As someone who has been navigating the crypto world since its early days, I must admit that I’ve witnessed a fascinating evolution in the landscape. One of the most intriguing aspects is the rise and resilience of stablecoins.

The crypto industry has seen its fair share of upheavals in recent years, from market crashes to major updates like The Merge.

During this period of transformation, digital coins known as stablecoins have emerged as a vital link connecting conventional banking with the innovative realm of blockchain tech. These stablecoins are tied to assets such as fiat money or physical commodities.

For over six years now, entities such as Tether and Circle have been offering stablecoins as a means for individuals to participate in the cryptocurrency realm. On the other hand, decentralized options, like DAI, employ distinct strategies to preserve their worth.

Let’s delve into the current status of stablecoins in 2024. Are they managing to maintain their value despite the persistent market fluctuations? In this piece, we’ll uncover key findings from CoinGecko’s latest report on stablecoins, focusing on shifts in market capitalization, transaction volumes, and the performance of different stablecoin models.

As a crypto investor, I’d like to share some insights I’ve gathered from my analysis based on the comprehensive report by CoinGecko, which covers the period from January 2020 to August 2024. For a deeper understanding, I strongly recommend checking out their full report for additional details that aren’t included in this summary. Kudos to CoinGecko for their diligent work!

Key Takeaways

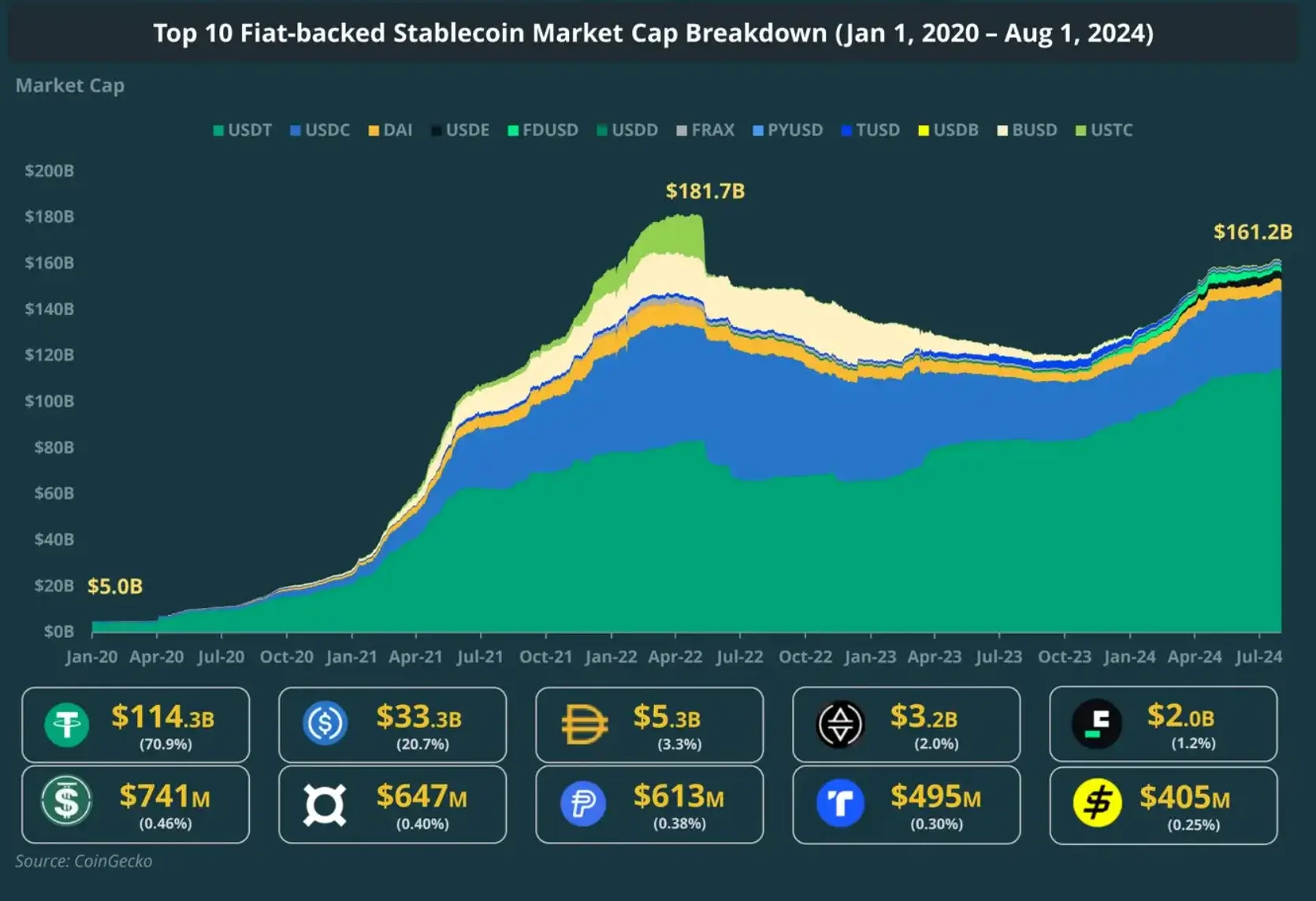

- Fiat-backed stablecoins reached a market cap of $161.2 billion in 2024 but remain below their 2021 peak of $181.7 billion.

- Commodity-backed stablecoins grew by 18.1% in 2024, reaching $1.3 billion, but only up 0.8% of fiat-backed stablecoins.

