-

Experts have outlined several factors indicating BTC’s potential for a long-term rally.

Prevailing data suggest an imminent drop in price before any upward movement.

As someone who has closely followed and traded Bitcoin since its early days, I have witnessed firsthand its incredible resilience and potential for growth amidst market volatility. While the current short-term data suggests a possible drop, I remain cautiously optimistic based on long-term analyst predictions.

After a dip down to around $58,000, Bitcoin (BTC) has experienced a 1.33% decrease in value over the last four weeks. At this point, short-term projections indicate that it may continue to fall as trades unfold.

Regardless of these ups and downs, certain experts continue to be hopeful, considering the present dip as just a temporary obstacle. They hold onto an optimistic viewpoint about the future of cryptocurrencies in general.

Bitcoin shows promising long-term potential

Mister Crypto’s analysis indicates that Bitcoin is presently developing a bullish pennant formation, much like it did in the year 2023, which was followed by another record peak.

Should this trend continue, it’s expected that Bitcoin could see a significant increase, possibly reaching a fresh record high.

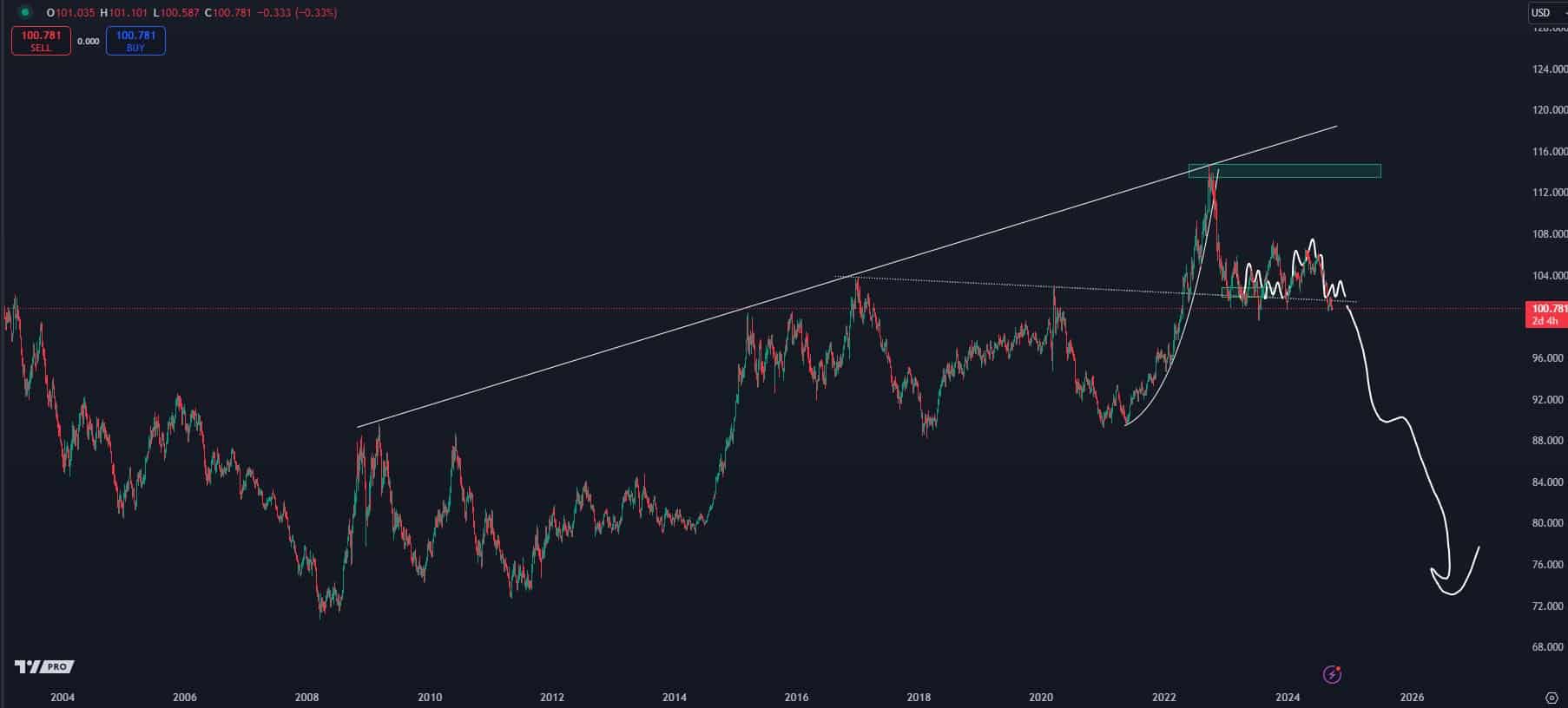

Analyst Crypto Kaleo, who’s been observing Bitcoin’s fluctuations in relation to the U.S. Dollar Index (DXY) for approximately 19 months, pointed out that the relationship has remained steady. The DXY graph shows the strength of the U.S. dollar compared to a group of other global currencies.

According to Kaleo’s forecast, a drop in the DXY might trigger an upward surge for Bitcoin, as these two often move oppositely. This potential scenario could drive Bitcoin prices to significant heights.

