In the vast and swirling abyss of commerce, where men’s hopes and fears play tug of war like children with a stubborn string, something curious has stirred among the keepers of Bitcoin. These holders—short-lived as shooting stars or stalwart as ancient oaks—have lately revealed their restless spirits through numbers etched upon the ledger of the blockchain.

The Stirring of the Bitcoin Short-Term Holder Flock

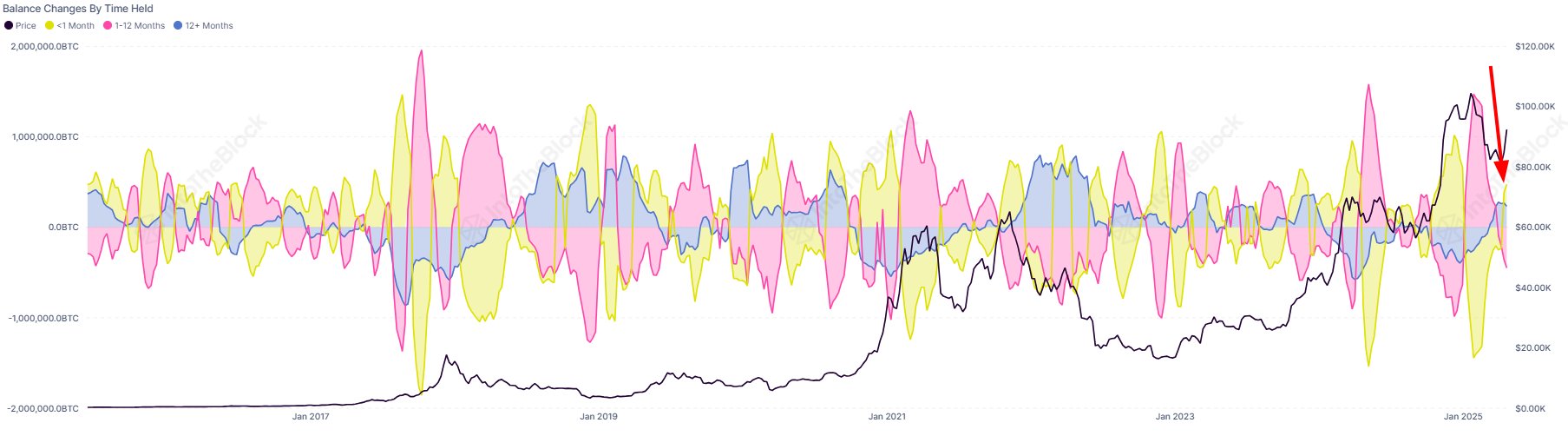

Let us peer through the keen eyes of IntoTheBlock, that modern oracle sifting through the ceaseless tides of data streaming from the digital fields. They divide these custodians by the time they have clung to their gleaming coins.

There are the traders, those impetuous souls who seized their Bitcoin within the last waning moon; the cruisers, those hopeful voyagers who anchored their treasure between one and twelve moons past; and, finally, the HODLers: tireless sentinels who have guarded their hoard for over a year, their hands forged into diamond, refusing to relinquish even a shard.

One understands, from the simple truth of human nature, that the longer a man clutches his treasures, the less he contemplates releasing them to the hungry world. Strength of will swells among the ranks as one journeys from the flickering candle-flame of traders to the eternal flame of HODLers.

Behold the chart — a strange, modern hieroglyph — provided by IntoTheBlock, laying bare the decade-long saga of these groups’ coffers:

Notice, with some amusement, the recent dance of the traders’ balance—that’s right, they have been piling on more coins amidst the swell of Bitcoin’s price. It is as if the youthful merchants, seeing a rally, hasten back to the bazaar, sleeves rolled, pockets jingling with fresh gold.

When the trader supply ascends, it whispers tales of the older, more seasoned holders stirring from their slumber—perhaps tempted by the siren call of profit. After all, the price has been climbing, and who can blame a mortal for eyeing the distant mountain of gains?

The venerable HODLers, steadfast as the Russian winter, show a quiet but firm increase in their holdings. Their resolve unmoved, their hands unshaken, these diamond graspers remain an unyielding bastion.

Thus, the cruisers emerge as the likely culprits releasing coins in a gentle exodus. Their resolve, though stronger than the fickle traders, is yet brittle compared to the ancient HODLers. One might almost hear their faint, panicked whispers as they let go.

Mark this: the selling from cruisers is no great shock. Even the most patient of us can, under pressure, turn and flee like a frightened rabbit.

Now, casting aside somberness for a moment, the rise in trader supply might be read with a cheeky grin. Could it be, dear reader, that fresh faces crowd the scene, hungry for a slice of the crypto pie? Such was the case in the last glow of 2024’s dawn when the trader supply leapt eagerly like a cat on a hot stove.

“Should this inflow persist,” muses the analytics sage, “we may witness a move beyond mere relief — the opening act of a grand ballet upward.”

The Capricious Dance of BTC Price

Yesterday, Bitcoin—a mercurial creature—dipped below the lofty perch of $93,000 only to find new vigor and burst upward again, reaching for the stars at $95,200. A fitting metaphor for human ambition, no?

So here we stand, watching the restless players of this digital drama, wondering if today’s jitters are but the opening gambit, or merely a comic twist in the endless saga of mankind’s pursuit of gold, this time cloaked in cryptographic garb. Keep your wits, friends, and may your wallets be as steadfast as the HODLers’ hands—diamond sharp and unyielding. 💎😉

Read More

2025-04-29 06:14