As a seasoned trader with years of experience navigating the volatile seas of the financial markets, I can confidently say that the Volume-Weighted Average Price (VWAP) is an essential tool in my trading arsenal. Much like a compass helps sailors find their bearings amidst turbulent waters, VWAP provides valuable insights into market activity and sentiment, enabling me to make informed decisions about entering and exiting positions.

Picture yourself shopping for groceries blindly, unaware if today’s prices are low or high. This resembles trading cryptocurrency without adequate tools to assess market value. A potent technical analysis tool that has gained traction among both novice day traders and seasoned Wall Street professionals is the Volume Weighted Average Price (VWAP). In simpler terms, VWAP helps gauge the average price at which a security has been traded, taking into account the volume of shares bought and sold.

As an analyst, I would describe it as a sophisticated pricing tool that not only provides real-time crypto prices but also gives insights into the actual transaction values happening throughout the day. This information is particularly useful because it’s based on the volume of purchases, offering a more comprehensive understanding of the market dynamics.

In this tutorial, we’ll break down what Volume Weighted Average Price (VWAP) is, illustrate why it has become indispensable for cryptocurrency trading, and provide you with practical methods to identify superior trading opportunities. Regardless if you’re a beginner or aiming to refine your approach, grasping the concept of VWAP could be instrumental in helping you make wiser choices amidst the unpredictable crypto market landscape.

Key Takeaways

- VWAP combines price and volume data to provide a dynamic trading indicator that helps crypto traders identify true market value and potential entry/exit points throughout the trading session.

- VWAP indicator is a reliable benchmark for determining overbought and oversold conditions, with prices above VWAP suggesting potential selling opportunities and below indicating possible buying zones.

- Successful VWAP trading requires combining the indicator with other technical analysis tools and implementing proper risk management strategies.

What Is the VWAP Indicator?

The Volume Weighted Average Price (VWAP) is a technical tool that computes the typical cost of a cryptocurrency, factoring in the total amount traded over a defined timeframe. Unlike standard moving averages, VWAP gives greater significance to price levels with higher trading volume, thereby offering a more precise depiction of the market value.

In simpler terms, the VWAP (Volume-Weighted Average Price) is determined using a particular equation that takes into account the average price and the amount of trading activity during a single day’s trading period. This makes the VWAP a dependable standard for judging trade execution quality, locating levels of support and resistance, and understanding market tendencies.

Fast Fact:

Peter Steidlmayer, an innovative expert in market analysis and creator of the Market Profile concept, developed the Volume-Weighted Average Price (VWAP) tool. This instrument, devised by Steidlmayer, was designed to assess institutional involvement and pinpoint potential areas of support and resistance.

