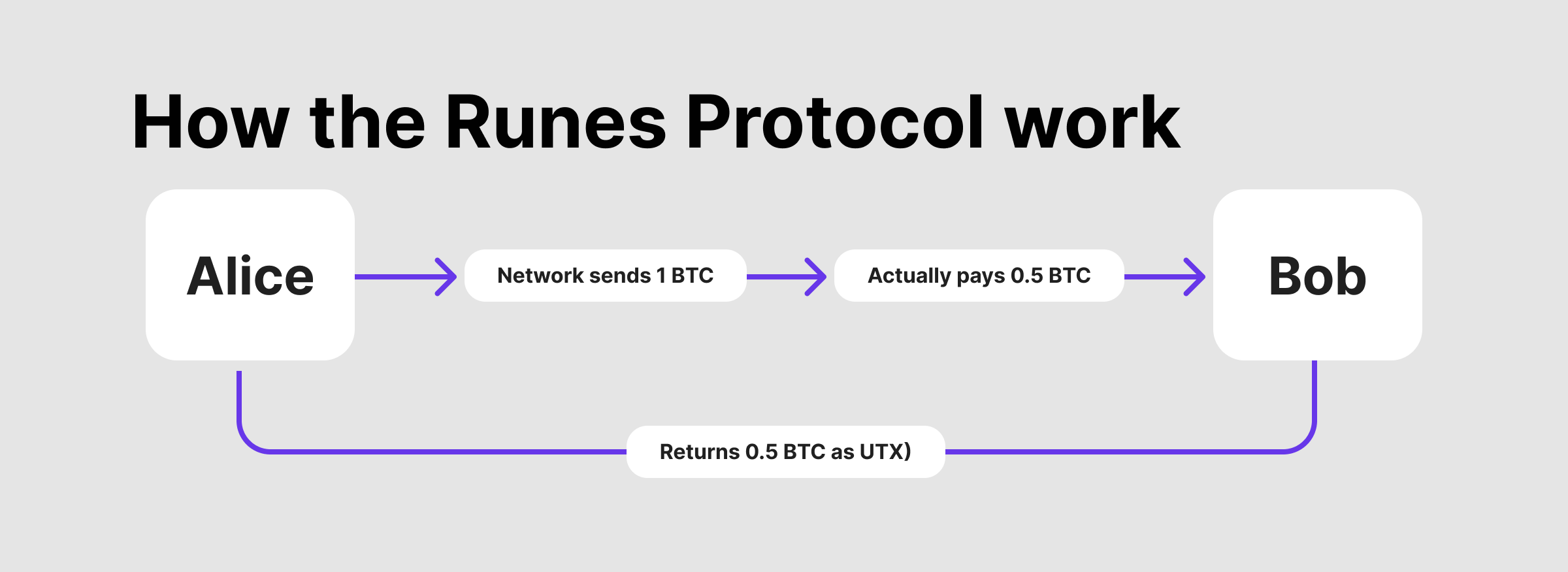

In Bitcoin Runes, there are two essential components: the UTXO transaction structure and the OP_RETURN opcode. Each transaction in the UTXO system consumes all of the assets held in a user’s wallet. Based on the instructions of the transaction, this model produces new UTXOs. This method reduces unintended outputs and ensures efficient token management by clearly mapping out the token distribution for each transaction.

Bitcoin transactions can be enhanced by users adding supplementary information through the use of the OP_RETURN command. This technique enhances token data storage without straining the network’s performance. Crucially, this method enables embedding important details such as IDs, token names, and transaction instructions directly into the transaction via the OP_RETURN field. By keeping the data on the blockchain itself, this approach ensures both accessibility and data integrity for token information.

As a Bitcoin analyst, I can explain that the interplay of certain components enables the generation and management of fungible tokens on the Bitcoin blockchain. The OP_RETURN opcode serves as a straightforward method for embedding essential token data into transactions. Concurrently, the Unspent Transaction Output (UTXO) mechanism ensures fair and productive asset distribution. This harmonious union facilitates the seamless operation of Bitcoin Runes within the existing Bitcoin framework, thereby simplifying token creation and administration processes.

