- MicroStrategy, Mara, and Riot stocks saw a surge in price as BTC hit $107K.

- BTC’s demand from new investors exceeds the March demand at the $70K level by 4%.

As an analyst with over a decade of experience observing financial markets and their dynamics, I find myself increasingly captivated by the burgeoning world of digital assets. The recent surge in Bitcoin‘s price to $107K has sent shockwaves throughout the crypto ecosystem, with notable players like MicroStrategy, Mara, and Riot benefiting significantly.

MicroStrategy significantly expanded its Bitcoin [BTC] portfolio by purchasing a total of 15,350 Bitcoins, with an average cost of approximately $100,300 per coin. This acquisition boosted their overall Bitcoin holdings to around 439,000 coins. The total cost for these purchases was about $27.1 billion, translating to a price of roughly $61,725 per Bitcoin.

The significant build-up in this strategy can be seen in their announced Bitcoin returns, which stand at 46.4% for the recent quarter and 72.4% since the beginning of the year.

As a researcher, I’d like to share an interesting perspective I recently came across from CEO Michael Saylor. He likened the long-term value of digital assets, such as Bitcoin, to the historical valuation of Manhattan Island. In essence, he suggested that just as Manhattan was once considered worthless swampland before its transformation into one of the most valuable real estate locations in the world, Bitcoin may also be undervalued today but could hold immense value in the future due to its potential transformative impact on digital economies.

His advocacy for a Digital Assets Framework and a Bitcoin Strategic Reserve, alongside MicroStrategy’s inclusion in the Nasdaq 100, highlighted their pivotal role in shaping the financial space.

Analyzing through the MSTR method might provide insights into potential directions for corporate investment distribution, as well as the increasing role of digital assets within financial planning frameworks.

Other crypto stocks were up

MARA Holdings’ shares increased by 11% due to Bitcoin reaching a fresh record peak of approximately $107,000.

As I delve into my analysis, I’ve noticed an intriguing correlation between the surge in MARA’s share prices and the performance of crypto-related stocks. This observation underscores the growing interconnectedness between traditional markets and the dynamic world of cryptocurrencies.

MARA financed its purchase of 11,774 Bitcoins using the funds raised from its zero-coupon convertible bond sales. This $1.1 billion deal, where each Bitcoin cost around $96,000, generated a 12.3% return for the quarter and an impressive 47.6% profit so far this year.

Currently, MARA owns approximately 40,435 Bitcoins, which equates to a staggering $3.9 billion in value. This significant Bitcoin holdings could potentially propel the company’s stock price up to around $45.

Furthermore, with the boosted funds from a larger $594 million convertible bond offering, Riot Blockchain invested in 667 Bitcoins, spending approximately $101,135 on average for each one.

By making this strategic decision, Riot’s Bitcoin holdings increased to approximately 17,429 Bitcoins, equivalent to a value of around $1.8 billion. During the course of the year, gains from acquisitions and mining activities boosted the company’s overall financial standing.

As a result, Riot’s Bitcoin Return Per Share was significant, amounting to 36.7% in the current quarter and 37.2% so far this year.

This strategic move clearly shows that Riot Games is well-equipped to capitalize on market trends to boost shareholder returns, underscoring their shrewd approach to navigating the ever-changing world of cryptocurrencies.

