Reflecting on my journey as a trader, I have come to appreciate the intricacies of both long and short positions. While I started with a traditional long position approach, it was the thrill of short selling that truly captured my interest.

For some, trading can be a valuable source of income, and the process itself can be exciting. However, with so many methods and strategies out there, it’s easy to feel overwhelmed. The essence of crypto trading is buying and selling digital assets. Knowing long and short positions is essential for anyone hoping to be effective. These terms describe particular tactics traders use to profit from price changes, regardless of whether they predict a rise or fall in the value of cryptocurrencies.

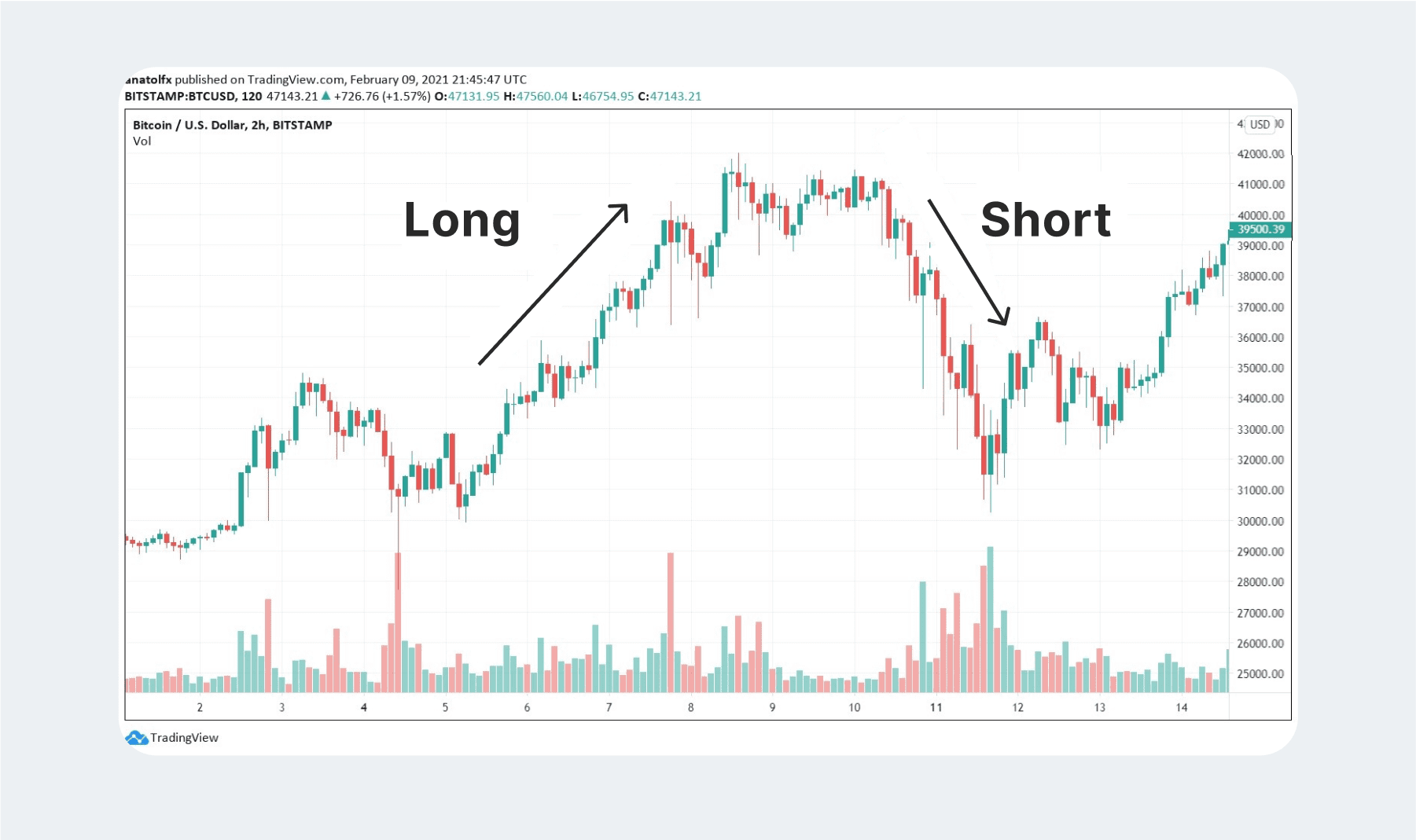

Unraveling the Art of Trading: Long vs Short Positions – Benefits, Drawbacks, and Strategic Implementation

Key Takeaways

- Purchasing assets with the hope that their value will increase and provide a profit when sold later is known as a long position.

