-

Analyst noted that nobody is using ADA technology, and investing in unused technology in 2024 is not a smart move.

Based on the historical price momentum, there is a strong possibility that ADA could decline by 10%.

As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself cautiously bearish about Cardano [ADA] at present. The low transaction per second (TPS) rate and the analyst’s observations about underutilized technology have raised some red flags for me.

In simpler terms, the total value of all cryptocurrencies is facing some minor challenges, and Cardano [ADA], according to a crypto expert’s analysis, seems to be showing signs of a downtrend because its underlying technology may not be fully utilized.

Currently, significant cryptocurrencies such as Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] are undergoing a period of price adjustment after a notable increase in value over the last few days.

Why is Cardano struggling

A crypto analyst made a post on X (previously Twitter) and shared Cardano’s current transaction per second (TPS) data, which currently stands at 0.41.

Pointing out the low adoption rate of ADA technology, the analyst advised against investing in technology that seems underutilized in 2024. They emphasized the importance of sticking to factual information and practical considerations.

Based on this data, it appears that the prolonged struggle and difficulty in rallying upwards for Cardano’s ADA may be due to these reasons.

Cardano technical analysis and key levels

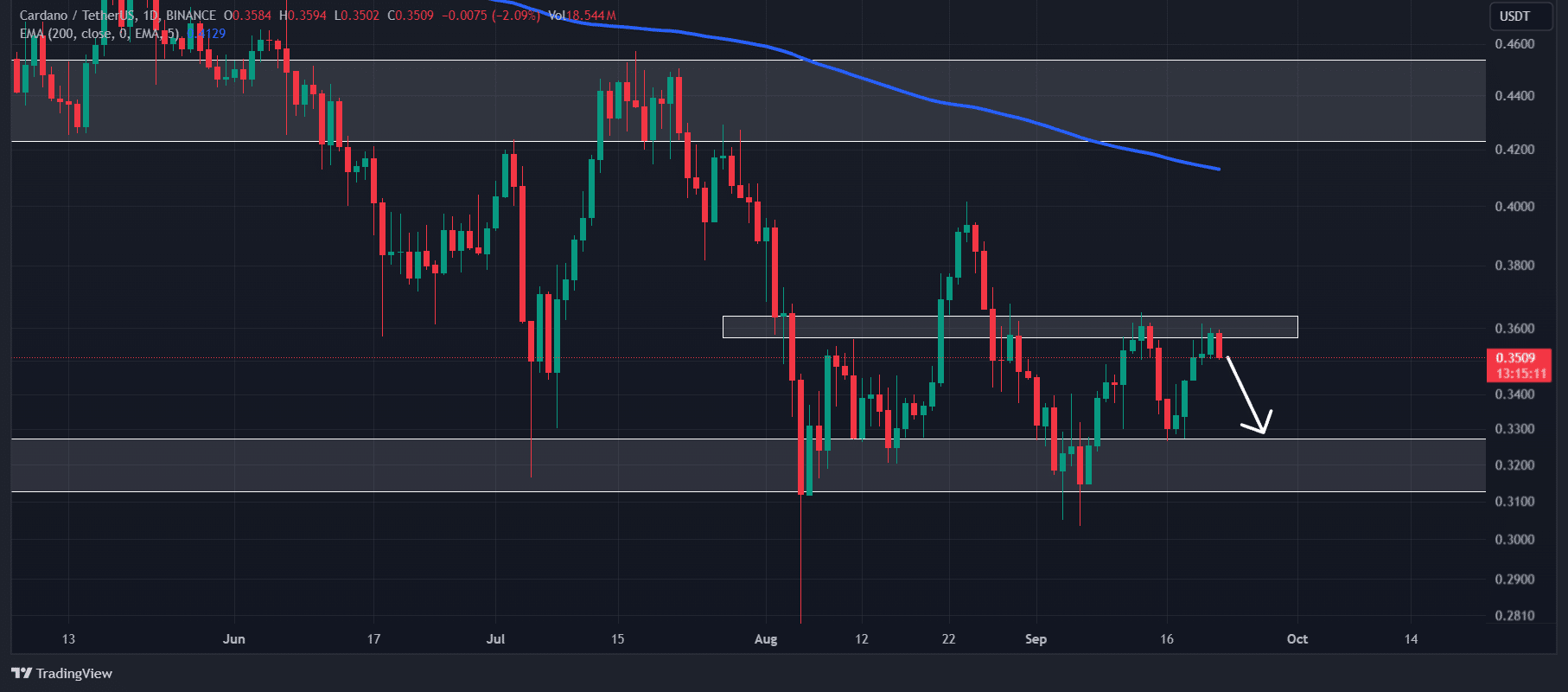

Based on the assessment of technical analysts, Cardano (ADA) appears to be moving downwards, since its price is currently lower than the 200-day Exponential Moving Average (EMA), when considering a daily timeframe.

Many traders and investors frequently rely on the 200 Exponential Moving Average (EMA) as a tool to decide if a particular asset is experiencing an upward trend or a downward trend.

Furthermore, ADA is undergoing a change in trend, moving downwards from the significant resistance point at around $0.36. Previously, this price level has also triggered selling activity for the asset.

On September 4, ADA experienced a similar price reversal and fell nearly 10% in just three days.

Looking at the trend of past prices, there’s a high likelihood that the value of ADA might drop by approximately 10% to hit around $0.325 in the near future. However, this bearish prediction could change if ADA manages to close its daily chart above the $0.365 mark.

