As a seasoned investor with over a decade of experience in both traditional markets and the ever-evolving crypto space, I cannot stress enough the importance of understanding market capitalization (market cap) when it comes to navigating cryptocurrencies.

For those new to the world of cryptocurrencies, you’ve likely come across the term ‘market cap’ or ‘market capitalization’. Essentially, this figure represents the total value of a cryptocurrency by multiplying its current market price by the number of coins in circulation. In November 2021, the combined market capitalization of all cryptocurrencies surpassed $3 trillion. But what does this mean for investors and traders?

As a seasoned investor with years of experience in the world of digital currencies, I firmly believe that understanding market capitalization is essential for anyone looking to navigate the crypto space successfully. Having witnessed the rapid growth and fluctuations of various cryptocurrencies, I have learned that having a solid grasp of market cap can help investors make informed decisions and stay ahead of market trends.

Let’s jump in!

What is Crypto Market Cap?

In simpler terms, the term “crypto market cap” refers to the overall worth of a specific cryptocurrency or all digital currencies when calculated in U.S. dollars. This is a crucial measurement used in crypto markets for assessing the total value of these digital assets.

To figure out a cryptocurrency’s market capitalization, simply multiply the current value of one unit of that cryptocurrency by the total number of coins or tokens that are actively circulating among users’ digital wallets.

In essence, examining a cryptocurrency’s market capitalization gives you an understanding of its significance and scale in the market. This knowledge empowers you to make educated choices and evaluate the potential for growth of other digital currencies.

Cryptocurrency’s Market Cap Categories

Large Cap Cryptocurrencies

In July 2024, the category of significant digital currencies, such as Bitcoin and Ethereum, falls under large-cap due to their respective market values exceeding $1.33 trillion for Bitcoin and $423.26 billion for Ethereum.

Consequently, numerous investors view larger market caps as lower-risk investments due to their established history of greater liquidity, stability, and growth possibilities.

Mid Cap Cryptocurrencies

Medium-sized digital currencies typically fall within the price range of $1 billion to $10 billion, offering significant growth opportunities but also carrying increased risk. Therefore, with more space for interested parties to invest, it’s essential to conduct thorough research on these mid-cap cryptocurrencies before making impulsive decisions.

Small Cap Cryptocurrencies

Smaller digital currencies with a value below one billion dollars are considered the riskiest because they’re relatively unknown or undeveloped. Yet, if public opinion shifts positively towards them, these lesser-known coins have the potential for significant growth.

In the year 2021, Fantom’s total value in the market was around $72,000 thousand. However, with several investors deciding to take a risk, Fantom’s current market capitalization stands at approximately $1.41 billion.

Top 10 Cryptos by Market Caps

-

Bitcoin (BTC): $1,315,133,586,569;

Ethereum (ETH): $419,830,394,460;

Tether (USDT): $114,253,038,202;

BNB (BNB): $85,100,379,517;

Solana (SOL): $82,009,209,663;

USD Coin (USDC): $34,082,303,375;

XRP (XRP): $33,403,631,522;

Dogecoin (DOGE): $19,521,795,962;

Toncoin (TON): $17,410,910,879;

Cardano (ADA): $15,214,396,717;

Why Is Crypto Market Cap Important?

Viewpoints vary regarding the significance of the cryptocurrency market capitalization. On one hand, some argue that it contributes to an increased risk level, fostering feelings such as fear and greed, and influencing market sentiment. Conversely, others stress the influence it wields within the complex workings of the crypto market environment.

As a crypto investor, I find it prudent to keep tabs on the total market capitalization of cryptocurrencies. This metric provides me with a clear, unbiased perspective on the crypto market’s overall performance, free from marketing gimmicks and social media hype that can often result in manipulation of market trends.

One factor influencing market capitalization is the degree of a currency’s acceptance across various sectors, given that broadly adopted currencies are utilized in multiple industries and generally enjoy higher levels of trust.

In other words, by considering a currency’s market capitalization, you can make wiser investments and distribute your crypto holdings thoughtfully. However, it’s important to note that the accuracy in cryptocurrency is not as precise as in traditional stock markets.

As an analyst, I’ve come to understand that a cryptocurrency’s market capitalization isn’t solely indicative of its growth potential. Adverse news or regulatory scrutiny can have a substantial negative impact on the market cap. Conversely, favorable news can bolster investor confidence and consequently boost the market cap.