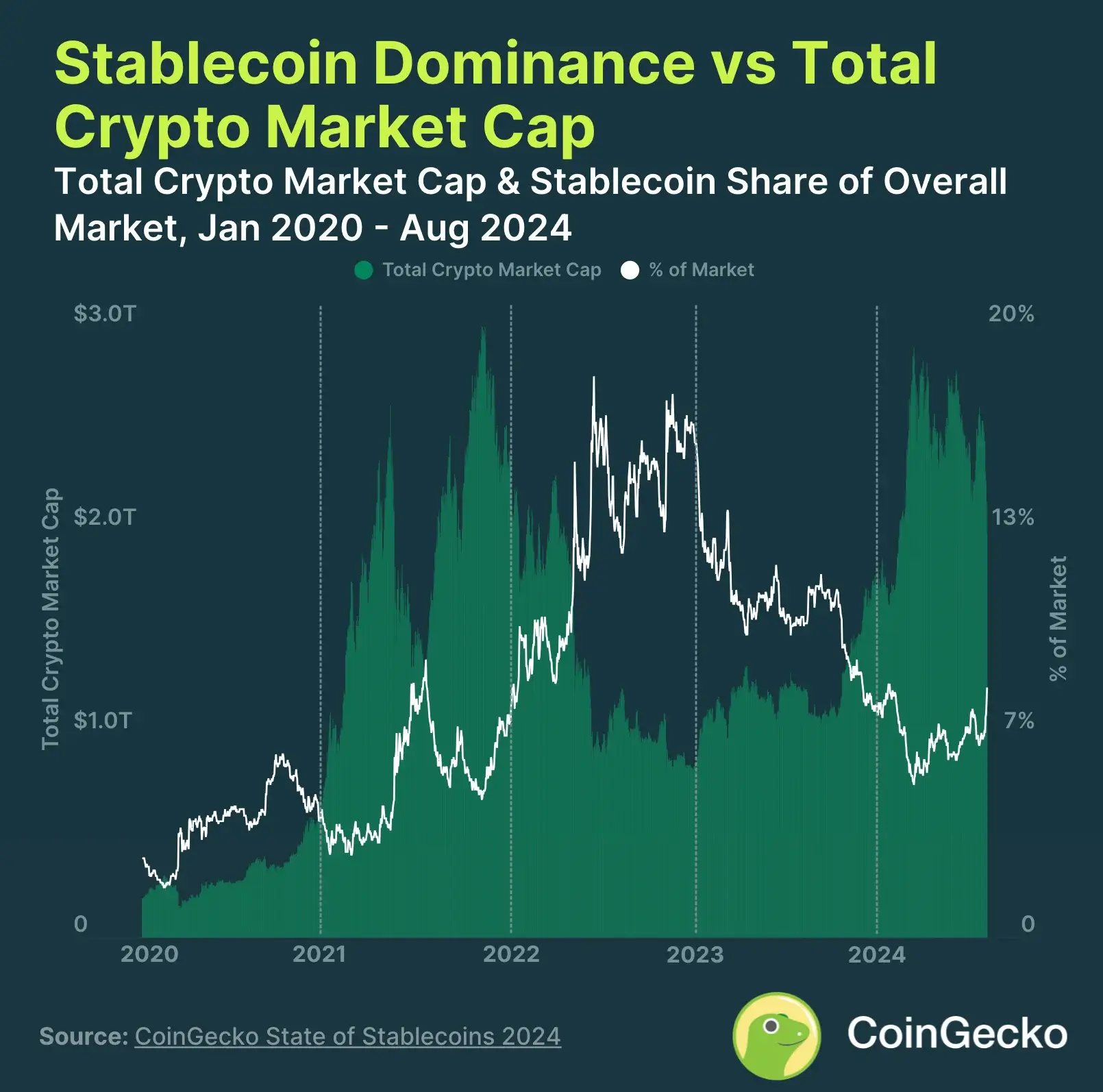

- Stablecoins represent 8.2% of the global crypto market cap and tend to gain more dominance during market downturns.

