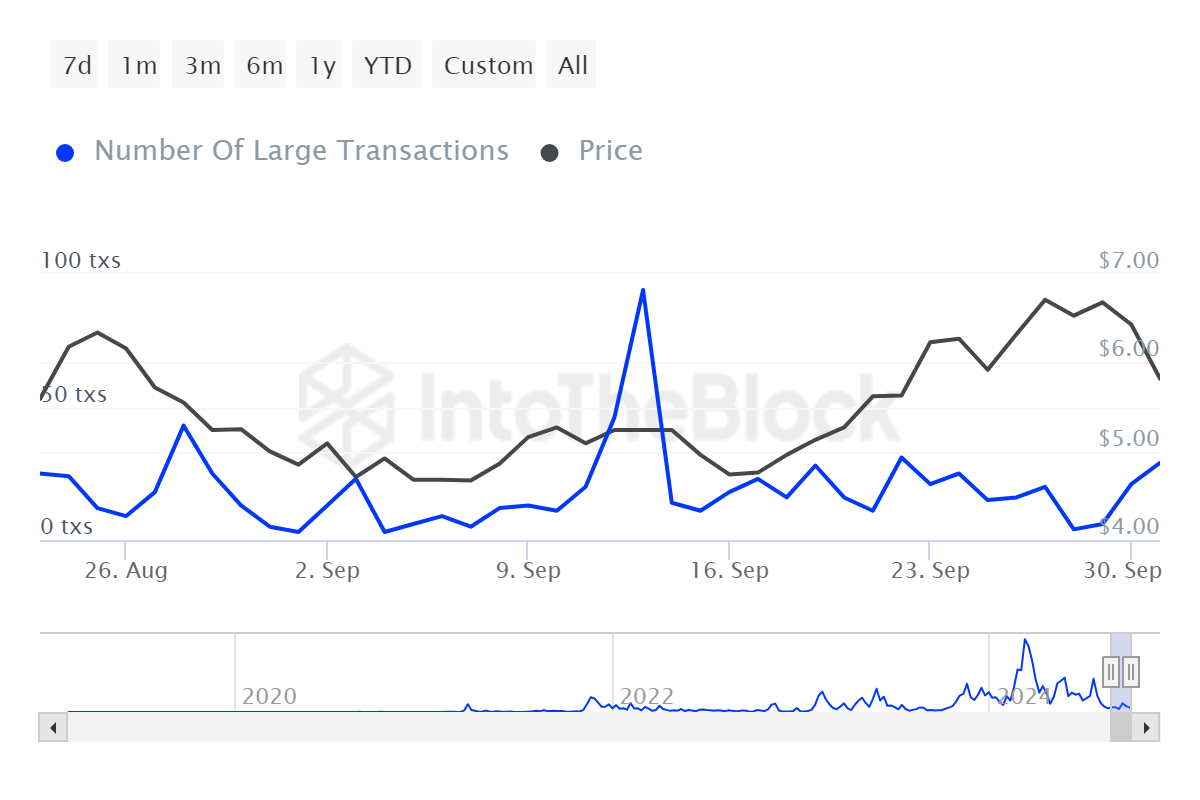

- Render witnessed a 3038% surge in large transactions within 24 hours

- Active addresses increased by 9% – A sign of growing market participation

As a seasoned analyst with years of experience under my belt, I find myself intrigued by the recent developments in the Render (RNDR) network. The 3038% surge in large transactions within 24 hours is a sight to behold, and it’s clear that the whales and institutional players are making their moves.

Over the last day, there’s been a massive 3038% jump in large transactions for RNDR, indicating a substantial rise in trading action and growing investor attention towards this asset.