Bearish on-chain metrics

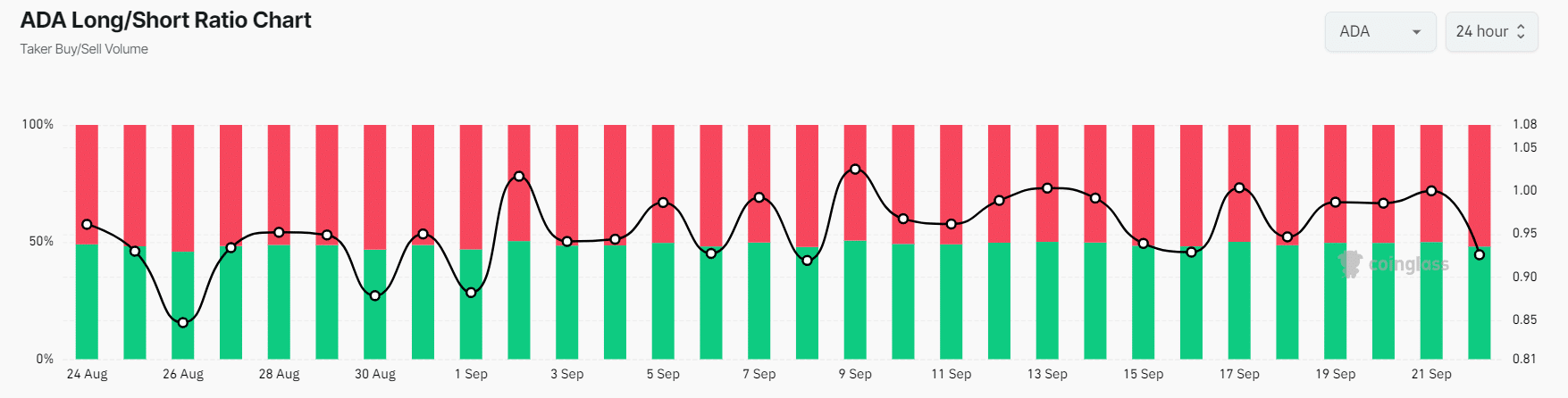

On the other hand, the pessimistic view is reinforced by the data from blockchain analysis. The long/short ratio for Cardano on Coinglass stands at 0.926, suggesting that most traders are leaning towards short positions, reflecting a bearish attitude in the market.

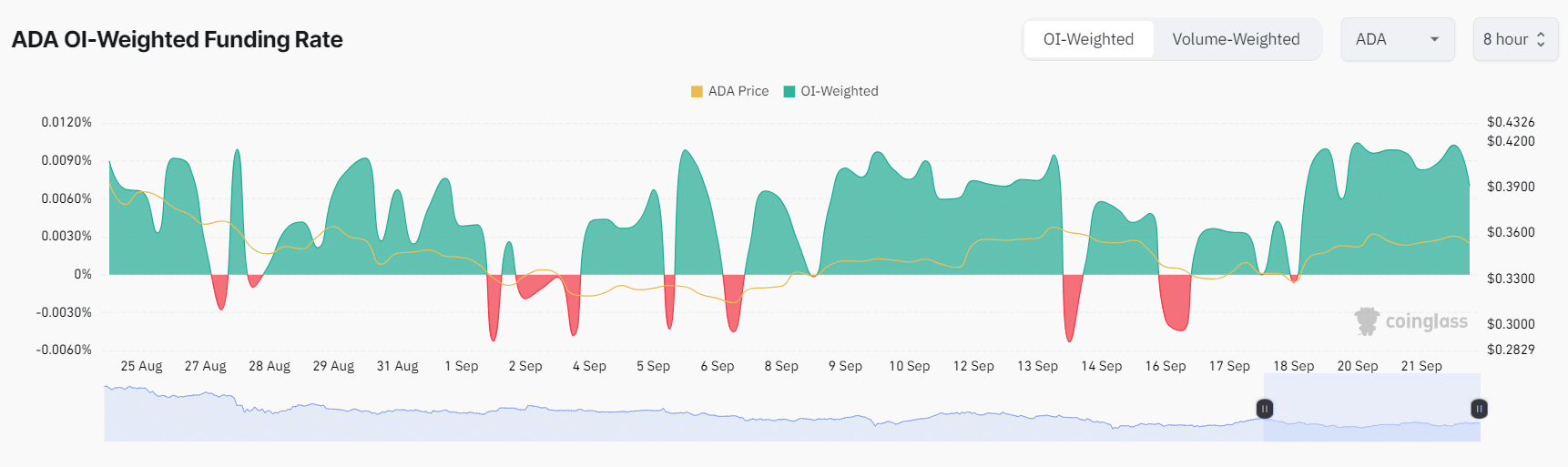

As an analyst, I’ve noticed a decrease of 3.8% in the futures open interest over the past 24 hours, which seems to be part of a downward trend. This could imply that traders are actively closing their existing positions or showing reluctance to establish new ones, suggesting potential market uncertainty or adjustments in trading strategies.

Conversely, the funding rate for ADA‘s OI-weighted is now at +0.007. This indicates a positive trend or ‘bullish’ sentiment, as long traders are prepared to pay to preserve their holdings.

Read Cardano’s [ADA] Price Prediction 2024–2025

At present, it seems that 52% of leading traders are choosing to bet on a decrease, while the remaining 48% are opting for an increase in the market.

As I analyze the current market situation, at this moment, Cardano (ADA) is hovering around $0.352. Over the past 24 hours, there’s been a slight dip of approximately 0.8% in its price. Simultaneously, the trading volume has decreased by 18%, suggesting that involvement from traders has reduced under the influence of selling pressure.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-09-22 19:03