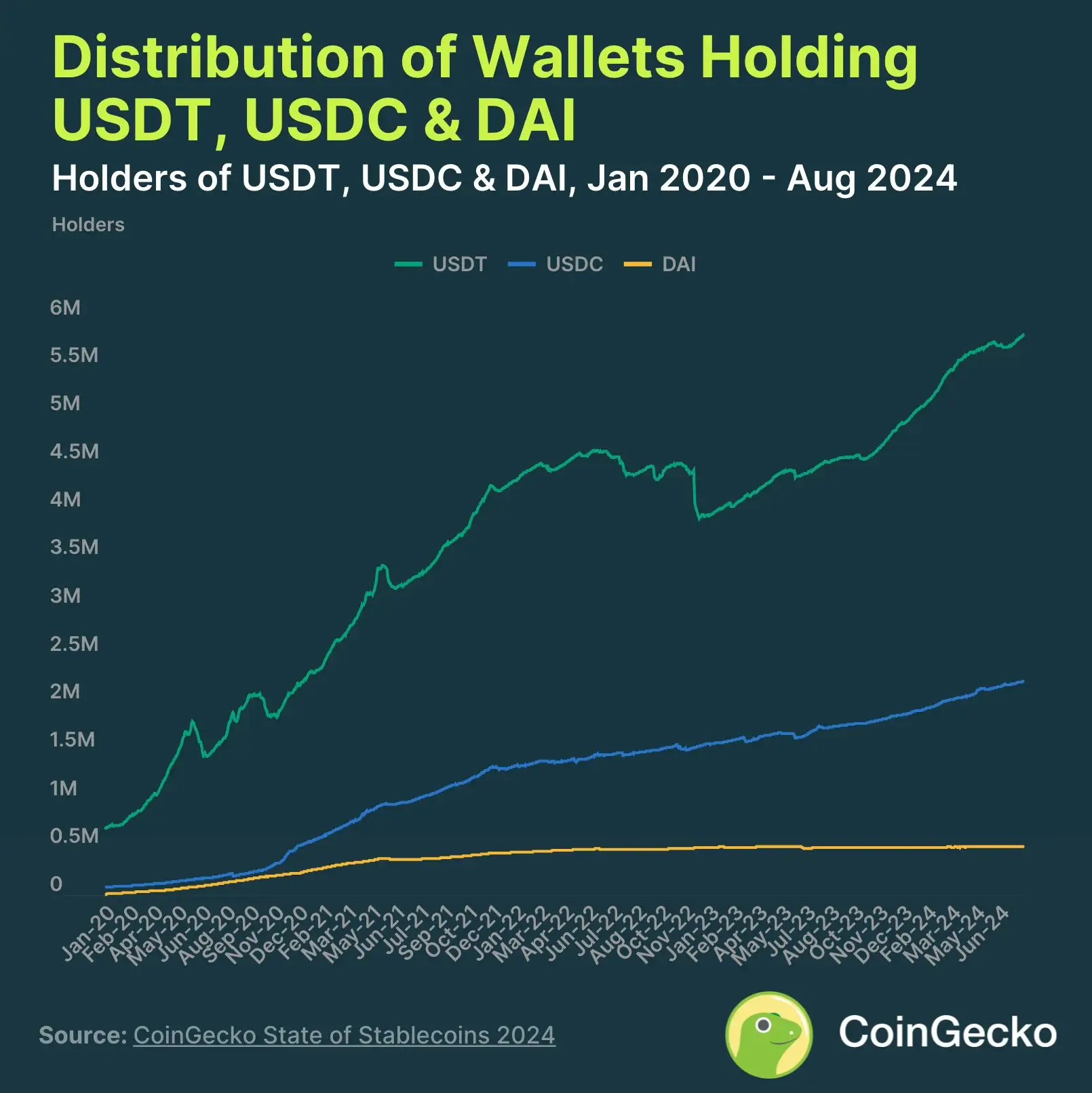

- There are 8.7 million addresses holding stablecoins, with 97.1% holding USDT, USDC, or DAI.

