As someone who has navigated the ever-evolving landscape of cryptocurrencies for years now, I can confidently say that DAI stands out as one of the safest decentralized stablecoins out there. Its diverse collateral reserves, which include Ethereum derivatives like Wrapped Ether (WETH) and Wrapped Staked Ether (wstETH), make it more resilient and less dependent on centralized sources.

Investing can be highly emotional as it involves an activity that can make or lose you money. We totally understand, especially when looking at the volatility of the crypto market.

However, even in the world of crypto assets, some variants are categorized as a little less volatile. So, remember that if this technology (blockchain and crypto) has caught your attention, you can be part of it by investing in a stablecoin.

This article will clarify what a stablecoin is and identify which one is considered the most secure. Let’s dive in!

What is a Stablecoin?

A stablecoin can be defined as a digital currency that aims to keep its worth consistent, usually by linking it to conventional monies such as the U.S. dollar, valuable assets like precious metals, or other digital currencies.

These digital currencies, commonly referred to as fiat-secured stablecoins, provide a more secure choice for individuals seeking to utilize cryptocurrencies while avoiding significant fluctuations in value.

These new forms of cryptocurrencies came about due to concerns over the volatile market behavior of existing cryptos such as Dogecoin, Shiba Inu, and Ripple. People sought a more stable digital currency alternative. These particular cryptocurrencies are widely utilized for trading, transferring funds, and supplying liquidity within the decentralized finance (DeFi) sector.

By September 9, 2024, stablecoins account for approximately 9.45% of the entire cryptocurrency market, which is worth roughly $170 billion within a total market cap of $1.8 trillion.

A significant number of these stablecoins are issued by well-known financial entities, which bolsters trust and reinforces security when they’re employed for transactions or trading. Stablecoins serve as a connection between traditional cash and digital money, making them beneficial to both individual users and regulated financial institutions alike.

How Does a Stablecoin Work?

Essentially, for a stablecoin to function properly, those overseeing it must maintain a reliable deposit equivalent to its value. To illustrate, if they want to sustain 10 million units of their stablecoin, they would need to hold $10 million in reserve.

This reserved money acts as a guarantee for the stablecoin. When someone wants to convert their stablecoin into fiat money, an equal amount of whatever is backing the stablecoin (like dollars from the reserve) is taken out and given to them.

Sometimes, stablecoins are not just tied to traditional currencies but also other valuable resources like government bonds. Furthermore, these stablecoins play a significant part in the wider cryptocurrency landscape by offering liquidity, minimizing transaction risks, and providing a dependable method for storing worth. Because they can connect fiat money with digital assets, they are crucial for payments, trades, and everyday transactions.

Types of Stablecoins

It’s worth noting that there are multiple varieties of stablecoins out there. To be more specific, we can categorize them into three primary types, each employing distinct methods to preserve their value.

Fiat-Collateralized Stablecoins

These digital currencies, called stablecoins, typically have their value supported by a deposit of traditional government-issued money, such as U.S. dollars, to maintain stability. While some may employ other forms of collateral like precious metals or commodities, the majority are linked to reserves of U.S. dollars.

Popular examples include Tether (USDT) and TrueUSD (TUSD), both backed by US dollar reserves.

Crypto-Collateralized Stablecoins

As an analyst, I find that some stablecoins maintain their stability by being over-collateralized with other cryptocurrencies. For example, MakerDAO’s Dai (DAI) is designed to hold a steady value relative to the U.S. dollar, but it is backed by digital assets such as Ethereum (ETH). This strategy helps mitigate potential volatility risks associated with these cryptos.

Algorithmic Stablecoins

Instead of relying on reserve assets like other forms, algorithmic stablecoins can either possess or not possess them. What sets them apart is their ability to maintain value consistency through automated supply management. This implies that the quantity of the stablecoin in circulation is controlled by a computer program according to a predetermined mathematical formula. Unlike central banks with clear policies, issuers of algorithmic stablecoins may lack transparency during times of crisis, as they don’t have the same advantages.

As an analyst, I can attest that various stablecoin options cater to diverse investor profiles. However, selecting the ideal one hinges on your risk appetite and financial objectives.

The Most Popular Stablecoins

Approximately 9.45% of the total cryptocurrency market is made up of stablecoins, which amounts to around $170 billion within the larger $1.8 trillion asset class. Notably, a significant portion of this 9.45% is dominated by the following well-known stablecoins:

- Tether (USDT);

- USD Coin (USDC);

- Dai (DAI);

- TrueUSD (TUSD);

- Binance USD (BUSD).