- In a short position, you borrow money, sell assets, and believe the price will drop so that you may repurchase them later at a profit.

- For both techniques to be successful, thorough market analysis and risk management are necessary.

What Does Going Long Mean in Trading

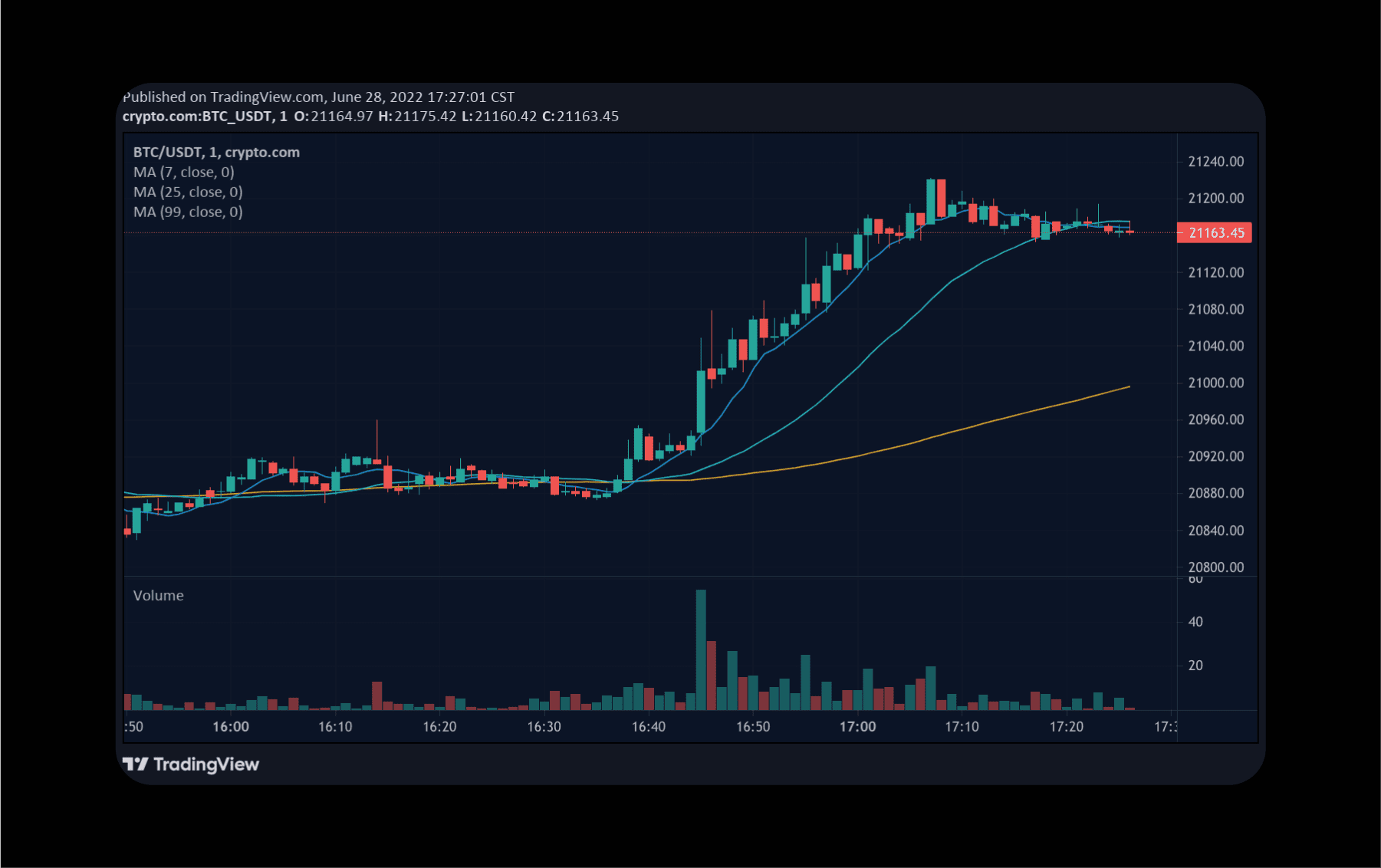

In simpler terms, having a long position means buying an asset (such as a cryptocurrency) with the expectation that its value will grow in the future. This approach is built on the assumption that the value of the cryptocurrency will go up, allowing the trader to eventually sell it at a higher price for a profit. This strategy is used not only in the rapidly changing crypto market but also in traditional stock markets.

In other words, when you select a cryptocurrency (X) for trading, after conducting thorough research, you’re confident that it is currently underpriced and its value will rise. As a result, you opt to invest in this cryptocurrency by buying 1 unit of X for $1,000. If your prediction proves correct, the price of X increases to $2,000, enabling you to sell your 1 X at a profit of $1,000.

How to Trade

Here are a few steps for trading a long position that will help you get started:

- To figure out when it is optimal to enter a trade, you need to examine the market carefully. Studying price fluctuations, market sentiment, and current trends are all necessary actions.

- Choose a cryptocurrency based on the likelihood that its value will rise. Do thorough research, read price analysis, and rely on your and the expert’s experience. Consider external factors that might influence the pricing as well.

- Complete the first transaction by paying the current market price for the coin of your choice. This establishes the long position.

- Hold onto the position while monitoring current market trends and cryptocurrency price fluctuations.

- Sell the cryptocurrency when its price reaches the level of your choice to earn profit.

