-

Per Hayes, BTC could drop below $50k despite the expected Fed rate cut.

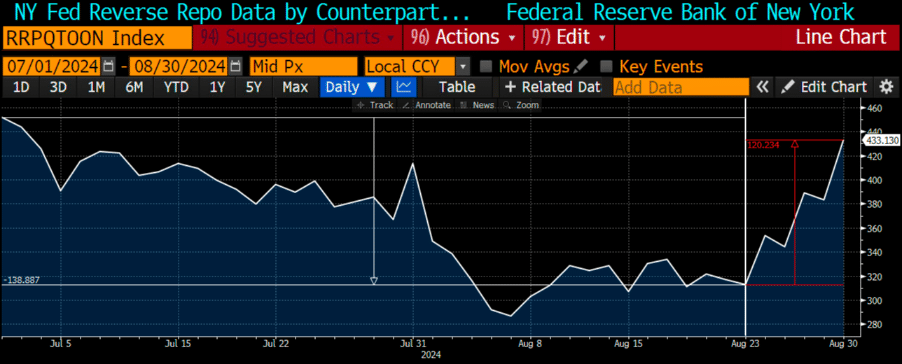

Financial institutions are reportedly parking money into the Fed’s RRP for higher yields instead of risk assets like BTC.

As a researcher following the footsteps of Per Hayes, I find myself standing on the precipice of Bitcoin (BTC) analysis. The recent drop below $56k has left me pondering about its future movements, even after the anticipated Fed rate cuts on September 18th.

In the early days of September, the value of Bitcoin (BTC) has decreased by about 4%, dropping from approximately $59,800 to barely maintaining above $56,000 at the moment of writing. Many market analysts anticipate that potential interest rate cuts by the Federal Reserve in September could serve as a significant factor boosting Bitcoin and other risk-related markets

In simpler terms, Arthur Hayes, co-founder of BitMEX, suggests that despite the anticipated Federal Reserve interest rate cuts on September 18th, the short-term vulnerability might continue to persist

According to Hayes’ recent analysis, Bitcoin (BTC) might see a decrease in value, potentially falling to around $50,000. This could be due to financial institutions shifting their liquidity towards the Fed’s Reverse Repurchase Agreement (RRP) for better returns

‘In other words, RRP balances are expected to keep increasing. As for Bitcoin, it might fluctuate near these values or, at its worst, gradually drop towards $50,000.’

The Federal Reserve’s Repurchase Agreement (RRP) is an essential instrument for shaping their monetary policy, particularly in managing the money supply (liquidity) and short-term interest rates. An increase in RRP would restrict U.S. liquidity, while a decrease would do the opposite

Macro uncertainty for BTC?

Initially, Hayes had projected that the US could increase treasury bills (T-bill) issuance, worth over $300 billion, injecting the needed liquidity and boosting BTC. However, he recently noted a hike in RRP compared to T-bill issuance, which is a net negative for US liquidity.

If the Federal Reserve decides not to lower interest rates prior to their September meeting, I anticipate that Treasury bill yields will continue to remain significantly lower compared to the Reserve Repurchase Agreement (RRP) rate

In this scenario, it could be expressed more casually as follows: “For context, BTC (Bitcoin) seems to have a positive relationship with U.S. (United States’) liquidity. Therefore, the ongoing liquidity squeeze might not bode well for digital assets in the near future.”

In simpler terms, the executive mentioned that his pessimistic Bitcoin view is short-term, suggesting this weakness could present as an opportunity for purchasing

My changing perspective leaves me poised above the ‘Buy’ button, indicating that I’m not currently selling cryptocurrency due to a temporary bearish outlook in the short term

Apart from the historical weakness in September for Bitcoin (BTC), it’s worth noting a potential caution on the macro front. Nevertheless, as suggested by QCP Capital, the crypto market could witness a significant recovery in October

‘When it comes to Bitcoin (BTC), October tends to be particularly favorable, as it’s historically seen strong bullish trends. In fact, over the past nine Octobers, BTC has demonstrated positive returns in eight of them, with an average increase of 22.9%.’