To ensure you make informed investment choices, always conduct comprehensive research first, since certain elements can either exaggerate or diminish the value of the cryptocurrency market capitalization.

The Crypto Market Cap and Volume Bond

In simpler terms, Market Cap (Market Capitalization) represents the total worth of a cryptocurrency in circulation, similar to how it signifies the value of a currency. On the other hand, Trading Volume refers to the level of activity or the number of transactions taking place, such as buying and selling, within the cryptocurrency market, reflecting its liquidity or ease of trading.

Indeed, it’s quite straightforward. To put it another way, when there are many trades being made for a specific asset, it typically indicates a heightened level of interest among investors. Conversely, if the number of trades is low, it often suggests that there’s less interest in that particular asset.

When evaluating the market, it’s crucial to take both market capitalization and trading volume into account. Pursuing a high market cap alongside substantial trading volume can increase the chances of longevity, but don’t forget to factor in market volatility as well.

Calculating Market Cap with Ease

As an analyst, I find calculating the market capitalization of a cryptocurrency to be a straightforward process. To do this, I simply multiply the current price of the cryptocurrency by its total circulating supply – often referred to as the quantity of the asset currently in circulation among users’ wallets. In other words, the equation I use is: Market Cap = Current Price * Total Circulating Supply.

Market Cap = Coin Price x Circulating Supply

As a seasoned investor with years of experience under my belt, I have learned that keeping track of both current prices and total circulating supplies is crucial to making informed decisions. While it may seem obvious to some, I cannot stress enough the importance of this practice. I’ve seen firsthand how prices on different exchanges can vary significantly due to factors like liquidity and market sentiment, while the total circulating supply on a project’s website remains constant. This information helps me gauge the potential value of an investment and make more educated choices about where to put my money. In my experience, having this knowledge at your fingertips is essential for any successful long-term investing strategy.

Let’s take a practical example.

In simpler terms, when you multiply the value of one Bitcoin ($67,498) by its total number in circulation (19.73 million), you get a total market capitalization of approximately $1.33 trillion.

Keep in mind that the market capitalization can fluctuate due to differences in cryptocurrency prices between various exchanges. Additionally, certain digital currencies may have a finite supply, which means their total circulating amount won’t grow over time.

For Bitcoin specifically, the total amount that can ever be mined is capped at 21 million units. This limitation on supply implies that its market capitalization can grow solely through an increase in price.

What Is the Total Market Cap?

In simpler terms, the overall market capitalization in the realm of cryptocurrencies reflects the combined worth of all existing digital currencies, as gathered from current market data. This enables us to monitor the performance of the entire cryptocurrency market in real-time.

Another important metric of the total market cap is the total supply, as altcoins have a limited supply, like Bitcoin, which has 21 million coins. However, other altcoins could have a much bigger total supply, like the XRP, with 1 billion.

Additionally, you’ll often find that cryptocurrencies with larger supply amounts generally have lower prices due to their lack of scarcity significantly impacting their overall value. Consequently, for a comprehensive analysis of your crypto portfolio, it would be more beneficial to focus on market capitalization rather than the individual price of each digital asset.

Subsequently, we have the circulating supply – another term for the total number of cryptocurrency units accessible to the general public.

