- Ah, BERA! The blockchain darling that’s been rising faster than my blood pressure during tax season.

- Traders are throwing their money at BERA like it’s a last-minute Christmas gift. 🎁

In the past 24 hours, Berachain [BERA] has decided to join the party, strutting its stuff with an 11% rise. Who knew blockchain could be so glamorous?

This sudden surge is like a surprise visit from your in-laws—unexpected but somehow exciting, with trading volume hitting a staggering $500 million. 💸

Growth in on-chain activity influences BERA

It seems BERA Chain is experiencing a surge in activity, possibly linked to its recent rally. Or maybe it just had a really good cup of coffee.

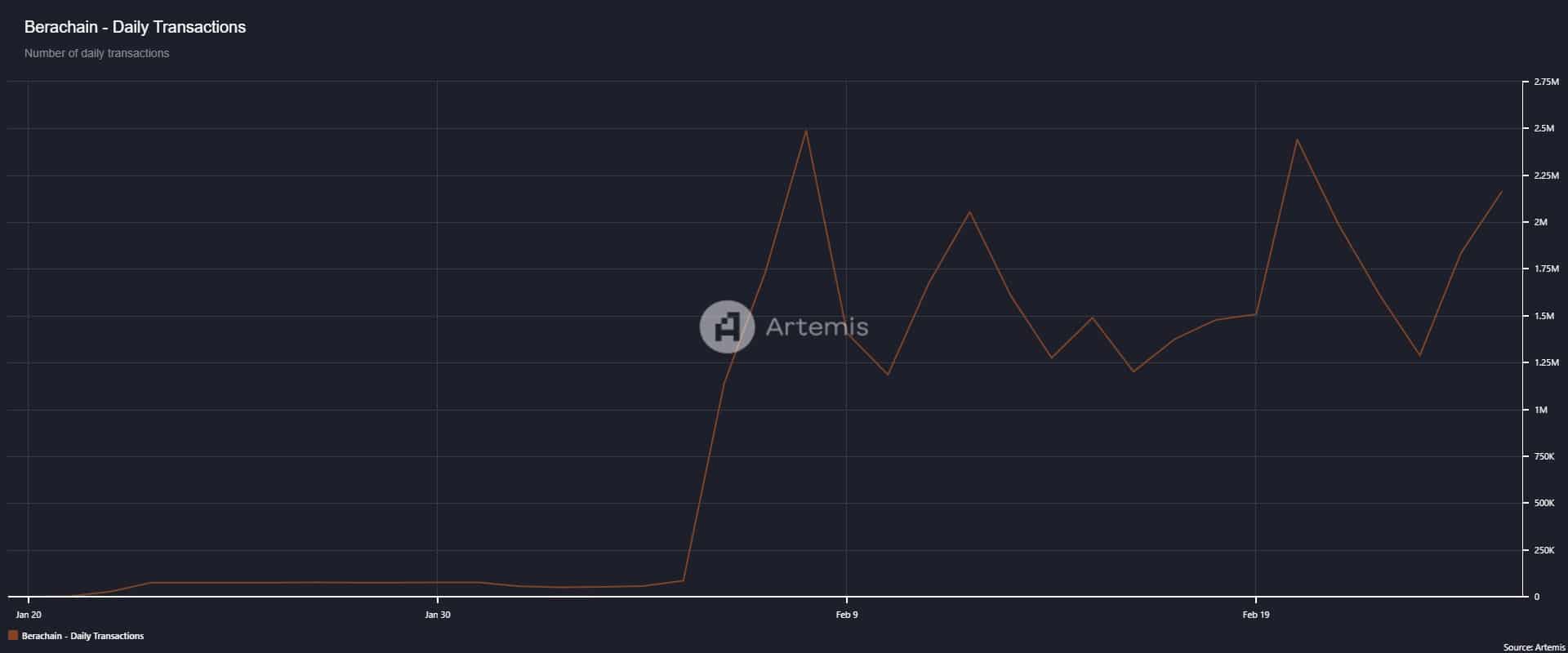

According to Artemis data (not the Greek goddess, but close), daily transactions have climbed significantly.

Daily transactions jumped from a lowly 1.3 million on February 23rd to a jaw-dropping 2.2 million. Talk about a glow-up!

During this wild ride, the number of daily active addresses on BERA reached a new high of 29,600. It’s like a social media influencer gaining followers overnight—everyone wants in!

This uptick in active addresses suggests that confidence in the asset is back, like a boomerang that just won’t quit. Expect more buying activity in the coming weeks!

When transaction and trading activity surge alongside price and volume, it’s usually a sign of strong market momentum. Or a sign that someone’s been watching too many financial thrillers.