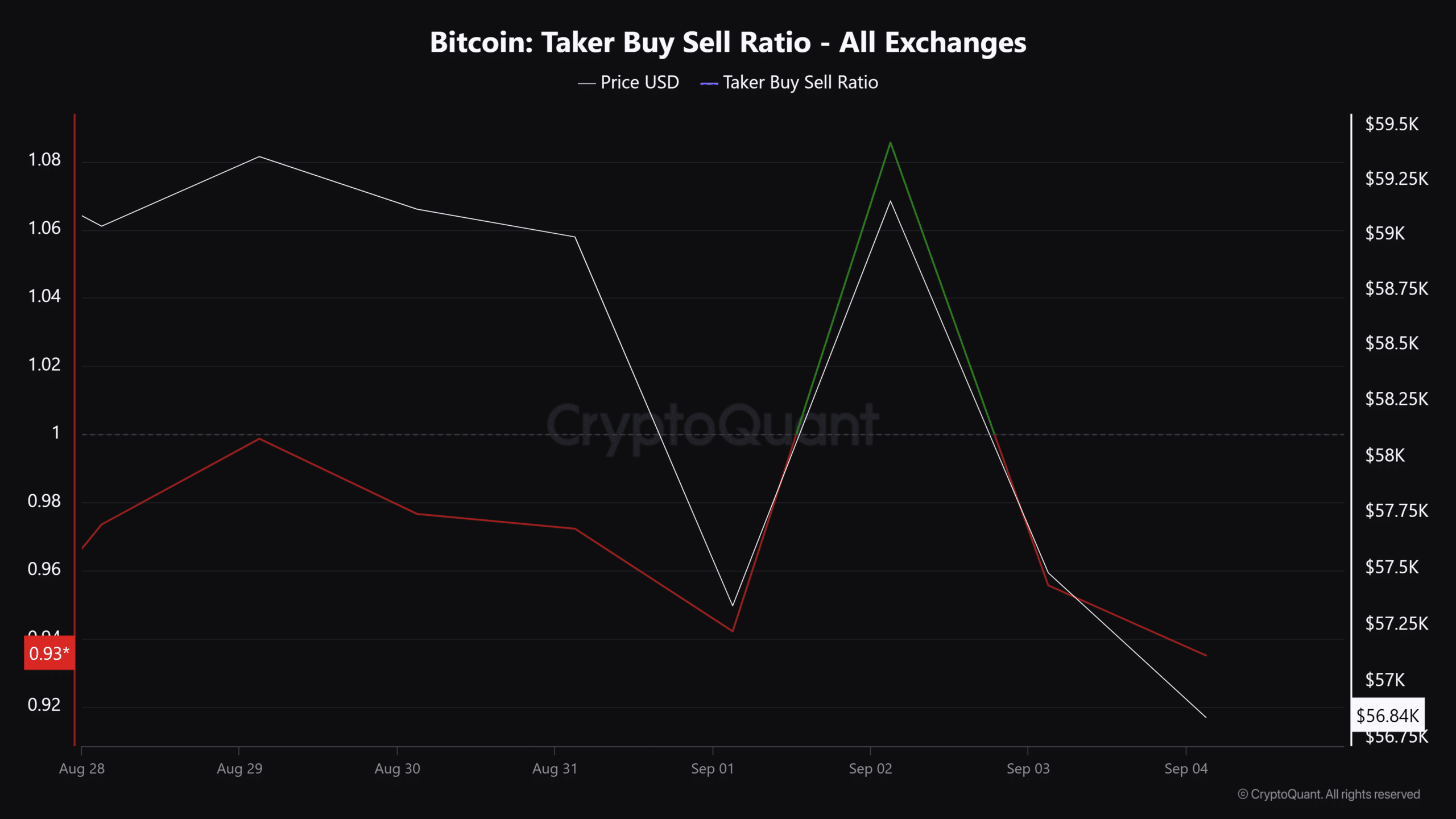

Currently, the Crypto Fear & Greed Index stands at 27, indicating ‘fear’ at this moment. Similarly, the derivatives market shows a strong sense of pessimism, as indicated by the Negative Taker Buy Sell Ratio

The reading meant seller volume dominated buyers, illustrating that weak sentiment prevailed.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-09-04 16:12