Key Benefits of Bitcoin Runes

Let’s now break down some crucial elements that characterize the concept of Runes.

Not Relying on Ordinals

Runes aim to minimize the impact on the blockchain and streamline UTXO management more effectively than BRC-20 tokens, which are rooted in the Bitcoin Ordinals protocol concept and could result in an excessive number of UTXOs. This approach helps prevent bloat on the Bitcoin network and enhances its overall functionality.

Diminished Transaction Charges

Among various token standards, Bitcoin Rune sets itself apart by offering more affordable transaction fees through efficient use of Unspent Transaction Outputs (UTXOs) and minimal on-chain data storage. This efficiency makes it an attractive option for individuals looking to create and manage fungible tokens on the Bitcoin blockchain.

Possibility of Decentralised Finance

The emergence of Bitcoin Runes opens up fresh avenues for Decentralized Finance (DeFi) utilization. These runes simplify the generation of interchangeable tokens, thereby fostering possibilities for peer-to-peer lending, borrowing, and trading directly on the Bitcoin blockchain – in addition to various other DeFi applications.

Suitability for the Bitcoin Infrastructure

The compatibility of Runes with the Lightning Network and other Bitcoin frameworks is seamless. This feature enhances the appeal and utility of Bitcoin Runes for developers and users alike, as it facilitates faster and less costly transactions. Due to its association with the Lightning Network, Bitcoin Runes present an attractive solution for various applications thanks to their swift and affordable transfer capabilities.

Compatibility with Different Protocols

As a blockchain analyst, I’d express it this way: With Bitcoin Runes, the tokens I work with can seamlessly interact with other token standards and protocols. This versatility lets my tokens communicate effectively with diverse blockchain networks and applications. Consequently, the adaptability and utility of tokens using the Runes protocol are significantly enhanced.

Efficiency of Resources

As a researcher studying the intricacies of blockchain technology, I’ve come to notice that Runes are more resource-efficient than BRC-20. This efficiency is crucial because an overabundance of Unspent Outputs (UTXOs) in the BRC-20 system could lead to network congestion. In contrast, Runes employ the OP_RETURN methodology, which minimizes blockchain bloat and uses fewer resources. The unyielding performance and scalability of the Bitcoin network hinge upon these resource savings.

A Rise in Miner Income

As a network analyst, I’d like to share an alternative perspective on the recent Bitcoin miner revenue halving and the role Runes play in sustaining the Bitcoin ecosystem. In essence, Runes provide an additional income avenue for miners in these challenging times. With every Rune creation and transfer, transaction fees are generated, which is a beneficial byproduct for miners and potentially attracts more network contributors. The sustained generation of these fees contributes significantly to the overall stability and security of the Bitcoin network.

Increased User Volume and Network Functionality

Through facilitating the development of meme coins and community-driven projects on the Bitcoin network, Runes aims to attract a larger and more diverse user base. This expansion in utilization could lead to increased network activity and broader acceptance, making the Bitcoin environment more vibrant and engaging. By enabling the creation of various tokens, Runes enhance the adaptability and appeal of the Bitcoin blockchain.

The Ability to Scale

The design of Runes protocol allows it to expand in tandem with the expanding Bitcoin network. Runes makes use of the UTXO (Unspent Transaction Output) concept to keep data storage needs minimal and manage high numbers of token transactions without negatively impacting Bitcoin’s blockchain performance. Scalability is crucial for addressing the mounting interest in tokenized assets.

Flexibility in Creating Tokens

Creating new Runes tokens through the minting process is straightforward and can be integrated into the Bitcoin Runes system. This capability expands the Bitcoin blockchain’s functionality for diverse applications by enabling the swift generation of new tokens. Inside the Bitcoin framework, the uncomplicated token production fosters a stimulating environment for exploration and invention.

Potential Drawbacks

The benefits of using Bitcoin Runes are numerous, but it’s important to consider some potential downsides before assessing the impact of this protocol on the Bitcoin network as a whole. Understanding these possible issues is crucial for making an informed evaluation.