Best Tools to Track Crypto Market Caps

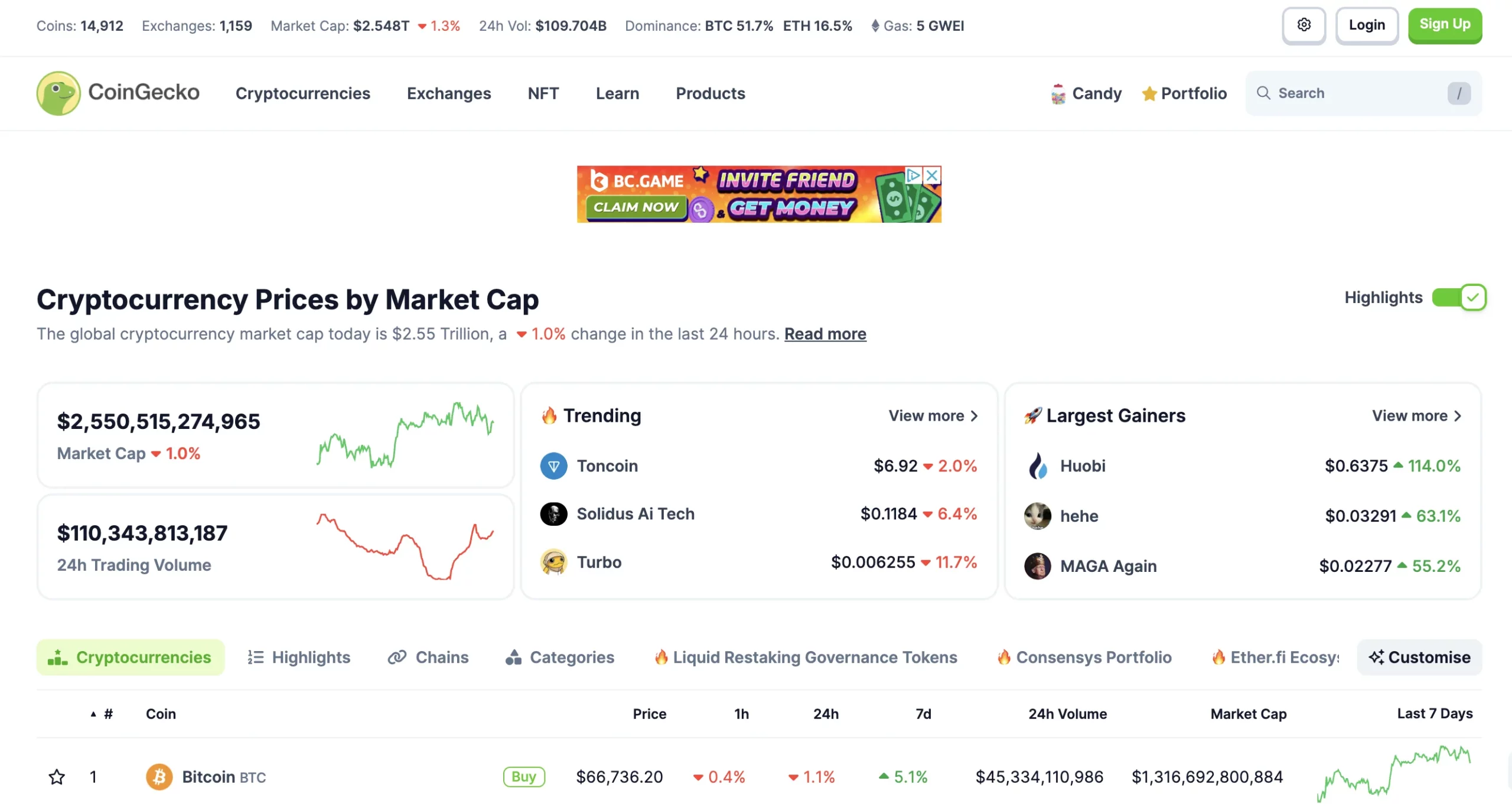

1. CoinGeko

As an analyst, I find myself frequently relying on CoinGecko as one of my go-to resources for cryptocurrency analysis. This powerful tool provides me with a comprehensive breakdown of various digital currencies, enabling me to delve deeper into the intricacies of market dynamics and volatility.

As a crypto enthusiast, I highly recommend utilizing CoinGecko for an extensive exploration of various cryptocurrencies, digital asset exchanges, Non-Fungible Tokens (NFTs), and more. It’s a great resource to deepen your knowledge through their insightful articles, current news updates, comprehensive reports, informative podcasts, and other valuable resources.

