- The rising stablecoin presence in this run is hugely encouraging for crypto investors.

- The stablecoin supply might expand greatly, like the previous run, to keep up with the demand and liquidity needs.

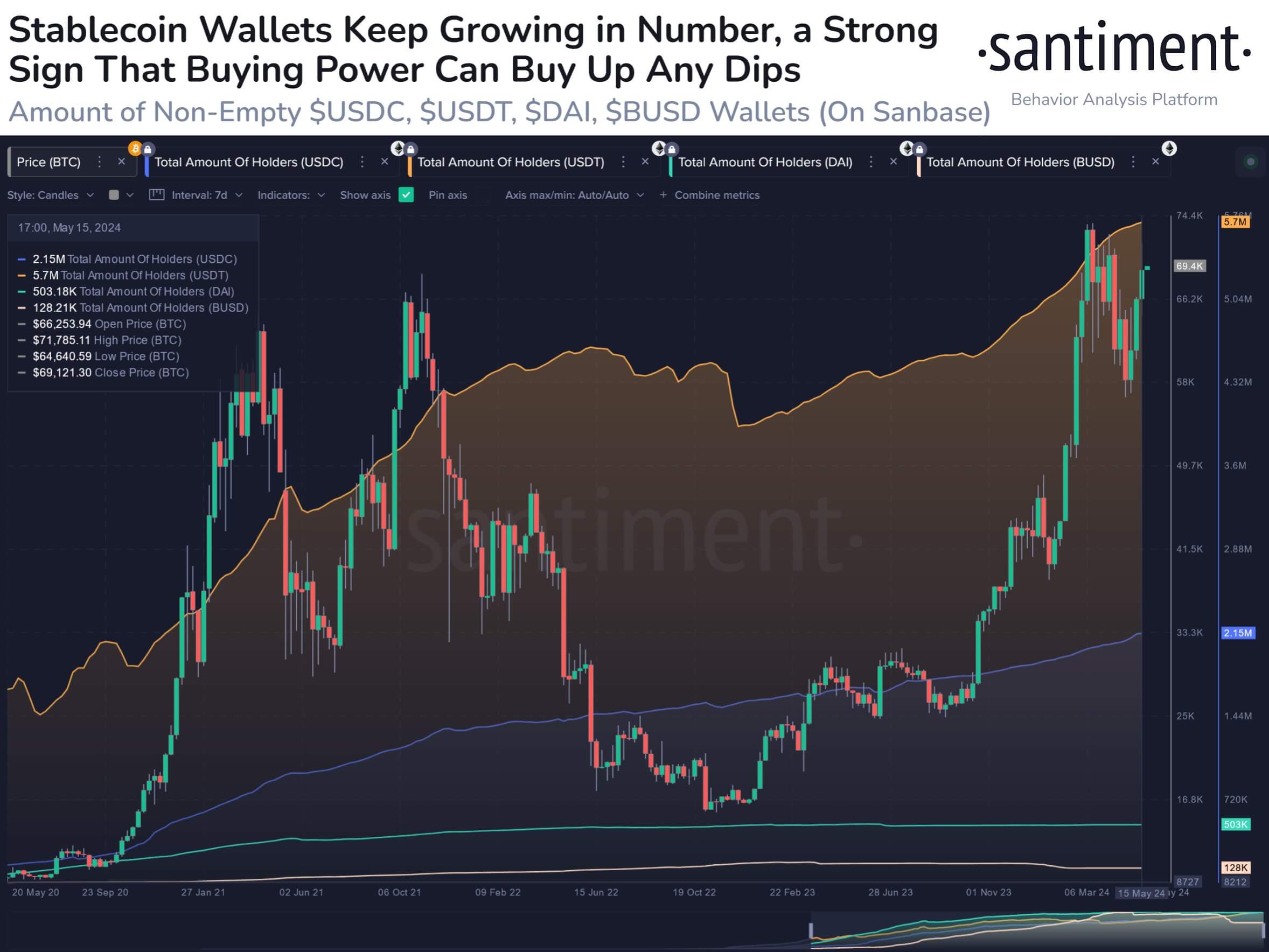

As a researcher with experience in the crypto market, I find the growing presence of stablecoins to be an incredibly encouraging sign for investors. The rapid expansion of stablecoin wallets, as observed by Santiment, is a clear indication that buying power is present in the market. This trend mirrors the growth during the previous bull run and suggests that non-crypto folks are becoming increasingly interested in participating in crypto.

As a financial analyst, I’ve noticed a significant increase in the growth of stablecoin wallets holding non-zero balances, according to my recent analysis posted on X. This trend persisted despite the heightened anxiety among investors regarding potential selling pressure following the cryptocurrency halving over the past three weeks.

In the past week, the price behavior of Bitcoin (BTC) and Ethereum (ETH) has shown significantly stronger bullish trends compared to the second half of April. As for the stablecoins, they offer valuable insights into the current market situation. Their relatively stable values against other cryptocurrencies suggest that investors are seeking safer assets during periods of market volatility. Additionally, the increasing demand for stablecoins may indicate a growing interest in entering or re-entering the crypto market, as investors look to minimize risk through holding stable assets. Overall, the trends in Bitcoin and Ethereum prices, along with the behavior of stablecoins, provide crucial information about market sentiment and trends.

Growing wallets showed buying power is present

As an analyst, I’ve observed some noteworthy developments in the digital currency landscape based on Santiment’s recent post. The number of non-empty US Dollar Coin (USDC) wallets has seen a significant surge of 13.9% in the year 2024. Similarly, Tether wallets have experienced an even more pronounced growth of 15.7%. These figures are truly impressive and echo the remarkable expansion we witnessed during the last bull market.

starting from December 2019, the count of USDT non-zero wallets in the United States has experienced a steep increase that lasted for almost three years up until October 2022. Following this period, there was a sudden decrease, which was later followed by a slow but consistent upward trend.

In November 2023, the upward trend in cryptocurrencies gained momentum, indicating a heightened sense of fear of missing out (FOMO) among non-crypto investors and increased readiness to join the crypto market. This development bodes well for the crypto sector as a whole.

