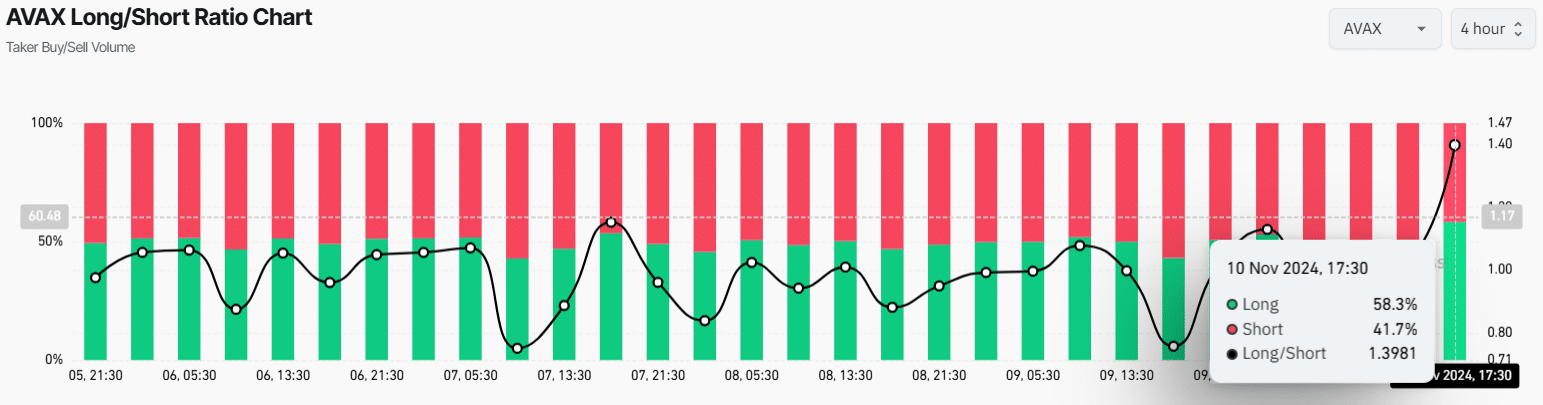

- AVAX’s Long/Short ratio stood at 1.40, suggesting strong bullish sentiment.

- 58.3% of top AVAX traders held long positions at press time, while 41.7% held short positions.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I’ve got to say, the current bullish outlook on Avalanche [AVAX] has me intrigued. With my experience of navigating the volatile crypto landscape, I can confidently say that AVAX’s impressive 40% gain is just the beginning.

In the current optimistic market atmosphere, Avalanche (AVAX) has made a significant leap of approximately 40%, indicating even more substantial growth potential ahead.

As a crypto investor, I’ve noticed that the daily chart of AVAX has been showing quite bullish price movements, indicating a potential golden opportunity for me to invest.