USDT (Tether) remains the dominant force in the stablecoin sector, accounting for approximately 70% of the market’s worth. Notable competitors such as USD Coin (USDC), Dai (DAI), and TrueUSD (TUSD) also hold significant positions in the market.

Stablecoins Trust Factors: What Makes a Stablecoin Safe?

As the use of stablecoins expands, investors face an increasing number of choices, yet this also presents the challenge of discerning which stablecoins are fully regulated, secure, and trustworthy. In this ever-growing selection, there are key factors that serve as crucial signs of a stablecoin’s dependability; however, it is important to remember that the primary objective of a stablecoin is to maintain a constant value.

So, here’s a breakdown of the essential elements to consider when investing in a stablecoin:

- Regulatory Oversight – Ensure the stablecoin issuer operates within a recognized regulatory framework, which provides a level of trust and accountability. Governments and financial institutions are increasingly taking steps to monitor stablecoins, ensuring they meet compliance standards.

- Asset Backing and Audits – Seek stablecoins backed 1:1 by reserve assets like US dollars stored in secure, audited vaults. Regular third-party audits and transparency reports should be easily accessible to verify these reserves.

- Network Security – Examine the security protocols of the underlying blockchain network. The stronger the network security, the less likely the stablecoin is to encounter vulnerabilities. For instance, a stablecoin issued on Ethereum ensures higher security than a network with fewer validators like EOS.

- Duration Risk of Reserves – Assess the types of reserve assets the stablecoin issuer holds. Short-term US Treasuries are generally preferable as they are less susceptible to interest rate fluctuations and offer better liquidity.

Safest Stablecoins: What is the Best Stablecoin to Invest in 2024?

After grasping the essentials of what makes a stablecoin reliable, you may find yourself wondering which ones are the most secure or high-performing in the year 2024. We’re here to guide you, providing reasons not only for the leading stablecoin but also for the top three stablecoins currently on the market.

When creating our ranking of the top and secure stablecoins, our experts carried out an extensive evaluation taking into account several security and reliability factors, as detailed previously. The following three stablecoins emerged as the safest according to our assessments:

- USD Coin (USDC);

- Tether (USDT);

- Dai (DAI).