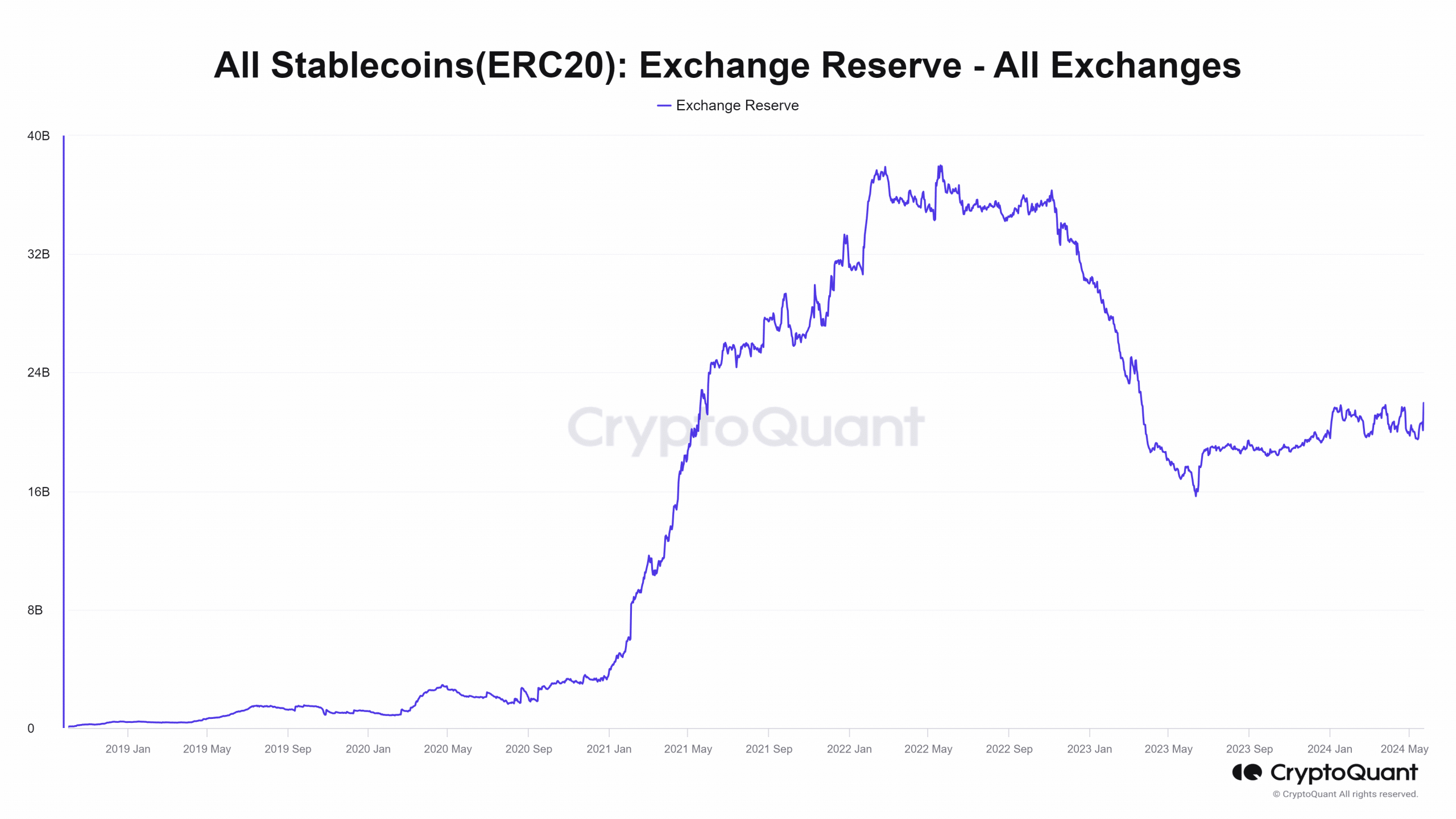

The exchange reserve did not mirror the previous bull run

In the 2020-21 period, the burgeoning cryptocurrency market demanded a significant increase in the supply of USDT and other stablecoins.

As a researcher studying the development of stablecoins, I’ve observed an impressive growth in their total supply from a mere $3.5 billion in February 2020 to a substantial $99 billion by March 2022. However, following this expansion, there was a decline in supply due to market contractions, bringing it down to $67 billion. More recently, the stablecoin market has started showing signs of recovery and the supply is once again on an upward trend.

The reserve of exchanged coins mimicked the supply trend and has gradually increased over the last 12 months. To match the intensity of the past cryptocurrency market bull run and stay aligned with the potential upcoming rapid expansion phase, this growth rate may need to pick up speed.

