As a seasoned trader who has weathered numerous market storms and seen my fair share of slippage, I wholeheartedly agree that understanding and managing slippage is essential for success in the crypto world. Over the years, I’ve learned the hard way that even small percentage points can make a significant difference in my bottom line.

In the dynamic world of cryptocurrencies, swift gains and losses are commonplace, making it a high-risk, high-reward environment. A less apparent hurdle that may impact your earnings is something called ‘slippage’, often underestimated by novice traders.

As a researcher delving into the intricacies of cryptocurrency trading, I liken the concept of slippage to the experience of attempting to board a rapidly closing elevator. Just as a momentary lag can prevent you from entering the elevator, even a minuscule delay in crypto trading can transform a profitable transaction into an unrealized gain.

Unraveling Slippage: Its Impact on Traders and Strategies to Minimize Its Effect

What is Slippage in Crypto?

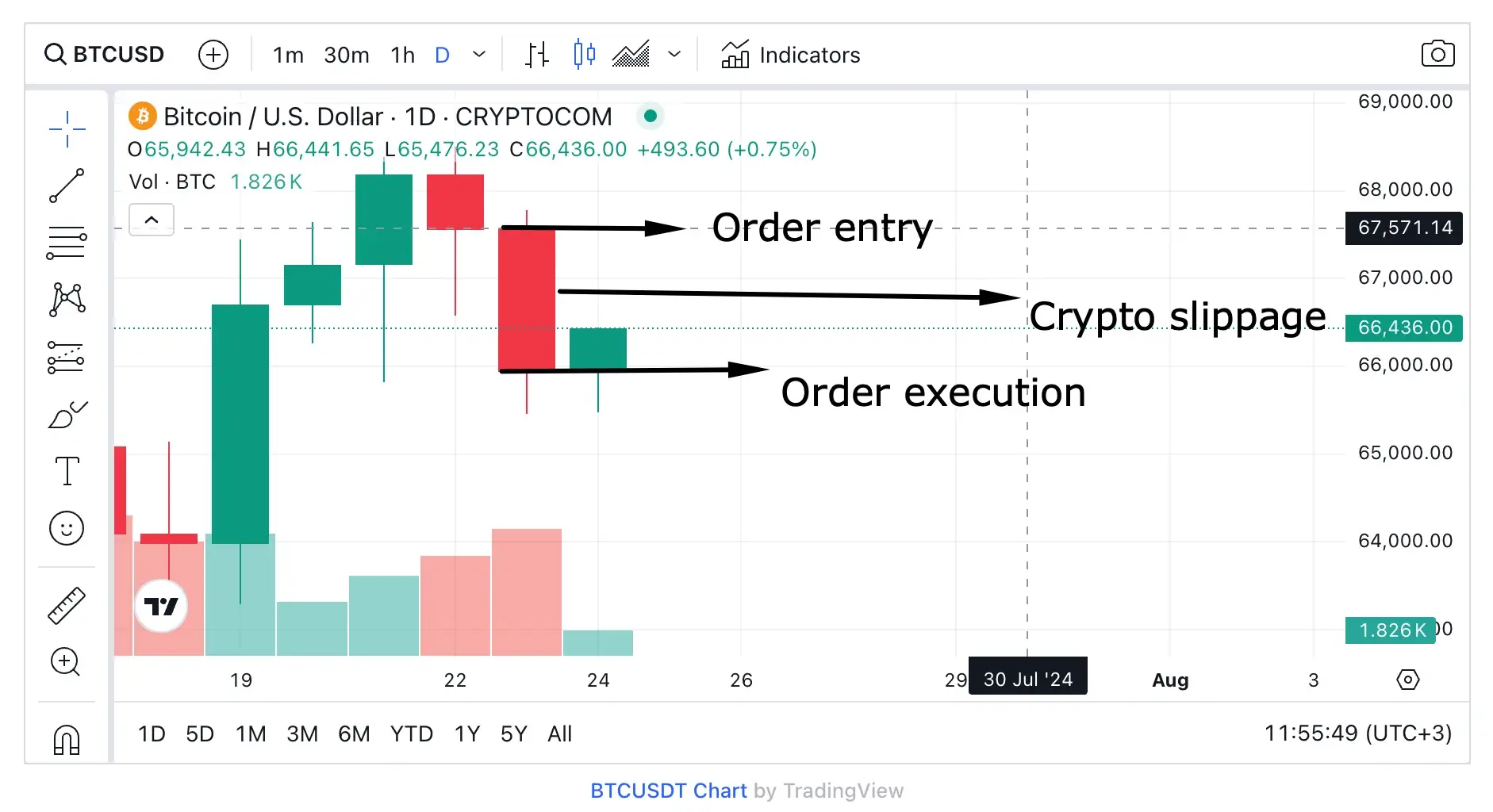

In simpler terms, crypto slippage means the variation between the anticipated price at which a cryptocurrency trade (buy or sell) was intended to happen and the actual price at which the transaction gets processed.

