- Bitcoin consolidated at $68K, possibly needing to touch $65K before aiming for its all-time high.

- On-chain metrics and bullish trader activity show stabilization, with potential for a surge post-consolidation.

As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market fluctuations and trends. Based on the current Bitcoin scenario, I believe that consolidation at the $68K level is necessary before aiming for new all-time highs.

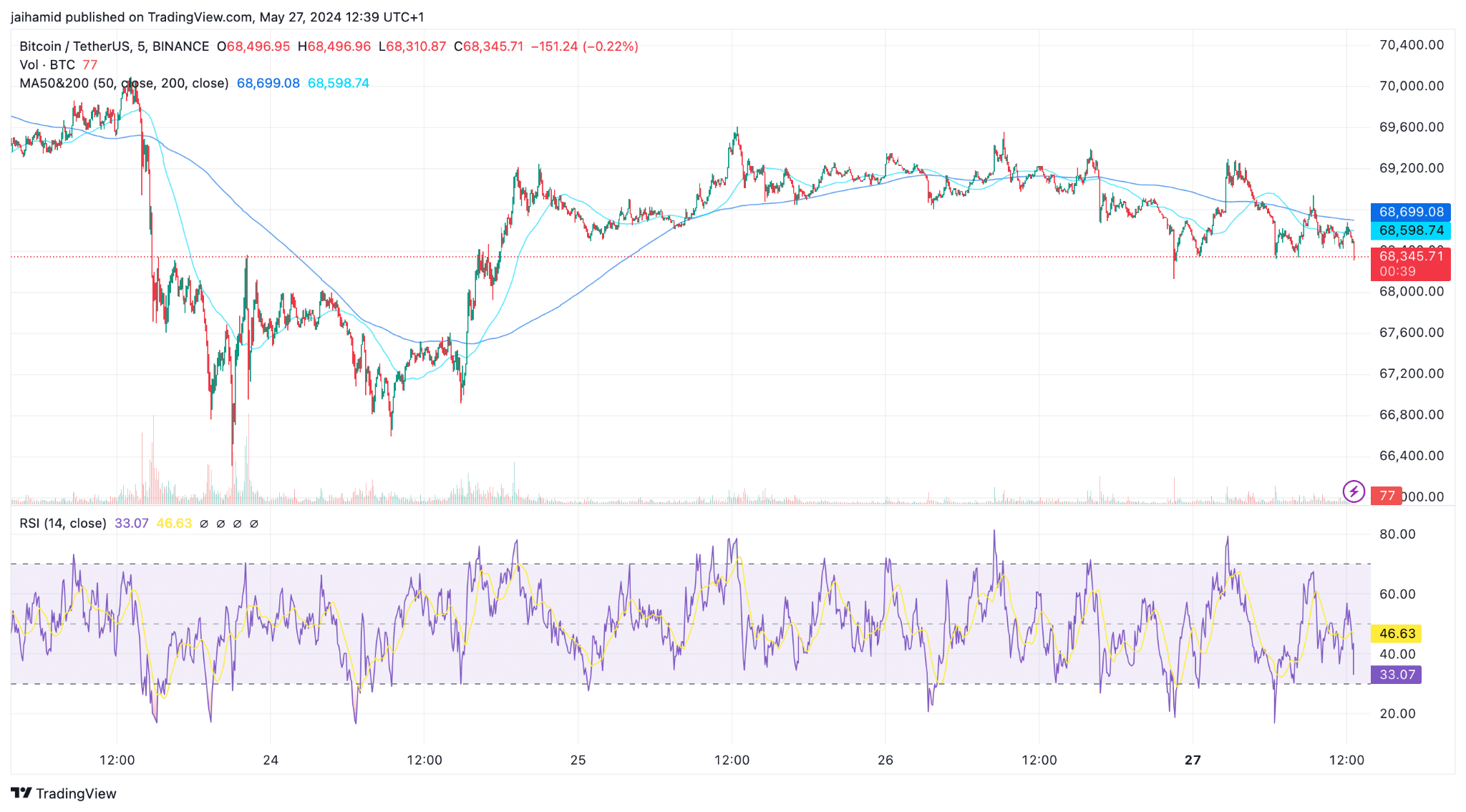

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin [BTC] has entered a phase of consolidation following its peak at $70,000 last week. This consolidation can be attributed in part to the excitement surrounding the Ethereum [ETH] ETF approval. However, with indications of a potential market slowdown, it seems Bitcoin may continue to consolidate before attempting another run towards its all-time high.