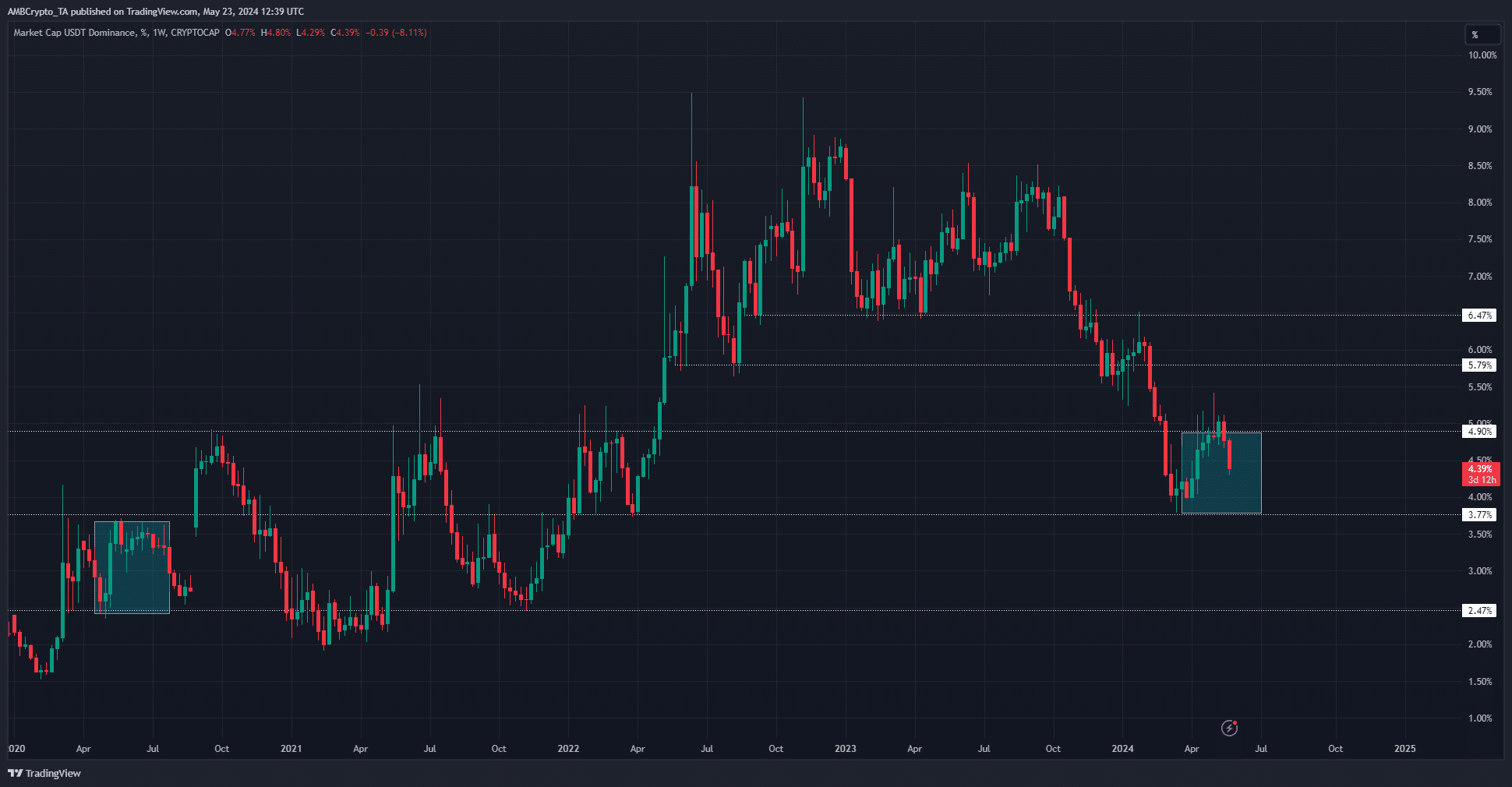

As a researcher studying the trends in cryptocurrency markets, I’ve noticed that the Tether dominance chart displayed some resemblances to its previous halving. Specifically, the cyan-boxed section indicates that the dominance of Tether decreased for approximately two months following the halving event, before experiencing a significant surge in August 2020.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a researcher observing the crypto market, I have noticed that a declining USDT (Tether) dominance tends to be followed by bullish price movements across the board. On the other hand, an increasing USDT dominance may suggest investors are seeking refuge in this stablecoin during bearish market conditions.

As a crypto investor, I’m keeping a close eye on the market trends. If the current patterns continue, we could be in for a significant sell-off as early as the first half of July – around six weeks from now.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-24 12:07