Benefits and Risks

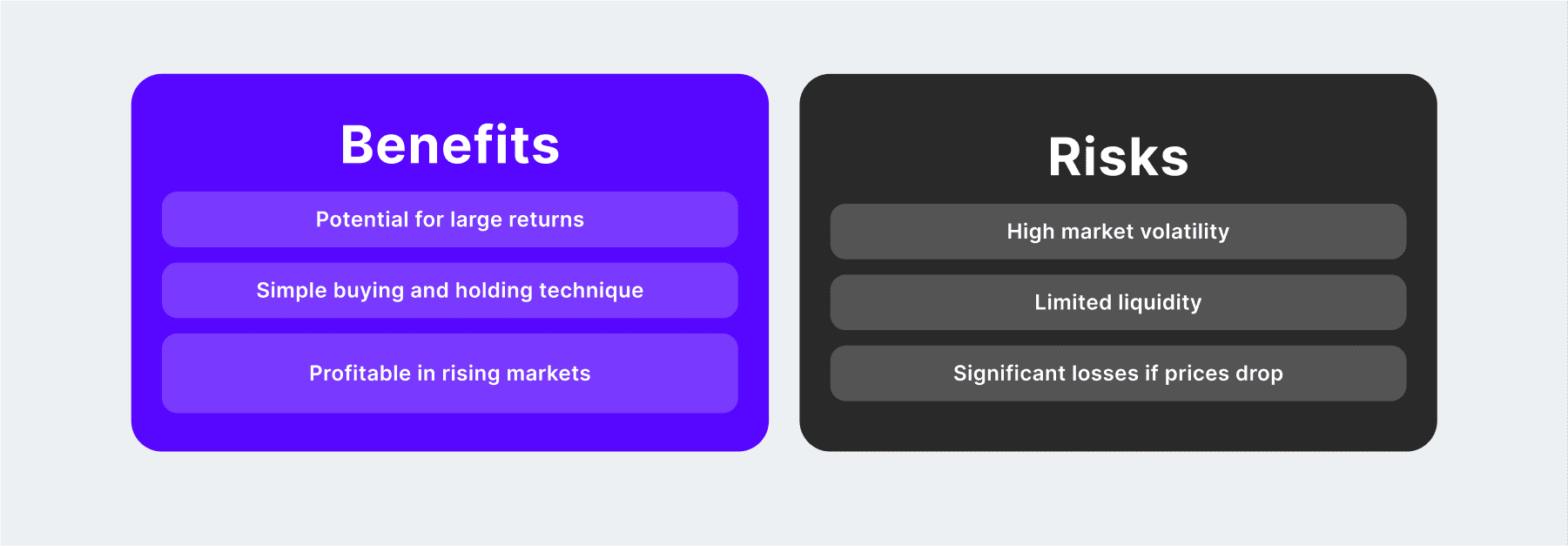

A key benefit of taking a long position is the potential for substantial profits; traders can potentially earn a great deal if the value of the cryptocurrency rises dramatically. This strategy, known as buy-and-hold, is quite straightforward and suitable for beginners. Moreover, since long positions are profitable when prices are generally trending upward, they align well with the overall optimistic sentiment in the market.

On the flip side, employing this strategy often involves risks. A significant issue is market volatility – cryptocurrency prices can change rapidly, potentially leading to losses when markets move against a trader’s position. Additionally, the investment may be locked up until it’s sold, reducing liquidity. In a worst-case scenario, substantial losses could occur if the price plummets. To mitigate these risks, effective risk management practices such as stop-loss orders should be utilized regularly.

