- Assessing the relationship between USDT dominance and crypto prices.

- USDT flows reveal an almost evenly matched outcome between buyers and sellers.

As a seasoned researcher with years of experience delving into the intricacies of the cryptocurrency market, I find myself constantly amazed by the dance between USDT dominance and crypto prices. It’s like watching a game of chess played by giants, where each move can shift the balance of power.

USDT dominance can reveal a lot about the mood of the market. This is largely because USDT is the largest stablecoin, thus its activity and on-chain flows may reflect on the state of liquidity in the market.

As a market analyst, I would observe that theoretically, the dominance of Tether (USDT) should show an inverse correlation with Bitcoin (BTC) and other altcoins. This means that as BTC and altcoins experience withdrawals or outflows, USDT’s dominance should increase. In essence, when these cryptocurrencies lose market share, USDT’s dominance grows.

During September, most cryptocurrencies showed a positive trend, but USDT.D saw a significant pullback instead.

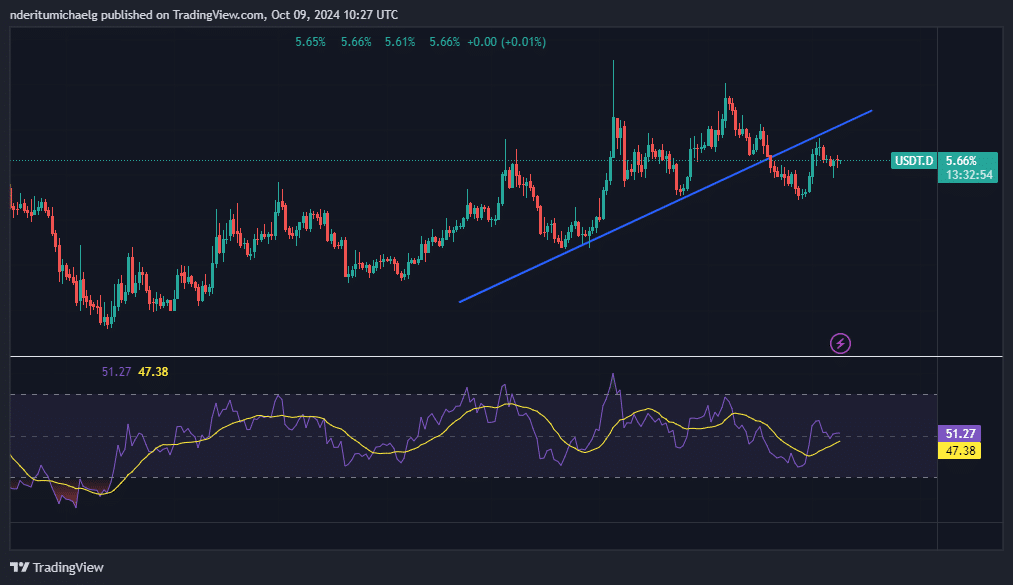

The trends observed in USDT’s dominance can provide a general indication of market direction. On September 19th, USDT.D fell beneath its three-month rising trendline, which might hint at potential shifts in the market.

It has also been hitting lower highs, indicating declining momentum.

Despite beginning the month showing signs of recovery, USDT’s dominance has experienced a slight dip over the past few days. Its Relative Strength Index (RSI) has been fluctuating slightly above the 50% mark, suggesting a period of uncertainty or indecisiveness in the market.

If the Relative Strength Index (RSI) falls below 50%, that’s a sign of potential continued drop. Translation: Under such circumstances, Bitcoin and altcoins might experience increased buying pressure, implying an influx of liquidity in their favor.

On the other hand, a bounce back from the current level may also be on the cards, in which case cryptocurrencies will continue to bleed. This will ultimately depend on market sentiment.

