-

Bitcoin could surge above its 4-month-long price range in September.

There has been increasing $100K per BTC calls by December 2024, per QCP Capital.

As a seasoned researcher with extensive experience in cryptocurrency markets and economic trends, I have closely monitored Bitcoin’s price action and underlying fundamentals for several years. Based on my analysis, I believe that Bitcoin could surge above its 4-month-long price range in September.

Despite significant declines in U.S. equity markets, Bitcoin’s price has shown remarkable strength and stayed above the $60,000 mark this week.

In the second half of 2024, favorable conditions may emerge, potentially pushing Bitcoin (BTC) to a new record high. BTC has been trading between $60,000 and $71,000 since March, but this period of sideways movement might soon come to an end.

Is BTC ready to surge above the 4-month range?

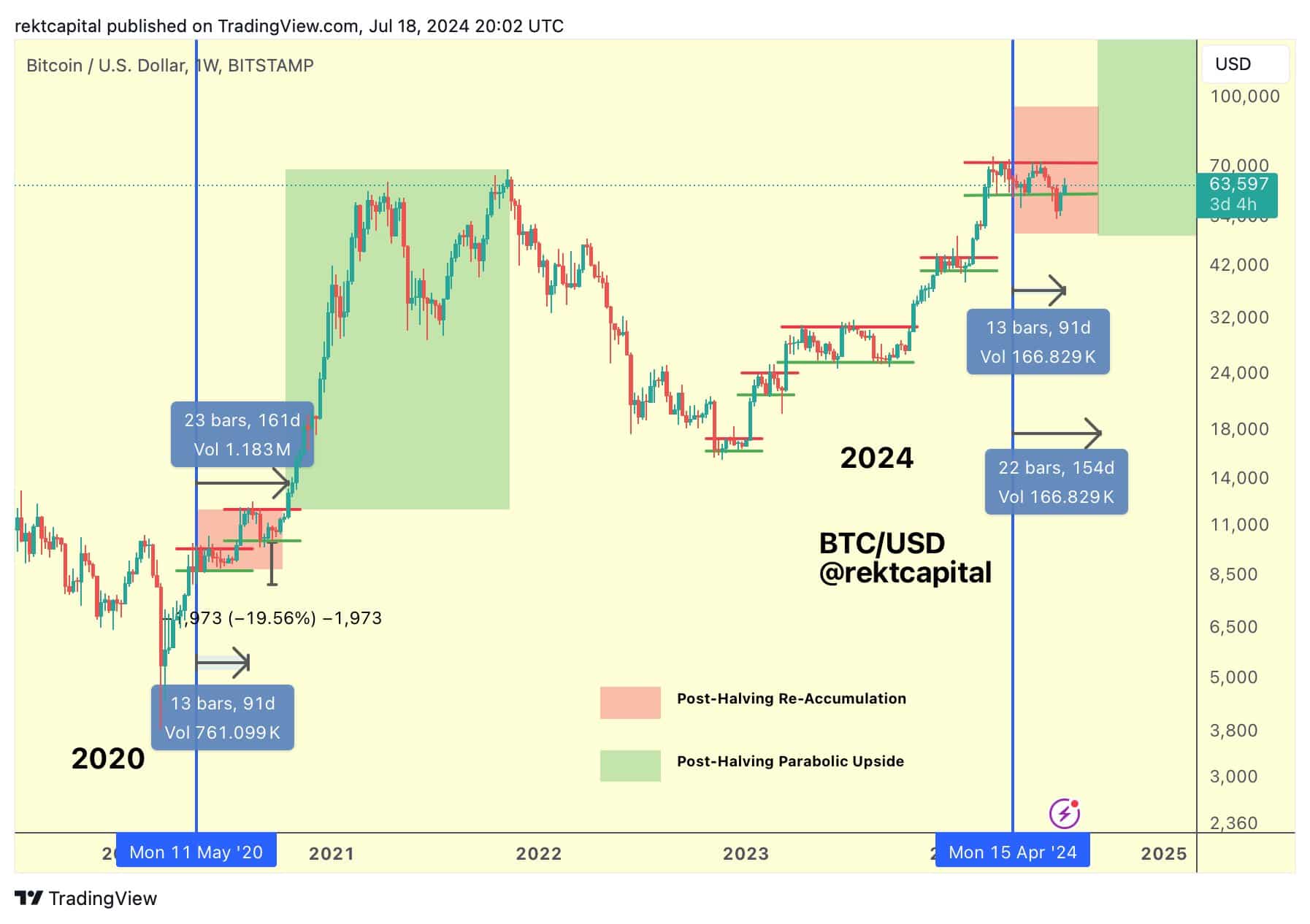

Based on historical trends analyzed by market expert Rekt Capital, there was a strong possibility of Bitcoin surpassing the price range between $60,000 and $71,000 around September.

Based on historical patterns, it is possible that Bitcoin will experience a significant price increase and break out of its current re-accumulation range around September 2024.

Based on historical trends following a halving event, the sideways price action may conclude around September.