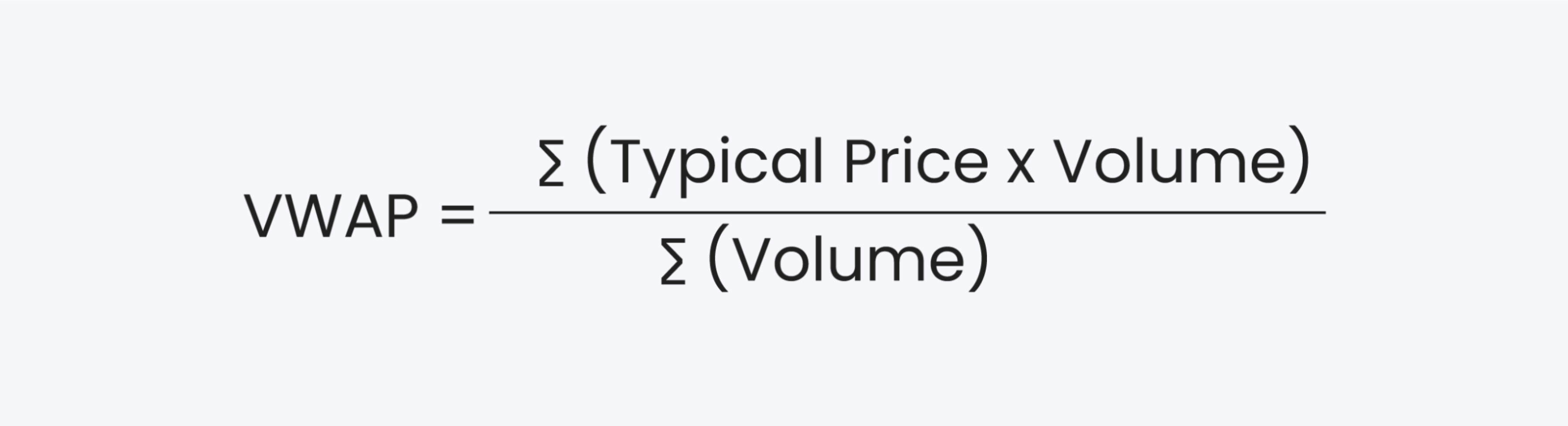

How Is the VWAP Indicator Calculated?

The weighted average price (VWAP) calculation involves three main steps:

You can find the average price by adding up the high, low, and closing prices, then dividing the total by 3.

2. Multiply the typical price by volume: Typical Price × Volume

3. Calculate the cumulative totals: Cumulative (Price × Volume) / Cumulative Volume

VWAP Formula: (Σ (Price × Volume)) / (Σ Volume)

The method for calculating the average price (VWAP) starts anew with each trading day, offering a new viewpoint on intra-day price fluctuations throughout the session.

VWAP Meaning in Crypto Trading

In the realm of cryptocurrency transactions, Value Weighted Average Price (VWAP) acts as a crucial reference point to determine if a particular asset is being traded at a price higher or lower than its true worth.

- Above VWAP Line: Indicates bullish momentum and potential overbought conditions.

- Below VWAP Line: Suggests bearish sentiment and possible oversold conditions.

Imagine a situation where Bitcoin‘s value is $30,000. A trader observes that the Value Weighted Average Price (VWAP) is at $29,800. If the price continues to rise and consistently stays above the VWAP, the trader might be inclined to invest in a long position, expecting more bullish movements. On the other hand, if the current price drops below the average price (VWAP), it could potentially indicate a good time for short selling, suggesting bearish tendencies.

VWAP offers valuable insights for crypto traders by:

Determining Possible Buy and Sell Opportunities: The Volume Weighted Average Price (VWAP) line on a graph serves as a shifting benchmark. If the price surpasses the VWAP, it indicates potential rising demand, while going below suggests possible selling pressure. This data can aid traders in finding suitable spots for entering and exiting their trades.

Evaluating Market Movements: By examining the slope of the Volume Weighted Average Price (VWAP) line, traders can determine the general direction of the market. An increasing VWAP suggests an upward trend, whereas a decreasing VWAP implies a downward trend.

Assessing Market Opinion: Hefty trade activity near the Volume-Weighted Average Price (VWAP) line implies robust confidence in that particular price point among traders. Swings away from the VWAP might signal possible overbuying or overselling.

As a market analyst, I can say that this insight empowers me to identify optimal entry and exit points for both short-term intraday and mid-term swing traders, as well as larger institutional investors. By employing these points, we can strategically minimize the potential impact of our trades on the market itself.

How to Use VWAP

VWAP is a versatile tool that can be applied in various trading scenarios. Savvy crypto traders can incorporate VWAP into their strategies in several ways:

VWAP as Support and Resistance

In simpler terms, the VWAP (Volume-Weighted Average Price) line can serve as a changing point where prices may find support or resistance. When the price fluctuates and touches the VWWAP, it could suggest possible price changes, while continuous breaks above or below might imply the continuation of the existing trend.

Combining VWAP with Other Indicators

Employing Volume-Weighted Average Price (VWAP) in conjunction with additional technical indicators such as the Relative Strength Index (RSI) offers a broader perspective on market movement. This blend enables traders to corroborate possible trading cues and fine-tune their tactics more effectively.

Advanced traders can explore more complex VWAP applications:

- Time-Weighted Average Price (TWAP): This is similar to VWAP but assigns equal weight to each data point within the chosen timeframe, offering a different perspective on average price action.

- Average price-weighted Calculation for Different Timeframes: Extending VWAP calculations beyond a single trading session can provide insights into longer-term market trends for swing traders.

- Combining VWAP with Risk Management Strategies: Integrating VWAP with stop-loss orders and other risk management strategies helps traders manage potential losses.

Grasping and applying the concept of weighted pricing could markedly improve your trading approach, regardless if you’re a short-term day trader, a position holder over several days (swing trader), or a large-scale institutional investor.