Bitcoin demand on the rise

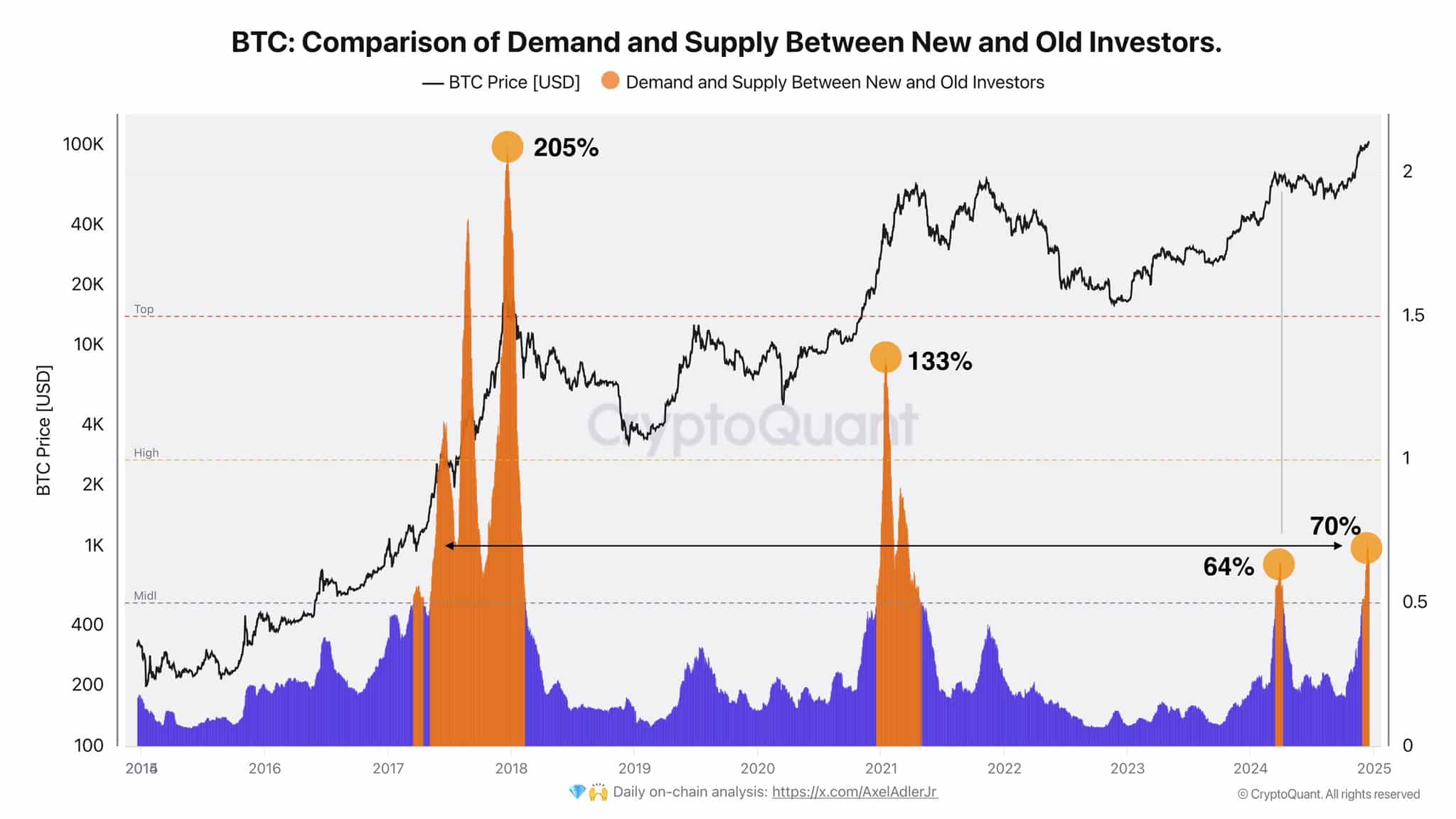

Notably, the latest influx of investment in this cycle surpasses the March high (Bitcoin at $70K) by a modest 4% increase.

While this current demand level is substantial, it’s worth noting that it’s less intense compared to past cycles, where the peak demands reached as high as 205% and 133%. This reduced intensity might be indicative of a change in market dynamics or investor sentiment at these particular price points.

Previously, these peaks have typically signaled major shifts in the market, suggesting that Bitcoin may undergo more substantial fluctuations in value.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In simpler terms, by looking at past trends, we can predict if markets might become volatile or grow, which matches how these markets tend to behave in the future.

Read More

2024-12-17 19:35