-

Most of the bets predicted a bullish close for BTC and ETH.

ETH might drop below the max pain point while BTC might end the week above it.

As an analyst with a background in financial markets and experience in cryptocurrency options trading, I find the upcoming expiration of Bitcoin (BTC) and Ethereum (ETH) option contracts intriguing. With over $9.3 billion worth of contracts set to expire on Friday, April 26th, the market is showing a clear bias towards bullish sentiment for both cryptocurrencies.

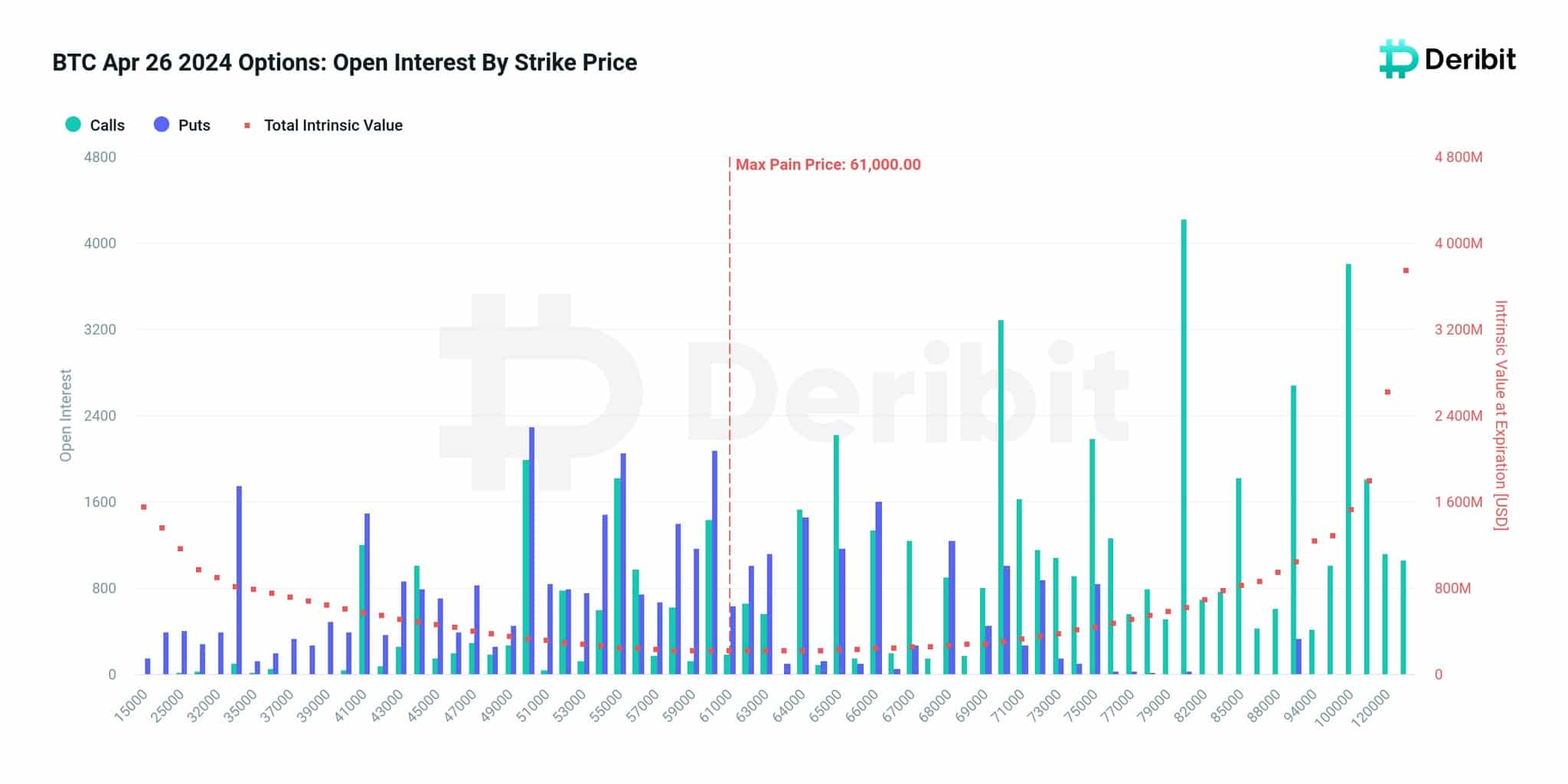

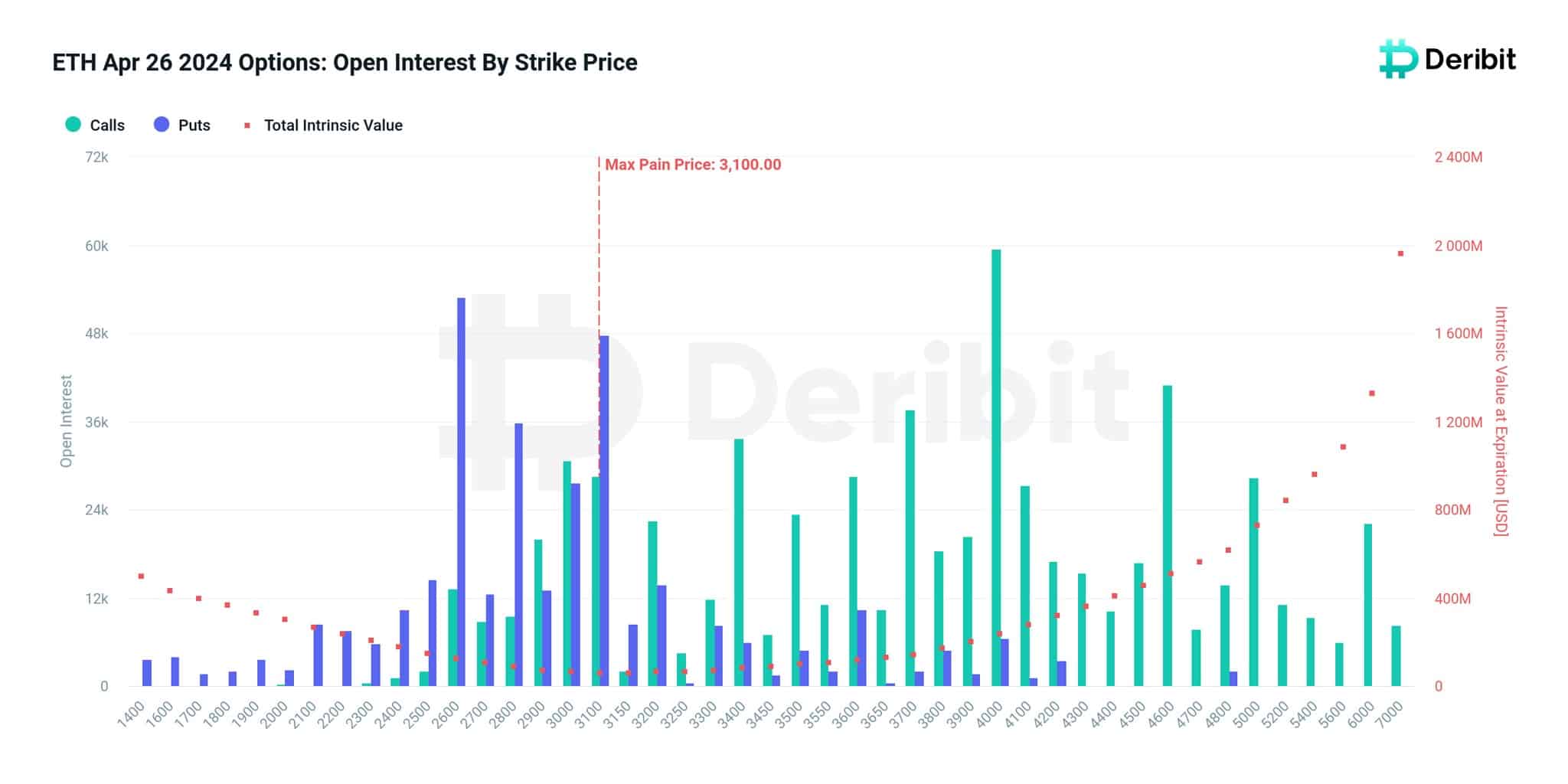

Approximately 96,000 Bitcoin [BTC] option contracts and over 978,000 Ethereum [ETH] contracts will reach their expiration dates on Friday, the 26th of April.

Based on Deribit’s derivative exchange data, the Bitcoin contracts had a value of $6.2 billion and Ethereum contracts were valued at $3.1 billion, resulting in a staggering total of $9.3 billion.

Traders have the ability to acquire contracts for cryptocurrencies, which grant them the right but not the obligation to buy or sell at a specified price. When an options contract approaches its expiration date, traders are required to make a decision: either execute the contract by buying or selling the underlying asset, or close it before the expiry to avoid any potential losses or gains.

Optimism rises despite the decline

Based on information obtained from Deribit by AMBCrypto, the Bitcoin put-call ratio displayed a negative value. Such a finding implies that the majority of wagers were placed as call options, suggesting that traders held a generally optimistic view regarding the price of Bitcoin.

If someone bought a call option, they would profit if Ethereum’s price rose. Conversely, a put option represented a bearish stance, meaning the holder would benefit if Ethereethereereprice decreased.