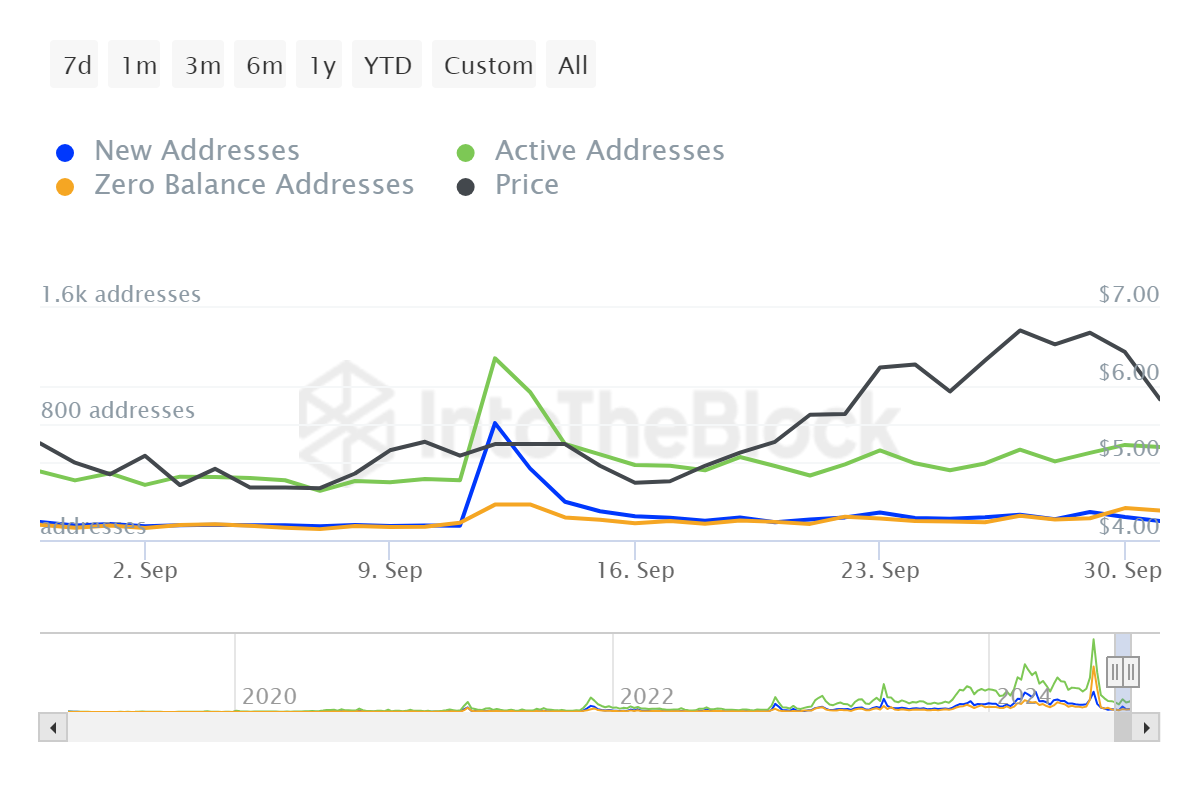

At the moment, the number of active addresses is experiencing an increase of about 9%. Could it be that large institutional players are entering the market, or could it be that crypto enthusiasts are stockpiling coins? Let’s explore further…

Massive surge in big money moves

A significant 3038% increase in large-scale transactions within the Render network’s ecosystem suggests increased attention from big investors (whales) and institutional players. Often, this pattern coincides with more substantial price fluctuations, as bigger market participants start accumulating tokens in anticipation of rising prices.

As a researcher, I’ve noticed an intriguing correlation between the recent surge in whale activity and a significant shift in the broader market trends. This potential pivot could potentially reshape the dynamics of RNDR’s price movement.

Render network’s pulse quickens as volatility flood in

The tremors of the massive whale activity were evident in the market dynamics though. According to AMBCrypto’s analysis of Render’s trading activity, for instance, Render saw a 9% uptick in active addresses.

A higher number of active accounts often corresponds with increased trading actions and user engagement.

Indeed, this measurement frequently aligns with price fluctuations. Moreover, the evolving market dynamics of RNDR might signal a surge of fresh traders joining the fray.

RNDR dips, but there is a twist

On September 23rd, RNDR’s price broke free from a pennant pattern, which is typically followed by additional upward momentum. This bullish indication led traders to expect that RNDR’s price might challenge the $7.5 resistance point.

Following the surge in price, Render’s value dipped by 15% and returned to the previous pennant resistance at approximately $5.76. At present, this level is serving as crucial support. Looking ahead, it suggests an opportunity for a bullish turnaround.

Currently experiencing a significant rise in large transactions and an increase in optimistic expectations, RNDR stands at a crucial juncture.

As a crypto investor, I’m keeping a close eye on Render, particularly the $5.76 support level. If this holds steady, I believe it could be a catalyst for fresh highs. The reason? Market participants seem eager to ride the growing bullish wave and capitalize on any potential price increases.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-03 08:07