-

The increase in development activity had little to no effect on XRP’s price.

A good buying opportunity might have presented itself, on-chain data revealed.

As an experienced analyst, I have closely monitored the XRP market and its related metrics for quite some time. Based on my observation of the recent development activity and other relevant indicators, here is my take:

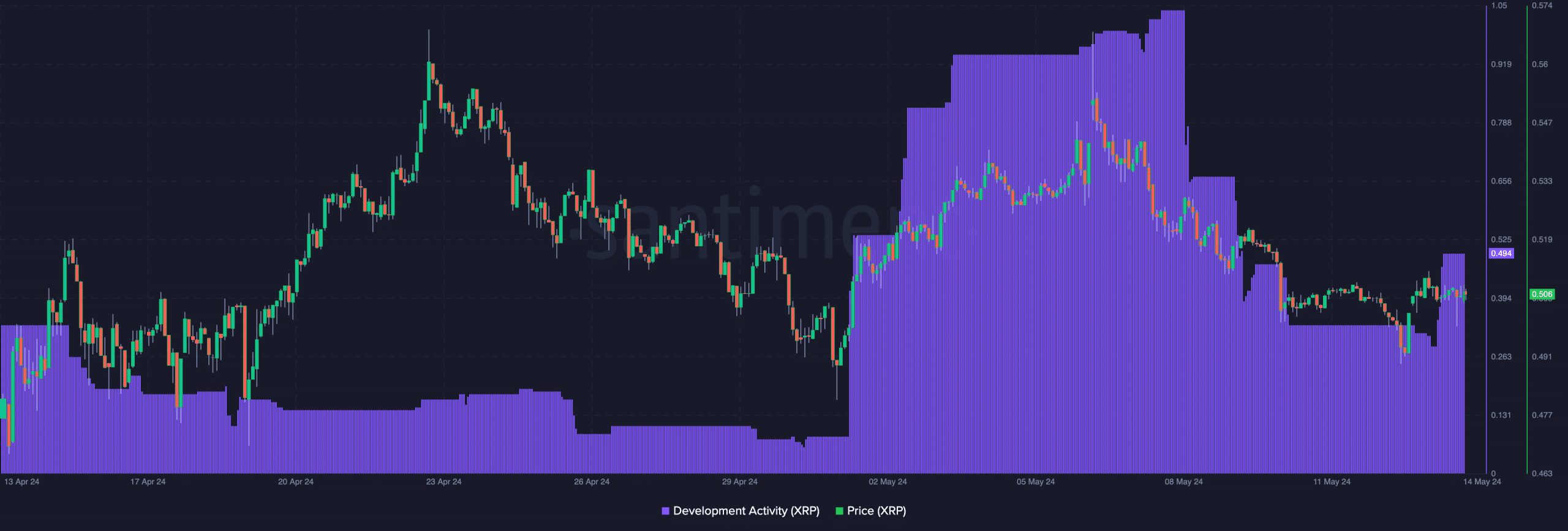

The XRP Ledger (XRPL) experienced a pickup in development activity following a brief downturn starting on April 13th.

According to data from Santiment’s blockchain analysis, AMBCrypto noted a decrease in the metric to 0.28, which subsequently bounced back to a level of 0.49.

XRPL serves as a decentralized, open-source blockchain platform facilitating the exchange of XRP, traditional currencies, and select digital assets.

As a analyst, I would put it this way: When development activity ramps up, it signifies that efforts devoted to maintaining the ledger’s optimal performance have gained momentum.

Dedication does not equal higher prices

Alternatively, a decrease in development activity may lead to fewer publicly available GitHub repositories. Consequently, the increase in shipments of new features suggests an effort to keep a comprehensive and accurate record of XRP transactions.

Had the event influence the cost of XRP? The value of XRP stood at $0.50 during the latest update, which was barely a change from its price 24 hours prior.

As a researcher studying the historical trends of XRP‘s price action, I have observed that upgrades to the ledger have not consistently influenced the token’s price movement. However, there have been instances where an increase in this metric was followed by a rise in XRP’s price.