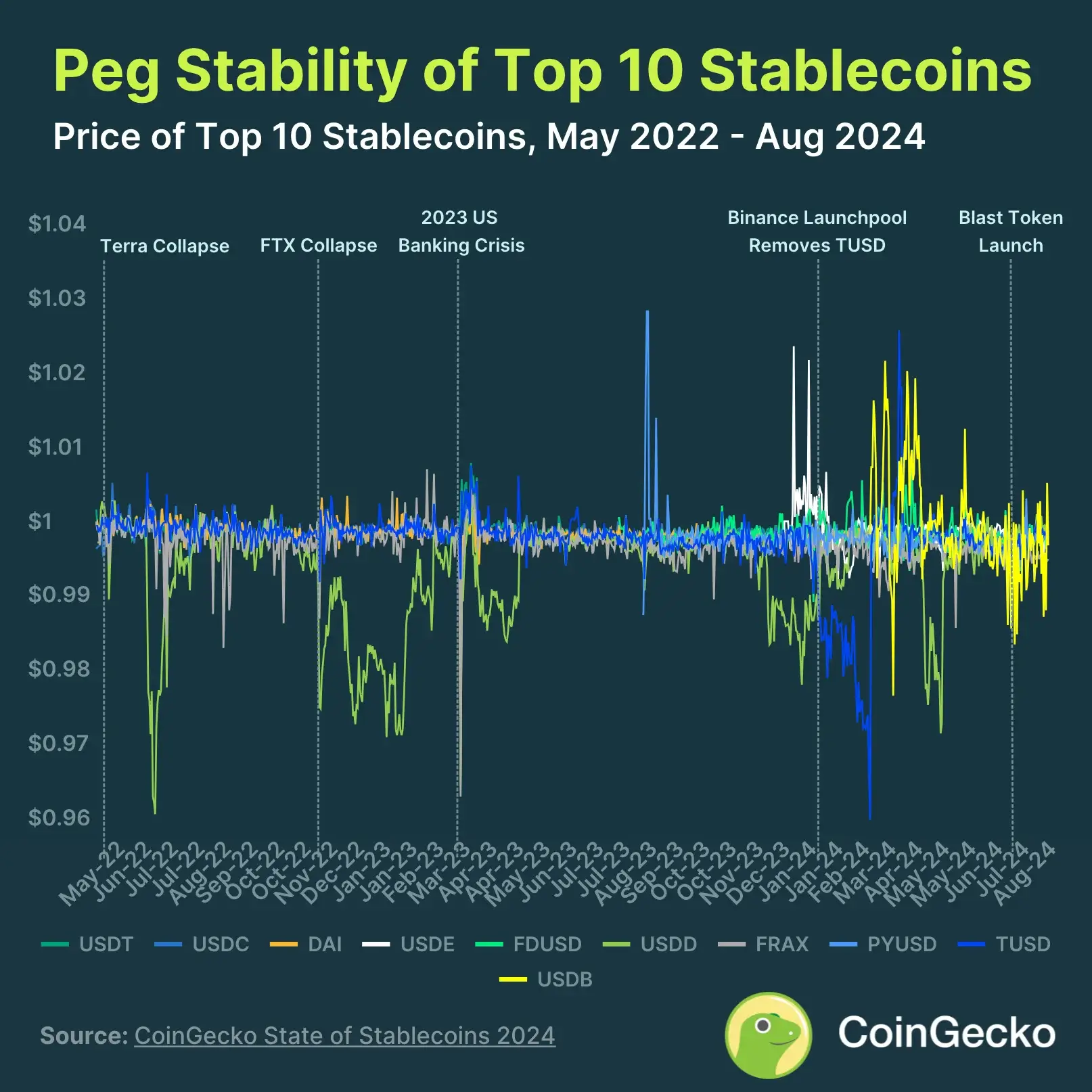

- Stablecoins still struggle to maintain their $1 peg, especially during uncertain or volatile periods.