On-chain metrics and investor behavior

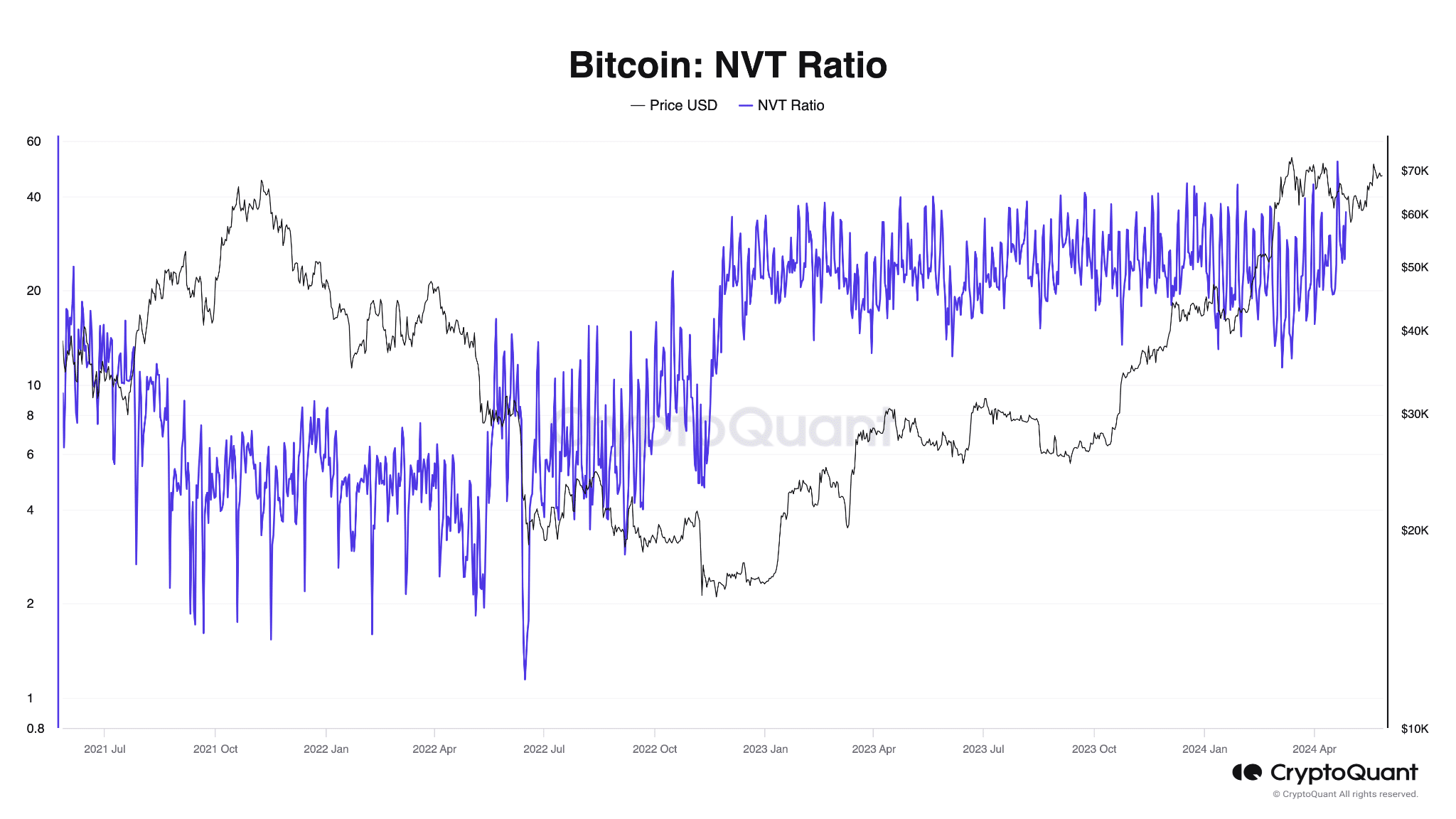

At present, the NVT ratio seems high, implying that Bitcoin’s current price might be slightly inflated relative to the level of economic activity taking place on its blockchain.

