- Bitcoin sentiment spikes with ETF inflows, but analysts warn of a bearish head and shoulders pattern.

- Market corrections follow Bitcoin’s bullish sentiment, with the MVRV ratio showing balanced market conditions.

As a seasoned crypto investor with a decade-long journey through the digital asset world, I find myself standing at the precipice of both optimism and caution. The recent surge in sentiment and ETF inflows has undeniably sparked my interest, yet the bearish head and shoulders pattern leaves me slightly apprehensive.

After a time of growing optimism, the price of Bitcoin (BTC) has seen a downturn, reflecting a market adjustment.

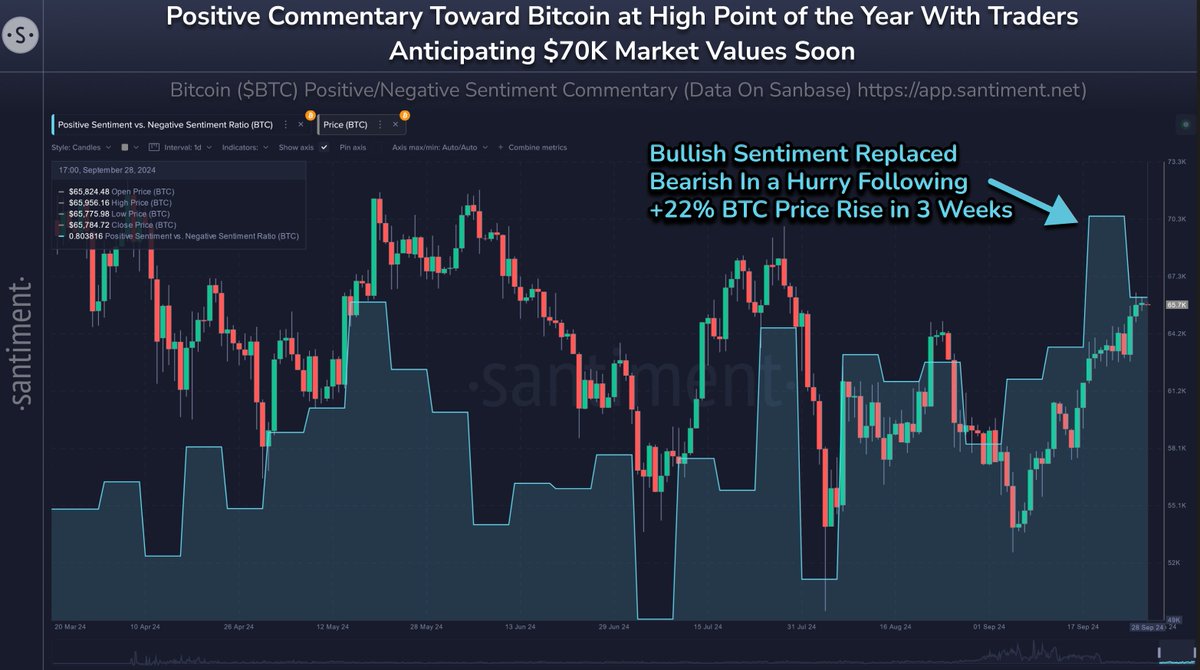

As a researcher delving into the cryptocurrency realm, I’ve observed an interesting trend: according to the insights provided by the market intelligence platform, Santiment, the collective enthusiasm towards Bitcoin appears to be on a consistent upward trajectory. The data suggests a significant shift in sentiment, hinting at increasing optimism among the crowd.

While this positive perspective is common, it has sparked worries about a possible market peak that historically triggers price adjustments within the realm of cryptocurrencies.

Bitcoin’s price retraced from $65,664 to $63,243 on Monday, triggered by some panic selling.

Santiment advises that should the present excitement about missing out (FOMO) evolve into worry, uncertainty, and skepticism (FUD), Bitcoin’s market may see increased volatility.

According to Santiment, there’s often a trend in the market where it goes against the popular belief, suggesting that this corrective phase might persist further.

Rising sentiment and ETF inflows

According to Santiment’s analysis from last Friday, there appears to be an increasing level of trust among Bitcoin traders, as a result of a significant 22% increase in its price over the previous three weeks.

The sentiment ratio, which tracks the balance between bullish and bearish posts about Bitcoin, revealed a significant rise in optimism, with 1.8 bullish posts for every bearish post.