In simpler terms, the slippage percentage measures the amount of investment that’s either lost or gained as a result of the unpredictable movements in the cryptocurrency market, including changes in prices and other market conditions. This issue is typically encountered on decentralized exchanges due to their high price volatility.

How Does Crypto Slippage Work?

In simpler terms, slippage during cryptocurrency trading occurs due to the fluidity of the crypto markets, which refers to how fast a crypto asset can be bought or sold without impacting the current market price. When there’s less activity in the crypto market (either low liquidity or fewer trades), the amount by which the actual trade price deviates from the expected price increases, resulting in higher slippage.

As someone who has been actively trading cryptocurrencies for several years now, I can confidently say that understanding the concept of slippage is crucial for any serious crypto trader. Let me give you a personal example to help illustrate this point.

As someone who has been involved in the world of cryptocurrencies for several years now, I can attest to the fact that the concept of crypto slippage is not a sign of fraud or poor quality. Instead, it’s simply a reflection of the volatile nature of the crypto market. I have experienced my fair share of slippage myself, and while it can be frustrating at times, I understand that it’s an inherent risk when dealing with digital assets that are subject to rapid price fluctuations. It’s important for investors to be aware of this risk and to make informed decisions based on their own research and understanding of the market.

By using slippage percentage, traders and investors can evaluate price fluctuations, trading tactics, and transaction volumes. Consequently, it’s essential to take slippage into account when submitting orders in the crypto market, as it offers opportunities for refining risk management strategies.

Types of Slippage in The Crypto Market

It’s clear that slippage in cryptocurrency trading can occur in either an upward or downward direction. This results in two distinct types of crypto slippage: favorable slippage (positive) and unfavorable slippage (negative).

Absolutely, traders and investors aim to avoid unfavorable price discrepancies known as negative slippage. Instead, they strive for a situation called positive slippage, which allows them to purchase or sell assets at prices better than originally expected.

The Positive Slippage

In simpler terms, a beneficial slippage happens when a market order gets executed at a lower price than initially anticipated, making it favorable. This situation arises when there’s increased demand that causes prices to rise swiftly, causing market orders to be filled quicker than expected.

In simpler terms, if you purchase an asset for $100 and the final transaction price turns out to be $95, this situation is called a ‘positive slippage’. This price difference indicates that you managed to secure the asset at a lower cost than initially anticipated, which is beneficial for you.

The Negative Slippage

When a market order is filled at a price higher than the anticipated price, this situation is referred to as a negative slippage. This results in losses for the trader because the actual transaction price exceeds the desired price.

In addition, an adverse slippage refers to an unintended movement in the price of a security due to volatile market conditions, like low trading activity or rapid market swings, resulting in market orders being filled at an unexpected price.

To prevent unwanted losses, traders might want to set limits on their orders, consider using automated trading systems, and make sure they have effective risk control measures, which we’ll discuss soon.

If you buy cryptocurrency when its listed price is $100, but the transaction ends up being executed at $105, there will be a negative slippage, meaning the actual cost was higher than expected.

As a researcher studying market dynamics, I can’t stress enough the importance of minimizing or eliminating slippage when trading. In the following chapters, you’ll discover some indispensable strategies to reduce slippage and thrive in volatile markets. Keep reading!

Crypto Slippages’ Impact Within the Market

As a seasoned crypto trader with years of experience under my belt, I can confidently say that slippage plays a pivotal role in determining the success or failure of any trade. The fluctuating trading fees and substantial slippage can either be a boon or bane for traders like myself. In volatile markets, where prices can change rapidly, even a minor delay in order execution can result in executing the order at a significantly worse price, leading to potential losses. This volatility can also cause delays in filling orders altogether, which could mean missing out on profitable opportunities or getting stuck with unfavorable trades. In essence, managing slippage effectively is crucial for any trader who wants to survive and thrive in the fast-paced world of crypto trading.

One important consideration is effective management of slippage risk, particularly for institutional investors handling significant trades. A practical guideline would be to divide large orders into smaller, more manageable pieces, and employ sophisticated algorithms to reduce potential slippage or completely eliminate it.

As an analyst, I’d like to highlight another crucial insight: Slippage tolerance, a setting that indicates a trader’s readiness to tolerate a particular level of slippage in crypto transactions. Essentially, a greater tolerance implies accepting a larger amount of slippage.

The Slippage Tolerance

In my analysis, it’s crucial to emphasize the importance of incorporating slippage tolerance into any trading or investment strategy regarding cryptocurrencies. This feature enables us, as traders and investors, to establish our maximum acceptable deviation from the desired execution price for our orders. By employing various techniques to restrict orders, particularly during periods of significant volatility within the crypto market, we can minimize slippage and thus, safeguard our profits more effectively.

In simpler terms, if you place an order to buy or sell stocks worth $100, we allow the price to fluctuate by up to 5%. Your transaction is considered final when you end up buying the shares for a maximum of $105, because that’s the highest price we consider acceptable.

