- A leverage flush down to $60,000 might trigger an elongated bearish phase.

- The NVT Ratio indicated that Bitcoin was overvalued, but could rally much later.

According to Will Woo, an expert in Bitcoin analysis who focuses on on-chain data, there’s a possibility that the price of Bitcoin could revisit the bear market.

On the platform previously known as X, or X (previously Twitter), Woo expressed that Bitcoin had a significant level of support for short-term holders at $58,900. Furthermore, he suggested that if the price were to drop below this point, many arguments for an upcoming bull market could be weakened or even rendered invalid.

The risk has not left

In addition to noting the significance of the STH support, the analyst pointed out that the Cumulative Volume Delta (CVD) reached its highest point.

The CVD calculates the gap between the demand (buying pressure) and supply (selling pressure) for an asset over a medium to long-term period.

Based on Woo’s assumption that the Cardano (CVD) cryptocurrency had reached its peak, there is a possibility that Bitcoin (BTC) might experience a decline in price. This notion was supported by the analyst’s analysis.

“Longer term: still weeks away from a proper bullish environment.”

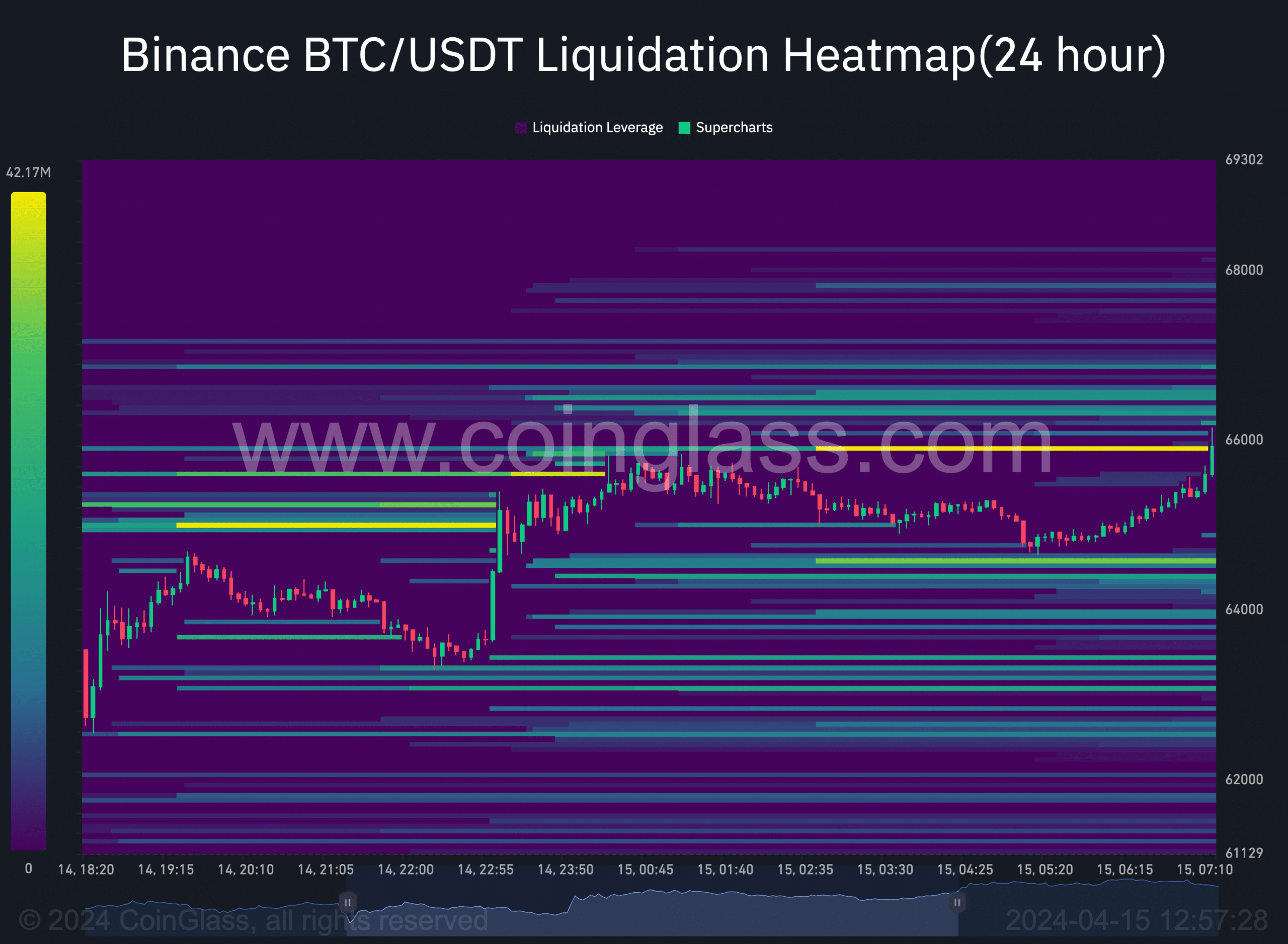

AMBCrypto assessed the accuracy of the analyst’s forecast by examining the liquidation map. This map indicates potential areas for significant market disruptions resulting in large-scale liquidations.