1. USD Coin (USDC) – Safest Stablecoin Overall

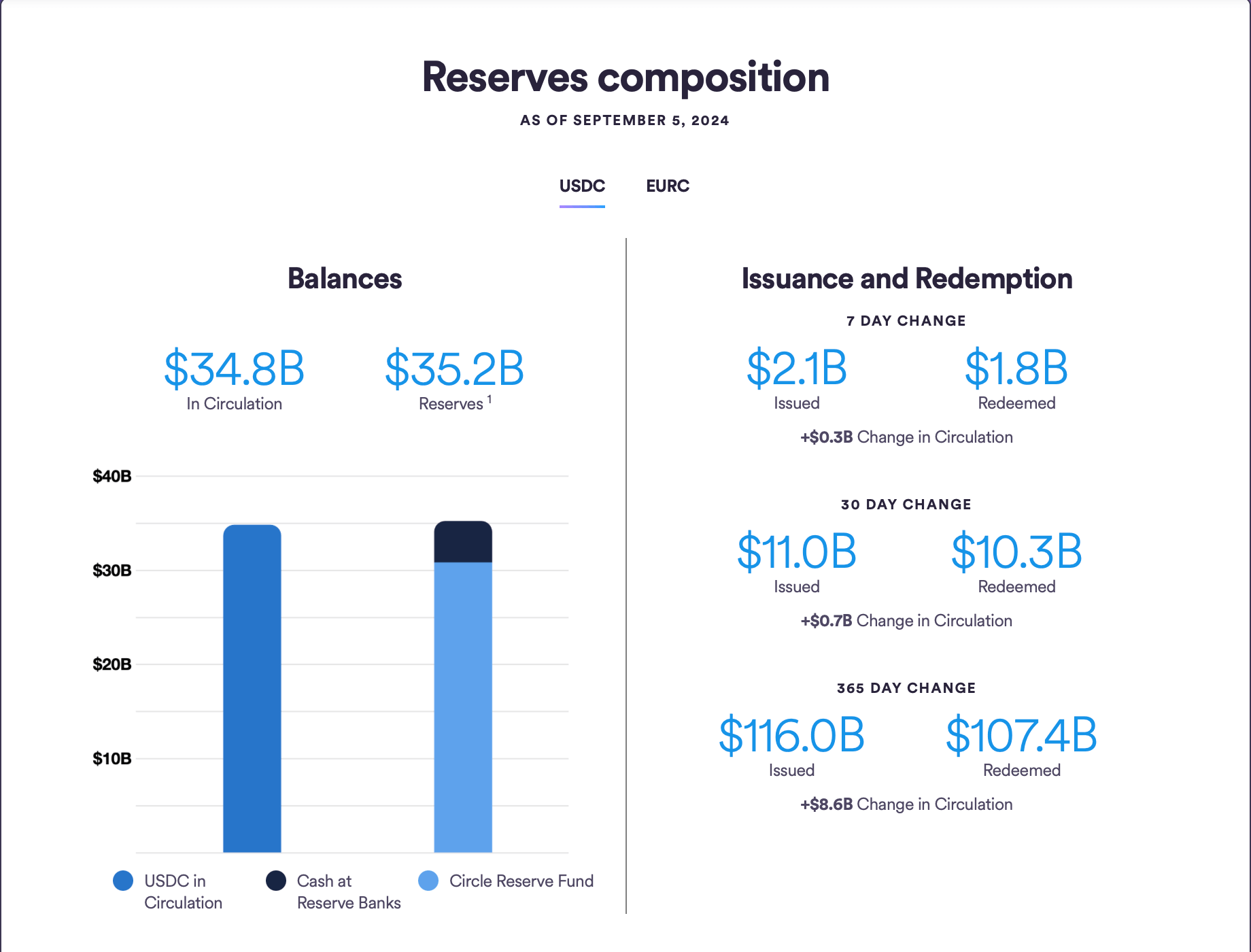

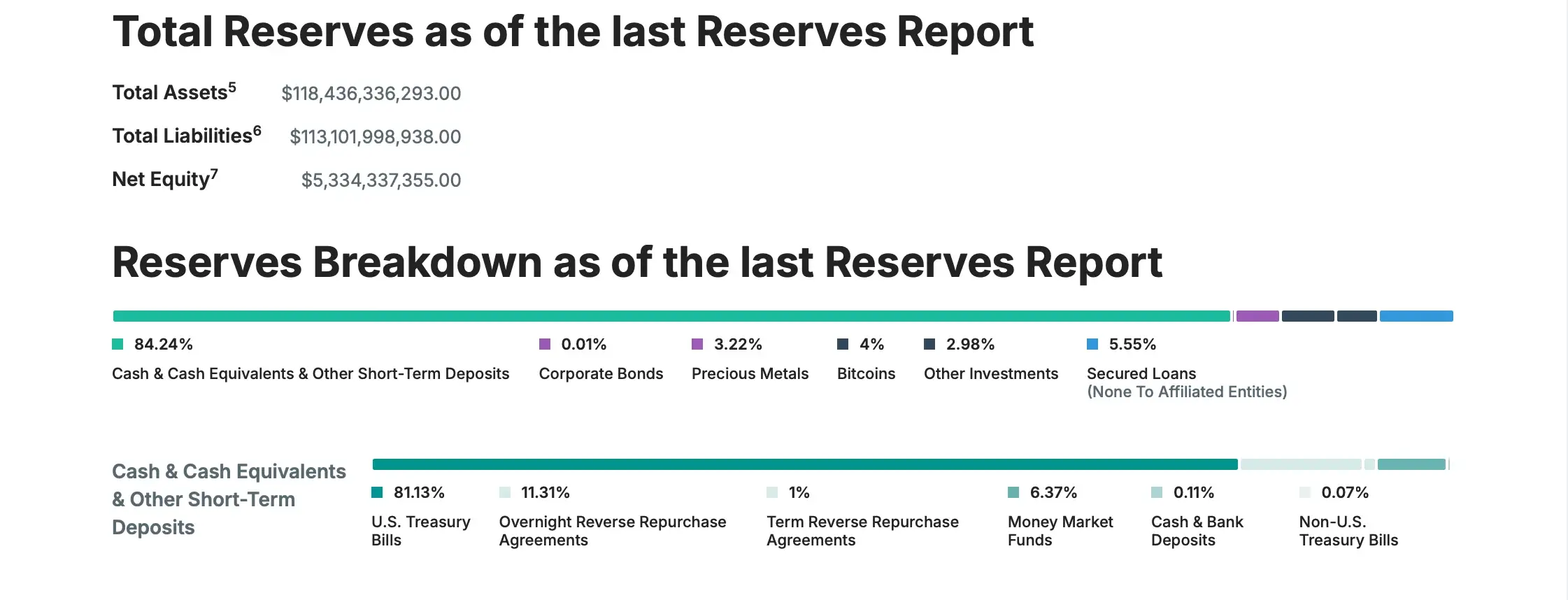

USD Coin (USDC) is a leading stable digital currency, tightly linked to the value of the U.S. dollar at a 1:1 rate. Every circulating unit of this cryptocurrency has an equivalent $1 in reserves, which is made up of both cash and short-term U.S. Treasury bonds.

A group, established by Circle (a tech company specializing in finance that operates under regulations) and Coinbase’s cryptocurrency marketplace, created USDC. This digital coin is regulated within New York, a region known for its thorough auditing procedures and demanding licensing standards. As a result, it stands as one of the most secure stablecoins, backed by a strong financial and regulatory infrastructure.

First introduced on a restricted scale back in September 2018, USDC stands as the embodiment of “money for the digital era.” Designed to cater to a society where cashless transactions are becoming more commonplace, it represents an ideal fit for this digitally-driven world.

Why is USDC the Safest Stablecoin Overall?

USDC distinguishes itself as the most secure form of stablecoin thanks to its dedication to openness and stringent fiscal procedures. In essence, it makes monthly auditing reports publicly available, providing a straightforward view of the assets supporting USDC.

At the moment, every US Dollar unit backed by US Dollar reserves or short-term U.S. Treasury bonds with maturities under three months is fully guaranteed to support USDC.

Enhancing its trustworthiness, USDC undergoes yearly audits of its financial records, adhering to the audit standards set forth by the American Institute of Certified Public Accountants (AICPA).

The Circle Reserve Fund, which is registered with the Securities and Exchange Commission (SEC), strengthens its safety measures by investing in short-term U.S. government securities like Treasury bonds and entering into agreements to buy and sell securities on an overnight basis.

As a financial analyst, I can attest that Circle, the organization responsible for the stablecoin USDC, has garnered significant support from prominent global investors such as BlackRock, JPMorgan, and Goldman Sachs. This backing not only bolsters the entity’s standing but also underscores its reputation for stability and reliability in the financial world.