Slippage tolerance, which is commonly shown as a percentage, can also be represented by a specific number of pips or ticks.

How to deal with slippage tolerance?

As a seasoned investor with years of experience under my belt, I’ve learned that managing slippage is crucial to success in trading. Personally, I prefer to integrate cost trading into my overall strategy and accept some degree of slippage. However, I also understand the importance of using limit orders to avoid slippage altogether when it matters most. With a keen eye on the market, I ensure that my purchasing price aligns with my desired level, thereby minimizing potential losses and maximizing profits.

How to Calculate Crypto Slippage

To determine slippage for most cryptocurrency transactions, you can find the difference between the price at which the transaction is executed and the current market price. Here’s a simple formula to help with that calculation:

Slippage = Current Market Price – Executed Trade Price.

As a seasoned cryptocurrency trader with years of experience under my belt, I can tell you that slippage is something every investor needs to be mindful of when making trades. In simple terms, slippage refers to the difference between the expected price and the price at which an order is actually executed.

To calculate the slippage percentage, simply find the difference between the price at which a trade was executed and the current market price, then divide that amount by the current market price. Here’s the simplified formula:

Slippage Percentage = (Current Market Price – Executed Trade Price) / Current Market Price * 100

In this case we’re using the same illustration: If you spend $10,000 on one Bitcoin but the actual transaction price is $9,900, your slippage rate amounts to 1%. This means that because of the 1% slippage, you end up paying a bit more than anticipated for the Bitcoin.

In case you’re looking to automate your calculations, fortunately, the cryptocurrency market provides various slippage calculation tools. All you need to do is enter your specifications, and the slippage calculator handles the remaining tasks for you.

Top Crypto Slippage Calculators

Even if calculating slippage in crypto trades is a straightforward process, you can always use a crypto slippage calculator if you don’t want to do it on your own. Here are some options you have:

1. Calculate Slippage with TradingView

As a seasoned trader with years of experience in both the cryptocurrency and forex markets, I find the Slippage Calculator to be an incredibly valuable tool in my arsenal. Originally designed for the highly volatile cryptocurrency market, this TradingView script has proven to be versatile enough to adapt to the challenges of forex trading as well. It’s essential for any trader who wants to minimize potential losses due to slippage and maximize their profits. Having used various calculators in my career, I can confidently say that this one stands out due to its accuracy and user-friendly interface.

2. Calculate Slippage with ForexBee

Another option for a crypto slippage calculator is the one developed by ForexBee. It provides basically the same features as the TradingView’s calculator.

Top Strategies to Avoid Slippage in Crypto

Streamlining the occurrence of discrepancies between the expected and actual execution prices is crucial for boosting trading success and mastering the complexities of the cryptocurrency market. By grasping the variables influencing these discrepancies and devising tactical methods, traders can substantially improve their trading results.

So, let’s present to you some top strategies to avoid crypto slippage:

Prioritize Limit Orders

Instead of buying or selling an asset instantly at the current market price with market orders, limit orders enable traders to define a particular price they are comfortable with for the transaction. This is advantageous, particularly in turbulent market conditions where prices may fluctuate swiftly, as it prevents them from overpaying unintentionally.

Focus on Liquid Trading Pairs

In simpler terms, liquidity indicates how quickly an asset can be bought or sold without affecting its price too much. Assets with high liquidity (many buyers and sellers) typically have lower discrepancies between the asked and actual price (slippage). Conversely, trading less liquid assets may cause a significant impact on the market price and result in higher slippage, where the final price you pay might not be as advantageous.

Time Your Trades Strategically

Market circumstances can influence the occurrence of slippage significantly, particularly in times of high market volatility, like significant news announcements or economic data releases. To minimize slippage, consider trading when the market is calmer and price fluctuations are more moderate.

Set a Slippage Tolerance

On several cryptocurrency trading platforms, users can specify a maximum allowable price difference for their transactions, known as slippage tolerance. This option aims to safeguard trades from being executed at unsuitable prices by limiting the price adjustment that is deemed acceptable.

Consider Off-Peak Trading

Engaging in trades during quieter periods, when the volume of transactions is generally lower, may result in smaller effects on market prices (less market impact) and fewer discrepancies between the expected price and the actual one (reduced slippage). By avoiding busy trading periods, you can potentially secure prices more aligned with your desired levels.

Conclusion

Slippage is an unavoidable part of cryptocurrency trading, but it doesn’t have to ruin profits.

Through grasping the factors leading to price discrepancies (slippage) and their mechanisms, traders can minimize its influence and execute trades more proficiently. Picking platforms with substantial market depth, employing limit orders wisely, and considering suitable trade volumes are strategies for mitigating slippage.

Although it’s impossible to eliminate the risks entirely, having a solid understanding of the market and strategic planning can empower traders to navigate the unpredictable world of cryptocurrency with greater confidence.

Every trade matters in the competitive crypto world. Reducing slippage is not just about saving profits; it’s about refining your trading strategy for long-term success.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-13 14:31