Day traders can leverage VWAP to:

- Identify Intraday Trends: By monitoring the VWAP line’s direction, day traders can quickly identify short-term trends and adjust their positions accordingly.

- Time Entries and Exits: VWAP can help day traders time their entries and exits more precisely. For example, buying near the VWAP during a dip or selling near the VWAP during a rally can improve profit potential.

- Manage Risk: VWAP can be used as a dynamic stop-loss level, helping traders protect their profits and limit potential losses.

Swing traders can use VWAP to:

- Identify Potential Reversals: When the price breaks below the VWAP, it may signal a potential downward reversal. Conversely, a break above the VWAP can indicate an upward reversal.

- Confirm Trend Strength: A sustained movement above or below the VWAP can confirm the strength of an existing trend.

- Set Profit Targets: Swing traders can use the VWAP as a reference point to set realistic profit targets.

Institutional traders can utilize VWAP to:

- Optimise Trade Execution: Institutional traders can minimize market impact and reduce transaction costs by breaking down large orders into smaller pieces and executing them strategically around the VWAP.

- Measure Trading Performance: VWAP can be used as a benchmark to evaluate the performance of trading strategies and algorithms.

Here are common VWAP trading mistakes to avoid:

1. Overreliance on a single timeframe

2. Ignoring market conditions

3. Not considering volume patterns

4. Trading against strong trends

5. Neglecting risk management

Advantages & Limitations

VWAP improves trade execution quality. By considering volume alongside price, traders can execute trades closer to the true market value, minimizing slippage and maximizing profits.

As a crypto investor, I find that Volume-Weighted Average Price (VWAP) offers priceless insights into the dynamics of the market and the prevailing sentiments. With VWAP, I can confidently gauge when it’s the right time to jump in or out of my positions, making my trading decisions more educated and strategic.

This tool could assist traders in spotting possible breakthroughs from the levels of support and resistance, as well as shifts in the direction of trends, which may present profitable trading chances.

Nevertheless, while the VWAP strategy offers several advantages, it also has some drawbacks. Much like other technical indicators, Volume-Weighted Average Price (VWAP) is a reactive tool that responds to previous price fluctuations rather than forecasting future ones. Instead, it can help identify possible trends. Moreover, it’s essential to consider that the substantial orders placed by institutional investors might substantially influence the VWAP calculation, potentially leading individual traders astray.

Conclusion

VWAP works best as part of a larger trading strategy. Just as you wouldn’t sail across the ocean with only a compass, you shouldn’t trade solely based on VWAP signals. Combine it with other technical indicators, fundamental analysis, and, most importantly, solid risk management practices. The most successful traders use VWAP as one piece of their decision-making puzzle, not the entire picture.

Strive not just for successful trades, aim to develop into a more disciplined and methodical trader instead. Value Weighted Average Price (VWAP) can aid in this journey, but it’s effective when utilized thoughtfully within your comprehensive trading arsenal.

FAQs

How accurate is VWAP?

Consider VWAP as peering into the rearview mirror as you drive – it displays past occurrences, thereby trailing behind current real-time price changes. While it remains a valuable tool, relying solely on it might not be advisable. Skilled traders often utilize it alongside other indicators to construct a more comprehensive understanding.

What is VWAP in trading?

The Volume-Weighted Average Price (VWAP) is calculated by dividing the total value of shares traded during a specific timeframe by the total number of shares that were traded, giving more importance to larger trades.

What does the VWAP tell you?

VWAP is the average price of a stock weighted by volume. By monitoring VWAP, a trader might get an idea of a stock’s liquidity, and the price at which buyers and sellers agree is fair at a specific time. Day traders can use the VWAP indicator to monitor intraday price movement.

Is VWAP better than EMA?

While both VWAP and EMA are valuable in their own right, they serve distinct purposes. VWWAP functions similarly to a GPS system for day traders, providing real-time guidance on market activity within a single trading day as it calculates the volume weighted average price of trades. In contrast, EMA operates like a compass, helping investors predict longer-term price trends by analyzing moving averages over extended periods.

What is the best timeframe for using VWAP?

VWAP really shines during active trading hours, especially on shorter timeframes like 1, 5, or 15-minute charts. It’s most helpful if you plan to get in and out of trades within the same day – like a daily reset button that helps you stay oriented in short-term price movements.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-12-12 20:23