This method, which involves multiple layers for safety and conformity, makes USDC a reliable choice in both conventional and digital monetary environments, garnering trust across the board.

2. Tether (USDT) – The Safest Alternative to USDC

Tether, known as USDT, is a digital equivalent of the U.S. dollar that operates on the foundation of blockchain technology. This digital currency maintains its value by being directly linked to the USD, providing individuals and businesses with a reliable and decentralized platform for exchanging value while utilizing a well-recognized accounting unit.

As one of the trailblazers, USDT was among the initial stablecoins to enter the market, and it has maintained its status as the largest stablecoin by cryptocurrency market capitalization since its debut in 2014.

First called Realcoin, it was created by Brock Pierce, Reeve Collins, and Craig Sellars, and now functions under the company Tether Limited Inc.

Tether strives to modernize the conventional financial structure by employing a forward-thinking strategy when it comes to money management. Via its platform, Tether enables transactions involving traditional currencies on blockchain technology, reducing the usual volatility and intricacy often linked with digital currencies.

Why is Tether on #2 and Why is the Safest Alternative to USD Coin?

Although Tether (USDT) is the largest stablecoin by market cap, it is not considered the safest option due to a range of concerns.

A major point of contention involves the matter of transparency, particularly concerning Tether Limited, the organization managing USDT (US Dollar Tether). They’ve encountered criticism due to their reluctance to disclose details regarding the reserves that back this stablecoin. Earlier disclosures suggested that only a minimal amount was backed directly by USD, with a large part depending on commercial paper—a type of short-term corporate debt. This ambiguity has fueled uncertainty about whether USDT is truly supported by fiat currencies such as the US Dollar.

Additionally fueling concerns about the stability of USDT are legal issues such as accusations of fraud from both the Justice Department and the New York State Department, which have brought about lawsuits.

Additionally, in the year 2017, Tether experienced a hack resulting in the theft of approximately 31 million USDT units. Instead of taking responsibility, the company responded by executing an “emergency update” intended to resolve the problem. However, this action sparked doubts about their dedication to openness and reliability.

