In the grim theater of modern struggle, our defiant Bitcoin has danced with fate itself—tariffs paused like an odd intermission in a bitter farce. Yet, in the shadows, bullish hopes linger as silent rebels, mocking our earnest toils. 😂

In the Crucible of Resistance: Bitcoin Endures, Bears Sneer

In a twist of fate as absurd as life, the cryptocurrency markets surged on April 9 when the mighty Donald Trump declared a 90-day respite from tariffs—a brief lull in the eternal storm. Meanwhile, this decree was met with a cold, hard tariff on China’s doorstep, as if the gods enjoyed a bit of cruel slapstick. Bitcoin clawed its way from the abyss of a $74,000 low to a peak of $82,077, while Ethereum and XRP nimbly recovered their losses.

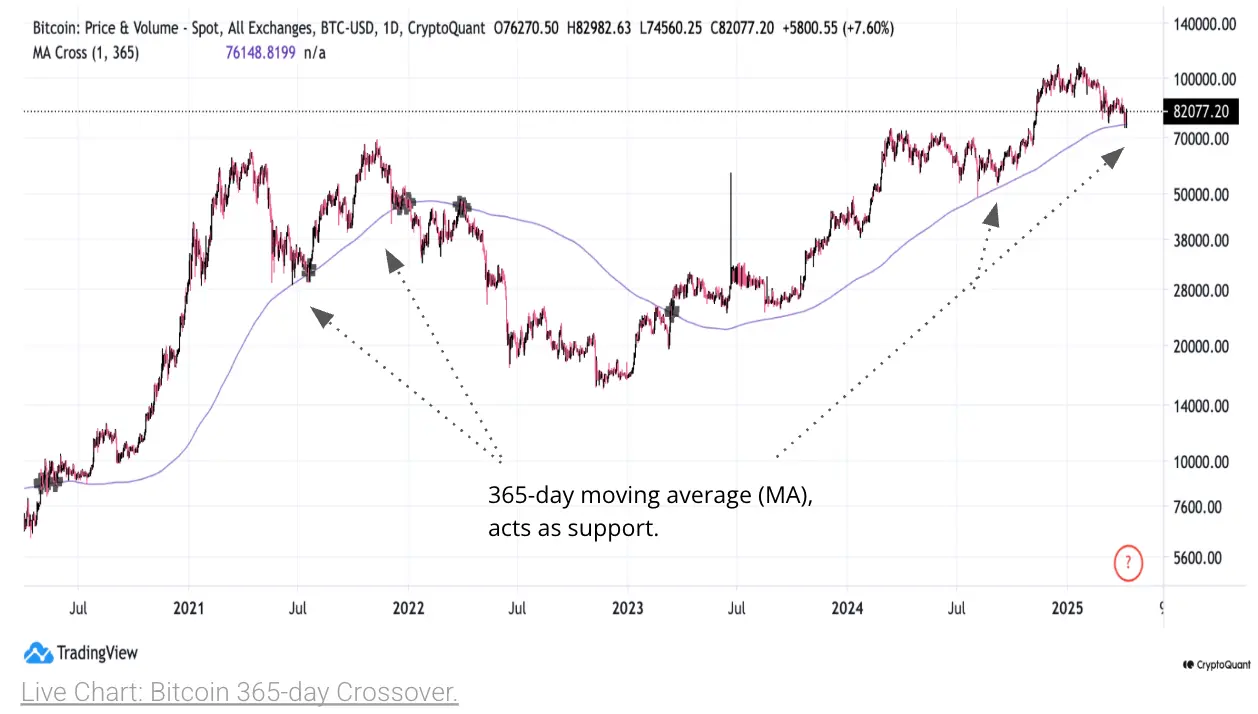

This unexpected resurrection came after Bitcoin tumbled to the venerable 365-day moving average—$76,100—a fortress that once staunched the relentless tide of decline back in 2021 and 2024. Should this bastion fall, it might herald the onset of a bitter bear winter, according to the cryptic tomes of cryptoquant.com.

Yet, in an irony as thick as the smog over industrial towns, Cryptoquant’s Bull Score Index sank to a dismal 10—its bleakest since November 2022. Only one stubborn ray of optimism remains: Bitcoin holding its ground above the fabled 365-day MA. To awaken the bull, this score must soar above 40, a resurrection more elusive than common sense in these tumultuous times! 😏

Looming like the colossal gates of an old fortress, resistance awaits at $84,000 and $96,000—echoes of past market struggles now serving as barriers to further glory. The market, as capricious as fate, may let these thresholds become the final joke at the expense of bullish dreams.

While the tariff reprieve has momentarily eased the savage clashes of trade, it has done little to stir the stagnant on-chain metrics—plummeting network activity and inert stablecoin liquidity serve as grim reminders of a cycle already marred by a 27% plunge earlier in the week. In a dramatic twist, Cryptoquant researchers urge that caution and vigilance must reign supreme as we await whether this brief respite will kindle the long-dormant fires of investor confidence.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-04-12 19:28