A 95% rally could hold

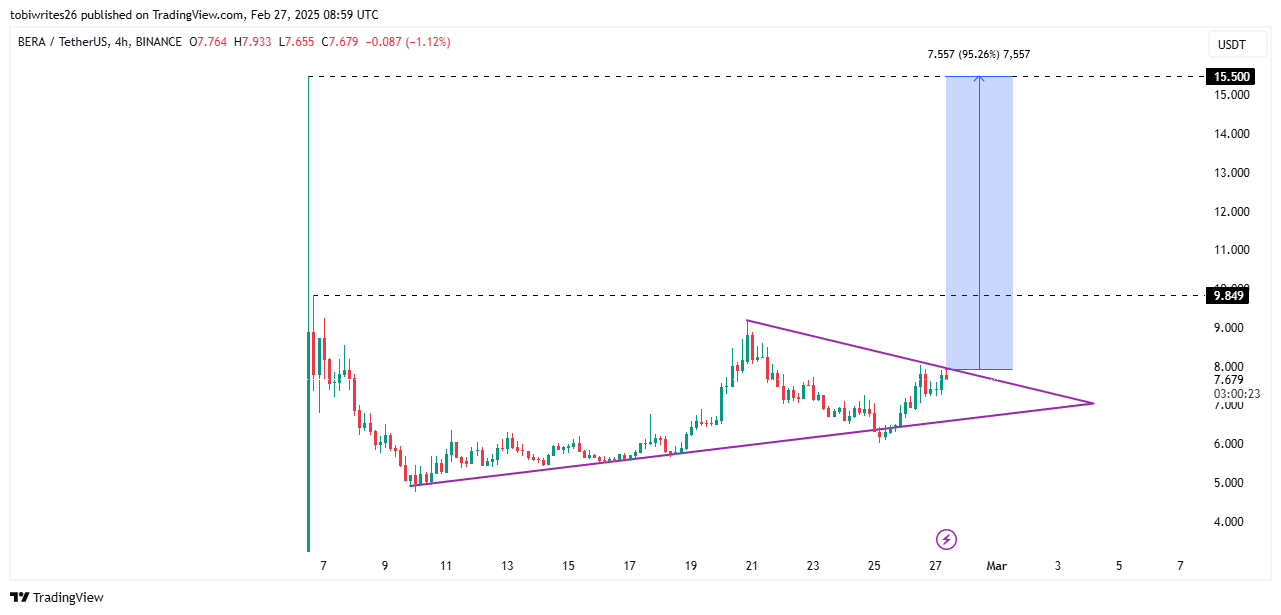

Zooming into the 4-hour timeframe, BERA is trading within a bullish symmetrical triangle pattern. Sounds fancy, right? It’s often a precursor to a market rally, or at least a good dinner conversation.

As I write this, BERA is at the resistance level of this pattern. A successful breakout could trigger a rally, with two key targets: a short-term move to $9.80 and a long-term surge to $15.50. That’s a 95.26% price increase—enough to make anyone’s head spin!

If the breakout attempt fails, BERA might just hunker down within the symmetrical triangle, like a turtle retreating into its shell, while market participants accumulate the asset at a lower cost. Smart move, right?

Speculation surges in BERA

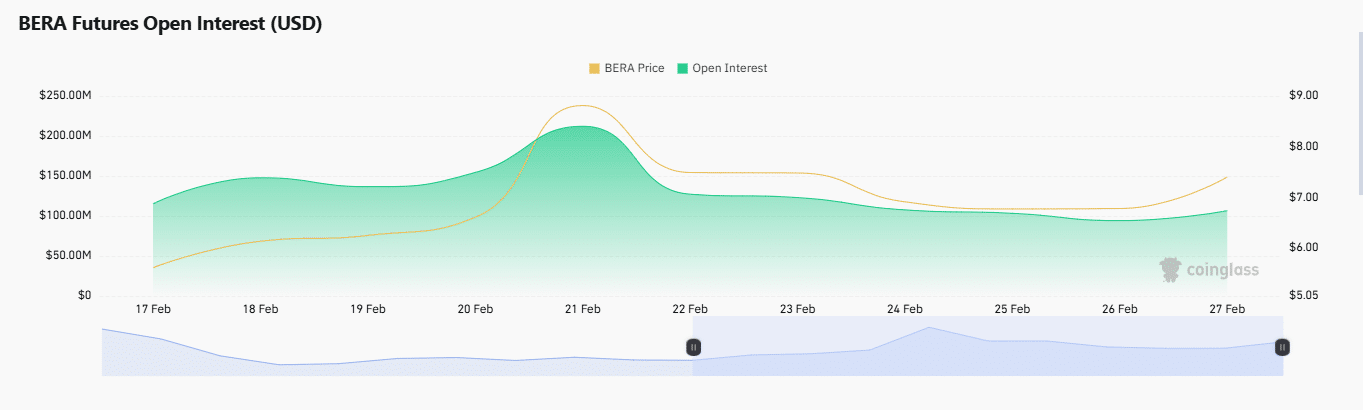

Speculation is rising among derivatives traders, and it’s not just because they’ve had too much caffeine. Both Open Interest and the Long-to-Short ratio are reflecting this trend.

Open Interest is on the rise, with more liquidity entering the market. In the past 24 hours, it has increased by 14.17%, from $94.26 million to $116.95 million—an additional $22.69 million. That’s a lot of zeros!

Also, the Long-to-Short ratio, which measures buying versus selling volume in the derivatives market, confirms this bullish sentiment as it remains above 1. It’s like a party where everyone’s dancing to the same beat!

Continued buying pressure in the derivatives market could help BERA break through the resistance level currently limiting its rally. Fingers crossed! 🤞

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2025-02-28 01:14