The Speculative Nature

Similar to meme currencies and other tokens, Bitcoin Runes could fuel speculative behavior. However, the Bitcoin network may not reap benefits or provide assistance in the long term from such speculation.

A Rise in Transaction Fees

As a Bitcoin analyst, I’ve observed a significant rise in transaction fees following the introduction of Bitcoin Runes. While this development benefits miners, it might discourage regular users from engaging with the network due to the heightened costs.

Symbol Squatting

In simpler terms, the Runes protocol allows individuals to reserve specific token symbols for future use, without necessarily needing them right away. However, this practice could lead to disputes and wastefulness during the token generation process.

Fast Fact:

As a researcher studying the intricacies of Bitcoin’s blockchain, I can tell you that each Bitcoin Runes is distinguished by a distinct Rune ID. This feature simplifies the process of identifying and tracking individual Rune units throughout the entire blockchain network.

Runes vs. BRC-20

Two approaches exist for generating and overseeing digital tokens on the Bitcoin blockchain: Bitcoin Runes and the BRC-20 token standard. Each method boasts distinct features and design philosophies. Casey Rodarmor, a notable figure in the crypto sphere, introduced Bitcoin Runes as a fresh technique to develop more practical and efficient fungible tokens compared to the existing BRC-20 standard.

The ways in which BRC-20 and Bitcoin Runes function at their core are remarkably different. While Bitcoin Runes adhere to the Unspent Transaction Output (UTXO) model, each transaction consuming existing assets and generating new UTXOs based on instructions given, BRC-20 coins operate using the Ordinals protocol. This protocol takes charge of managing and generating tokens separately.

As an analyst, I would explain it this way: When it comes to managing data, there’s a significant distinction between Bitcoin Runes and BRC-20 tokens. In the case of Bitcoin Runes, I handle token-specific information such as name, ID, and instructions for specific tasks within the OP_RETURN field of Bitcoin transactions. Conversely, with BRC-20 tokens, data is directly inscribed onto a satoshi, which might lead to less efficient data management and storage due to potential limitations in capacity and readability.

Moreover, there are distinctions between the token creation and transfer mechanisms of BRC-20 and Bitcoin Runes. Runes offer greater control over token generation through both open and closed minting options. Additionally, they streamline transactions by allowing multiple activities related to various tokens to be executed in a single step. Conversely, BRC-20 tokens may encounter inefficiencies due to their requirement for new inscriptions each time a token is transferred, and the restriction on open minting.

Considering all aspects, Bitcoin Runes and BRC-20 represent distinct approaches to creating tokens on the Bitcoin blockchain. For developers and users looking to delve into tokenization within the Bitcoin ecosystem, Bitcoin Runes offer an enticing option due to their focus on simplifying token creation and management processes, as well as enhancing overall efficiency.

Final Thoughts

it’s user-friendly, resource-efficient, and compatible with the existing Bitcoin network. However, there are potential downsides, like increased chances for speculation and higher transaction fees.

As a crypto investor, keeping a close eye on the development of the Bitcoin Runes ecosystem in comparison to Bitcoin and the broader market is essential for me. The progress they make could result in more streamlined and user-friendly tokenization solutions, ultimately fostering growth and advancement within the Bitcoin community.

FAQs:

How is the Runes protocol implemented?

The use of Runes enhances the efficiency of direct token transactions. Underlying this system are Unspent Transaction Outputs (UTXOs), which serve as a base and grant enhanced control over transactions while maintaining compatibility with the fundamental design of Bitcoin.

Where should I keep Rune?

Hardware wallets, often referred to as cold wallets, provide the most secure method for keeping your cryptocurrencies offline and available for backup use.

Is it wise to Invest in Rune?

When considering your investment choices, it’s important to keep in mind several key aspects, including your personal investment goals. If you’re looking for a cryptocurrency with a unique purpose and significant growth prospects, RUNE could be an option worth exploring.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-06-21 14:05