What Does Going Short Mean in Trading

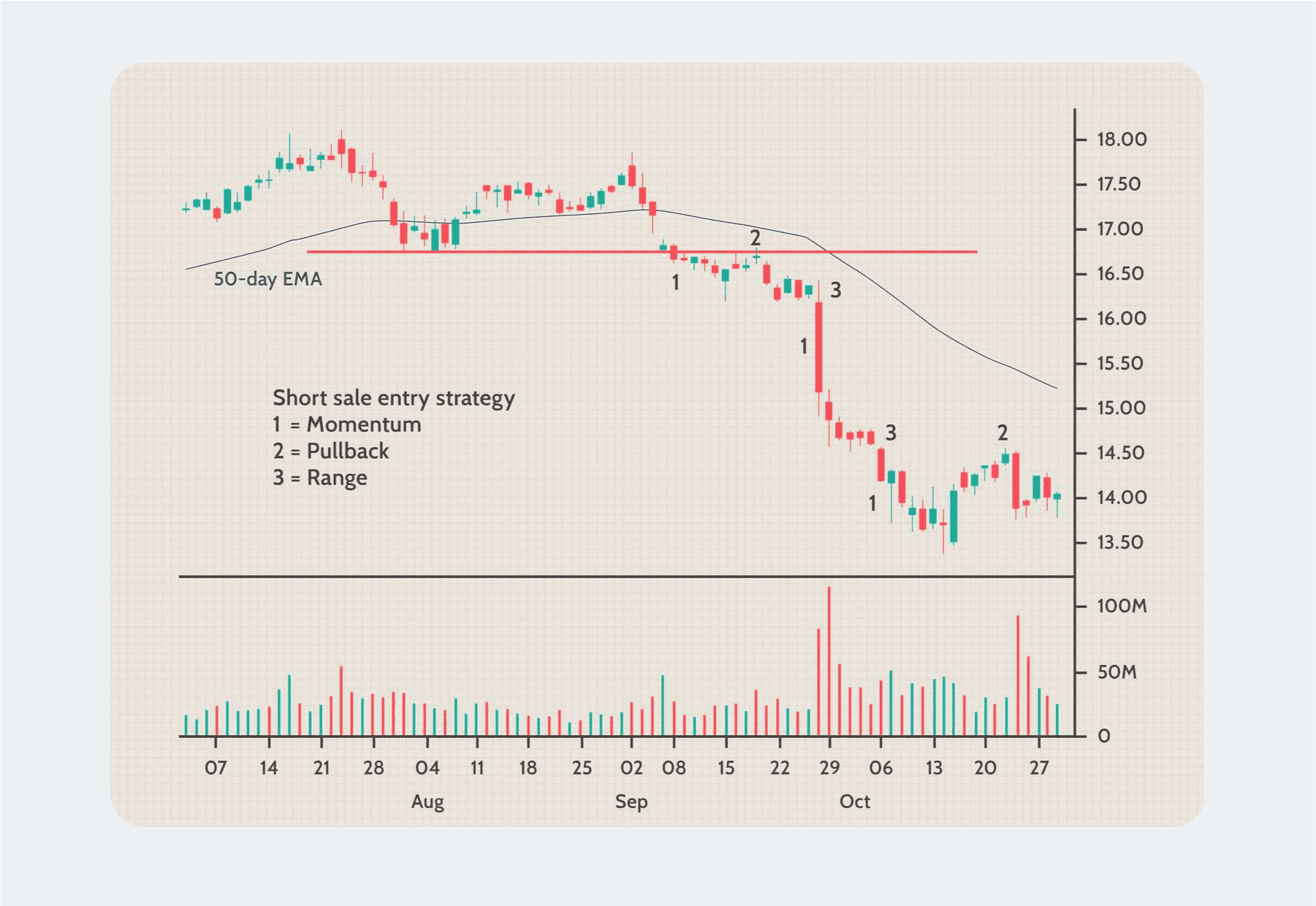

Taking an asset on loan with the expectation that its worth will fall, and then reselling it (with the intention of buying it back later at a lower price and returning it to the lender) is called having a short position. The goal is to eventually buy it back at a cheaper price, return it, and pocket the difference as profit. This practice, originally common in traditional investing, has also been adopted and thrived within the crypto market.

If you think crypto Y’s value has been overstated and expect it to decrease, your strategy might involve going short by borrowing 1 Y from a broker at the current price, which could be $1,500. Then, you sell this coin immediately. Later, when you return the borrowed coin to the broker, if the price has indeed dropped to $1,000 as you anticipated, you can buy another Y to replace the one you borrowed earlier. This allows you to close your short position and earn a profit of $500 (the difference between the selling price and the repurchasing price).

How to Trade

To fully understand a short position, follow these steps:

- Usually, you have to create a margin account to borrow the asset from a broker. You can trade with borrowed funds in this account, but you will have to pay interest on the borrowed amount.

- After borrowing an asset, you sell it at market value to later buy it back at a reduced price.

- Since short trading is subject to market changes, monitor developments carefully. Significant market events, such as the release of economic data or earnings reports, may impact the asset’s price.

- When the asset reaches your goal level, repurchase it at a lower price. This is an essential stage since timing the market impacts your trade’s profitability.

- Return the borrowed asset to the lender to finish the short selling cycle. Paying off any interest or fees accumulated over the borrowing term is part of this phase.