1. Stablecoins Hit $161.2B in 2024, Still Below 2021 Peak

Over the course of the 2020-2021 bull market, the value of fiat-backed stablecoins has significantly increased. In fact, their combined market capitalization has skyrocketed more than 3,100%, reaching a staggering $181.7 billion.

After the fall of Terra’s UST, growth in the stablecoin market stalled and it continued to decline in value until November 2023.

Based on data from CoinGecko, the stablecoin market has shown signs of improvement since November 2023. Between late 2023 and August 2024, it recovered by approximately 35.4%, reaching a value of $161.2 billion. However, it hasn’t yet surpassed its previous record high, unlike Bitcoin did at a similar point in time.

In terms of influence within the stablecoin market, there’s a significant imbalance with Tether (USDT), USD Coin (USDC), and Dai (DAI) holding an overwhelming majority, accounting for approximately 94% of the market share. Notably, Tether accounts for about 70.9% of this dominance alone.

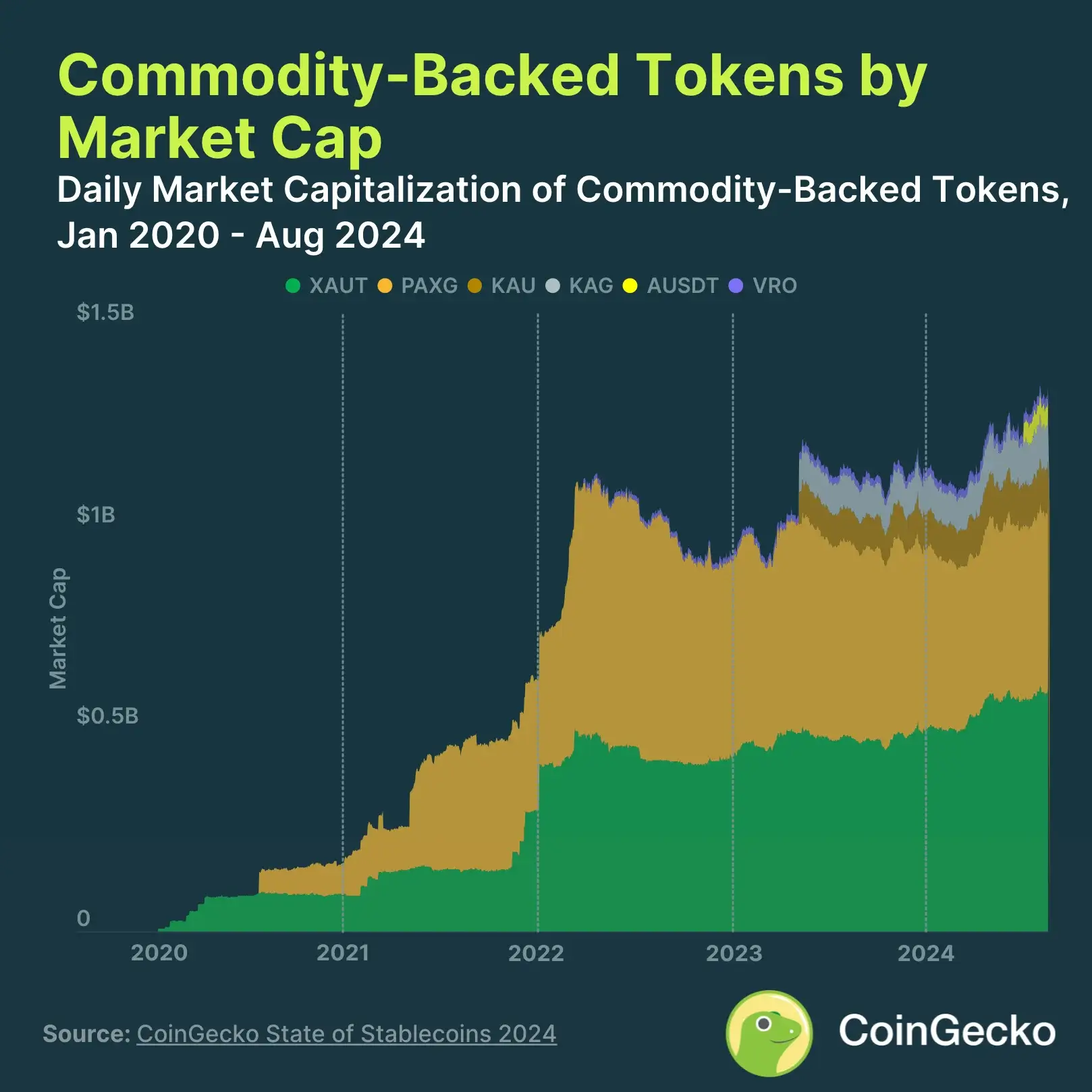

2. Commodity-Backed Stablecoins Market Grows with 18.1%, But It’s Still a Small Part of the Market (0.8%)

Despite the growth in the market for stablecoins tied to commodities, this sector is still relatively minor when compared to the broader market for stablecoins backed by traditional currencies (fiat).

As a crypto investor, I’ve been keeping an eye on the growth in commodity-backed stablecoins since 2020. According to CoinGecko’s latest report, these digital assets have made significant strides, with their market capitalization reaching a staggering $1.3 billion as of August 1, 2024. Among the key players, Tether Gold and PAX Gold have been leading the pack, controlling a whopping 78% of the total market cap.

Nevertheless, even with this expansion, commodity-backed stablecoins account for just 0.8% of the total market value of fiat-backed stablecoins. Primarily, it’s precious metals that are used as the underlying commodities in these stablecoins; however, there has been exploration into using other commodities such as uranium.

3. Stablecoins at 8.2% of Market Share, Rising in Market Downturns

In recent times, stablecoins have gained substantial prominence within the cryptocurrency sector, making up approximately 8.2% of the entire market’s worth. A recently published study suggests that this expansion can mainly be attributed to the fluctuating value of Terra’s UST stablecoin.

Initially in 2020, they held approximately a 2% share, expanding to 6% as DeFi surged. Additionally, their control over the market expanded significantly between November 2021 and May 2022, primarily due to the swift growth of Terra’s UST, increasing from 4.8% to 15.6%.

