As an experienced financial analyst, I have closely monitored the recent developments surrounding Ethereum (ETH) and related tokens, particularly the update on Spot Ethereum ETFs by Nate Geraci. Given my extensive knowledge of market trends and investor behavior, I believe that the postponement of the SEC’s decision to mid-July has significantly impacted the crypto market.

Nate Geraci’s latest announcement about Spot Ethereum ETFs on his X platform has generated significant interest among investors and financial institutions. Originally slated for approval by the US Securities and Exchange Commission (SEC) as early as 2 July, the decision has now been pushed back to mid-July.

After Geraci’s recent announcement, I observed a significant wave of selling in various Ethereum tokens.

Whales dump LDO, AAVE, and UNI tokens at a loss

On July 3, Lookonchain, a firm specializing in on-chain analysis, disclosed that a large investor or institution unloaded large quantities of Ethereum tokens, including Lido DAO (LDO), Aave (AAVE), UniSwap (UNI), and Frax Share (FXS). The data indicates that they sold $5.77 million worth of LDO tokens (3.13 million units), $4.54 million worth of AAVE tokens (49,771 units), $2.41 million worth of UNI tokens (269,177 units), and $708,000 worth of FXS tokens (250,969 units). They incurred a loss during these transactions.

After the recent market downturn, the prices of various tokens took a hit. For example, Lido’s token saw a 14% decrease in value, Aave’s token fell by 9%, Uniswap’s token dipped by 5%, and Fei Exchange’s token suffered a loss of 12%.

It’s important to note that back in May 2024, the whale made a significant purchase of Ethereum (ETH) and associated tokens, spending approximately $73.5 million. This came after the approval of the spot Ether ETF was announced. Despite this large sell-off, the whale continues to hold a substantial amount of Lido (LDO), valued at around $5.83 million, as well as 31,191 AAVE tokens worth roughly $2.8 million.

Ethereum’s (ETH) price following ETF update

If the Securities and Exchange Commission (SEC) in the United States postpones or delays its decision on approving a spot Ethereum (ETH) exchange-traded fund (ETF) again, there’s a possibility of another significant sell-off in ETH and related tokens. According to the Head of Asset Management at Galaxy Digital, Steve Kurz, the SEC might make a decision within the next few weeks.

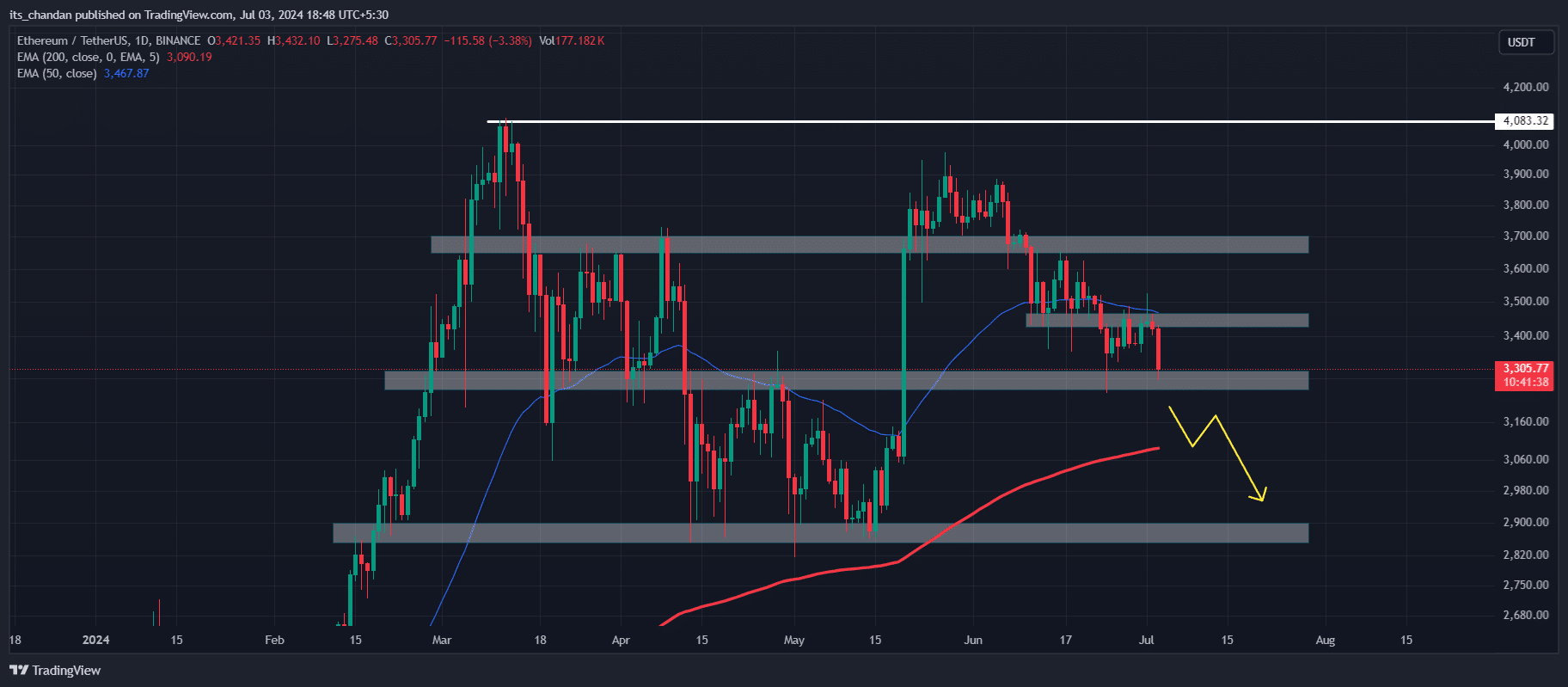

According to the price graphs, Ethereum appeared to be hovering near its significant support of $3,250 and beneath the 50-day Exponential Moving Average (EMA). If Ethereum cannot maintain this position, it may lead to a substantial drop in price towards the $2,870 mark within the following days.

As a crypto investor, I’ve been excited about the potential approval of Spot Ethereum ETFs and the growth of other Ether-linked tokens. However, even with this positive outlook, Ethereum itself experienced a disappointing 5% price decrease within the past 24 hours.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-04 15:03