- AAVE defies the market trend with a 13% rally, as open interest soars.

- Currently, 68.50% of top traders on Binance hold long positions, while 31.50% hold short positions.

As an experienced analyst with a knack for spotting trends and deciphering market movements, I find myself intrigued by the performance of Aave [AAVE]. In the midst of a turbulent cryptocurrency market, AAVE is defying the odds, rallying by 13% while other major assets falter.

In the midst of the ever-fluctuating market conditions, I’ve noticed an intriguing development – Aave (AAVE) is consistently outpacing the broader market trends. This captivating performance has sparked a growing fascination within the cryptocurrency community, myself included.

Aave defies market trend

Currently, as a crypto investor, I’m witnessing a challenging phase for the broader cryptocurrency market, with heavyweights like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] facing turbulence. However, amidst this struggle, AAVE is making a strong statement, surging by 15%.

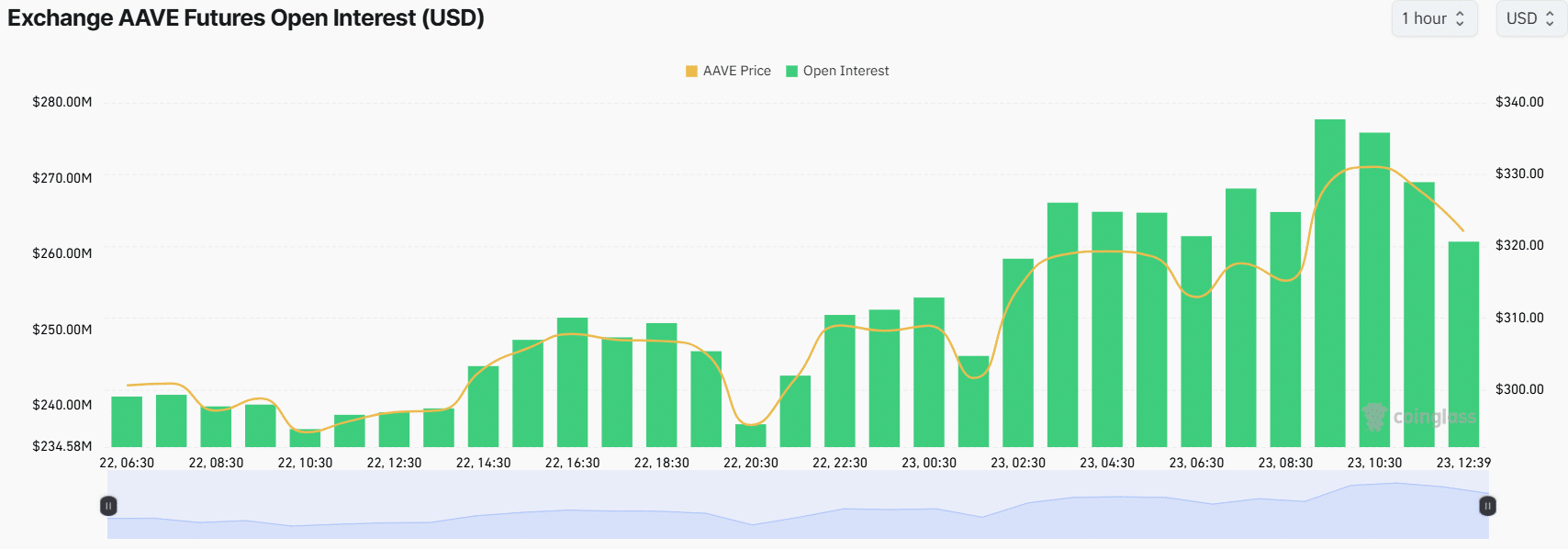

The strong upward trend in the market is fueled globally by increased investor attention, according to reports from Coinglass, a company that specializes in blockchain data analysis.

Based on recent data, there’s been a 15% increase in the number of open positions for AAVE’s futures contracts over the last 24 hours. This growth indicates that traders are actively leveraging the current market atmosphere to establish fresh positions.

68% of traders go long

As a researcher, I’ve been examining various factors influencing the crypto market, and one metric that has caught my attention is the AAVE/USDT long/short ratio on Binance. Currently, this ratio stands at 2.10, suggesting a robust bullish sentiment among traders, implying they are more inclined to bet on rising prices rather than falling ones.

Approximately two out of every three top traders on Binance have taken a long position, compared to about one out of every three who have taken a short position.