What USDT dominance and flows reveal

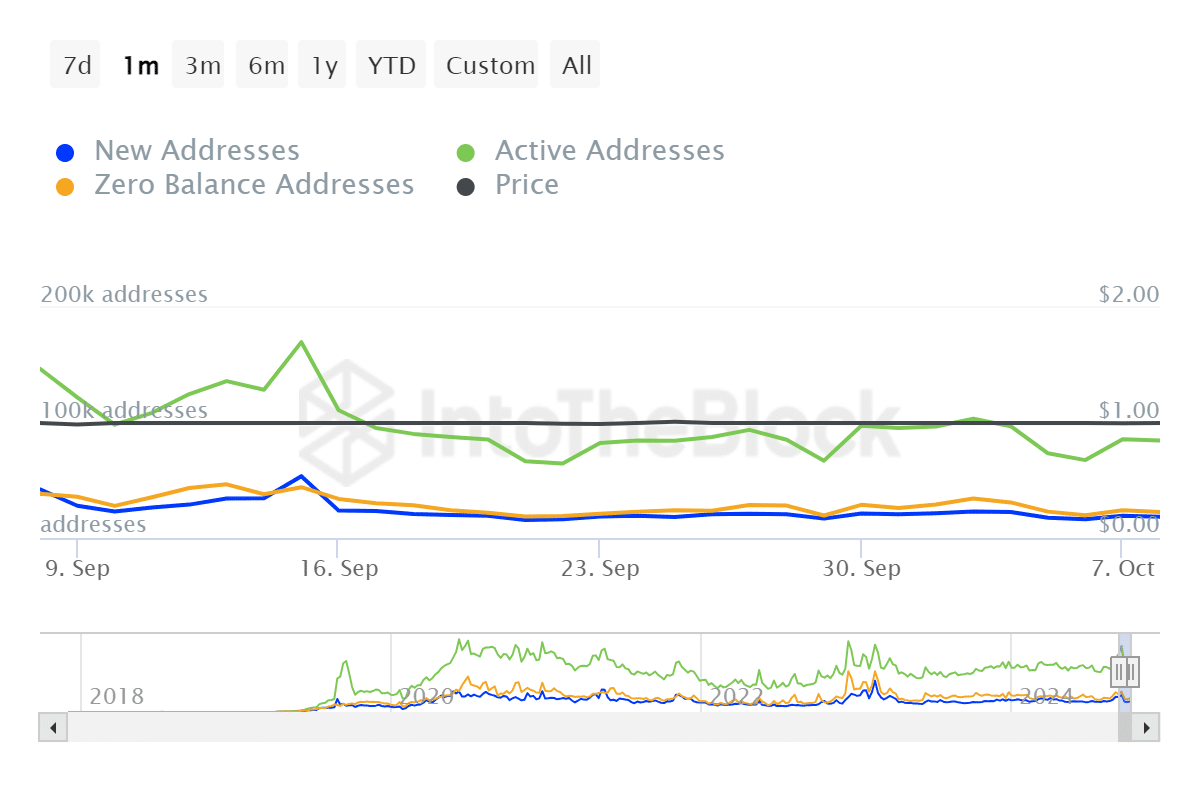

USDT address activity dropped considerably between the 3rd and the 6th of October.

Meanwhile, the number of active addresses has rebounded, increasing from approximately 16,360 addresses to more than 18,400 addresses within just the past three days.

The number of addresses holding no funds increased from 19,860 on October 6th to 22,530 on October 9th.

This implies that many addresses transferred their liquidity from USD Tether (USDT) to other cryptocurrencies, which aligns with the decrease in USDT’s dominance during the same timeframe.

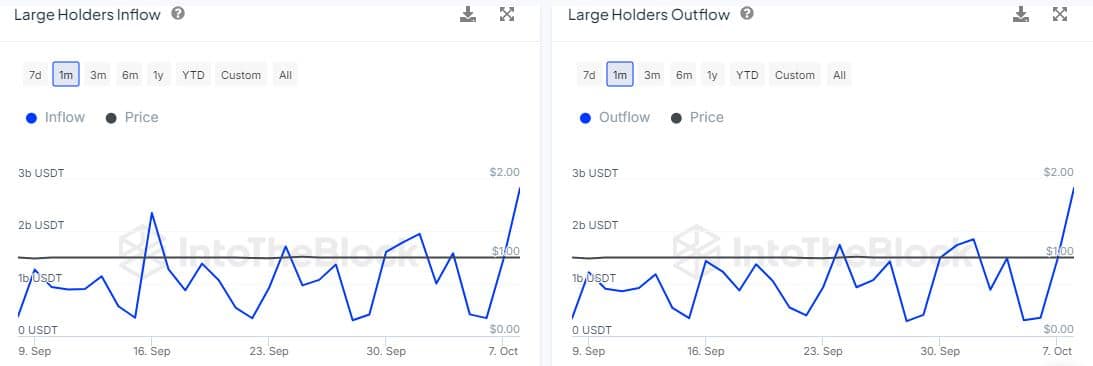

Regardless of the previous finding, it appears that there’s some uncertainty regarding the influence’s direction coming from significant investors.

As an analyst, I often observe that significant investors, commonly referred to as ‘whales,’ significantly shape liquidity movements due to their substantial holdings. Consequently, these large players can exert a notable influence over the general market trend.

In the past 24 hours, the inflow and outflow of USDT by significant holders were nearly balanced. The inflow reached a high of approximately 2.82 billion USDT, while the outflow slightly surpassed this with a peak of around 2.83 billion USDT.

Given the information presented earlier, it appears that the market’s direction was somewhat ambiguous, mirroring the general neutral outlook prevalent within the market.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-09 15:35