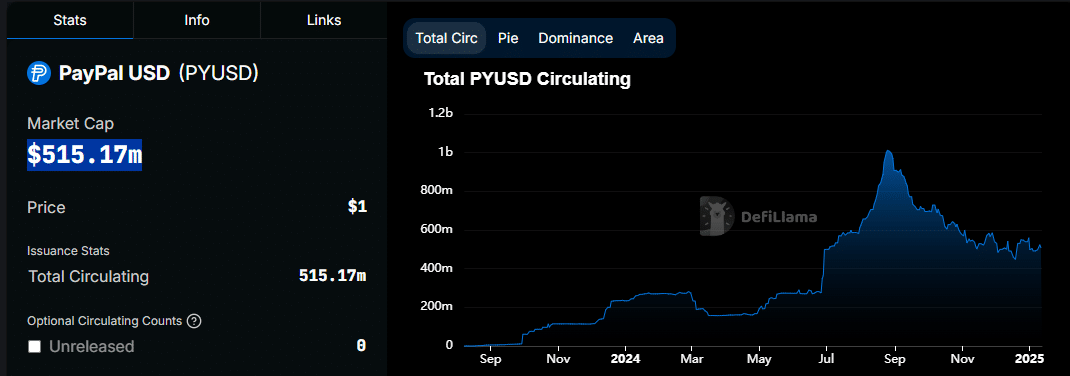

- PayPal USD marketcap is down considerably from its historic peak

- Despite recent recovery, it may not be enough in the long run

As an analyst, I found myself captivated by PayPal’s bold move in the second half of 2024, which made waves throughout the market. This was not just another step for PayPal, but rather their inaugural foray into Web3 on a mainstream scale. This event signified a significant shift, heralding a new era for tokenized assets and digital currencies, marking a pivotal moment in the evolution of our financial landscape.

Initially, PayPal had high hopes for USD-backed tokens, but as we stand today, it seems that the momentum behind tokenized assets is slowing down. When it first debuted on Solana, there was a significant buzz, and its initial success was clear. However, since then, the excitement has waned.

On August 25th, the market capitalization of PayPal’s USD equivalent reached an all-time high of $1.01 billion. Since then, it has been on a steady downward trend and dipped below $500 million in December. Currently, its market capitalization stands at approximately $515.17 million.

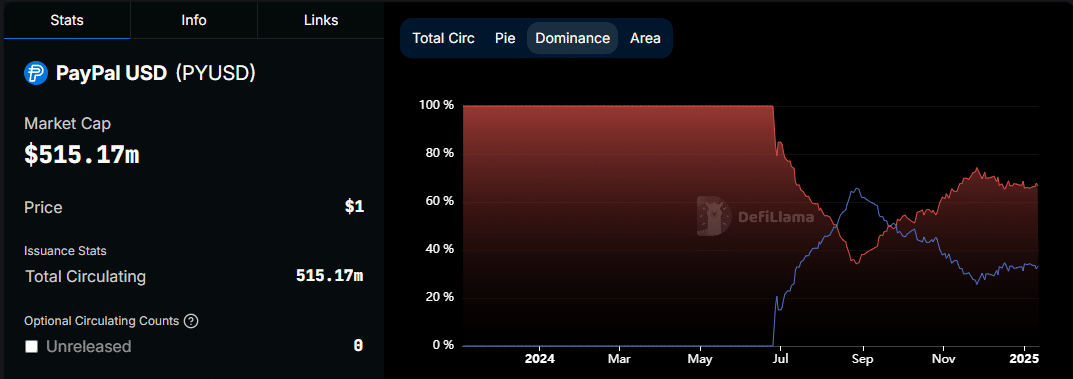

As a crypto investor, I noticed an intriguing dip in PayPal’s USD market cap coincided with a downtrend in its influence within the Solana ecosystem, around the same period.

Previously, PayPal’s market capitalization on Solana surpassed Ethereum due to its initial enthusiasm. On August 29, it reached a maximum market cap dominance of 65.79% on the Solana blockchain. However, by November 27, its dominance had dropped to 25.42%.

source: DeFiLlama

The overall market value of PYUSD (PayPal’s US Dollar stablecoin) performed similarly to Solana’s dominance in the crypto world, which suggests that the utility of PYUSD on Solana’s network did not last. It’s important to note that, at the time of reporting, Ethereum accounted for about 67.21% of the circulating supply of PYUSD.

Or:

The performance of the total market value of PYUSD mirrored Solana’s influence in the crypto market, implying that the use of PYUSD on Solana wasn’t sustained over time. At the moment of reporting, Ethereum held approximately 67.21% of the circulating supply of PYUSD.

What fueled the initial PayPal USD marketcap growth and what’s different now?

From June 26th to August 30th, 2024, the PYUSD marketcap surged due to increased demand in the crypto market. However, this upward trend reversed as the market began experiencing heightened excitement, which coincided with a decline. It’s important to note that during this earlier phase, there were more stablecoin holders, and the PayPal stablecoin on Solana was offering competitive yields.

On the other hand, as the market has become exceptionally bullish, it’s possible that yield miners have withdrawn their liquidity and invested it in cryptocurrencies. Moreover, since PayPal’s USD service was recently introduced, it hasn’t yet achieved consistent transaction volumes.

Although the previously mentioned reasons might clarify the decrease in liquidity for the PayPal-associated stablecoin, it’s important to note that speculation could be a factor as well. In reality, this stablecoin continues to see substantial activity on the blockchain. For instance, its circulating supply on both networks has significantly increased over the past month.

In the past four weeks, its value increased by 5.31% on Ethereum and 4.12% on Solana. This suggests that there’s still interest in this stablecoin. However, it’s currently only available on these two platforms, which could be problematic when considering adoption because it is not yet widely spread across other networks.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-01-13 10:15