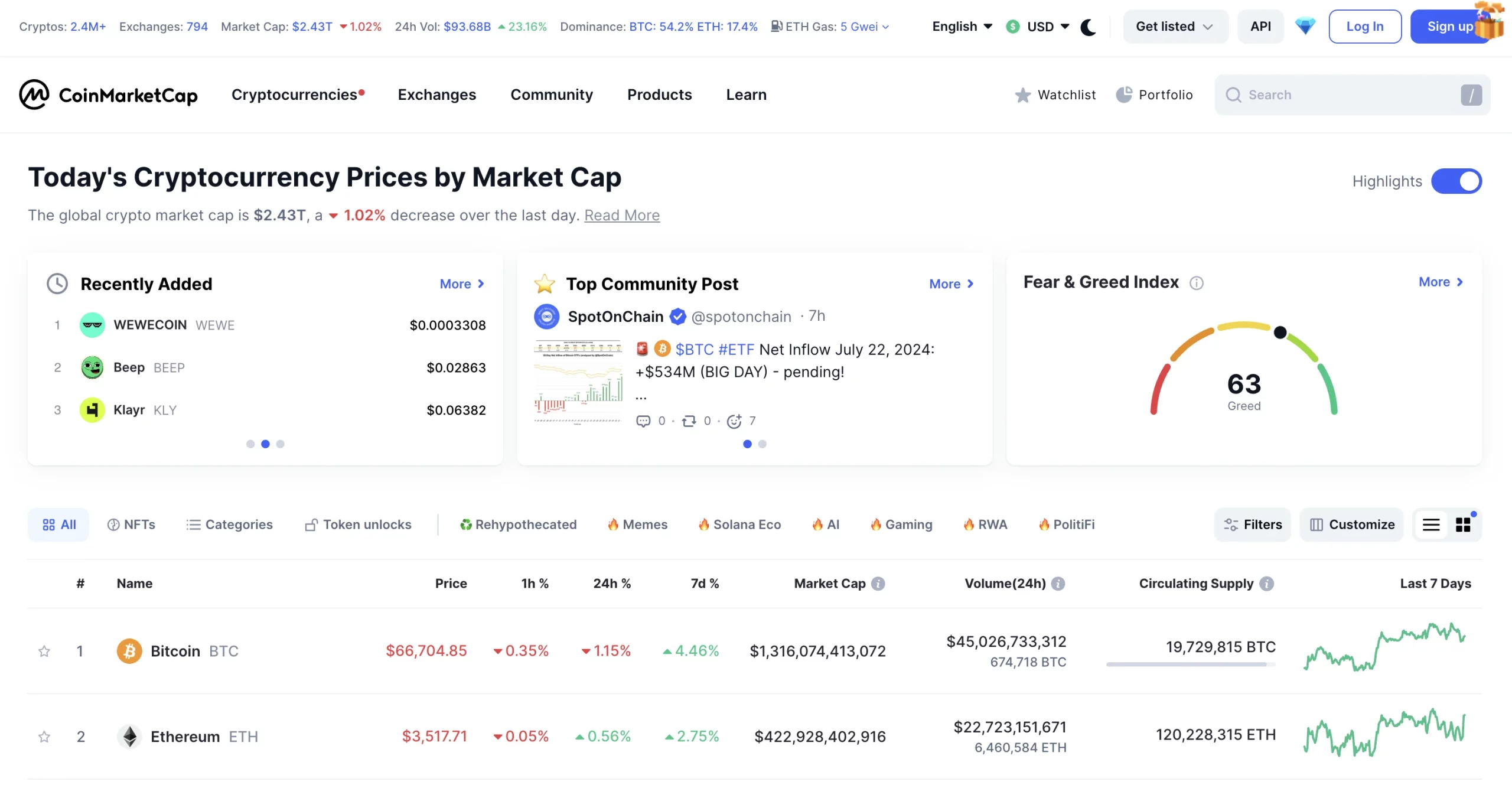

2. CoinMarketCap

Did you realize that CoinMarketCap was among the pioneers in ranking cryptocurrencies based on their total market capitalization?

As an analyst, I firmly believe that CoinMarketCap stands out as the most reliable and precise platform for obtaining data on cryptocurrency market capitalization, pricing, and other crucial global insights within the crypto sphere.