When there’s a disparity between prices and trading activity, the market typically responds by bringing them closer together in an effort to restore balance.

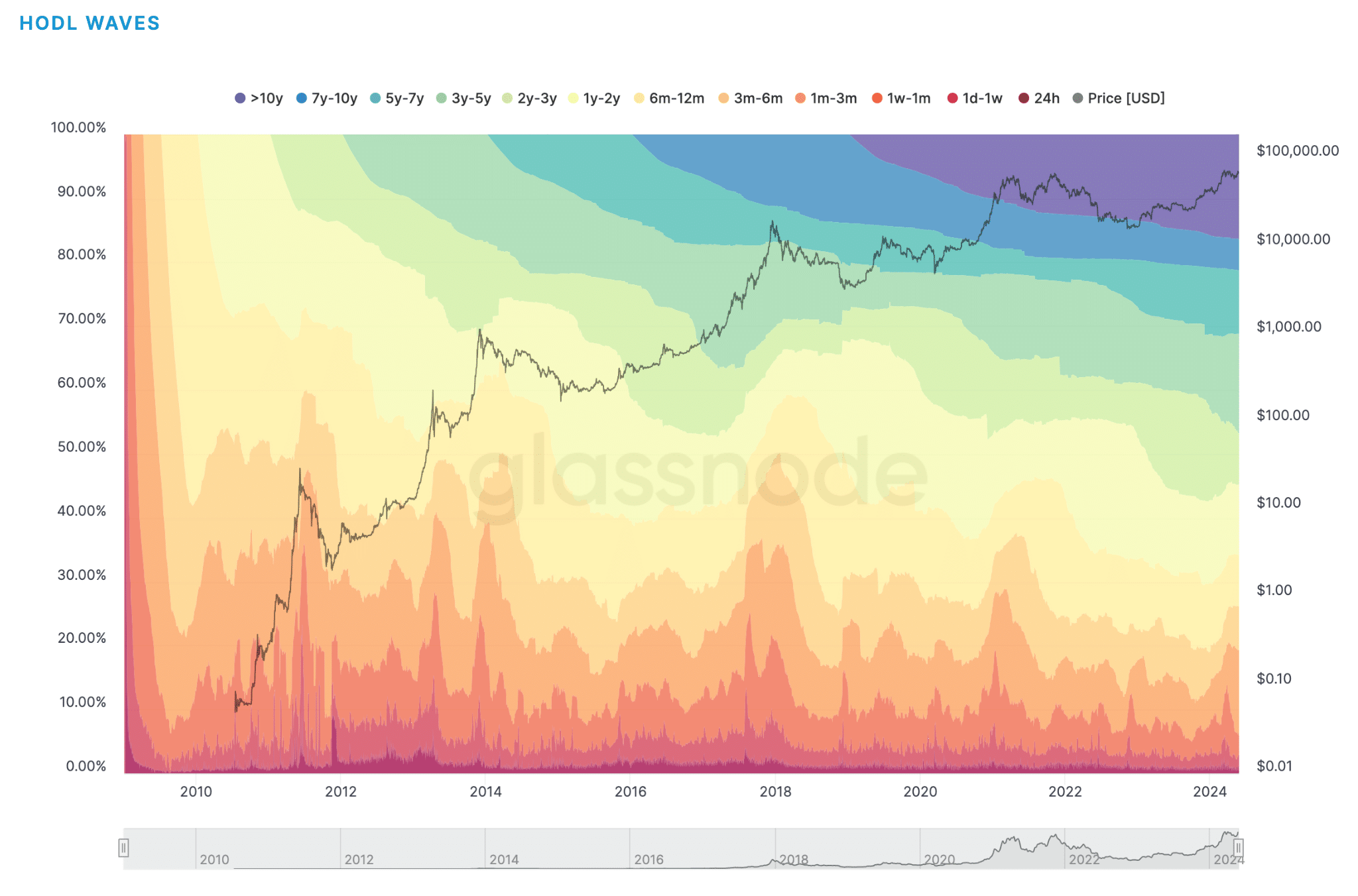

The HODL waves graph indicated a long-standing trend of Bitcoin owners keeping their investments, signaling that the cryptocurrency’s price would likely remain stable during this stage as investors waited for increased value before making any significant moves.