Even though things look promising, AMBCrypto notices that some traders and investors are choosing to offload their holdings temporarily at present.

Traders are backing out of BTC

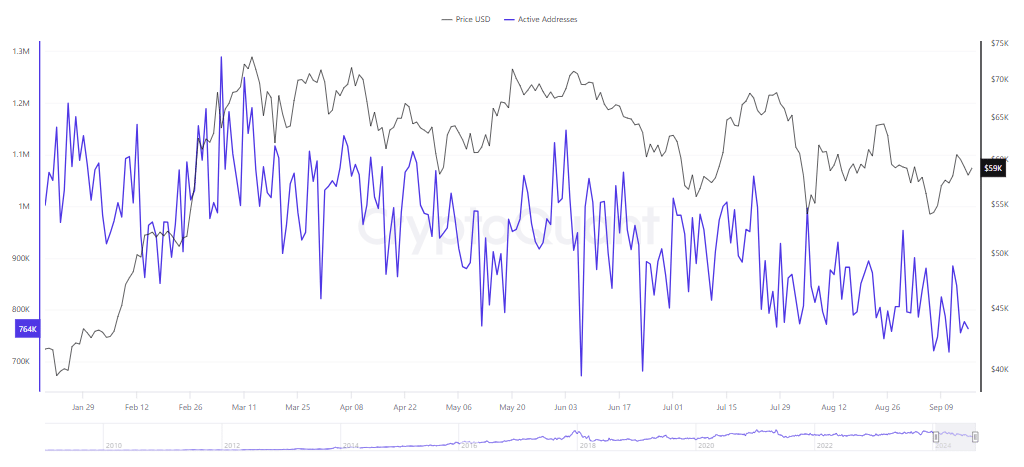

It appears that traders’ enthusiasm for Bitcoin (BTC) is waning, as there has been a significant drop in the level of trading activity.

Observing the current data, I notice a decline in the number of active Bitcoin (BTC) addresses, shifting from 885,329 to 764,033. This downward trend seems to indicate a bearish outlook among BTC participants.

Furthermore, it’s worth noting that there’s been a significant rise in the quantity of Bitcoin being traded on exchanges, referring to the overall amount of the asset accessible across different platforms.

The quantity of Bitcoin currently in circulation has increased to approximately 2.58 million, and if there isn’t enough demand from buyers to match this supply, it might cause the price to fall.

These patterns suggest that Bitcoin’s prices might temporarily decrease in the near future, unless there are alterations in the current market conditions.

The bears are still present

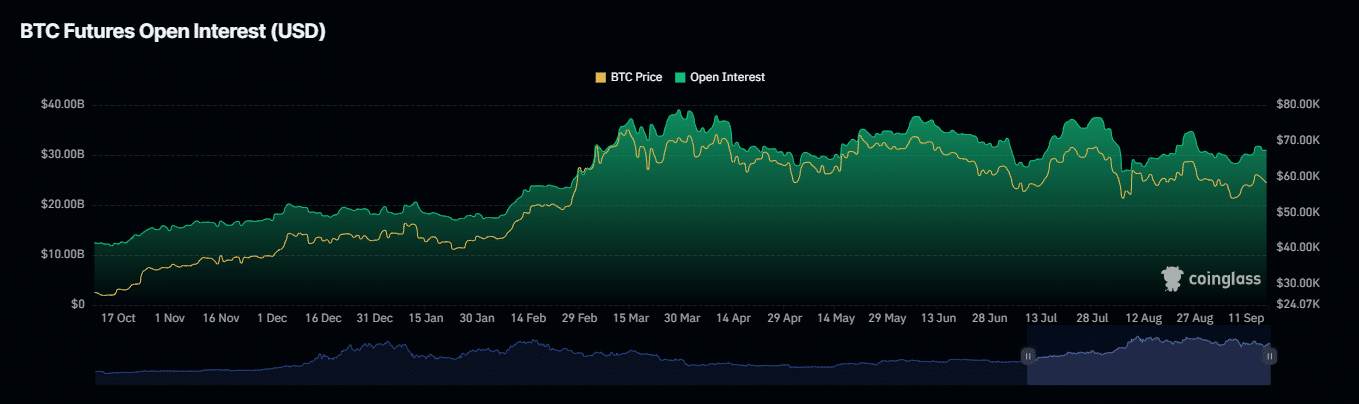

A pessimistic short-term forecast for Bitcoin is starting to take shape, as current data from Coinglass suggests that traders expecting an increase might be facing unfavorable results. At the moment, approximately $23.96 million in long positions have been forcibly closed out.

The information found in liquidation data pertains to the compulsory ending of trade transactions. This occurs when traders are unable to fulfill margin obligations or if their trades experience significant adverse price movements.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Additionally, the level of investor attention towards the asset, as measured by open interest, has dropped by 0.44% according to Coinglass.

If these trends continue, there’s a likelihood that both indicators will continue to fall, potentially leading to a short-term decrease in Bitcoin prices.

Read More

2024-09-17 21:12