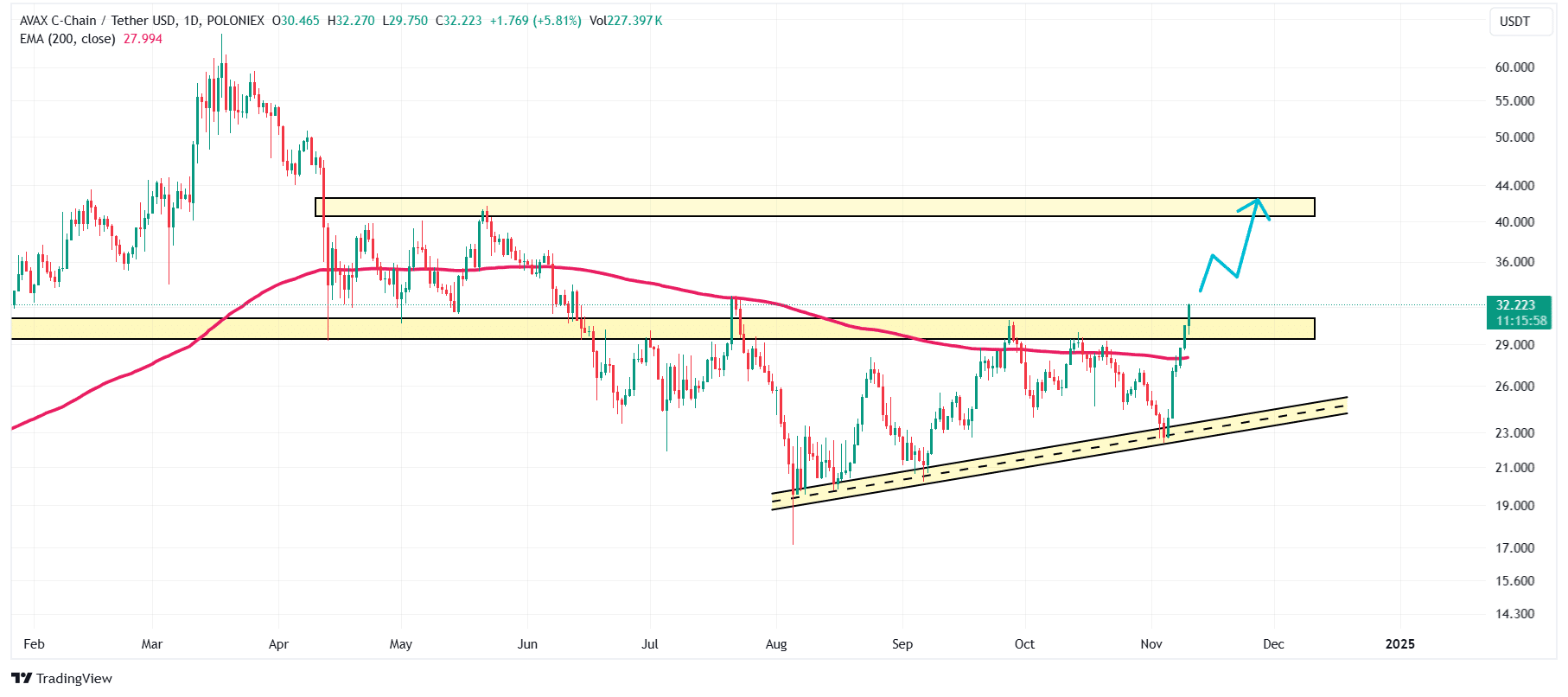

Avalanche technical analysis and key levels

Based on AMBCrypto’s technical assessment, Avalanche (AVAX) has burst through a significant barrier at $30 and appears to be moving towards its next potential resistance point.

As a crypto investor, I’ve noticed that the asset’s value has significantly spiked recently, breaking through the resistance of the 200 Exponential Moving Average (EMA) on the daily chart. This shift in the market trend now indicates a transition from a downtrend to an uptrend, suggesting potential growth opportunities ahead.

If AVAX manages to close its daily trading session at a price higher than $32, there’s a high likelihood that it may surge by approximately 35%, potentially reaching around $42.5 over the next few days.

In light of the present market trends, it seems quite plausible that the asset can effortlessly reach this point without encountering major obstacles.

AVAX is bullish, on-chain

As per data from Coinglass, the Long/Short ratio for Avalanche (AVAX) was 1.40 at the time this text was written. This figure indicates a robust optimism among traders, suggesting they are predominantly betting on the price increase (going long).

Furthermore, there was a significant increase of 13.6% in Open Interest during the last 24 hours, suggesting that traders are actively engaging due to the recent market breakout, demonstrating strong interest.

Currently, as I’m typing this, approximately 58.3% of active AVAX/USDT traders are taking long positions, compared to about 41.7% who are trading with short positions.

It seemed clear that bulls and whales were influencing the market significantly, potentially leading to a strong increase in the near future.

At press time, AVAX was trading near $32.05, having gained over 9.6% in the past 24 hours.

Over that timeframe, its trading activity significantly increased by 26%, suggesting active involvement from both traders and investors, reflecting their optimistic outlook.

Read More

2024-11-11 09:11