Following the fall of UST, the dominance of stablecoins in the market decreased significantly. Yet, during the subsequent financial downturn, their market share experienced a dramatic increase, reaching approximately 18.4%, as investors turned towards these assets due to their perceived safety and stability.

4. 8.7M Stablecoin Holders, USDT, USDC, and DAI Dominate

Currently, approximately 8.7 million unique wallets hold stablecoins. The majority of these, about 97.1%, are made up of USDT, USDC, and DAI.

In comparison, USDT boasts more than 5.8 million users, far exceeding USDC’s 2.2 million. The rest of the eight stablecoins have fewer than a million users each, with DAI being held by approximately 505,000 wallets.

2020 saw a swift expansion of these stablecoins, but their growth stagnated noticeably in 2022 as a result of solvency worries stemming from Terra’s collapse, causing concern.

5. Stablecoins Struggle to Stay Pegged During Uncertain Times

During periods of instability or uncertainty, many types of stablecoins have found it challenging to consistently hold their value near one U.S. dollar. While well-established coins like USDT, USDC, and DAI have improved in this regard, they still encounter difficulties during market upheavals, such as the March 2023 banking crisis, where they may experience fluctuations from their intended $1 peg.

These newer, semi-automatic stablecoins such as USDD, DAI, and FRAX may exhibit more volatility and require market trading to remain pegged to a specific value. In some instances, coins like Iron Finance and Basis Cash have struggled to sustain this peg, leading to failure.

Conclusion

Without a doubt, it’s evident that stablecoins now play a pivotal role within the cryptocurrency sector, serving as a bridge connecting conventional finance with the digital realm.

As an analyst, I’ve observed that despite encountering challenges such as market fluctuations and struggles to sustain their value, dominant stablecoins like USDT, USDC, and DAI have demonstrated remarkable resilience and maintained their strength in the crypto market.

Indeed, it’s clear that there’s still much potential for enhancement, given the concentration of power among a select few dominant entities and the persistent difficulties in maintaining stable pegs.

Watching the constant advancements in the cryptocurrency sector, it’s intriguing to speculate whether innovative stablecoin frameworks might address existing challenges and provide dependable alternatives for users well into the future, past 2024.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-20 12:34