As a crypto investor, I would interpret this as follows: Based on current market trends and the exchange’s analysis, if Bitcoin (BTC) price closes above $61,000, sellers could potentially reap significant gains. On the other hand, should Ether (ETH) reach a closing price of $3,100, buyers might experience substantial losses.

The withdrawal of the $61,000 cap on Bitcoin options and the approaching expiration of approximately $3 billion worth of Ethereum options, which previously had a $3,100 maximum pain price point.

As of now, Bitcoin’s price stood at $64,140, marking an 8.52% decline over the past thirty days. In contrast, Ethereum was being traded at $3,129— a 12.46% decrease in value during the same timeframe.

Different patterns for the top two

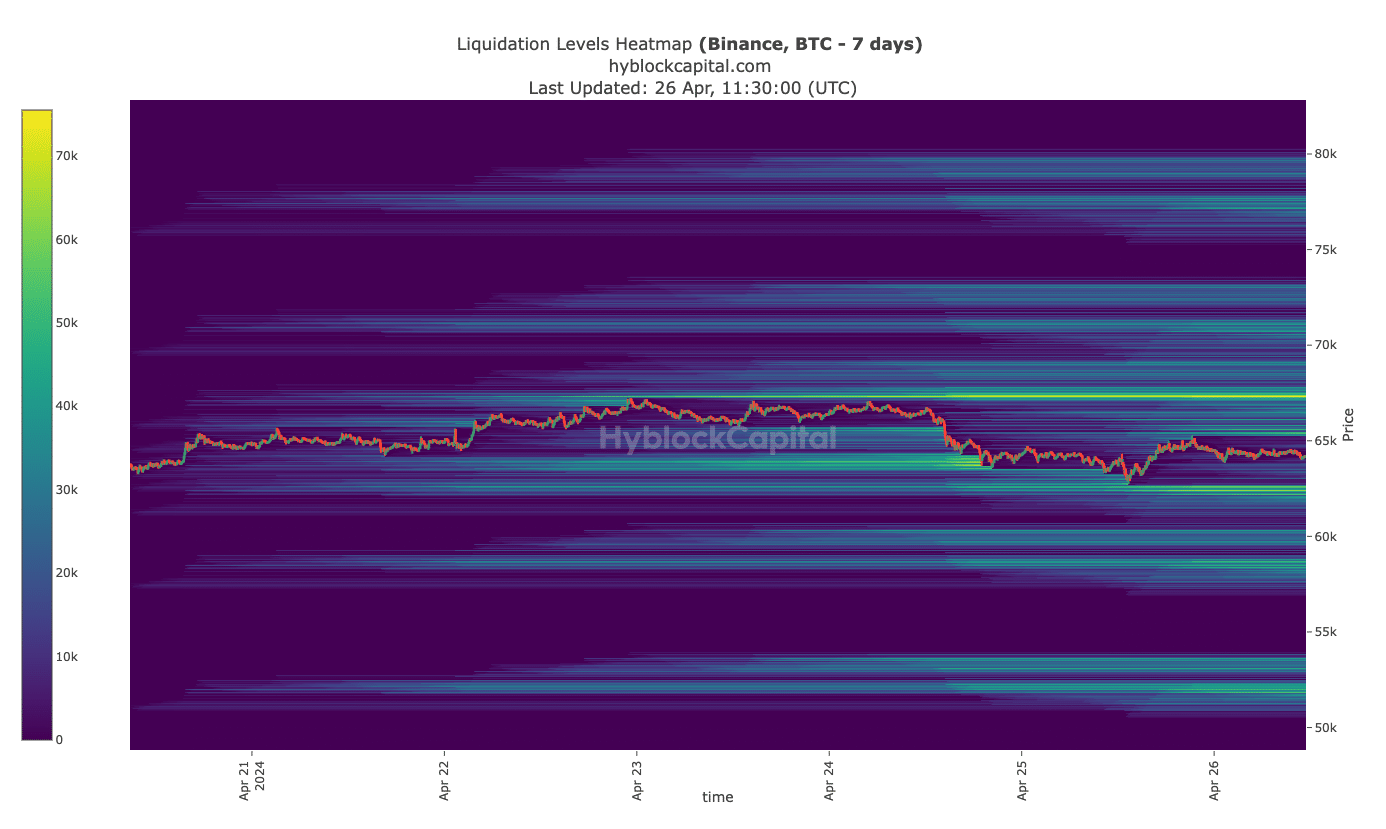

To determine potential price closures this week, AMBCrypto examined the liquidation heatmap, revealing zones with significant liquidity (areas of strong magnetic attraction for trades).

Identifying potential significant price drops, this finding reveals the likelihood of Bitcoin’s price reaching specific levels. Based on information from Hyblock, a yellow-marked magnetic zone emerged on the Bitcoin liquidation chart, signaling a possible price approach to $67,250.

