- Crypto market is crushing at high rates than envisioned.

- Here’s a look at three reasons causing the cryptocurrency market dip.

As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed numerous market cycles and learned to navigate through them with caution and patience. The recent crypto market crash has been particularly noteworthy due to its magnitude and rapidity.

In the past day, we’ve witnessed one of the most significant drops in the cryptocurrency market over the past few months. The fall of Bitcoin‘s [BTC] value from $50,000 to $60,000 has contributed significantly to this substantial downturn in the market.

Amid heightened instability in global financial markets and Bitcoin’s dramatic price swings, alternative cryptocurrencies have suffered the most. According to recent reports by Spectator Index, the cryptocurrency market has experienced roughly $1 billion in liquidations within the last 24 hours.

Traders and analysts are puzzled about what’s behind the significant fall we’ve seen recently. After investigating, AMBCrypto identifies three key factors contributing to the cryptocurrency market downturn over the last 24 hours.

Altcoins decline to high lows

Due to the significant drop in cryptocurrency values recently, many alternative coins (altcoins) have suffered substantial losses, reaching new lows. Over the last week, these altcoins have been affected by pessimistic trends, leading them into a bear market.

In the face of this downward trend, most prominent alternative cryptocurrencies are taking a significant hit. For instance, Ethereum (ETH) was priced at approximately $2326 during the press time, following a 19.85% drop in daily trading and a more substantial 30% decrease over the past week.

Over the past fortnight, I’ve witnessed a significant decline in ETH‘s market capitalization. Just two weeks ago, Ethereum was commanding a market value of an impressive $410 billion. Today, however, that figure has dropped to around $280 billion – a staggering reduction of $127 billion. To put this into perspective, this loss is greater than the total market capitalization of both Solana and Binance Coin (BNB).

Similarly, BNB has fallen by 15% in daily trading and 24% over the past week to currently trade at $446. Additionally, Solana has seen a significant decrease to $121 following a 36% drop in weekly trading and a 14.77% decline in daily trading.

What’s causing the crypto dip?

Three major reasons are pushing crypto markets down.

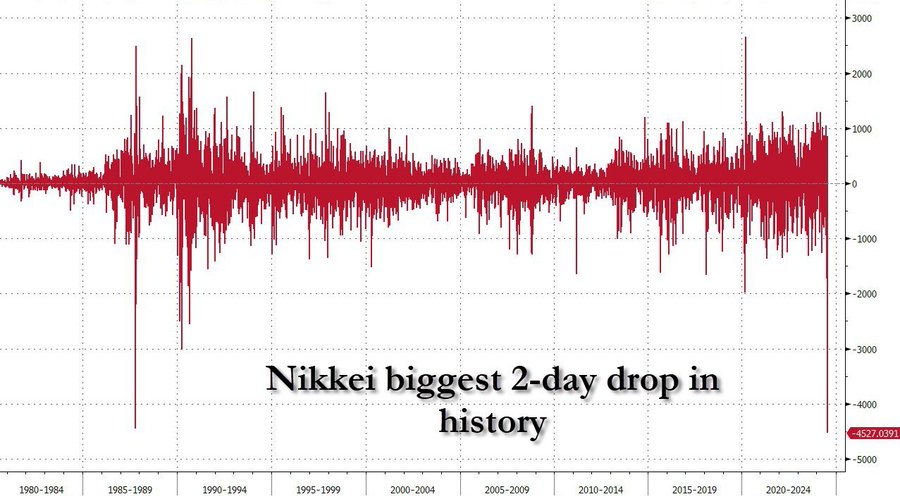

Initially, the dramatic drop in Japan’s stock market has been felt across the broader cryptocurrency sector. In fact, Japan’s stock market has experienced one of its steepest two-day declines in recent times.

Zerohedge states the decline is larger than the Black Monday crash of 1987.

Consequently, trading in the stock market becomes challenging for individuals who bought yen at a low price to amplify their positions, as the yen’s value might increase, causing losses. Adam Khoo highlighted this trend.

“The Japanese stock index Nikkei 225 is dropping significantly, more than 25%, from its peaks down to approximately 30,900. If this level of support remains strong, we might see a decent rebound.”

Consequently, Japan’s stock market has experienced a downturn due to several factors. Initially, the Bank of Japan (BoJ) is raising interest rates with the aim of managing inflation, and it’s predicted that this trend will persist. Additionally, financial expert Adam Khoo has pointed out…

“An increase in the value of the Japanese Yen (JPY) could potentially weaken the competitiveness of large, multinational Japanese companies in export markets, leading to a decrease in their profit margins from foreign sales.”

1. Due to a sell-off in the Japanese market, other markets like Taiwan and South Korea have been impacted as well. It’s also being speculated that the U.S. Federal Reserve will lower interest rates to protect other markets from potential fallout from the Japanese market situation.