Benefits and Risks

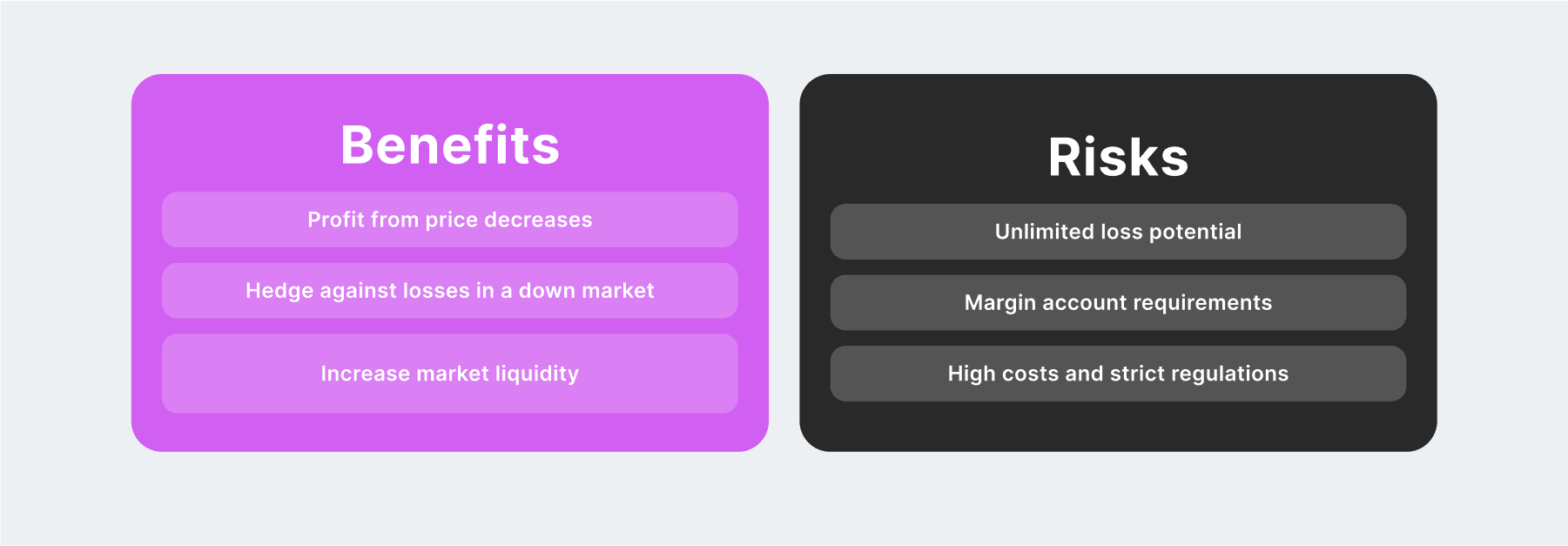

Benefits of taking short positions vary from traditional trading methods. Instead of relying on rising prices for profits, short sellers can capitalize on falling prices. Moreover, short selling serves as a protective measure in a declining market, helping traders minimize losses on other investments. Lastly, high-volume short selling could significantly impact market liquidity.

Despite the potential profits, it’s important to be aware of the substantial risks associated with taking a short position. Unlike long positions, where losses are confined to the initial investment, short positions carry the risk of unlimited losses if the asset’s price rises or market conditions become bullish. This is because short sellers must have a margin account and maintain a minimum balance as a safety net for any potential losses. If the market moves against their position, they may receive a margin call, requiring them to either inject more funds or close losing positions. Since markets can be highly volatile, rapid price increases could lead to substantial losses for short sellers. Furthermore, borrowing the asset comes with interest and other fees that accumulate over time, increasing the cost of holding the position. Additionally, laws governing short sales vary by country, adding another layer of complexity.

Fast Fact

In 1971, Nasdaq made its debut and soon became widely recognized. By the year 1992, it represented an impressive 42% of all trading activity in the United States. Notably, that same year marked the introduction of Globex – the first-ever electronic trading platform.

What’s the Difference Between Them

The key differences between long and short positions in trading revolve around a trader’s perspective on market trends and predictions for price movements. A trader who takes a long position anticipates that the asset’s value will rise, whereas one who opts for a short position believes it will fall. This difference is significant because it shapes the trading strategy and risk management tactics employed.