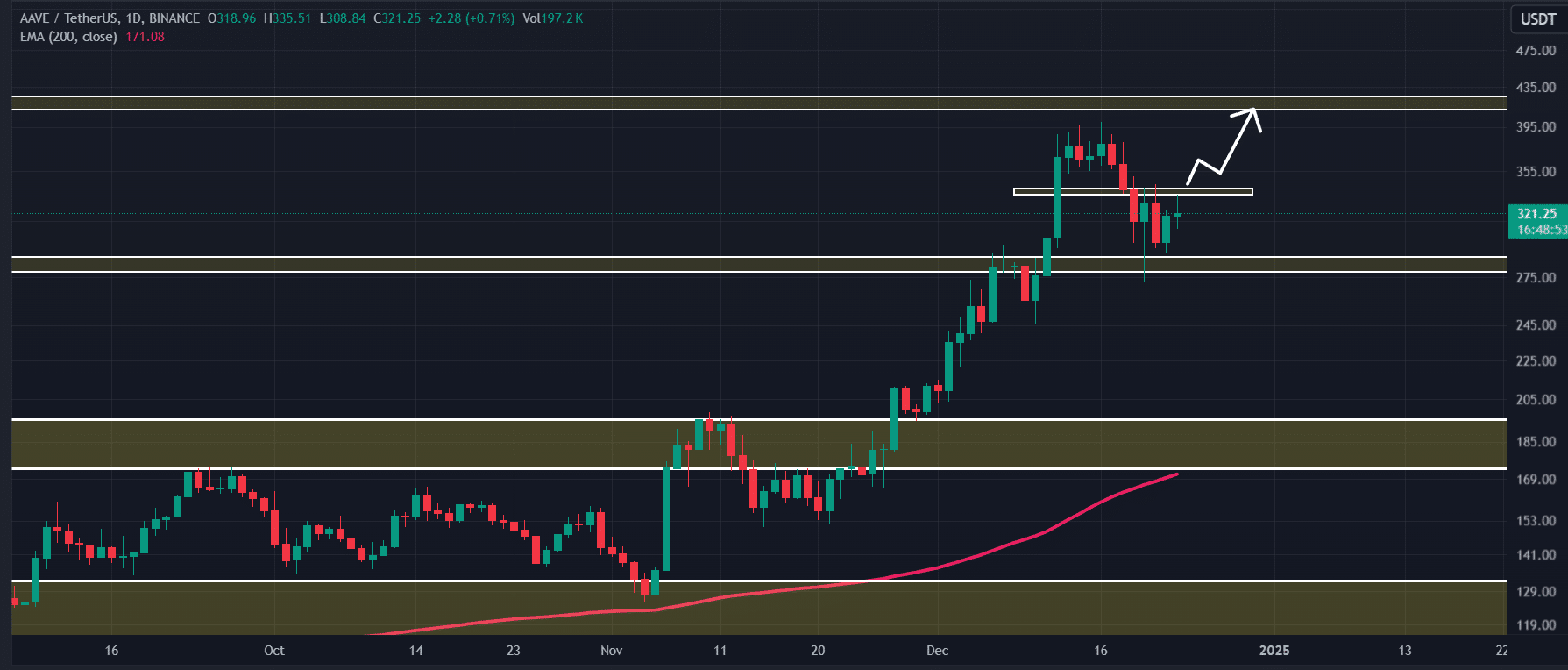

Consequently, the significant increase in AAVE’s participation is linked to a successful retesting of a key resistance level, a feat it hadn’t managed before this breakout. Essentially, AAVE has now established a bullish trend in its price action.

AAVE technical analysis and key levels

Based on AMBCrypto’s technical assessment, the cryptocurrency AAVE exhibits a bullish engulfing pattern at the significant support point of $290. However, it seems to be facing difficulties as it approaches the resistance level of approximately $337.

Given the latest price trends and past performance, if the altcoin finishes its daily chart at a value higher than $340, it’s likely that we might witness an increase of around 25%, potentially pushing the coin up to $415 in the upcoming days.

Besides maintaining a positive trend, the recent drop in AAVE’s price is also seen as a correction, suggesting it may be preparing for an upturn.

Read Aave’s [AAVE] Price Prediction 2024-25

Looking on the optimistic side, the Relative Strength Index (RSI) of AAVE is presently around 57, which is near the zone often considered ‘overbought.’ This suggests that there’s potential for more growth in the altcoin’s upward trajectory.

As I pen these words, AAVE is hovering around $330 in the current market scenario. Interestingly, within the last 24 hours, we’ve witnessed an impressive leap of more than 13% in its price. This surge has been accompanied by a significant uptick in trading volume – up by 15%. Such a spike suggests a heightened interest from traders and investors, who appear to be optimistic about the coin’s future trajectory.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-23 15:03