- Ah, the Official Trump, a creature of the market, now shows signs of a short-term range formation below the lofty heights of $12.2.

- Lo and behold! The OBV, that fickle friend, reveals an increase in selling pressure, as if the market itself is laughing at our misfortunes.

In the grand theater of finance, the short-term performance of our dear Official Trump [TRUMP] has been nothing short of tragicomedy. Since it reached the local resistance around $12.5 on the 15th of March, it has receded by a staggering 10.55%, now languishing at $11.19, like a forgotten soul in a Dostoevskian novel.

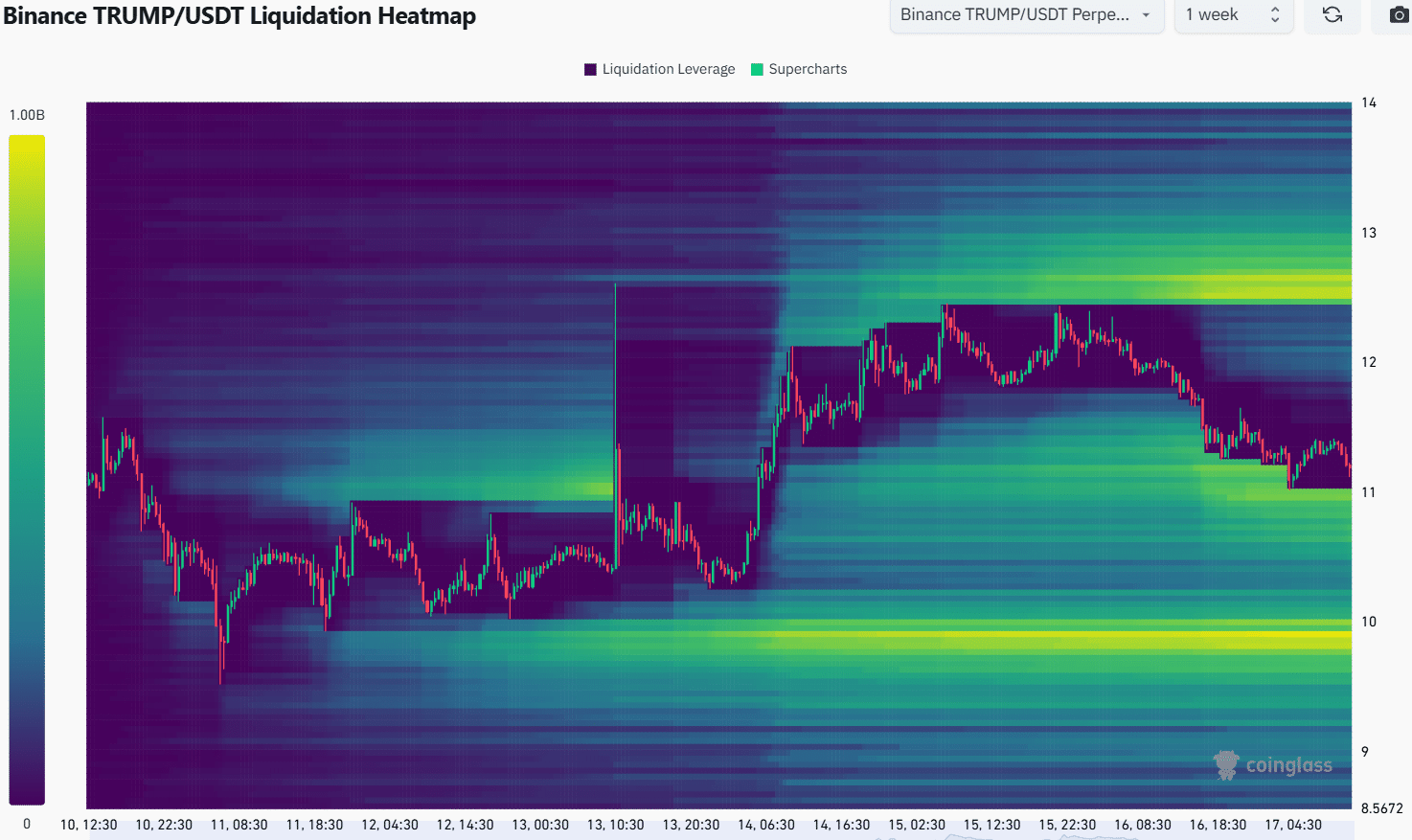

Ah, Mondays! The day when volatility dances like a madman, setting the tone for the week’s price trends. AMBCrypto, in its infinite wisdom, has examined the liquidation heatmaps of Official Trump, seeking to divine the next short-term trends, as if they were prophets of old.

Is TRUMP forming a range below $12.2? Or is it merely a mirage? 🤔

From the depths of despair, we observe the downward move from $13.88 to $9.54 earlier this month. Fibonacci retracement levels, those mystical numbers, have been plotted, revealing that the 61.8% retracement level lies at $12.22, a cruel reminder of what once was.

This level, a fortress of resistance, has stood firm for the past four days, mocking the hopes of the weary traders.

Our memecoin, alas, did not set a convincing higher high, nor did the OBV. Together, they paint a picture of buyers lacking strength, like a feeble character in a Dostoevsky novel, struggling against the weight of existence. The $10.2 level, a beacon of short-term support, may yet be retested, leading to a range formation for our beleaguered Official Trump.

In recent hours, the choppiness index has fallen, hinting that a trend is materializing, while the DMI, in its contradictory wisdom, suggests a strong bullish trend has been in place since the 13th of March. Oh, the irony!

Unless the OBV finds the strength to rise again, the short-term uptrend may remain a mere illusion.

If the $10.2 level is retested in the coming days and cannot be defended as support, the $9.54 and $8.52 levels await like hungry bears, ready to feast on the remains of our hopes.

Liquidity pockets to the south appear to possess a certain strength, as if they were the very essence of despair. The $10.9-$11 and $9.8-$9.9 areas are particularly shaded on the heatmap, reflecting a higher concentration of liquidation levels that could attract prices like moths to a flame.

These are the short-term price targets, dear reader. To the north, the $12.5-$12.7 region could also pull prices, but alas, such a miracle seems unlikely in the short term.

Traders, with bated breath, can wait for a move to $10.9 and $9.9 before evaluating whether a bullish reversal is likely, or if we are merely characters in a tragic farce. 🎭

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-03-17 16:11