As a crypto investor, I’ve found that taking long positions generally involves less risk compared to short ones. The reason being, while the value of an asset in a long position can only decrease up to the amount initially invested, a short position carries the potential for unlimited risk because an asset’s price could theoretically grow without limit. This makes it crucial for traders who opt for short selling to employ careful risk management strategies to prevent substantial losses. Additionally, short positions may require margin trading, which introduces yet another layer of complexity to the trading process.

In simpler terms, having both long and short positions in a market influences its behavior. Short positions increase market activity by increasing trading volume, while long investments raise the asset’s price due to increased demand. Together, these actions keep the market lively and well-balanced.

In making the decision between buying or selling stocks (long or short), a trader’s viewpoint, the current market conditions, and their risk appetite are crucial factors to consider. A detailed analysis and careful examination of the price trends and demand patterns of the underlying asset are essential for both strategies.

Last Remarks

In essence, grasping both long and short positions is vital for thriving in financial market transactions. A short position involves selling assets you don’t currently possess, anticipating a price drop, while a long position means buying assets with the aim of price growth. To execute these strategies effectively, thorough market analysis and smart risk management practices are indispensable. These tactics aren’t merely for protection; they serve as active tools that empower traders to capitalize on market fluctuations. Acquiring an understanding of these concepts will bolster your potential success, but remember that trading demands practice, perseverance, and mental preparedness as well.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-15 16:01