-

Traders reduced their amount of leverage as BTC prices stabilized.

Holders remained unprofitable despite the price appreciation.

As a seasoned crypto investor with a few bear market experiences under my belt, I find the recent stability in Bitcoin’s price and the signs of decreased leverage in the derivatives market encouraging. The significant reset in Funding Rates and the falling Open Interest as a percentage of market cap are positive indicators that suggest reduced risk for BTC.

As a crypto investor, I’m thrilled to see Bitcoin (BTC) regaining its footing and reaching the $64,000 mark once again. The past day has been relatively stable for BTC, with only minor price fluctuations around this level.

Declining leverage

The stability we’re experiencing is pleasantly accompanied by positive developments in the derivatives market, which now shows robust signs of vitality.

One indication of this is the notable shift in Funding Rates following the latest price decline. This adjustment implies that the amount of borrowed funds in the market could be diminishing.

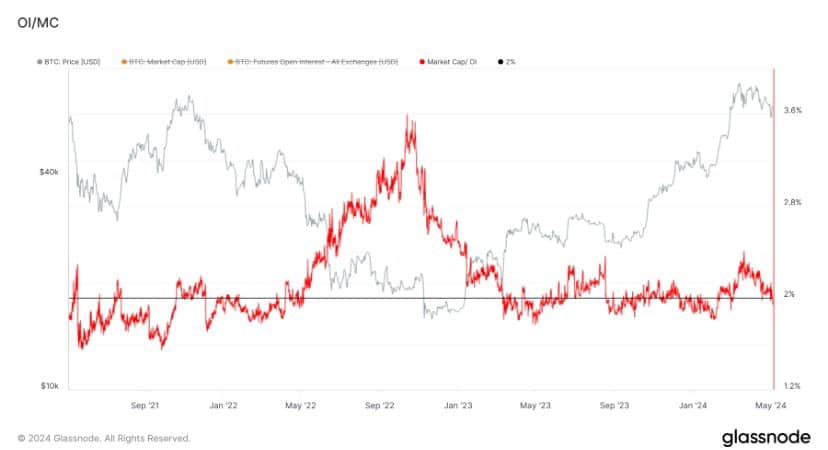

The open interest, which represents the total number of outstanding contracts in a financial instrument, now makes up less than 2% of the market capitalization. This decrease adds to the optimistic outlook.

None occasioned by February has transpired prior to this incident, underscoring the market’s reduced capacity for influence.

A lower leverage in Bitcoin (BTC) indicates less risk, which is typically beneficial for its long-term stability.

Traders showed a greater inclination toward skepticism rather than optimism regarding Bitcoin. According to Coinglass’ findings, the number of short positions opened against Bitcoin exceeded the number of long positions significantly.

How are holders doing?

As of the current moment, Bitcoin was priced at $64,232.57 on the markets. Over the past day, its value had gone up by 1.37%. Yet, there was a noticeable decrease in Bitcoin’s trading volume, which amounted to 11.18% during this period.

Despite BTC’s recent surge in price, holders remained unprofitable.

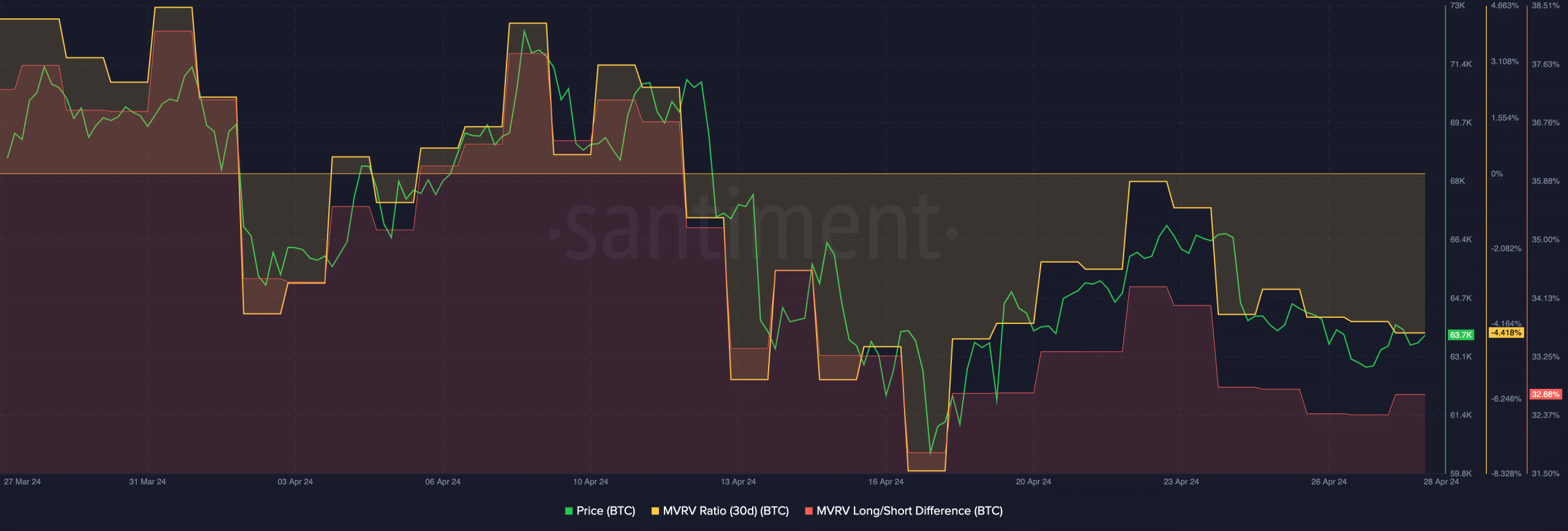

As a researcher examining the data from Santiment, I discovered that the MVRV ratio for Bitcoin had dropped. This finding suggests that the majority of Bitcoin holders are currently holding onto their assets, hoping for a price increase to realize a profit.

As a crypto investor, I can interpret this situation positively for Bitcoin in the near future. The reason being, these identified addresses are likely to keep holding onto their Bitcoins until the market reaches a specific price threshold. This could potentially lead to increased buying pressure and price appreciation.

However, what would challenge BTC’s rally would be the declining Long/Short difference.

TheLong-Short gap is shrinking, indicating a decrease in long-term investors and an increase in those with short-term horizons.

As a financial analyst, I would describe this phenomenon as follows: When it comes to short-term investors, there’s a common behavior referred to as “paper hands.” This term signifies their propensity to sell their investments during market fluctuations instead of staying the course and demonstrating faith in their holdings.

The views and firm belief of investors holding Bitcoin for a short period will significantly influence its price trend in the future.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-05-06 09:11