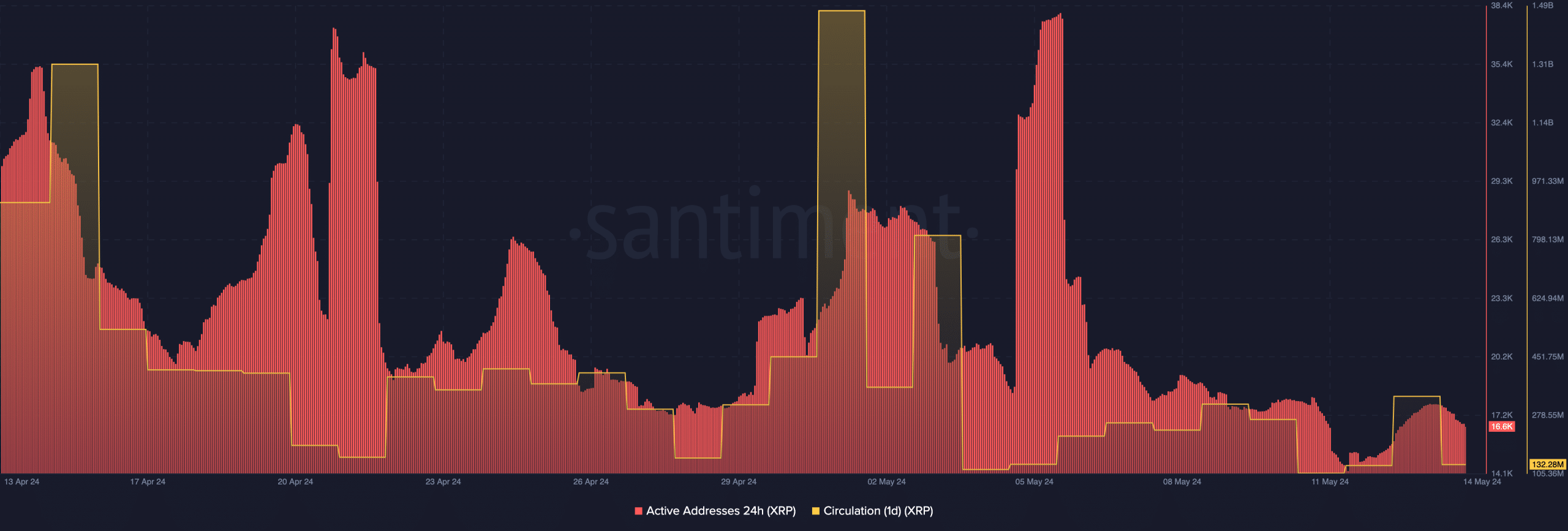

At times, the price may halt or drop. During such periods, AMBCrypto examined various aspects of the network. Subsequently, we turned our attention to the number of active addresses as our next indicator.

“This measure monitors the volume of user interactions. A rise in the number of active addresses indicates a growth in the number of successful transactions.”

In simpler terms, when the metric declines, it indicates that the number of transactions involving the sending or reception of tokens is relatively low.

Network activity on the ledger drops

At present, there are approximately 16,600 actively used addresses on the XRP Ledger – a decrease from before. This reduction suggests that the number of addresses engaged in XRP transactions has diminished.

As a data analyst, I’ve uncovered some intriguing insights from the latest statistics. Specifically, I’ve noticed that the daily circulation of XRP reached approximately 132.28 million units according to Santiment’s reports.

As a crypto investor, I’ve noticed a significant drop in the number of transactions exceeding one billion on or around May 1st. This decline indicates that traders have been shying away from this particular cryptocurrency.

For individuals intending to keep the XRP token for an extended period, this situation might bring excitement. Some forecasts indicate that XRP could reach a value of $3 during this market cycle.

Should that hold true, purchasing at fifty cents might prove to be a great bargain. Nevertheless, it’s essential to note that there’s no certainty the price will reach the previously mentioned goal.

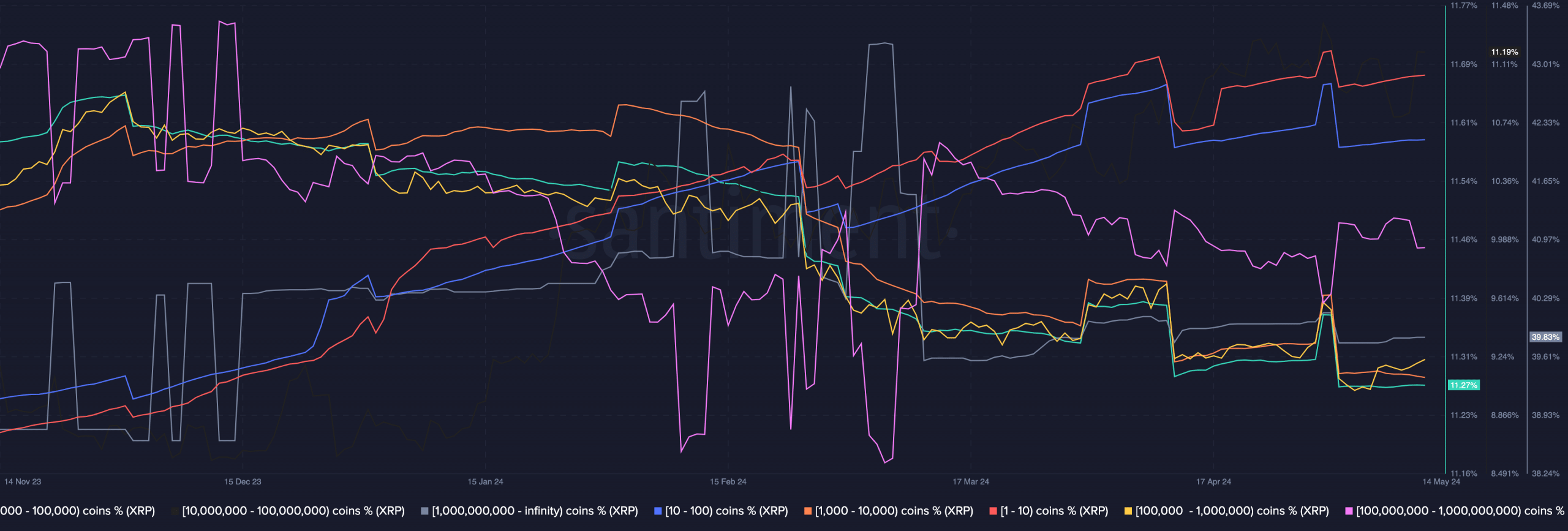

Another approach: We also examined whether token owners were buying more of the token at its current price. To accomplish this, AMBCrypto analyzed the balances of various addresses.

Is your portfolio green? Check the XRP Profit Calculator

During the time I’m composing this text, smaller XRP holders (those with 1 to 100 coins) managed to expand their token collections. Contrastingly, a different trend emerged among larger XRP holders (those with 1000 to 1 billion coins).

Based on our observations, this particular group reduced the amount of XRP they possessed. Consequently, it appears that small-scale investors were the ones driving the short-term bullish sentiment towards XRP, whereas large market players did not exhibit similar behavior.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-05-15 13:11