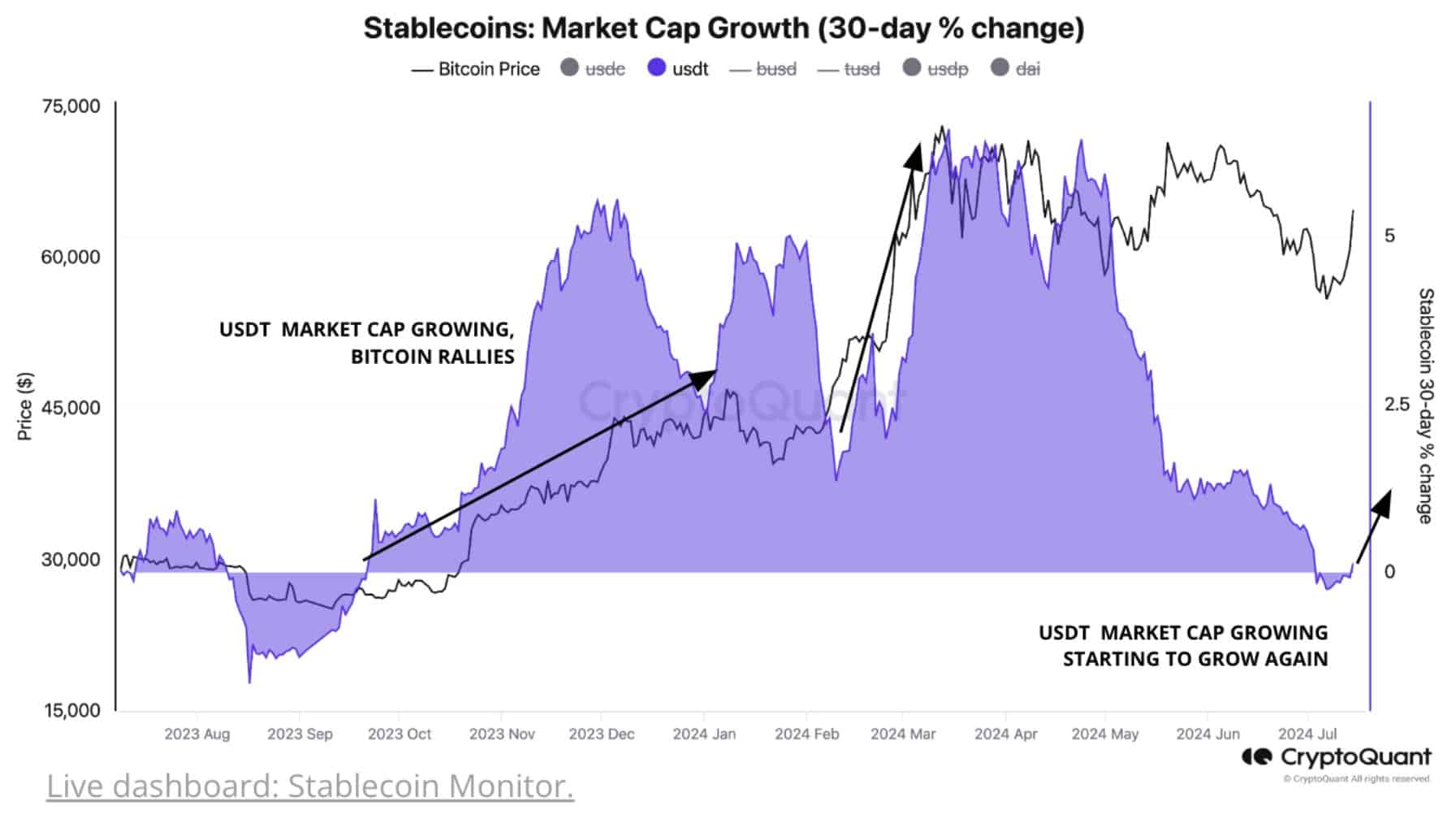

A notable increase in the expansion of stablecoins, which saw a substantial decline in the first half of 2024, bolstered the potential for a bullish market rally.

The flow of stablecoins into crypto markets has turned positive once more. Historically, this trend has been associated with Bitcoin price surges.

With the increasing development of stablecoins, investors gained the opportunity to prepare for purchases as the market mood became more favorable.

As an analyst, I’ve been closely monitoring the Federal Reserve’s upcoming decision. While over 90% of interest rate traders anticipate no change in rates during the end-of-July meeting, the situation shifts dramatically come September. The odds of a rate cut then stood at a substantial 93%.

Reducing interest rates might stimulate the growth of Bitcoin. Additionally, Bitcoin’s price could surge further if Donald Trump, known for his supportive stance on cryptocurrencies, secures victory in the upcoming US presidential elections in November.

However, a September rate cut was not that obvious.

As a researcher examining economic news, I came across a Bloomberg report indicating that prior to November, then-President Trump cautioned Federal Reserve Chair Jerome Powell against reducing interest rates. This warning was presumably intended to prevent Democratic nominee Joe Biden from potentially benefiting from such monetary policy moves during the 2020 election campaign.

“It would be prudent for the Federal Reserve to hold off on lowering interest rates until after the November election, in order to avoid potentially benefiting the economy and President-elect Biden unfairly.”

It remains to be seen whether Powell will take the warning seriously and dent market expectations.

Despite the market’s determined price movements, analysts at QCP Capital maintained a bullish outlook, predicting Bitcoin prices could hit $100,000 by year-end.

Despite a decrease in the price at the close, there was substantial institutional buying of December $100,000 call options. This suggests a firm belief among large investors that the market will experience a significant rally by the end of the year, with the likelihood of a Trump victory further bolstering this conviction.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-07-20 04:07