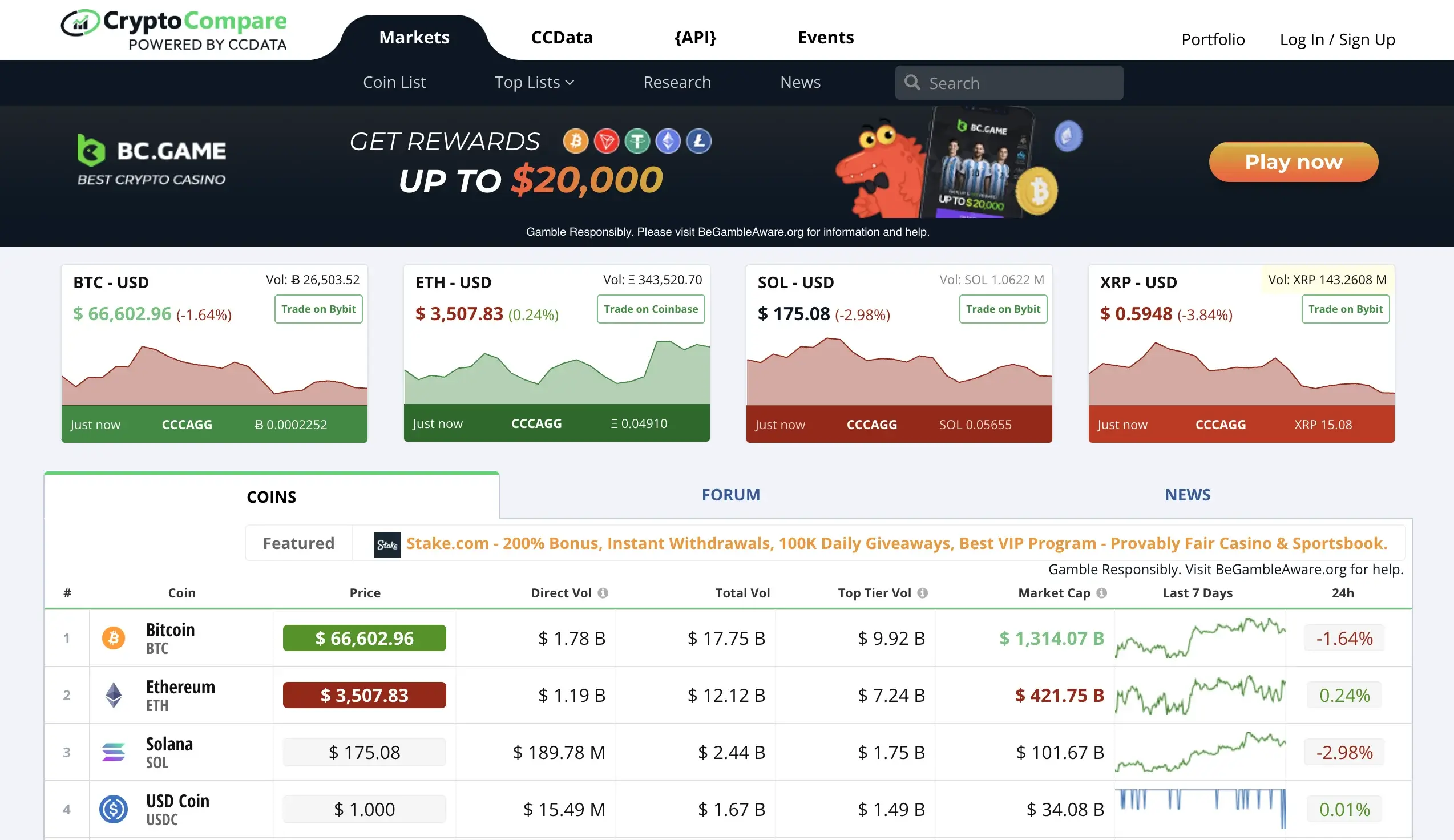

3. CryptoCompare

CryptoCompare serves as a leading supplier of cryptocurrency market information, research, and insights. It provides clear, accessible data that benefits all cryptocurrency investors and dealers.

Additionally, CryptoCompare provides comprehensive evaluations of cryptocurrency exchanges, while keeping tabs on various aspects, including regional differences and unusual occurrences within the market.

Market Cap FAQs

What is the current crypto market cap?

The total market capitalization is $2.42T as of July 23, 2024.

Why is crypto market cap important?

In simpler terms, the total value of all cryptocurrencies gives a fair and unbiased view of the crypto market’s success, rather than relying on advertising strategies or popular opinions on social media which can potentially distort market values due to manipulation.

What is the highest crypto market cap ever?

The total market cap reached its all-time high of $3 trillion in November 2021.

How is Market Cap calculated?

Market cap is calculated based on the following formula:

Market Cap = Coin Price x Circulating Supply.

Final Thoughts on What is Market Cap in Crypto

In summary, grasping what market capitalization means is vital when diving into the intricate realm of cryptocurrency investment. Keeping an eye on market cap together with aspects like trading volume can help you make shrewd choices regarding your crypto investments. However, don’t forget that in-depth research is indispensable, and while understanding market capitalization is a crucial step, it’s merely one piece of the larger puzzle you need to solve when managing your portfolio.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-07-31 11:05