Traders have the ability to pinpoint regions with large numbers of buyers and sellers, acting as significant levels of resistance or support. These areas, rich in activity, are often referred to as “magnetic zones.”

The liquidity heatmap now shows a shift in colors, indicating that the price could be heading in that direction.

Currently, the Bitcoin metric indicates a potential increase in value to around $66,638. This could result in approximately $7.18 million being withdrawn from contract positions.

If Bitcoin decreases in value, the next significant support level is at $64,580. A drop to this level could result in a loss of over $29 million for open positions on Binance alone.

Essentially, for Bitcoin to signal a continuing bear trend, it’s important that long leverage positions are liquidated back down to the $60,000 mark. If this doesn’t occur, there’s a possibility of the coin’s price reaching heights between $72,000 and $75,000 instead.

Stay calm, BTC’s decline is not end

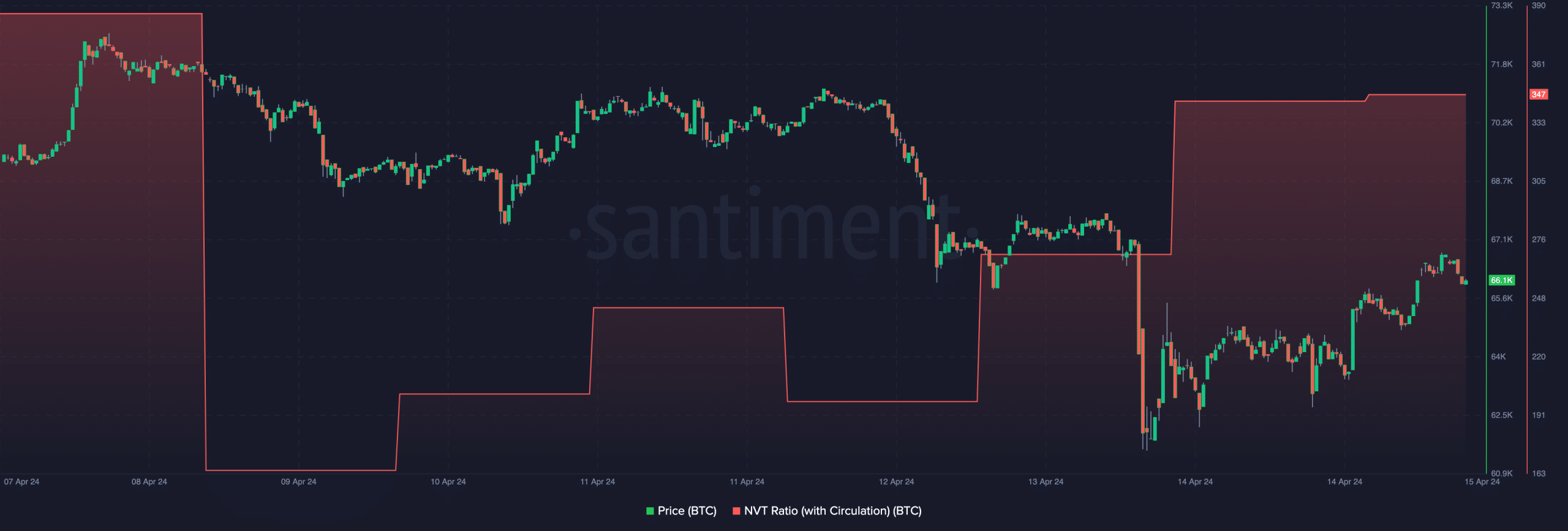

Despite Bitcoin showing signs of a bullish market, the Network Value to Transactions (NVT) ratio suggested that the caution raised by the analyst could be valid.

The NVT ratio serves as a guide for determining if a cryptocurrency is potentially overpriced based on its transaction activity. When this ratio significantly increases, it could be an indication that the cryptocurrency might be more expensive than its actual value in terms of transactions.

An NVT ratio that is lower than average suggests the network is underappreciated by the market. Prices may rise in the near future as investors recognize its true worth.

At present, the NVT ratio for Bitcoin has risen, implying that its current price might be more expensive than what the market situation warrants.

If the reading continues to be high in the near future, Bitcoin’s price may experience another price drop. But just hours afterwards, Woo revealed his optimistic outlook for Bitcoin in the long term.

According to him, the coin might hit $91k this cycle and $650k in the years to come. He concluded,

According to asset manager predictions, the introduction of new Bitcoin ETFs could lead to price targets reaching $91,000 at the bear market’s lowest point and an astounding $650,000 during the bull market’s peak. It is important to note that these figures are considered quite conservative. Once investors fully invest in these ETFs, Bitcoin is expected to surpass gold’s market cap.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-16 08:07