Although it appears to convey a favorable attitude, Santiment cautions that an overabundance of confidence can lead to market declines, as traders might become unduly optimistic.

Concurrently, there has been a significant increase in investments into Bitcoin-based exchange-traded funds (ETFs). As per reports from Lookonchain on the 30th of September, these Bitcoin ETFs received approximately 7,111 Bitcoins in total deposits.

This equated to approximately $453.42 million.

About 3,085 Bitcoin, equivalent to approximately $196.71 million, was contributed by ARK21Shares, significantly increasing their total Bitcoin holdings to almost 50,684 Bitcoin.

These institutional investments occur while investors watch for the U.S. Securities and Exchange Commission’s (SEC) verdict on currently pending requests for traditional Bitcoin Exchange-Traded Funds (ETFs).

The anticipation of potential ETF approvals has likely contributed to the growing interest from institutions.

Moderation in the market

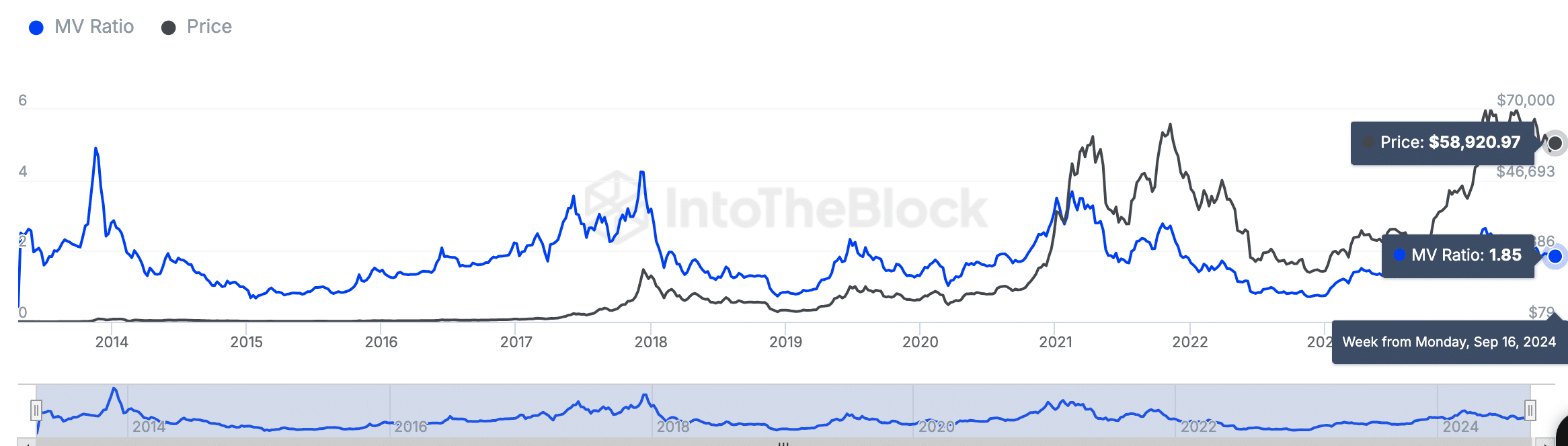

The MVRV ratio, which compares Bitcoin’s market value to its realized value, currently stands at 1.85. This suggests that Bitcoin is trading above its realized value, but is not in an overheated or undervalued state.

Previously, when the MVRV ratio surpassed 3.5, it often indicated peak Bitcoin prices, as seen in the bull markets of 2013, 2017, and 2021. After these instances, significant declines and bear market stages followed.

When the MVRV (Money-Value-Realized) ratio drops below 1, it usually means that Bitcoin’s current market price is lower than its actual worth based on the amount investors originally paid for their holdings. This situation can frequently signal potential investment opportunities.

At a press time ratio of 1.85, it indicated that the market was at an equilibrium, showing signs of either further adjustment or growth, contingent upon upcoming changes in public opinion.

Bearish technical pattern adds to uncertainty

Enhancing the existing apprehension, a fresh analysis from AMBCrypto has brought forth reservations expressed by a well-known cryptocurrency expert called Ash Crypto.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The analyst highlighted a prolonged bearish “head and shoulders” formation on the Bitcoin graph, which has been taking shape since the year 2021, suggesting a downward trend.

As the cost of the coin gets close to the line that acts as its potential base (neckline support) in this pattern, not maintaining this support might lead to a significant decrease in its price.

Read More

2024-10-02 01:12