-

Ethereum whales have become more active recently.

ETH is attempting to establish the $3,600 range as its support.

As a researcher with experience in cryptocurrency market analysis, I have been closely monitoring the recent activities of Ethereum whales and the broader Ethereum ecosystem. Based on my findings, I believe that Ethereum whales have become more active recently, as evidenced by one particular whale’s acquisition of a large amount of ETH before the Ethereum spot ETF was approved.

Prior to the Ethereum [ETH] ETF’s approval, a notable Ethereum investor, represented by a specific whale address, took significant actions by purchasing larger quantities of ETH at a particular price point.

I discovered that this particular address had an substantial, yet unreaped gain following this event. Furthermore, my investigation revealed a comparable trend amongst other “whale” addresses prior to the ETF approval.

Whale acquires Ethereum and ecosystem tokens

As a researcher studying blockchain data, I discovered an intriguing finding using Lookonchain’s analysis. A notable Ethereum (ETH) wallet, identified as a “whale,” made a significant investment in ETH prior to the approval of the Ethereum spot Exchange Traded Fund (ETF).

Based on the data, a whale purchased roughly 8,733 ETH at an average price of about $3,054.56, amounting to around $26.67 million in total. Currently, this wallet holds approximately $32.67 million worth of ETH, resulting in an unrealized profit of nearly $6 million.

After obtaining the green light from the Securities and Exchange Commission (SEC) regarding Form 19b-4, the large investor went on to acquire additional tokens valued at $24.7 million within the Ethereum network.

As a crypto investor, I’ve got a sizable stash of Ethereum (ETH) staked across various platforms. Among them is Lido DAO [LDO], which boasts the largest volume of ETH stakes. The potential profit from these ecosystem tokens in my wallet adds up to approximately $1 million, yet to be realized.

Ethereum whale activities increase

According to AMBCrypto’s investigation, there has been notable activity among Ethereum addresses containing 10,000 or more Ether in the past few days.

Based on Glassnode’s data analysis, there were decreases in the count of these addresses prior to a turnaround observed around May 19th.

At the time of writing, the chart showed a rise in the number of addresses from roughly 997 to about 1,006.

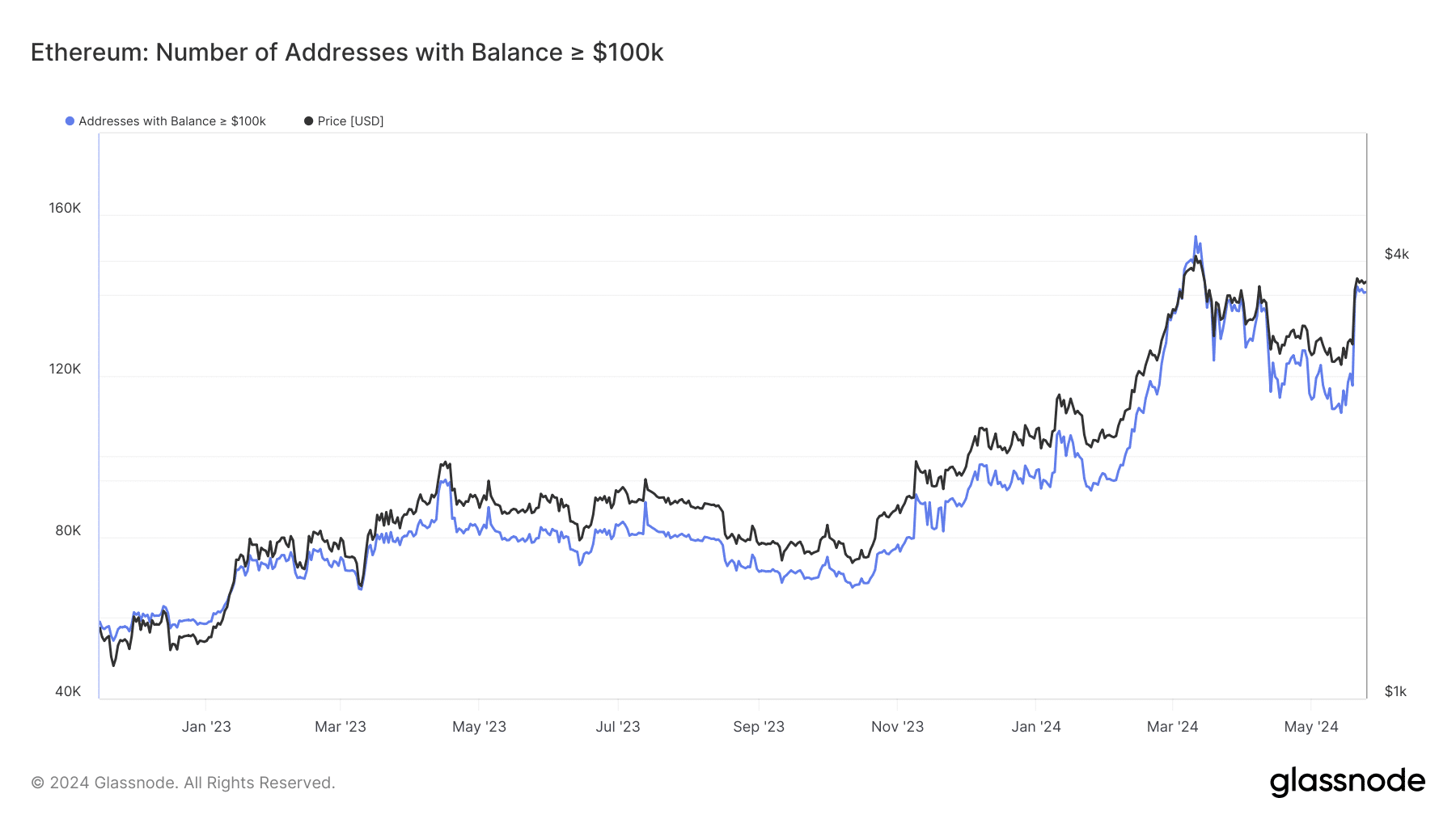

A closer look revealed that the count of Ethereum addresses containing over $100,000 in value significantly increased.