On the negative side, a magnetic level for Bitcoin’s price was hit at $62,600. Should Bitcoin’s value reach $67,250, most option contracts will result in profits for their holders.

Alternatively, if the price falls towards $62,600, losses may result. Yet, the impact would likely be small if the price avoids dropping below $61,000.

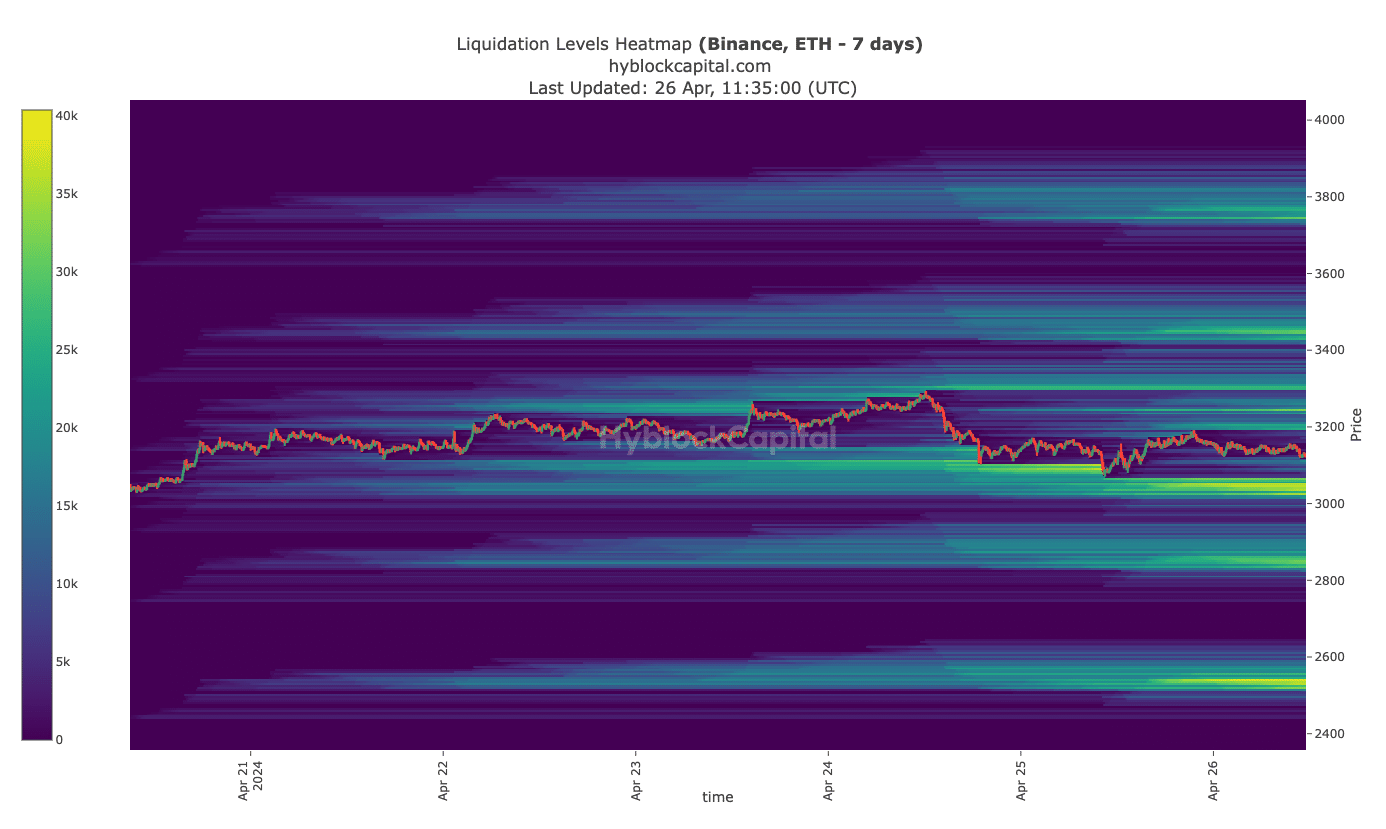

However, it might not be the same case for traders who went with the ETH call option.

Realistic or not, here’s ETH’s market cap in BTC terms

As of the latest reporting, the market exhibited a substantial pool of available funds around the $3,025 mark, potentially signaling a possible drop in price beneath the $3,100 maximum resistance level.

As an analyst, I would rephrase it as follows: Should Ethereum (ETH) fail to maintain its value above $3,100, approximately $3.1 billion in put options could potentially be erased. Conversely, if ETH manages to sustain a price above this level, the holders of these puts wouldn’t be the sole beneficiaries of the price action.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

2024-04-26 19:42