To clarify certain questions about Tether’s reserves, they began publishing detailed reserve reports prepared by BDO Italia on a quarterly basis instead.

In comparison to Tether, USD Coin (USDC) emphasizes transparency by releasing regular audits of its reserves. This focus on openness and responsibility sets USDC apart as a safer option compared to USDT when making a choice between stablecoins.

3. Dai (DAI) – Safest Decentralized Stablecoin

DAI is a digital currency introduced in 2017 that runs on Ethereum’s platform. It’s governed by two key components: the Maker Protocol and the decentralized organization called MakerDAO. This organization operates independently using self-governing smart contracts within the Ethereum blockchain network.

The worth of DAI is set to have a flexible link with the US dollar, and it’s supported by a mix of different cryptocurrencies stored in smart contract safes each time fresh DAI tokens are minted. It’s crucial to recognize the difference between Multi-Collateral DAI and Single-Collateral DAI (SAI), an older version that accepted only one type of cryptocurrency as collateral, and didn’t support the DAI Interest Rate.

Introduced in November 2019, the Multi-Collateral DAI broadened the range of assets that could be used as collateral and introduced features such as the DAI Savings Rate. This feature enables users to accrue savings simply by holding DAI tokens.

Why is DAI the Safest Decentralized Stablecoin?

DAI has taken important steps to boost its safety features. Instead of relying heavily on centralized assets, it now draws 43.9% of its reserves from various sources, 24.6% from real-world assets, and 31.5% from Stablecoins. However, it’s now leaning more towards Ethereum derivatives like Wrapped Ether (WETH) and Wrapped Staked Ether (wstETH). This diverse foundation contributes to DAI’s stability, making it one of the most secure decentralized stablecoins on the market.

Enhancing its robustness, DAI boasts a collateralization rate of 25% above the asset’s value, providing greater stability and resilience.

FAQ

Which is the Major Stablecoin?

When considering market capitalization, USDT is the dominant stablecoin in the cryptocurrency landscape. Yet, it’s essential to look into other significant stablecoins as well, as they might offer attributes that surpass USDT. Among these potentially safer options are USDC and DAI.

Which Stablecoin is the Safest in 2024?

According to our comprehensive assessments considering multiple factors, US Dollar Coin (USDC) appears to be the most secure stablecoin in 2024. US Dollar Tether (USDT) and Dai (DAI) come in second and third place respectively.

Is USDC Safe?

Absolutely, USDC stands among the most secure stablecoins available. It maintains a fixed 1:1 relationship with the U.S. dollar, meaning that each USDC in circulation corresponds to an equivalent $1 held in reserves – a combination of cash and short-term U.S. Treasury bonds. This digital currency operates under New York regulations and is renowned for its rigorous auditing procedures. Regular monthly attestation reports and annual audits contribute to transparency, demonstrating that the USDC’s backing by U.S. Dollar reserves is 100% verifiable. The robust financial and regulatory infrastructure supporting USDC contributes to its reputation as a reliable and safe digital asset.

Is USDT Safe?

As a crypto investor speaking here, I’d say that at the moment, USDT serves as a secure stablecoin, but it’s not the most secure option in my view. Tether, being the largest stablecoin by market cap, has taken steps to boost transparency, which is commendable. However, there are lingering concerns about its reserves and past legal matters that make some people uneasy. In comparison, USDC is generally perceived as a safer choice due to its greater emphasis on transparency and more frequent reserve audits.

Conclusion

Stablecoins are the way of connecting traditional finance with the world of cryptocurrencies. They provide stability, allowing people to use digital currencies without worrying about big price swings. As the stablecoin market continues to expand, staying informed about regulations and the technology behind each coin will help you make smarter investment choices.

Even though stablecoins are generally less volatile than other cryptocurrencies, it’s still important to do your own research. Understanding what makes a stablecoin safe—such as regulatory oversight, asset backing, and network security—will help you choose a reliable option.

Stablecoins are not just for trading but are also practical for everyday transactions, offering a more secure and accessible way to interact with digital finance. We hope this article has given you the information you need to explore this space confidently.

Keep in mind that any investment carries some level of risk, so be sure not to put more funds at stake than what you’re prepared to part with if things don’t go as planned.

* The information in this article and the links provided are for general information purposes only and should not constitute any financial or investment advice. We advise you to do your own research or consult a professional before making financial decisions. Please acknowledge that we are not responsible for any loss caused by any information present on this website.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-18 10:17