Increased geopolitical tensions

As a crypto investor, I’ve noticed that the ongoing geopolitical uncertainties have had a ripple effect on the broader crypto market, leading me to feel a sense of unease and prompting a wave of sell-offs among traders.

Over the past week, escalating conflicts in the Middle East have sparked fears of a larger-scale war breaking out. The assassination of a Hamas leader by Israel and heightened military actions in Lebanon have led to growing apprehension about a full-blown war. Moreover, the U.S. military has dispatched additional forces to the region as a precautionary measure.

Via his webpage, Patrick Bet-David pointed out that geopolitical tension plays a role in shaping market conditions. In other words, he emphasized the impact of regional conflicts on financial markets.

Reports suggest that a secretive underground shelter, believed to be ready for long-term use by top Israeli leaders during conflicts, was constructed by the Shin Bet security agency. This alleged bunker is said to be operational as per reports published by Walla News on Sunday. The disclosure comes amid growing concerns about potential attacks against Israel originating from Hezbollah and Iran.

It’s clear that a potential regional conflict could lead to a downturn in the cryptocurrency markets as well as other financial market sectors.

Market uncertainty

Due to the Federal Reserve not making any interest rate reduction announcements, the financial market has been thrown into a brief state of apprehension. Given that the U.S debt surpassed $35 trillion, the markets have exhibited signs of alarm as concerns escalate about inflation and the Fed’s stance on rate adjustments.

Consequently, the escalating unease in the stock market is sparking speculation that the Federal Reserve might decide to lower interest rates due to the prevailing circumstances.

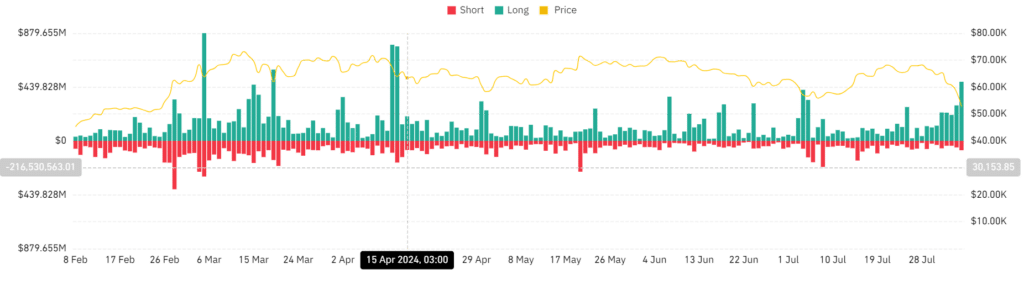

Similarly, a rise in market uncertainty has led to an uptick in cryptocurrency liquidations during the last 24 hours.

Based on data from Coinglass, the total liquidations in the Cryptocurrency market have risen significantly from approximately $269.4 million to $482.5 million on a daily basis. Additional information from Spectator Index indicates that over $1 billion has been liquidated in the crypto markets.

Investors’ doubts about the future of cryptocurrency lead them to abandon paying extra for holding their investments, instead choosing to sell (liquidate) due to uncertainty, resulting in a surge in liquidations.

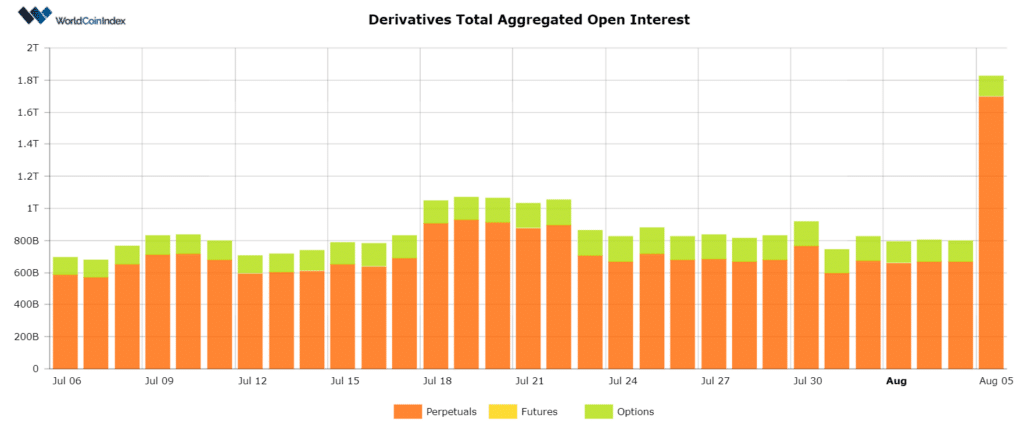

In summary, as per the Worldcoin index, the total value of crypto derivative contracts (open interests) has surged significantly, rising from approximately $667.2 billion to a staggering $1.7 trillion.

As a crypto investor, when I notice that the total value of outstanding derivative contracts (open interest) is increasing while market prices are decreasing, it suggests that new entrants to the market are placing bets predicting further price declines rather than expecting an uptrend.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-08-05 17:12