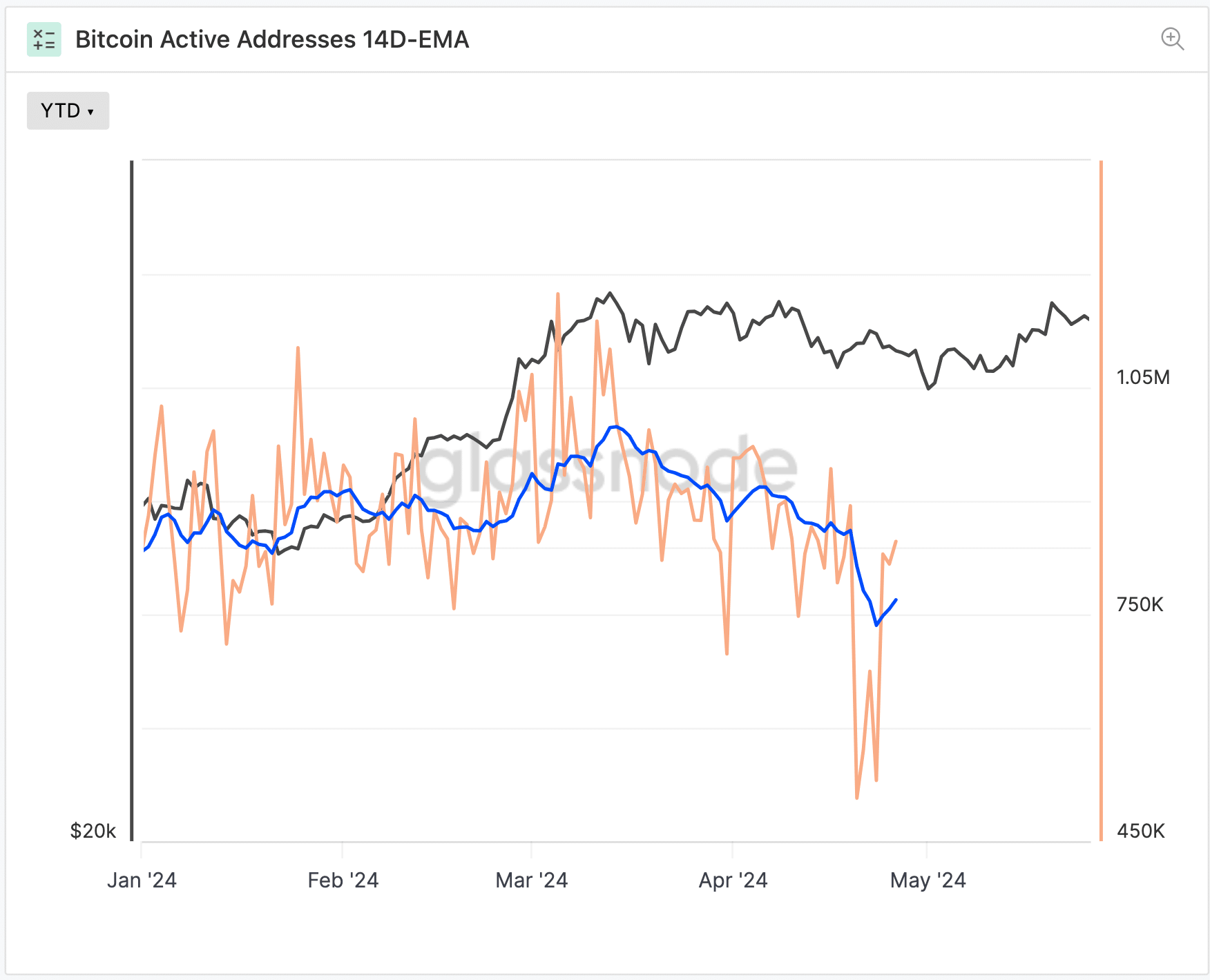

Although the number of active Bitcoin addresses has decreased, the value of each bitcoin coin hasn’t fluctuated significantly, implying a period of consolidation during which price movements aren’t greatly influenced by shifts in user activity. Historically, this stage tends to be followed by a bull market.

Technical analysis and resistance levels

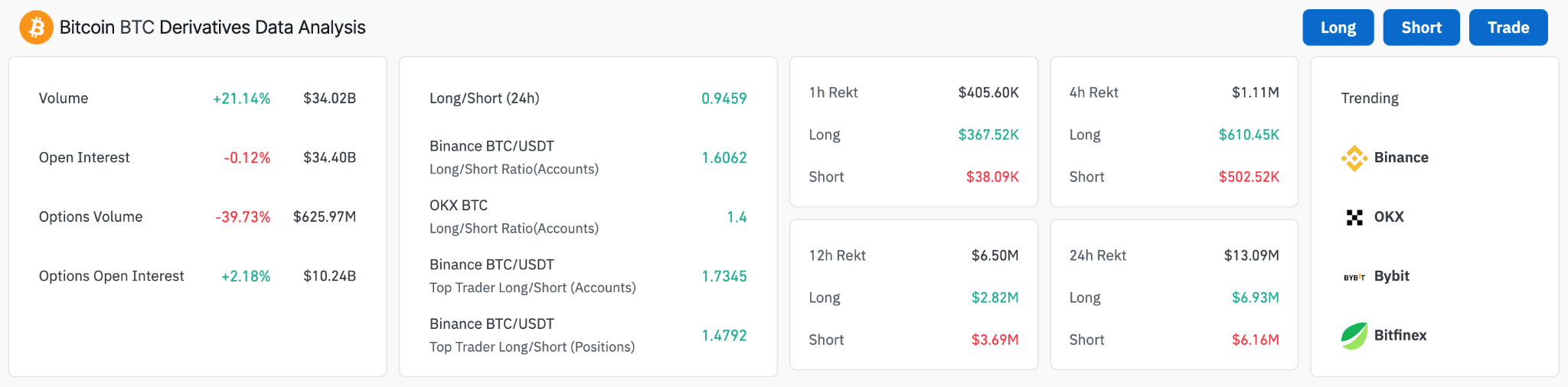

The trading volume of Bitcoin has risen by 21.14%, which is a significant surge, reflecting heightened trader activity and a robust bullish attitude. Yet, a modest drop of 0.12% in open interest implies some uncertainty or apprehension among traders.

In the options market, there’s a noticeable discrepancy between the decrease in trading activity, which was 39.73% lower, and the slight uptick in open positions, which rose by 2.18%.

Across prominent trading platforms such as Binance and OKX, the prevalence of longer hold positions over shorter ones in the major asset markets is indicative of a bullish sentiment amongst traders.

In simpler terms, the greater profits from holding long positions in the short term come with a warning of possible market instability and price fluctuations that may impact investor confidence in the future.

As a crypto investor, if the price falls below the $66,800 mark, I believe we could see a pullback towards $65,000. However, this potential drop may serve as a solid foundation for the upcoming price surge.

With a RSI reading of approximately 46, the market isn’t showing signs of being either overbought or oversold. This condition supports the ongoing consolidation phase.

If Bitcoin manages to surpass the $70,000 threshold, it’s likely that it will strive to touch its peak price of approximately $73,800.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-05-28 14:15