In the same period, this figure rose from around 117,500 to over 140,000 as of the current writing.

Staked ETH sees a slight decline

As a crypto investor following the Ethereum scene closely, I’ve observed some interesting developments with regards to the amount of Ether being staked on the network. According to AMBCrypto’s analysis, there was a brief decrease around mid-May, only to rebound strongly near the 20th of the month.

During this timeframe, the number of Ethereum tokens staked exceeded 32.5 million from approximately 32.3 million. At present, the estimated total is about 32.56 million ETH, showing a minor decrease.

Also, the current staked volume represented approximately 27.1% of the total Ethereum supply.

Ethereum maintains a bull run

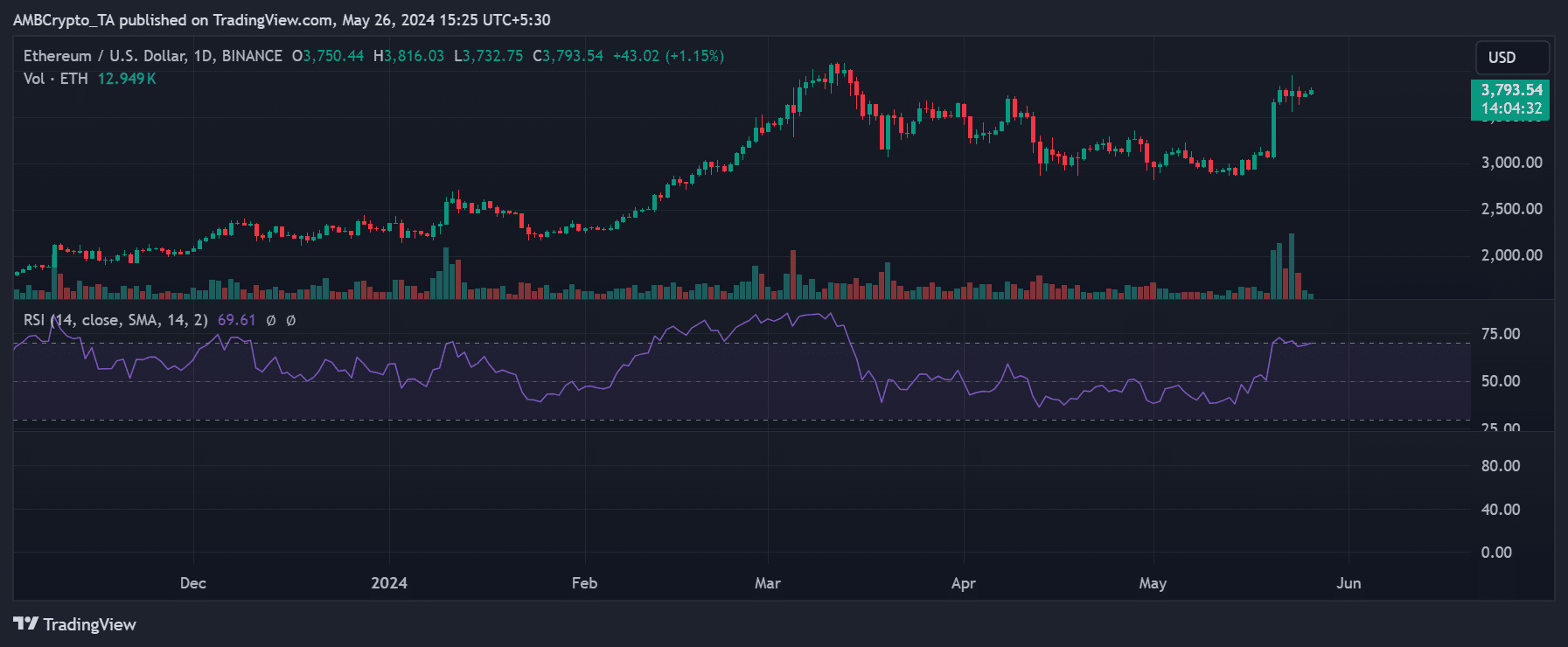

At the moment of writing this, Ethereum was valued around $3,790 in the markets, representing a gain of more than 1%. The daily chart analysis suggested that Ethereum had been making efforts to maintain the $3,700 price range since reaching that level.

Read Ethereum’s [ETH] Price Prediction 2024-25

The current trend suggested Ethereum’s attempt to establish the $3,600 range as its support.

As a crypto investor, I closely monitor the Relative Strength Index (RSI) to gauge Ethereum’s market strength. Recently, the RSI indicated that Ethereum was just below the overbought threshold. This observation signaled a robust bullish trend; however, it also hinted at the potential for a price correction or even a brief bearish spell, despite the ongoing possibility of another bull run.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-05-27 03:03